Cocoa Market Intelligence

Access comprehensive technical and fundamental analysis for global cocoa markets, along with incisive commentary from our team of analysts.

Make cocoa market expertise your edge.

All participants in the cocoa markets face price volatility. Supply and demand changes, weather events, political uncertainty, and currency fluctuations can all significantly impact prices – and your bottom line. From producers to cooperatives, importers and end users, StoneX arms businesses in the cocoa markets with the market analysis and insights they need to outperform the competition.

- Fundamental + technical cocoa market analysis

- Breaking news

- Global coverage

- Daily price data

- One powerful platform

Cocoa Gold Plan

Cocoa Platinum Plan

This comprehensive plan contains all the resources you need to excel in the cocoa markets. We tailor our supply and demand data for cocoa markets in the Americas, Europe and Africa to help our trading customers make informed decisions regarding their strategy and price-risk management.

In addition to all the key benefits of a Gold Plan, you have access to daily weather conditions, daily global cocoa market news, weekly differentials, cocoa futures open interest and volume reports, weekly Brazil reports and more. Our deep analyst insights aim to go beyond the data and deliver you a decisive advantage.

Choose your package

We offer two comprehensive Market Intelligence cocoa packages, both offering yearly or monthly pricing options and a 14-day free trial option.

| Cocoa Gold | Cocoa Platinum | |

| Cocoa Certified Stocks ICE NY |  |

|

| Cocoa Open Interest ICE NY |  |

|

| Cocoa COT Report |  |

|

| Cocoa Historical Price Behavior |  |

|

| Mid-Session Cocoa Recap |  |

|

| Cocoa Weather Report |  |

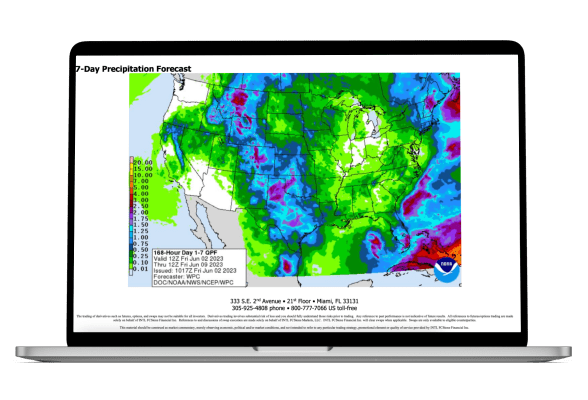

|

| Breaking New Articles |  |

|

| Interactive Differentials & Ratio Report |  |

|

| Certified Stocks Weekly Report |  |

|

| Open Interest & Volume |  |

|

| Weekly Market Report |  |

|

| Global Grinds data |  |

|

| ICCO Reports and analysis |  |

|

| $50 (USD)/mo

$480 (USD)/yr |

$100 (USD)/mo

$1,080 (USD)/yr |

Why choose a Cocoa Market Intelligence Package with StoneX?

Make our cocoa markets expertise your edge. Access to our market intelligence gives you actionable insights and data-- all in one easy-to-use platform.

- Stay up to date with every development in the cocoa market that impacts your bottom line

- Access daily data of ICE certified cocoa stock inventories

- View seasonality, cocoa price and percentages charts

- View reports showing indications of CIF, FOB, and ExWarehouse pricing across major origins

- Access recaps with terminal prices, spreads, arbitrage, currencies and cocoa event calendar

- See the relationship between volume, open interest, and price, and the effect these factors can have on managed money net positions

- … and much more

ICE Cocoa Futures Open Interest Down 656 Contracts, December 9

Tuesday 4:11 PM

ICE Cocoa Futures Open Interest Down 656 Contracts, December 9

Tuesday 4:11 PM

ICE Cocoa Futures Open Interest Down 276 Contracts, December 6

Monday 2:19 PM

ICE Cocoa Futures Open Interest Down 276 Contracts, December 6

Monday 2:19 PM

ICE Cocoa Futures Open Interest Up 940 Contracts, December 5

Friday 2:50 PM

ICE Cocoa Futures Open Interest Up 940 Contracts, December 5

Friday 2:50 PM

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 40+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

-

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

© 2024 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.