Last Tuesday (16), the National Cooperative Federation of Sugar Factories of India (NFCSF) released its monitoring of the sugarcane crop in India. In 2023/24 (Oct-Sept), crushing in the country reached 156.3 million tonnes by the first half of January, an annual drop of 7.0%. In 2022/23, in the same period, the volume was 168.2 MMT. The current cycle has seen a drop in sugarcane productivity, the result of monsoon rains that were 6% below the normal average in 2023 and distributed unevenly across the states and over the months, most severely damaging the development of sugarcane plantations in the southern region of India - where the harvest started, on average, two weeks late, contributing to the lower crushing figure.

According to the progress of the Indian season, productivity results in Maharashtra (MH) and Karnataka (KA) may end up higher than initially expected. Some agencies estimate that these two states together will produce only 12 million tonnes of sugar, which would mean a drop of more than 4.4 MMT (-27%) compared to 2022/23, a cycle that had already recorded lower volumes. However, the market's most pessimistic estimates are unlikely to materialize, although a drop of at least 18% in production in this region is still likely.

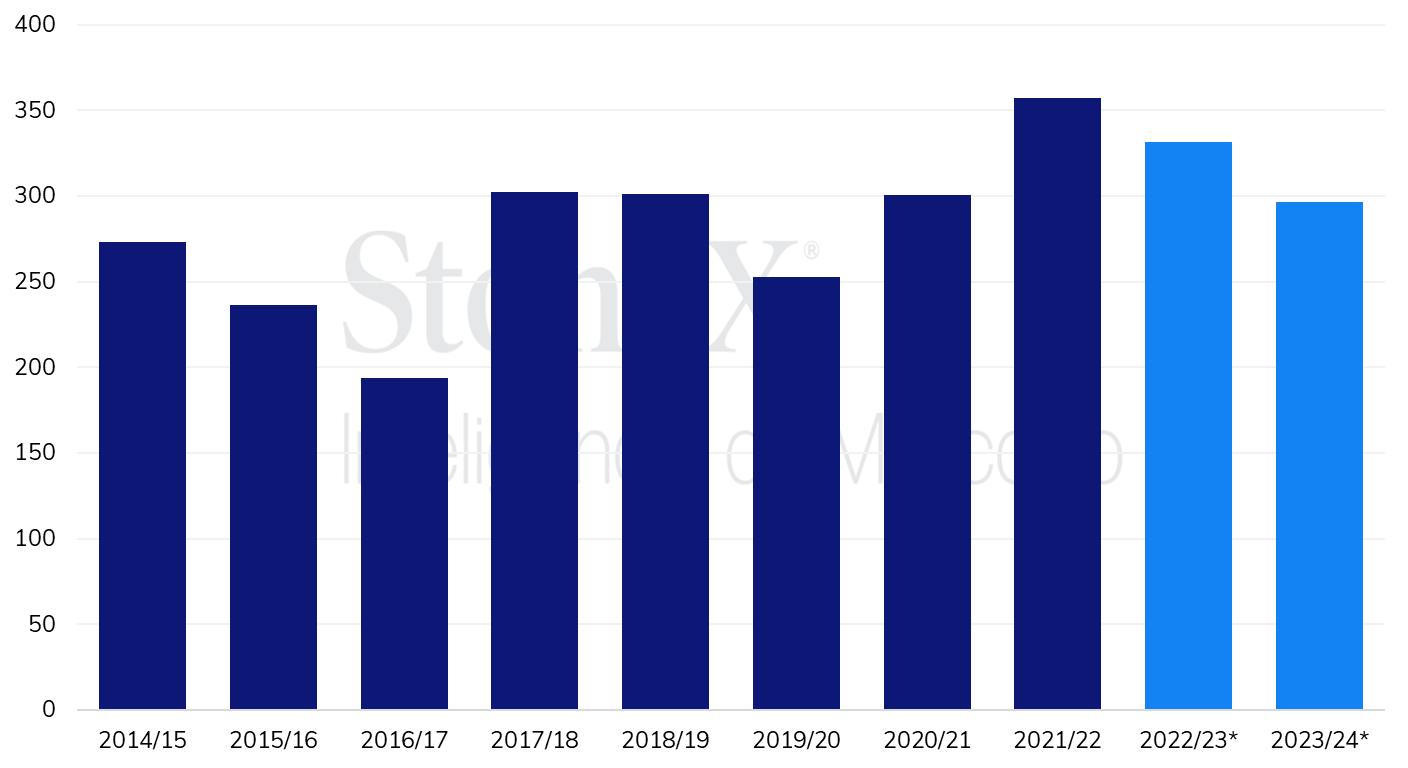

The main conditioning factor for this scenario is the high probability that the 2023/24 harvest cycle in MH and KA will be shortened, as it was in 2022/23, when the crop in Maharashtra had already ended at the end of March, and this year the end may be even earlier. Therefore, cane crushing in India in the current crop is expected to shrink by 10% year-on-year and may not exceed 300 million tonnes - the record was in 2021/22, with 357.4 MMT of cane crushed.

Sugarcane crushing in India (million tonnes)

