Global multi-asset custody, clearing and technology solutions

Experience exceptional US and international clearing and custody services offering the best in customer service, global access and consistent innovation in pre- and post-trade technologies.

Securities custody and clearing

Systems and services designed to provide you and your clients access to execution, clearing and custody of a full array of financial products in US and international markets.

Futures clearing and execution

As one of the largest non-bank FCMs globally with roots dating back a century, our comprehensive suite of institutional grade clearing & execution services delivers broad exchange access and transparency to clients worldwide.

Your global partner in securities clearing

StoneX Financial Inc., a clearing broker-dealer and member of FINRA/SIPC, is a wholly owned subsidiary of StoneX Group Inc. (NASDAQ: SNEX). StoneX is a leading provider of execution, risk management, market intelligence, and pre- and post-trade services across asset classes and financial markets around the world.

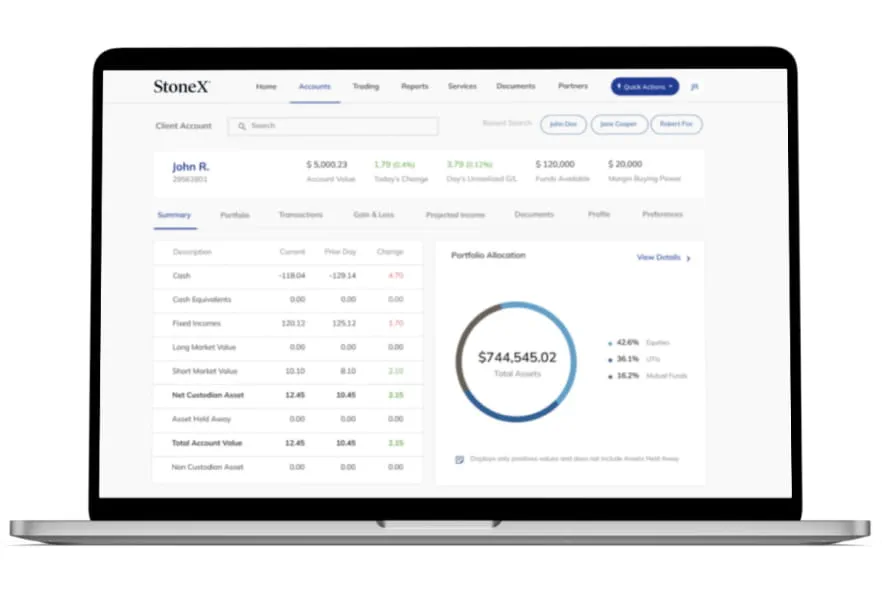

Securities custody and clearing: Advanced technology & integration

Our state- of-the-art platform is specifically designed to make your job easier so you can focus on what matters most — your clients. Customization sets our platform apart from the rest. Our correspondents have input on how the technology functions, what programs we integrate with and control over how they manage accounts in the system.

Additionally, we understand that no single platform can address all your unique needs, so we have strategically partnered with leading third-party solution providers and data resources to power and inform your business decisions in one comprehensive workstation.

US and global asset classes supported:

- Equities

- Options

- ETFs/ETPs

- Mutual funds

- Fixed income

- Structured products

- IPOs/new Issues

US and international account types and relationships supported:

- Individual, joint, TOD, retail

- Entities (trusts, corporations, PICs)

- Retirement (US)

- Institutional

- DVP/RVP

- Broker-to-broker

Securities custody and clearing customized for every business model

You will not be interacting with a call center, but with someone who understands your business at a personal level. Every client receives direct access to an experienced relationship manager dedicated to your firm. With a support to correspondent ratio that is among the highest in the industry, we’re here to personally guide you through the process and help you build your business.

Futures clearing & execution services

As a leading global FCM with roots dating back a century, our comprehensive suite of institutional-grade futures clearing & execution services delivers broad exchange access and transparency to our clients worldwide.

We are also one of the largest non-bank FCMs globally, which allows us to deliver institutional-level capabilities under fewer regulatory burdens than banks.

Let’s get connected

To learn more about how our customized financial solutions can help you stay one step ahead in the global markets, contact our team today.

Select your location

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to securities trading and prime services are made on behalf of the BD Division of SFI. References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. You can learn more about the background of StoneX Financial Inc. on BrokerCheck.

StoneX Outsourced Services LLC provides Outsourced Trading Services. The company is a member of FINRA/SIPC and NFA , and registered with the SEC as a Broker Dealer and CFTC. You can learn more about the background of StoneX Outsourced Services LLC on BrokerCheck.

Wealth management services are offered through StoneX Wealth Management, a trade name used by StoneX Securities Inc., member FINRA/SIPC and StoneX Advisors Inc. StoneX Securities Inc. and StoneX Advisors Inc. are wholly owned subsidiaries of StoneX Group Inc. You can learn more about the background of StoneX Securities Inc. on BrokerCheck.

StoneX One is a proprietary online trading platform through which investors and traders can open securities and/or futures accounts. Accounts opened through StoneX One are currently available to U.S. persons only. Not all products are available. StoneX One accounts opened through StoneX Securities Inc. are introduced to and custodied at StoneX Financial Inc. (SFI), and all customer orders will be transmitted to SFI for execution, clearance and settlement.

Securities products offered by StoneX Financial Inc. (“SFI”) & StoneX Outsourced Services LLC are intended only for an audience of institutional clients only. Securities products offered by StoneX Securities Inc. and investment advisory services offered by StoneX Advisors Inc. are intended for an audience of retail clients only.

This information is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX Group Inc. of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you.

Additional disclosures can be found on https://stonex.com/compliance-library/

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.