Advanced risk solutions for turning volatility into opportunity

Risk management solutions and platforms

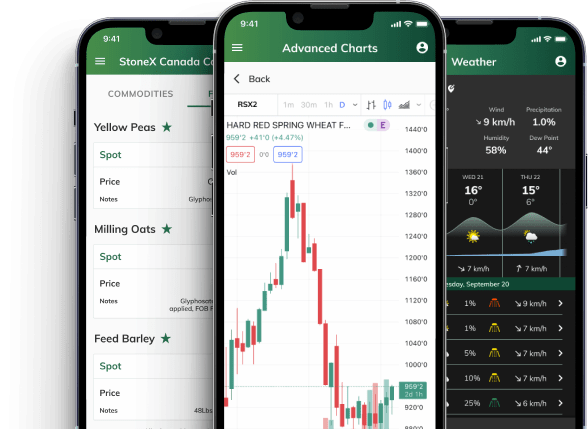

StoneX’s web-based and mobile apps provide on-the-go capabilities for managing your business.

OTC (over-the-counter)

Customizable terms aligned to your unique hedging requirements

The StoneX risk management expert team develops OTC products to fit a diverse array of risk profiles and market views. We provide robust customizability and can offer 20% lower margin requirements with equal or better liquidity than typically available on exchanges.

Exchange-traded products (ETPs)

Flexible, efficient access for hedging commodity price risk via exchange-traded futures

StoneX acts as a regulated futures broker on 33 commodities markets across the globe. Whether you need to hedge soybeans in Brazil, gold in Taiwan, or LNG in Europe, StoneX can help you expand your opportunities and open new markets.

Consulting and advisory services

High-touch, responsive consulting backed by sophisticated risk management tools and strategies

Our consulting and advisory network doesn’t provide cookie-cutter solutions. Instead, we learn your business from the inside out. Then we work with you to assemble the right mix of exchange-traded products, managed futures, options contracts, and customized OTC solutions to meet your specific risk management needs.

StoneHedge® merchandising system

The StoneHedge® web-based merchandising system empowers commercial grain customers of all sizes to increase grain origination efficiency via the industry’s most advanced toolset. Features and benefits include:

- Automatic cancellation and replacement of hedge orders tied to cash offers when there is a basis change or offer adjustment.

- Ability to quickly quote producers their spot contract price after a market order is filled.

- Streaming futures and cash prices, and the status of offers and orders.

- Views customizable by location, commodity, and originator, among other variables.

To learn more, you can request a demo below from our tech team. We can get you up and running quickly, and once we do, we’re confident you’ll never go back to managing offers manually again.

Farm Advantage mobile app

Improve your margins and grow your business with the Farm Advantage mobile app from StoneX.

Farm Advantage provides powerful tools that empower you to market with confidence, including:

- Cash bids

- Market quotes

- Market intelligence

And more. Available on the App Store and Google Play.

Visit the Farm Advantage page to get started.

Physical commodities

Manage commodity price risk without tying up your internal accounting, logistics and hedge management resources

We’ve built our business on a “boots-on-the-ground” approach that prizes our relationships with our customers above all else. When you’re faced with extreme volatility, you need to know someone will be at your side to help you mitigate your exposure to supply chain risk.

Insurance

Combine your coverage with proven risk management strategies

StoneX’s risk management consultants can help you take advantage of current market conditions and subsidies to create a risk management plan that fits your operational needs. Let us help you find the best mix of coverage and hedging strategies to protect and expand your operation.

Know-Risk™ Commodity Management Software

Information plays a crucial role in today’s marketplace, but managing that information can often be a challenge. If you are still using a spreadsheet to manage your business’s information, you may not be getting all the value out of the data you collect. The key is having the right information at the right time in order to drive decision-making.

Know-Risk is designed to help you manage and interact with information so that you can develop risk management strategies and tactics. This interactive information manager aggregates information from several different sources and presents it in an easily understood format, designed to enable users to make informed decisions about their risk management strategies and tactics.

StoneX: Boots on the ground (BOTG)

What sets StoneX apart? Discover how we draw on deep market knowledge and personal connections to deliver an unrivaled advantage to our clients.

Top Third Closing Audio Comments

Friday 7:48 PM

Top Third Closing Audio Comments

Friday 7:48 PM

Economic Calendar MIB

Friday 4:13 PM

Economic Calendar MIB

Friday 4:13 PM

Perspective: Morning Commentary for December 13

Friday 2:34 PM

Perspective: Morning Commentary for December 13

Friday 2:34 PM

Upcoming events

FAQ

How do I hedge my commodity risk?

Selecting the best tools for the job – including exchange-traded futures and options, cash and forward-market contracts, and customized over-the-counter products is critical to constructing a risk-management program suited to your company’s specific needs. By limiting risk and uncertainty, and improving margins and bottom-line results, you can concentrate on what you do best: running your business.

What is commodity price risk?

Simply put, commodity price risk is the danger posed to your business by an adverse move in the value of a commodity.

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 40+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

-

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

© 2024 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.

The trading of commodities and derivatives such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. Advisory services as well as the trading of futures and options is available through various subsidiaries of StoneX Group Inc. including but not limited to the FCM Division of StoneX Financial Inc. Public Disclosures for the FCM Division of StoneX Financial Inc. The trading of over-the-counter products or swaps is available through subsidiary StoneX Markets LLC to individuals or firms who qualify under CFTC rules as an eligible contract participant. Please click here for the full disclaimer.

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.