January 17 - Stocks remain in the red at mid-day, driven lower by pessimistic Chinese data and souring prospects for aggressive rate cuts due to the ongoing strength in the U.S. economy. The VIX remains elevated relative to recent months near 14.8, though still low compared to historical levels. The dollar continues to show strength, pushing above 103.4 this morning for the first time in over a month. Treasuries remain up on the day as well, with 10-year yields still hovering around 4.09% and 2-year yields near 4.35%. Crude oil has rebounded from its morning lows but remains in the red, with the nearby WTI contract now hovering just above $72. The ags have largely reversed course, with corn and the wheat complex now in the green on the day, though soybeans continue their freefall.

U.S. retail sales rose by more than expected in December, climbing 0.6% month-on-month versus analyst estimates of a 0.4% rise and doubling the 0.3% seen in November. Excluding autos, December retail sales were up 0.4% month-on-month, also above expectations of a 0.2% increase. In year-on-year terms, retail sales were up 5.6% in December, the sharpest pace seen since January. Online retailers led the way, highlighting the ongoing trend of U.S. consumers shifting away from traditional stores in favor of online purchases since the pandemic. Today's data also points to a stronger than expected U.S. economy. While this sounds like good news on paper, stocks are reacting negatively because this gives the hawks at the Federal Reserve more ammunition to justify holding rates higher for longer. Fed Governor Christopher Waller yesterday urged caution in cutting rates, while European Central Bankers today echoed a similar hawkish sentiment, dealing a blow to the optimism of traders expecting significant cuts from the Fed starting at their March meeting and continuing through 2024.

U.S. manufacturing production rose by 0.1% month-on-month in December, beating forecasts of remaining flat, while November was revised down to a 0.2% rise versus its initial reading of 0.3%. In year-on-year terms, manufacturing production was up 1.2% in December, the first positive reading since February and the largest gain seen since October 2022. The strength in the sector was driven mostly by production of vehicles and parts, following the surge in November as striking UAW employees returned, as well as in furniture and related products. In total, U.S. industrial production also showed 0.1% month-on-month growth, also beating forecasts of remaining flat and representing the first monthly increase since September. Capacity utilization held at a weak 78.6%, however, remaining over 1% below its long-term average closer to 80% as the sector remains relatively weak.

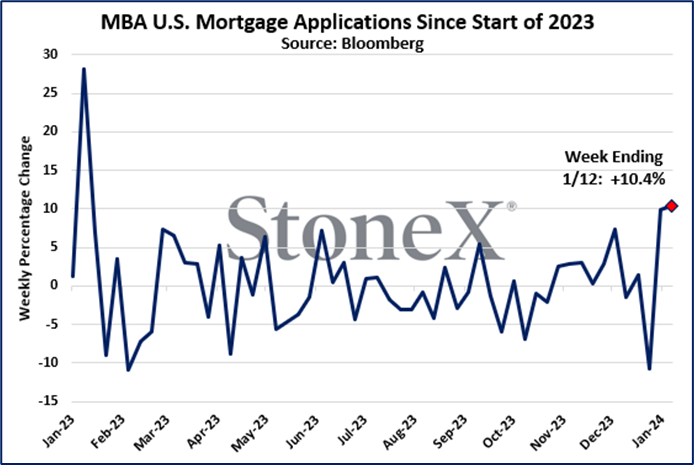

The U.S. housing market is showing some significant improvement in today's data releases, bringing the first positivity to the sector in what feels like quite a while. Mortgage applications in the U.S. jumped by 10.4% on the week ending January 12th while refinance applications jumped by 11%, their highs since last January and May, respectively. This was driven in large part by falling mortgage rates, with the Mortgage Bankers Association (MBA) reporting a 0.06% week-on-week drop in 30-year rates to 6.75%, solidly lower than their recent peak of close to 8% in October. The NAHB/Wells Fargo Housing Market Index also showed improvement to a reading of 44 in January, up for the second month in a row to match its best level since September, though remaining in contractionary territory.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.