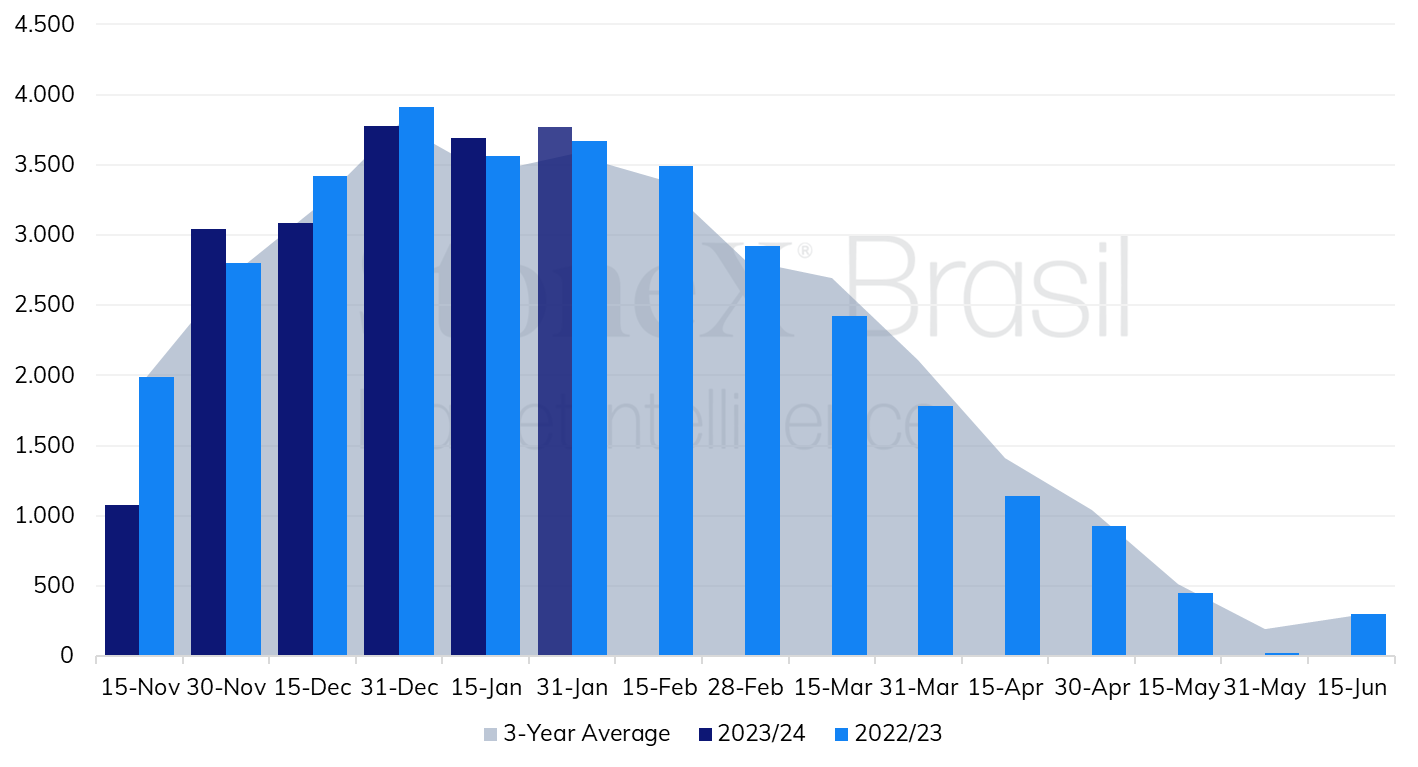

Also according to the NFSCF, sugar production in the country reached 14.87 million tonnes by the first half of January for the 2023/24 season, down 7.1% on 2022/23, as was crushing. The peak of the cycle is usually in the second half of December, which explains the lower volume produced in the reported two weeks, a natural movement. Since the mills are still fully operational, the second half of the month should continue with high volumes of crushing and sugar supply and, given the delay in the crop, part of what would normally be harvested in December has been moved to January, meaning that the first month of 2024 has the potential to reach 7.5 MMT of sugar, which would be 3.1% higher than January/23.

India's two-week sugar production ('000 tonnes)

However, the prospect of a crop lasting even less in 2023/24 and the drop in productivity should lead to a period between February and May when the crushing rate slows down more than last year and is above average, putting the estimate for sugar production in India down compared to 2022/23.

In December, the government's decision to limit the use of sugar for ethanol production to just 1.7 million tonnes provided a bearish fundamental for the market, which believed that the measure could strengthen domestic sugar production, opening up the possibility of exports in India in 2023/24, which were halted by the government even before the start of the new crop.

What the market has already digested, it seems, is the fact that, in reality, the development of the season raised the alarm that the availability of cane and consequent supply of sugar was worse than expected at the beginning of the year and, in this sense, in addition to banning exports, the government decided to limit ethanol production to guarantee domestic sugar stocks - coming, it is worth mentioning, from three crops in a row of declining final stocks.

