- Mixed data for the American economy raised doubts about the start of the Fed's reduction of interest rates, decreasing the bets for an interest rate cut in March.

- December CPI in the US is expected to show a slight hike compared to November, signaling the persistence of inflationary pressures.

- Disclosure of IPCA should reinforce the Central Bank's (BC) view that the Brazilian economy is still going through a disinflationary process and that interest rate cuts should proceed more slowly, favoring the maintenance of a higher interest rate differential compared to the American economy.

The week in review

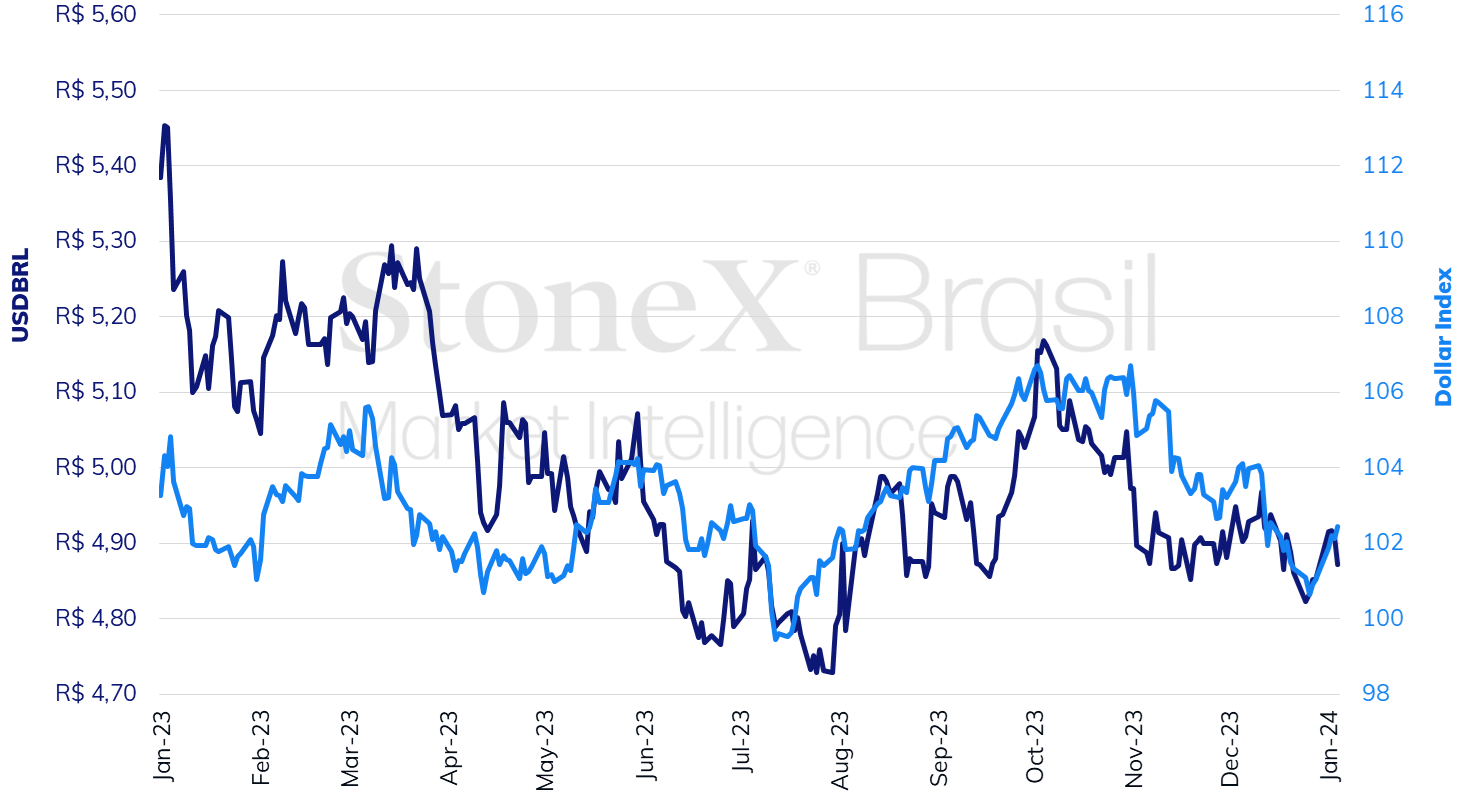

As observed throughout most of December, the main influencing factor in the Brazilian foreign exchange market last week continued to be the movement of bets regarding the start of interest rate cuts in the United States. The mixed performance for the activity level and labor market data released recently has kept doubts about the next steps of the Federal Reserve, supporting the USD compared to most global currencies.

The USDBRL ended the week slightly higher, closing Friday's session (05) at BRL 4.872, a variation of +0.4% for the week. The dollar index closed Friday's session at 102.4 points, close to stability compared to the previous week's closing.

