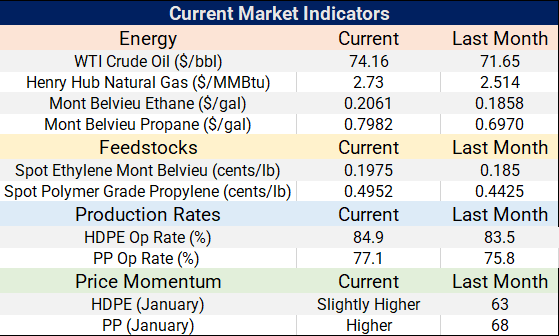

- US polyethylene producers have kept their 5.0 cent per pound increase initiative on the table for the month of January. This follows another “flat” price settlement in the month of December (third flat month in a row). PE exports have remained strong throughout 2023 as domestic demand languished. Unseasonably cold weather in the Texas Gulf Coast this week has led to some precautionary plant shutdowns/slowdowns. This may contribute to upward price pressure in January.

- Domestic polypropylene production also being impacted by the Gulf Coast cold snap. Propylene production disruptions during the month of January may also contribute to higher feedstock costs for PP. Due to weak domestic demand and the cost dis-advantage of US based PP in the international market, North American suppliers are struggling with exports and seeing their days of inventory grow to almost 47 days. Lower plant operating rates are inevitable.

- Natural gas prices rallied throughout much of January due to a cold spell that spread across the U.S. while crude oil prices have been relatively flat to higher. One major benefactor of the recent cold has been propane and also PGP which is at its highest level since late 2022. With energy and feedstock prices on the rise, PE and PP prices could see support in the next several months.

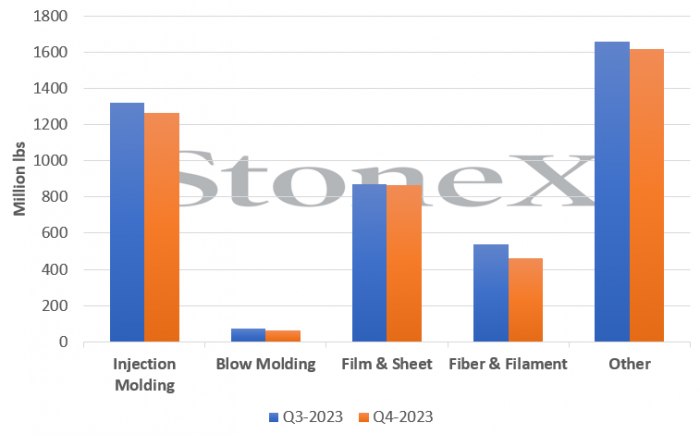

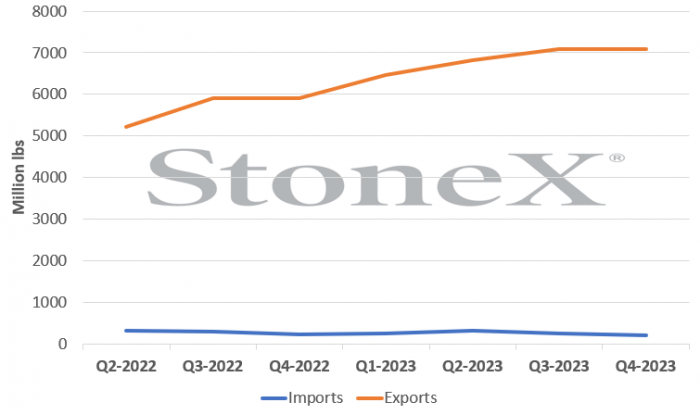

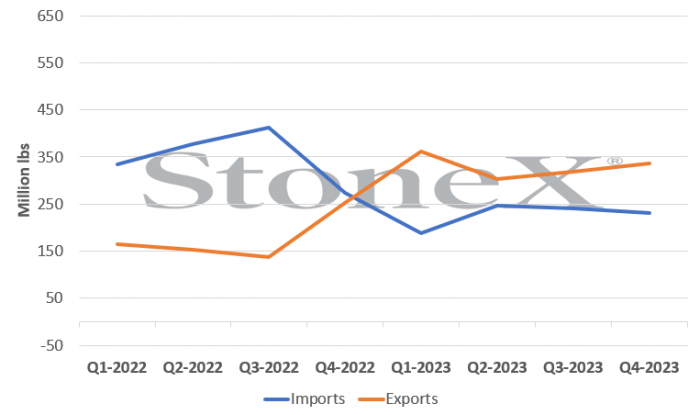

Polyethylene exports have remained strong throughout most of 2023. All three PE types are ahead of the same period in 2022 with LLDPE leading the increase. China is the top destination for LDPE and LLDPE exports, while Mexico was at the top of the list for US HDPE exports (followed by China). Polypropylene exports were also up by a significant amount in 2022 with Mexico as the lead destination by a factor of two. While PE exports have benefitted from the ethane cost advantage in the US, PP has had the opposite experience due to unusually high feedstock costs as a result of PGP supply chain disruptions throughout much of 2023.

As we enter 2024 buyers have returned to the marketplace in an effort to replenish diminished inventories which were drawn down at year-end. In the short term we may see the impact of unseasonably cold weather this week in Texas which has prompted producers to turn down operations accordingly as a precaution. The combination of an active spot market coupled with industry downtime due to inclement weather may facilitate additional leverage for US suppliers to negotiate higher prices this month for both PE and PP.

This material should be construed as the solicitation of an account, order, and/or services provided by StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the individual authors or presenters. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results. All references to and discussion of OTC products or swaps are made solely on behalf of SXM. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. SXM is not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SXM for specific trading advice to meet your trading preferences.

Howard Rappaport is an independent consultant to the Swap Dealer, StoneX Markets LLC (“SXM”) focusing on plastics market commentary. He does not have a personal futures trading account. All forecasting statements made within this material represent the opinions of the author unless otherwise noted.

Reproduction or use in any format without authorization is forbidden.

© 2024 StoneX Group Inc. All Rights Reserved.