In addition, there is already talk that the government may set a new quota for using sugar for ethanol production if the crop goes better than expected - with some sources indicating an addition of between 800,000 and 1.3 MMT to the allowed volume - in other words, before exports take place, the Indian government's priority seems to be, firstly, the domestic supply of the product, the demand for which is growing year-on-year, and, secondly, the availability of ethanol for blending into gasoline in order to meet the stipulated annual targets. Should exports take place, the Indian government would only release it after an assessment of domestic reserves in March, something it has no evidence of at the moment. Another factor that could prevent a release of sugar to the foreign market is the initial expectations for 2024/25, a crop in which some agents already estimate a drop of up to 2.0 MMT in sugar production compared to the 2023/24 projection, a volume that would be close to or even below domestic consumption - which is around 28.0 million tonnes in the current crop.

Reflecting the lower supply of ethanol from the sugar sector, India's ethanol blend in gasoline for the new fiscal year (which began in November 2023) stands at 10.77%, down from 12% (E12) in the previous season. For 2024, the initial target was for the country to reach E15, and then E20 in 2025. This year, given the prospect of limiting ethanol from sugarcane, it is possible that 2023/24 will not reach the 10% blend, and the market will become a little more dependent on the availability of grains (mainly rice and corn) to increase the domestic supply of ethanol. The "mollasses-based" plants, which use sugarcane juice and molasses to produce ethanol, have a production capacity of 8.75 billion liters of ethanol per year, and the "grain-based" plants have around 5.05 billion liters. However, investment and capacity are not determining the supply of biofuel on the Indian market, but rather the feedstock, either due to the weather (as in the case of sugarcane), or competition from its food function - as is the case with grains.

