January 31 - We're bringing January to a close today, but its fireworks "may" still lie ahead, depending on this afternoon's statements from the Federal Reserve. The tech sector remained under pressure this morning, while other stocks were largely mixed. The VIX is trading near 14 at midday, reflecting a modest rise through the morning as we approach this afternoon's Fed statement, while the dollar index dropped to trade near 103.2 as Treasury yields also fell. Yields on 10-year Treasuries are trading at a 19-day low near 3.96%, while yields on 2-year Treasuries are trading near 4.23%. The broader commodity sector is under pressure today, with traders selling yesterday's rally that was largely based on bargain buying money flow. Crude oil prices are 2% lower, while the grain and oilseed markets are generally steady to 2% lower. Those commodities that saw the bigger gains on Tuesday generally saw the bigger losses early today. We've drifted off today's session lows for most of these markets, with soymeal actually trading positive at times on bargain buying, while corn prices have flirted with the same. Nonetheless, the market still lacks the sentiment or fundamental justification thus far to sustain a rally. The protein sector traded mostly mixed to higher this morning, with the cattle market consolidating ahead of this afternoon's highly-anticipated cattle inventory report from USDA.

We're seeing a bit of a risk-off sentiment across both the equity and the commodity sectors ahead of this afternoon's statements from the Federal Reserve, with mixed signals throughout the marketplace. The dollar followed Treasury yields lower this morning, reflecting expectations that we will see more support voiced by the Fed today for rate cuts this spring. The weaker dollar should have been supportive for the commodities, but instead they pulled back from yesterday's big gains. The tech sector is still worried about returns for that sector, with the prospect for rates holding at current levels raising their risks, even though we're not seeing that being traded in the Treasury market. Fresh news is largely lacking today, leaving traders to focus on their risk exposure. For now, that means general weakness, although we've seen some markets drift higher as we approached midday.

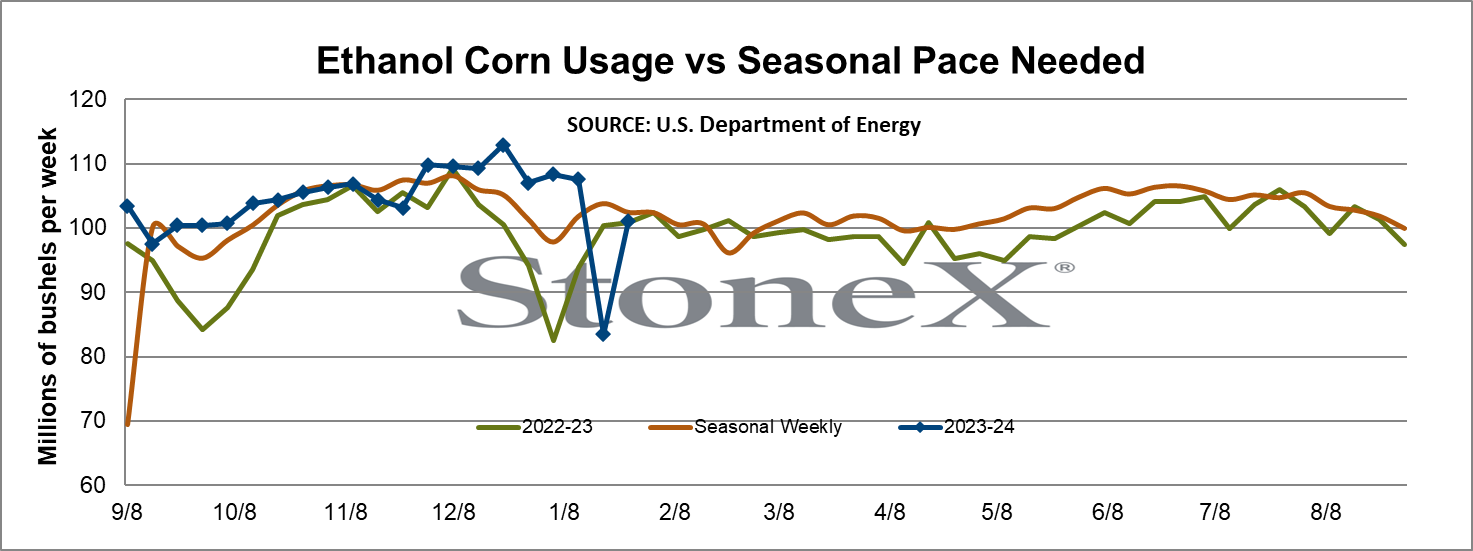

U.S. commercial crude oil inventories (excluding the Strategic Petroleum Reserve) increased by 1.2 million to 421.9 million barrels in the week ending January 26, putting them roughly 5% below levels typically seen in late January. Gasoline supplies also rose 1.2 million barrels during the week, putting them 1% above the five-year average for the week. Distillate supplies fell by 2.5 million barrels, leaving them 5% below seasonal levels. Ethanol stocks dropped to 24.3 million barrels in the week ending January 26, down from 25.8 million barrels the previous week, and down from 24.4 million barrels in the same week last year. Ethanol production bounced back to 991K barrels per day last week, up from the previous week's plummet to 818K bpd due to adverse weather, but still down from the 1,028K bpd the previous year. The production of ethanol utilized an estimated 101.1 million bushels of corn in the week ending January 26, as shown below, up from 83.5 million the previous week, but down from 102.4 million bushels in the same week last year. Marketing year to date estimated corn use for ethanol totals 2.200 billion bushels, up 107 million or 5.1% from the previous year's pace, and nearly 70 million bushels above the seasonal pace needed to hit USDA's target this year.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.