31st January Marks the Release of Key U.S. & Chinese Data Points for the Base Metal Market

The 31st of January will mark an important date in the diary for this week, with release not only of China’s first scheduled major economic reading of 2024 (PMIs), but the end of the U.S. Federal Reserve’s first FOMC meeting of the year. Individually these two events have the potential to mould expectations for what to expect in the near-term for the base metal markets.

China’s PMI Readings

The Purchaser Managers’ Index (PMI) readings in China mark not only the first release of a major economic data point over each month of the year for the country, but have historically been a barometer for what to expect from other key economic readings over the following 30 days, and therefore it captures market attention.

What Do We Expect?

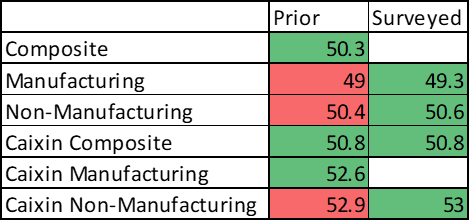

Market Forecasts for January PMI Readings

Source: Bloomberg

State Produced PMIs

The market is calling for the January manufacturing PMI reading to moderately reduce its pace of declines, after falling to its weakest level since June 2023. Here, activity is set to improve ahead of the Lunar New Year Holiday (9th-16th February), given that the markets will be closed over the period. Meanwhile, services are forecast to tick higher on the back of increased travel.

Caixin Produced PMI

The independent smaller-to-medium sized business focused and export-led Caixin reading is set to post more robust evaluations than the state-produced PMIs, with manufacturing set to remain steady in growth of 50.8 for a second month, with modest gain in services. Please note, the Caixin manufacturing reading has held in expansionary territory since July.

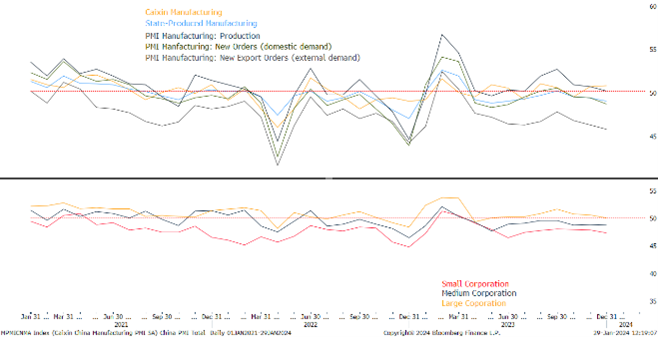

In our View - We Forecast a Muted Start to the Year

We forecast only a modest improvement in PMI readings for January, with manufacturing the focus, being unable to sustain gains in activity over 2023 or likely Q1 this year, especially given the slowdown in the industrial sector over the Lunar New Year holiday. Meanwhile, we foresee that external demand will remain weak, with regions like Europe and Japan lingering within manufacturing recessions. Furthermore, looking at exports out of South Korea (which is a marker for global export health), exports have fallen 1% Y/Y in the first 20 days of 2024, versus a 5% Y/Y uptick in December.

Manufacturing PMIs

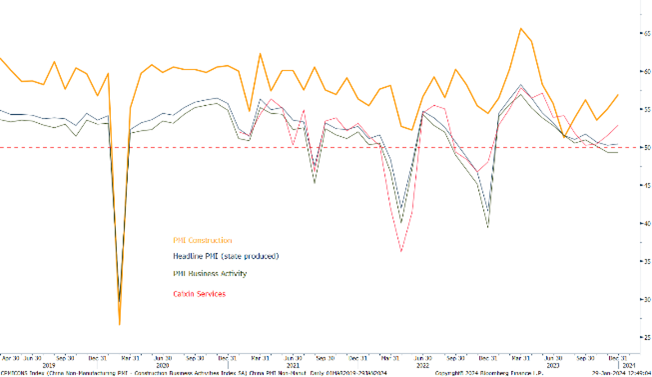

Non-Manufacturing PMI

Meanwhile, Could Chinese Infrastructure Investment Be at a Turning Point?

The only bright spot on the horizon appears to be stemming from construction, with the December state-produced PMI reading posting its highest level of activity since May 2023. In addition to this, Fixed-Asset Investment (FAI) recorded its first M/M gain of 2023 in December, suggesting that perhaps targeted stimulus (such as the surprise issuance of 1Tr yuan ($139Bn) of sovereign debt in early-October), is starting to trickle through. In addition to this, moves over the last week from the Government and PBoC are set to further support investment.

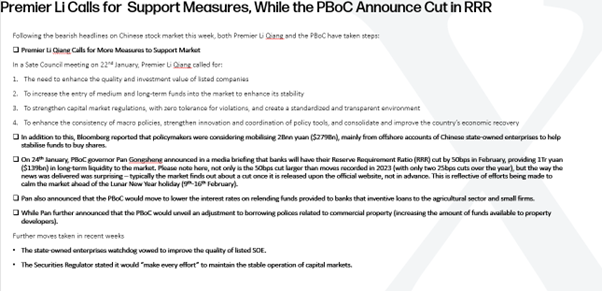

Support Measures Announced in China

Key Chinese Economic Readings December Versus November 2023

The Property Market Will Remain the Key Headwind for China in 2024

On the morning of 29th January, Evergrande Group (the world’s largest indebted property-developer) was issued a liquidation order by Hong Kong’s Judge Linda Chan. Now while Hong Kong’s courts have issued at least three liquidations orders for other Chinese developers since 2021, Evergrande stands alone with respect to the level of complexity, numbers of stakeholders and indeed asset size. A key issue ahead will be whether the insolvency proceedings gain recognition in mainland China; however, regardless of this, the ruling alone will only add to the weak sentiment for this sector moving ahead, which makes up ~25% of Chinese GDP. Please note, the property markets have faced a dismal start to 2024, with market data suggesting that new home sales in 30 major Chinese cities fell 38% in the first three weeks of January versus the same period last month.

Key Chinese Economic Readings 2023 Versus 2022

Home Prices

Residential Home Sales

January U.S. Federal Reserve Meeting to Conclude on 31st January – Rates to Hold Steady

Market expectations over the timing for the first rate cut this year have been varied, with hard and soft economic data painting moderately different pictures over the health of the economy in recent weeks (please see our Base Metal Weekly Call Slides here). As it stands, the bond market is pricing in just a 2% chance of a rate cut in January, while expectations for March stand at 50%. Given the uncertainty, official comments (particularly from Chairman Powell’s speech and Q&A session post-FOMC meeting) will be vital to better project what to expect in the months ahead.

Inflation Has Been Tracking towards 2% Target

Implied Overnight Rates

Please find the below links to our most recent Base Metal Weekly Macro Call Slides, which delve into the details of economic reading releases each week.

Base Metal Weekly Macro Call - 10th January 2024

Base Metal Weekly Macro Call - 17th January 2024

Base Metal Weekly Macro Call - 25th January 2024

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.