- Weekly summary

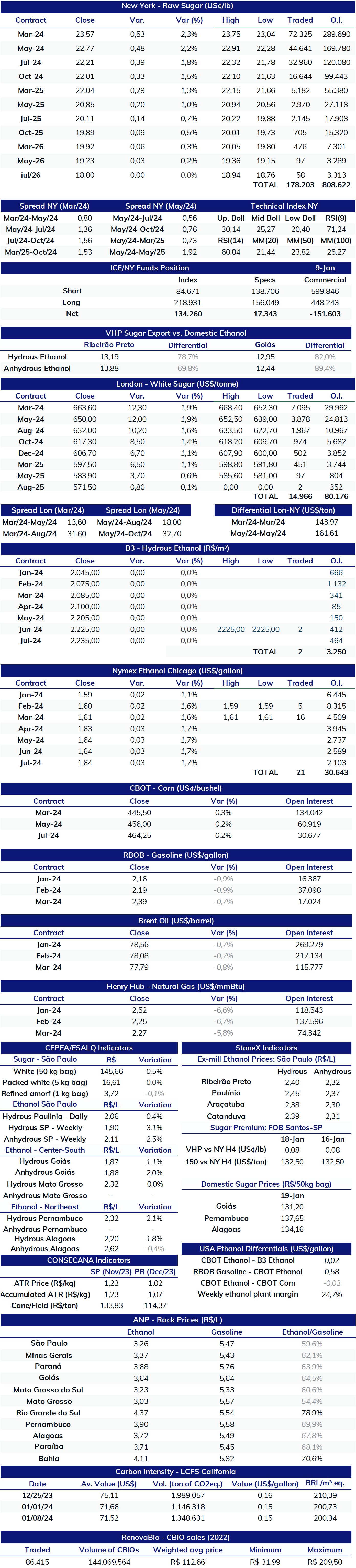

Last week, raw and white sugar prices posted a strong recovery on the futures markets. For the more liquid raw #11 contract (SBH24), the period since the previous week's close pointed to growth of 9.1%, ending last Friday (19) at the 23.57 c/lb mark. For white #5 (SW24), the movement was similar, with an 8% increase over the period. In this context, sugar's reaction comes in the face of a sideways week for most commodities, reinforcing the changed sentiment for the sugar market. In light of the strong bullish movement, the shift in market perception is supported by the release of crop monitoring reports in India and Thailand confirming the sector's pessimistic expectations due to El Niño, which strengthens the argument for an oversold scenario for sugar after the strong sell-off by speculators at the end of December.

- Chinese sugar imports down 24.7% in 2023

Last Thursday (18), China's customs agency reported the number of sugar imports from the country in December/23, revealing a demand of 500,000 tonnes from the international market, down 3.8% year-on-year. Considering the consolidated figure for 2023, the Chinese agency's figures indicate 3.98 MMT, down 24.7% in relation to 2022, a scenario related to the country's worse import margin for most of the year. For more details, click here.

- Thailand releases crop monitoring data

Last Tuesday (16), Thailand's sugarcane industry body (OCSB) updated its crop monitoring up to January 15. From the start of the season in October until that date, the world's second largest sugar exporter had processed a total of 29.82 MMT of cane, down 7.5% compared to the last cycle. In this context, due to a lower sugar recovery rate, the country's sugar production since the start of the crop has been 4.7 MMT, down 15.3% from the previous year. For more details, click here.

- NOAA releases updates to its El Niño and La Niña estimates

On Friday (19), the US weather agency NOAA updated its estimates for the transition of the El Niño phenomenon to neutrality by the second quarter of 2024, with implications for the global weather, focusing mainly on Southeast Asia, where the phenomenon affected the 2023 monsoon rainy season, leading to drier conditions. Considering the long-term outlook, the weather agency already sees a gradual transition to La Niña from the third and fourth quarter of the year, a scenario that should become clearer in the next weather updates throughout the year.

- Weekly price summary

Last week, ethanol prices made a significant recovery in the main trading areas in the state of São Paulo. After starting the week with the latest indications around BRL 2.20/liter - the lowest level for mill-based ethanol since September 2020 - hydrous ethanol ended the week with trades close to BRL 2.40/liter. In this scenario, in addition to the inter-crop context, which limits supply from the mills, demand seems to have finally responded to the largely favorable parity levels. Last week, the ratio between hydrous and gasoline at service stations in the state of São Paulo stood at 59.5%, the lowest level ever recorded for the inter-crop period.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.