Curious about adding OTC products to your hedging activities?

Discover the benefits of trading OTC with StoneX Markets (SXM) – the first non-bank swaps dealer to be provisionally registered by the CFTC.

OTC instruments from SXM Technologies

Over 300 OTC products available from ags, softs, dairy, livestock and energy to metals, forex, interest rates and equities.

Learn how SXM Technologies can customize our OTC products to match your specific business risk profile and market view – from simple swaps to exotic options and structured products. Our OTC product offerings include:

- Lookalike (or “plain vanilla”) options and swaps – the advantages of exchange-traded products in terms of strike, expiration date, and premium. OTC instruments utilize a financial/cash settlement and are traded bilaterally. On the other hand, exchange listed products utilize a physical delivery or financial settlement style and centrally clear all counterparty risk.

- Customizable options – build on the benefits of lookalike options by adding in more customizable expiration dates, strike, or futures reference contracts.

- Exotic options (Asian, Digital and Barrier options) – providing added customizability with the capacity to decrease upfront costs due to the ability to remove coverage when not needed by the client.

- Structured products – typically provided by SXM at zero up-front cost, these products “accumulate” an agreed-upon short swap above the current market or a long swap below the current market within a specified range.

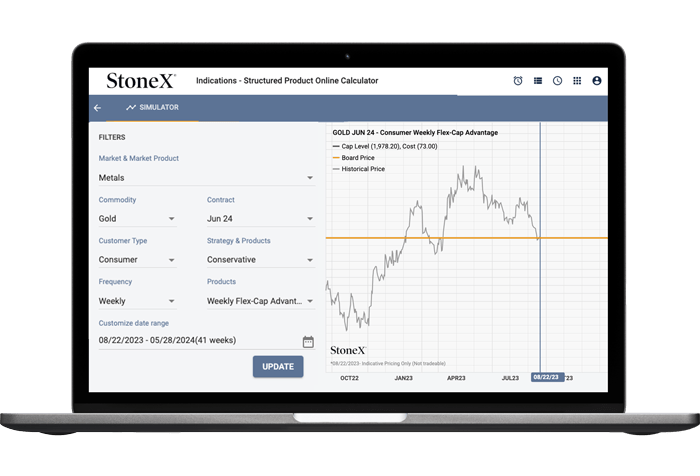

Quotes available 24/7/365 via our structured products app

First-in-class transparency: access to 22 structured products available inside our market-disrupting technology

Discover how qualified customers can view OTC structured product indications and request quotes in the over-the-counter commodities markets – 24 hours, 7 days a week – via SPOC, our breakthrough structured product online calculator.

From novice to expert, SPOC contains the education and support tools you need to execute hedging strategies that align as closely as possible with your unique risk exposures and strategic goals.

OTC Structured Product Guide PRODUCER

Wed, Oct 25, 2023 at 07:10 PM UTC

OTC Structured Product Guide PRODUCER

Wed, Oct 25, 2023 at 07:10 PM UTC

OTC Structured Product Guide (Flipbook)

Wed, Oct 25, 2023 at 07:08 PM UTC

OTC Structured Product Guide (Flipbook)

Wed, Oct 25, 2023 at 07:08 PM UTC

iMatch FAQ

Fri, Jul 7, 2023 at 02:00 PM UTC

iMatch FAQ

Fri, Jul 7, 2023 at 02:00 PM UTC

Upcoming events

FAQ

What are exotic options?

Exotic Options with SXM include Asian, Digital and Barrier options.

Asian options determine payout by figuring the average of the underlying price over a pre-set period. (Example: an average of the futures settlement each Friday for a month.)

Digital options (a.k.a. Binary or All-Or-Nothing options) pay the owner a fixed amount if the market settles at a predetermined level. Conversely, if it does not settle at that level, the owner receives nothing.

Barrier options are based on the market touching a pre-determined level where the option is either activated (knocked-in) or deactivated (knocked-out).

What are OTC options?

OTC products are designed to deliver the benefits of exchange-traded futures and options, with the advantage of customizable terms that align more closely with a customer’s unique hedging needs – including non-standard quantities, strike prices, expiration dates, etc. They can range in complexity from swaps, which behave like conventional futures and options, to structured products, in which multiple contracts combine to pursue a larger strategy. In all cases, OTC products aim to create more flexible, customizable solutions for each customer’s specific needs.

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 40+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

-

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

© 2024 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.

The trading of commodities and derivatives such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Advisory services as well as the trading of futures and options is available through various subsidiaries of StoneX Group Inc. including but not limited to the FCM Division of StoneX Financial Inc. Public Disclosures for the FCM Division of StoneX Financial Inc. The trading of over-the-counter products or swaps is available through subsidiary StoneX Markets LLC to individuals or firms who qualify under CFTC rules as an eligible contract participant. Please click here for the full disclaimer.

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.