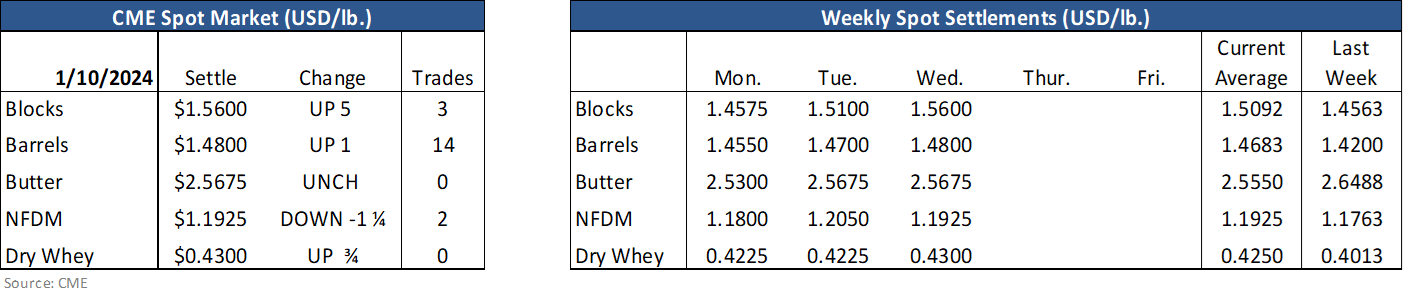

The Class III/Cheese futures strength continued Wednesday another round of firming spot price action. Block cheese gained 5 cents to close at $1.5600 on 3 trades – the highest price since December 14 when Block cheese settled at $1.5700. Barrel cheese finished a penny higher at $1.4800 on 14 trades. So there is cheese out there, but the aggressive selling seen at the end of 2023 seems to have subsided. At the same time, spot buyers have become more aggressive or more willing to push prices up. And futures have kept pace and premium versus spot this week.

Over 1,600 Class III contracts changed hands and open interest was up 3. Just 3 contracts yesterday. This tells us there was a lot of positions changing hands in Class III. Open interest in February – the lead contract month – was down 123 contracts in Class III and 38 in Cheese. Likely a mix of short covering and long-liquidation (short-term traders who bought earlier this week taking profit by selling). Over 600 Cheese futures traded yesterday with Open Interest up 152 contracts. Class III and Cheese was higher again (nearby) overnight, but we expect a good two-sided trade today.

Spot butter remained unchanged yesterday after the 3.75 cent jump on Tuesday. That seemed to bring some follow through buying as 2024 buy side interest remains healthy. Sell side interest pulled backed yesterday so that caused futures volume to dwindle to 90 contracts as nearby months were up as much as 4.25 cents. Q1 prices, as seen below, are nearing levels of resistance between 260-262 so we’ll see how trade develops today and potentially see more sell side come in.

After a 2.5 cent jump in nonfat on Tuesday, prices pulled 1.25 cents yesterday which put some pressure on nearby futures. Q3 futures saw some support on light volume as futures remain rather sideways awaiting fresh news. Rumors of a new Algerian tender were circling in the last week and details of the tender were released this morning. Roughly 15k MT of WMP and 22k MT of SMP were purchased with delivery set March-May.

Soybeans and oils are leading the way higher this morning but the grain complex remains range-bound and confined very close to move lows overall, ahead of tomorrow’s wide-ranging USDA January reports date.

The USDA will release a slew of reports on tomorrow at 11 AM Central including the USDA WASDE, Crop Production, Quarterly Grain Stocks, and Winter Wheat Seedings. The Reuters survey of analysts estimates 2023/24 World soybean carryout at 111.58 MMT—close to 3 MMT lower than the December WASDE report. The trade expected World corn carryout to land at 313.03 on the January WASDE—down from 315.22 on the December report.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.