Institutional client offerings and solutions

Providing institutional clients access to sales and trading expertise in global equities, fixed income and futures, extensive capital markets services, and robust multi-asset clearing and custody solutions.

We connect clients to markets

At StoneX, we provide our institutional clients with access to information, sophisticated products and efficient markets.

It’s important to know the people you’re trading with, and the values they stand for. At StoneX, we believe that transparency, education and clear communication create lasting relationships with our clients.

Our institutional clients

We provide global access, unparalleled insight and advanced expertise to help our institutional clients meet their financial goals.

- Asset managers

- Broker-dealers

- Commercial bank trusts

- Family offices

- Financial institutions

- Fund managers

- Hedge funds

- Insurance companies

- Introducing broker dealers

- Money managers

- Pension funds

- Professional traders

- Wealth managers

Our prime brokerage offering

StoneX Prime provides hedge funds, family offices, mutual funds and other investment managers with a full self-clearing prime offering combined with introduced prime solutions.

Securities lending

Custody solutions

Repo and outsourced trading

Debt Capital Markets

We provide a full range of services to clients of all sizes looking to raise capital through private credit, bond issuances, and other creative financing solutions.

Our FX trading and liquidity offering

We offer deep market access, advanced technology, customized FX solutions, and high-touch service to our clients.

Pairing experience with expertise to position our clients for success

In 2021, StoneX worked with The GEO Group Inc. to underwrite a $230 million convertible bond new issue for the Boca Raton-based, publicly traded REIT. This engagement demonstrated the full breadth of our team’s experience, our industry contacts, and our ability to distribute across our own client base – leveraging the capabilities and reach of our StoneX High Yield and Distressed teams in addition to our own.

Solutions

StoneX offers a wide variety of customized financial services to help you meet your strategic objectives.

Upcoming events

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 40+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

-

Expertise

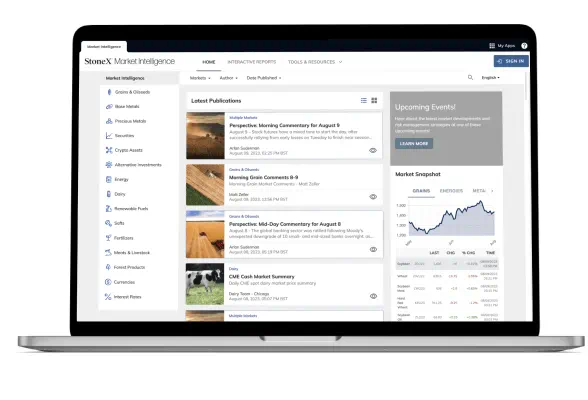

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

© 2024 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to securities trading and prime services are made on behalf of the BD Division of SFI. References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. You can learn more about the background of StoneX Financial Inc. on BrokerCheck.

StoneX Outsourced Services LLC provides Outsourced Trading Services. The company is a member of FINRA/SIPC and NFA , and registered with the SEC as a Broker Dealer and CFTC. You can learn more about the background of StoneX Outsourced Services LLC on BrokerCheck.

Wealth management services are offered through StoneX Wealth Management, a trade name used by StoneX Securities Inc., member FINRA/SIPC and StoneX Advisors Inc. StoneX Securities Inc. and StoneX Advisors Inc. are wholly owned subsidiaries of StoneX Group Inc. You can learn more about the background of StoneX Securities Inc. on BrokerCheck.

StoneX One is a proprietary online trading platform through which investors and traders can open securities and/or futures accounts. Accounts opened through StoneX One are currently available to U.S. persons only. Not all products are available. StoneX One accounts opened through StoneX Securities Inc. are introduced to and custodied at StoneX Financial Inc. (SFI), and all customer orders will be transmitted to SFI for execution, clearance and settlement.

Securities products offered by StoneX Financial Inc. (“SFI”) & StoneX Outsourced Services LLC are intended only for an audience of institutional clients only. Securities products offered by StoneX Securities Inc. and investment advisory services offered by StoneX Advisors Inc. are intended for an audience of retail clients only.

This information is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX Group Inc. of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you.

Additional disclosures can be found on https://stonex.com/en/compliance-library/

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.