“Morality is a private and costly luxury.” -Henry Adams

The key market takeaway from the annual IDFA Conference, which wrapped up yesterday in Phoenix, was no one is quite sure of a market direction. Frankly, more of the same sentiment means the disparity between Class III and IV milk pricing ought to continue. For now. In other words, IDFA attendees are largely bearish current demand but bullish (or at least concerned about) future milk supplies.

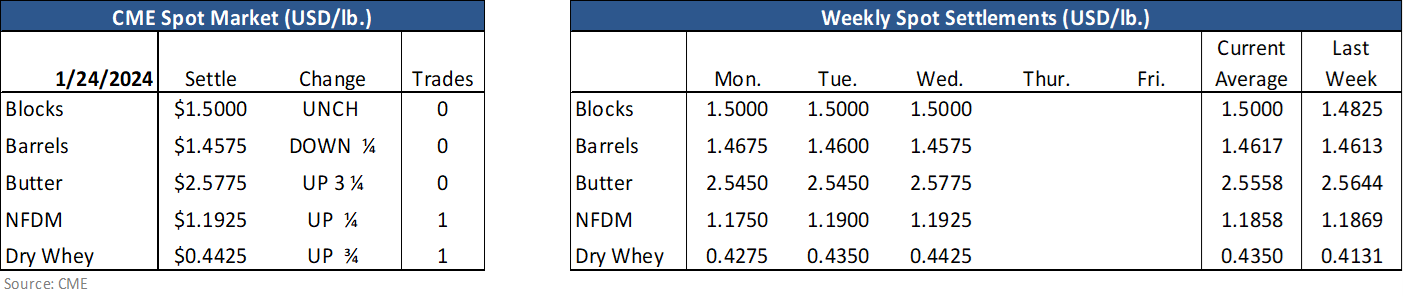

Class III and Cheese futures markets are ‘giving up the ghost’ this week. Deferred contracts sold off making new lows yesterday as the forward curve adjusts lower after watching the spot market continue to trade in the $1.40s (on a block/barrel avg basis). Volumes surged on the decline as did open interest. Over 3,300 Class III and over 900 Cheese contracts changed hands yesterday and open interest rose by 433 and 225, respectively. It should be noted that over 2,700 Class III traded in the February and March contracts alone, which looks to be mainly driven by rolling February positions into March. Also, note the lead month of February has yet to make new lows – all the fresh downside was seen on more deferred contracts into 2nd half of 2024.

Meanwhile Class IV milk was largely stable yesterday as Butter futures spiked higher heading into yesterday afternoon’s double header Milk Production and Cold Storage report release. Spot butter gained 3.25 cents to close at $2.5775 and the futures gained ~1-2.5 cents on over 300 contracts of trade volume. Perhaps it’s the buyers ‘giving up the ghost’ in this market. Perhaps there was pre-report positioning (and the Cold Storage report was bullish butter, see below). End-users remain dedicated to getting price coverage in 2024 keeping price action buoyant this week despite a myriad of conversations about “plenty of cream available” we had over the past few days. NFDM futures sold off yesterday on 388 contracts as the forward curve there works off some of the premium against a very stable spot price.

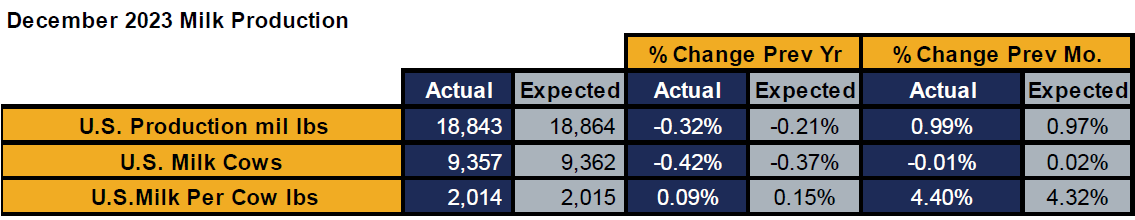

US milk production continued to be constrained in December. Headline U.S. milk production was quite close to our pre-report expectations falling 0.3 percent YoY. Both cow numbers and milk per cow came in fractionally below our expected numbers. Western states continue to struggle growing milk production and in December we added Idaho to that list of negative milk production growth. Q4 milk production fell 0.6 percent from Q4 2023.

The report doesn’t reveal any major surprises for the dairy complex markets. Milk production remains somewhat subdued, but milk components remain strong. There are signs of financial pain on US dairy farms, but overall supplies of fresh milk remain adequate to meet current demand. A wider view of current conditions, however, reveal a

lack of growth in the US cow herd and, perhaps more importantly, a lack of incentive to change that trend.

US markets may shrug this one off. Weaker cheese demand continues to weigh on Class III and Cheese markets while Class IV remains rather stable at higher levels. What this report won’t do is weigh on the markets. For that we need to continue to see lackluster demand.

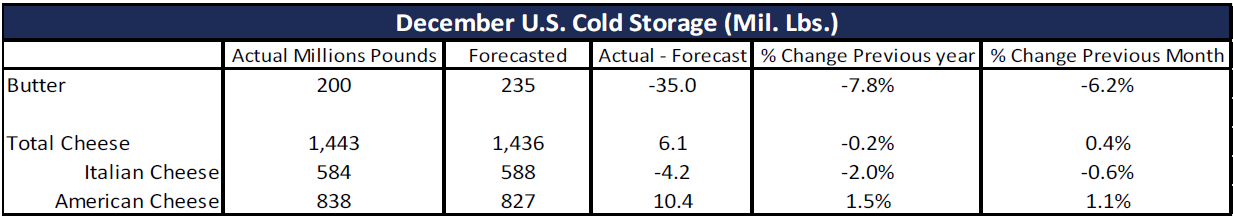

With the December Milk Production report coming in relatively neutral, the Cold Storage report had a few surprises . Total cheese stocks 6.5M lbs. higher than forecast will left total stocks slightly below year ago levels at –0.2%. When we released out forecasts we mentioned it wouldn’t be a huge shock is stocks came in heavier given the weakness in spot prices. American cheese stocks came in 10M lbs. above forecast while other varieties were 26M below. We remain the cheapest cheese in the world market so that should help to clear more cheese exports through December and January.

The big surprise came in butter with stocks coming in 36 million lbs. below forecast which puts stock roughly 8% below year ago levels. After the report futures started to trade above settlement prices so expect butter futures to open higher tomorrow. This is the lowest we’ve seen stocks since 2021 and chances the dynamic a bit for 2024. Cream demand has loosened up a bit but overall demand of butter has stayed rather steady after the holidays but could stronger than originally anticipated.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.