Amidst investors' efforts to better understand the pace of the American economy slowdown and how it will influence the trajectory of interest rates in the United States, the Consumer Price Index (CPI) for December in the United States, which will be released next Thursday (11) by the Bureau of Labor Statistics (BLS), is the most anticipated indicator for the next week. The median of the projections indicates a monthly increase of 0.2%, a slight pick up compared to the 0.1% rise recorded in November and the highest level since September when it was 0.4%. The expectation for the core of the Index is for a 0.3% increase, repeating the previous month's pace. If the predicted variations are confirmed, the CPI will accumulate increases of 3.7% and 4.1% for the full index and the core, respectively, in the 12 months.

The CPI will be even more important to gauge expectations regarding American monetary policy after mixed data released this Friday (5) contributed to maintaining some uncertainty among investors. The Employment Situation report for December released by BLS came in higher than expected for the second consecutive month, showing a net creation of 216 thousand new jobs in the country, versus a median estimate of 170 thousand, and a significant increase compared to November, which was revised from 199 thousand to 173 thousand, suggesting a heated jobs market in the country. The index that measures the variation in wages also exceeded expectations, with a 0.4% increase in December (compared to a consensus of +0.3%), accumulating a 4.1% increase in one year. The robust demand for labor and the wage hike reinforce the reading of persistent inflationary pressures.

However, on the other hand, the ISM Institute reported that last month's PMI for Services marked 50.6 points, significantly below analysts' consensus, which was 52.6, and a slower pace of sector growth since May. Additionally, the Employment Index in the ISM services sector marked a sharp fall from 50.7 points in November to 43.3 in December, with the report pointing out difficulties in hiring skilled workers and an increase in layoffs in some activities. This scenario is more in line with expectations of moderation in the level of activity in the country. In this context, if a week ago, CME FedWatch indicated an 88.5% likelihood that the Federal Open Market Committee (FOMC) would begin cutting the benchmark rate at its March meeting this Friday, that likelihood would be 68.3%.

In Brazil, the highlight of next week's agenda is the release of the December Extended National Consumer Price Index (IPCA) data. The indicator serves as a reference for the target of price stability set by the Central Bank, defined by the National Monetary Council (CMN) for 2023 at 3.25%, with a lower limit of 1.75% and an upper limit of 4.75%.

As pointed out in the latest Focus Bulletin, economists' median expectations project a 0.4% increase in IPCA last month, in tandem with the variation of its preview, IPCA-15, released on December 28. According to IBGE, IPCA-15 recorded an acceleration of inflation in December, reflecting the hike of 0.77% in the Transport category (impact of +0.16 p.p.) - driven by the increase in airfare prices (+9.02%), and the Food and beverages group, which advanced 0.54% (impact of +0.12 p.p.) due to the increase in the cost of a basic food parcel.

If the IPCA repeats the high recorded by its preview, the index will end the year with an increase of 4.45%, above the center of the inflation target, but it would still be within its upper limit, meeting what the CMN defines. This result would represent considerable progress concerning the accumulated IPCA variation 2022 of 5.79% and market bets at the beginning of 2023, which projected the accumulated until December at 5.36%.

Even though the price level has responded to the more restrictive conditions adopted by the Monetary Policy Committee (COPOM) throughout 2023, the disinflationary process cannot yet be considered complete, as it has not fully re-anchored future expectations for the IPCA. For the participating institutions of the Focus Bulletin, the indicator should end 2024 with a 3.90% increase and 2025 and 2026 with a 3.50% increase, surpassing the target center of 3.00% defined for the three years.

In the minutes of its most recent meeting, published on December 19, COPOM adopted a more cautious tone than expected. The Committee acknowledged the results achieved in stabilization. Still, it emphasized the need for "serenity and moderation" in conducting monetary policy until the alignment between projections and the target for inflation is observed in the two-year horizon. The moderation in comments has reduced the room for more intense cuts in the Selic rate. It has made Copom's decision-making process from the second quarter more dependent on the evolution of economic indicators. For the meetings on January 31 and March 20, the magnitude of the cuts is already signaled at 50 basis points unless an unexpected event occurs.

The risk balance for price levels in 2024 shows a bullish slant. If, on the one hand, there is still a margin for adjusting the cost of diesel in refineries by Petrobras, using the import parity price as a reference, the full re-encumbrance of PIS/Cofins from January 1 combined with the increase in tensions in the Middle East may have an impact on the value of the derivative. In addition to the escalation of the conflict between Israel and Hamas, the attack by the Islamic State in Iran and the instability in the Red Sea were support factors for international oil quotes in the last week.

For another important category in the IPCA, food and beverages, the effects of the El Niño phenomenon, expected to have peaked in December, can also be inflationary. According to the latest pre-COPOM survey, participating analysts indicated seeking a potential impact of 0.6 p.p. on consumer prices, with 0.2 p.p. already incorporated into the projection of a 4.00% increase in the index in 2024.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.