January 25 - Stocks are quietly higher at midday as Wall Street shrugs off predictions of recession after two years of fearing one. The VIX is trading near 13 at midday, while the dollar index is trading near 103.6. Yields on 10-year Treasuries are trading near 4.15%, while yields on 2-year Treasuries are trading near 4.33% as the inversion continues to shrink. Crude oil prices are 2% higher at eight-week highs as U.S. inventories shrink and as geopolitical risks increase. The grain and oilseed complex was mixed, with wheat prices continuing higher, while soybeans lead corn lower on disappointing weekly export sales.

New home sales rose to an annualized rate of 664K units in December, up from an upwardly revised 615K in November, and exceeding analyst expectations of 650K as the market responds to the fall drop in mortgage rates. This ties in with shelter costs in the inflation data that the Federal Reserve will be following closely in its monetary policy decisions. We still have a shortage of shelter in this country, and therefore demand for it surges whenever interest rates drop / consumer sentiment rises.

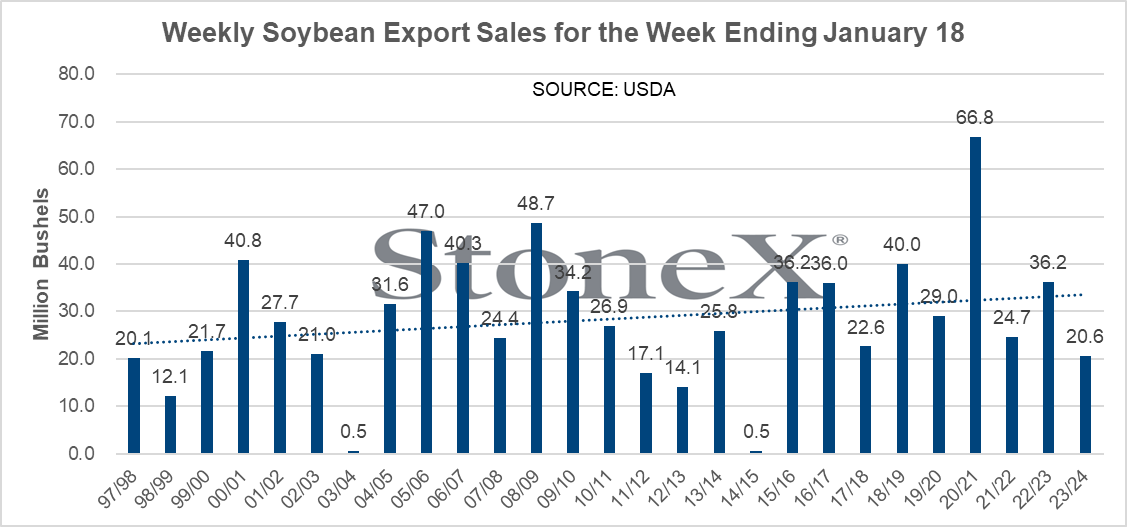

Exporters sold 37.6 million bushels of this year's corn crop in the week ending January 18, along with 20.6 million bushels of soybeans (as shown below), 16.6 million bushels of old-crop wheat and 2.4 million bushels of grain sorghum. Soybean sales continue to disappoint, with beans priced into the port in China now roughly $2.15 per bushel cheaper for February shipment if they come from Brazil rather than from the U.S. Gulf, and the discounts are even greater for March and April shipment. China was the featured buyer of U.S. soybeans in the week ending January 18 at a net 20.7 million bushels, but nearly half of that 9.3 million bushels - were previously purchased by "unknown destinations" and merely shifted in the books to China in this morning's report. Marketing year to date soybean export sales to all destinations total 1.394 billion bushels, down 313 million or 18% from the previous year's pace, while falling short of the seasonal pace needed to hit USDA's target by 17 million bushels - and the deficit is growing. It's difficult to justify a rally that rations demand for U.S. soybeans when they're already the highest priced on the market, and they're already struggling to generate export demand.

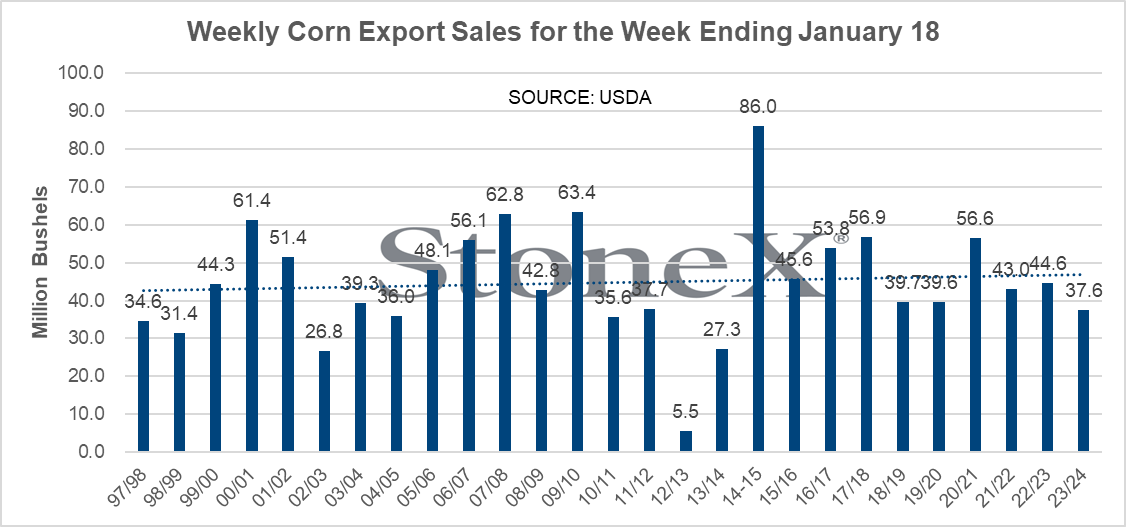

The break in the corn market came 60 days earlier than the soybean market, and demand is benefiting from that, supporting higher livestock feeding and ethanol grind rates, as well as generating export demand as Brazil focuses more on soybean shipments. Mexico was the featured buyer of U.S. corn in the week ending January 18 at a net 22.2 million bushels of old- and 1.5 million bushels of new-crop. Marketing year to date export sales to all destinations total 1.279 billion bushels, up 332 million or 35% from the previous year's pace. I covered the ethanol estimates yesterday, showing how those numbers need to rise as well. It still doesn't pull projected ending stocks below 2 billion bushels, but it is a move in the right direction for a commodity that is over supplied.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.