- Economic data for Brazil is expected to show a slowdown in activity in the country and may make investments in national assets less attractive, contributing to the weakening of the real.

- The logistic crisis in the Red Sea may magnify global risk aversion and increase freight costs, harming the global trend of disinflation and the performance of risky assets, such as currencies of emerging countries.

- Economic data for the United States may suggest that economic activity remains stronger than anticipated, reducing bets for interest rate cuts by the Fed and strengthening the USD.

- Economic data for China may reinforce the perception of weakening domestic demand in the country and harm the performance of risky assets, such as commodities and currencies of emerging countries.

- Talks between Haddad and Pacheco on the provisional measure (PM) of payroll tax relief can result in alternatives to increase government revenues this year, reducing the perception of Brazilian assets' fiscal risks and strengthening the real.

The week in review

The week was marked by the release of inflation data for the United States and Brazil in December. The slightly stronger figures than expected for the Consumer Price Index in the US did not reduce investors' optimism for bets on interest rate cuts by the Federal Reserve this year. Still, they should motivate the Fed to be more cautious and prudent in its interest rate cuts throughout 2024.

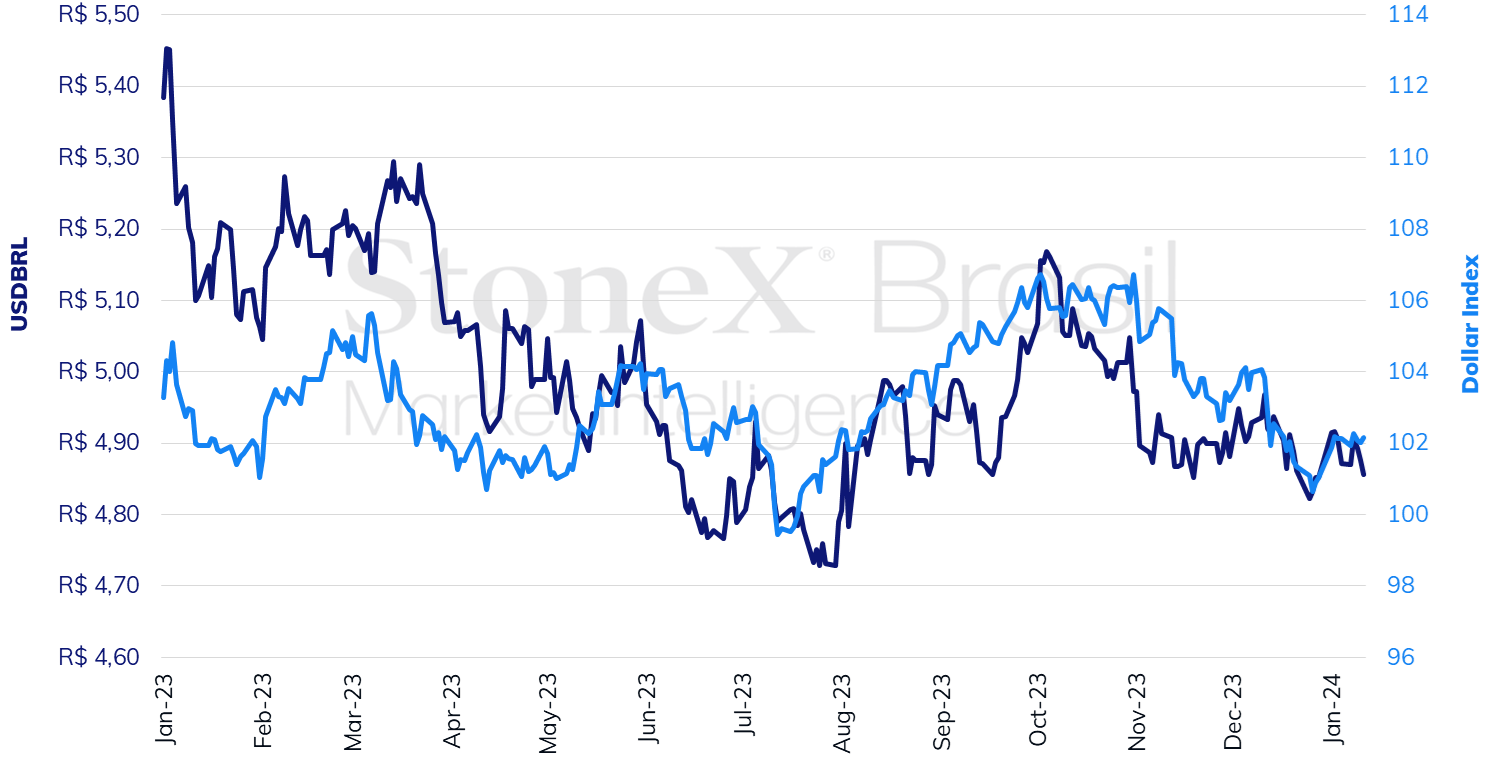

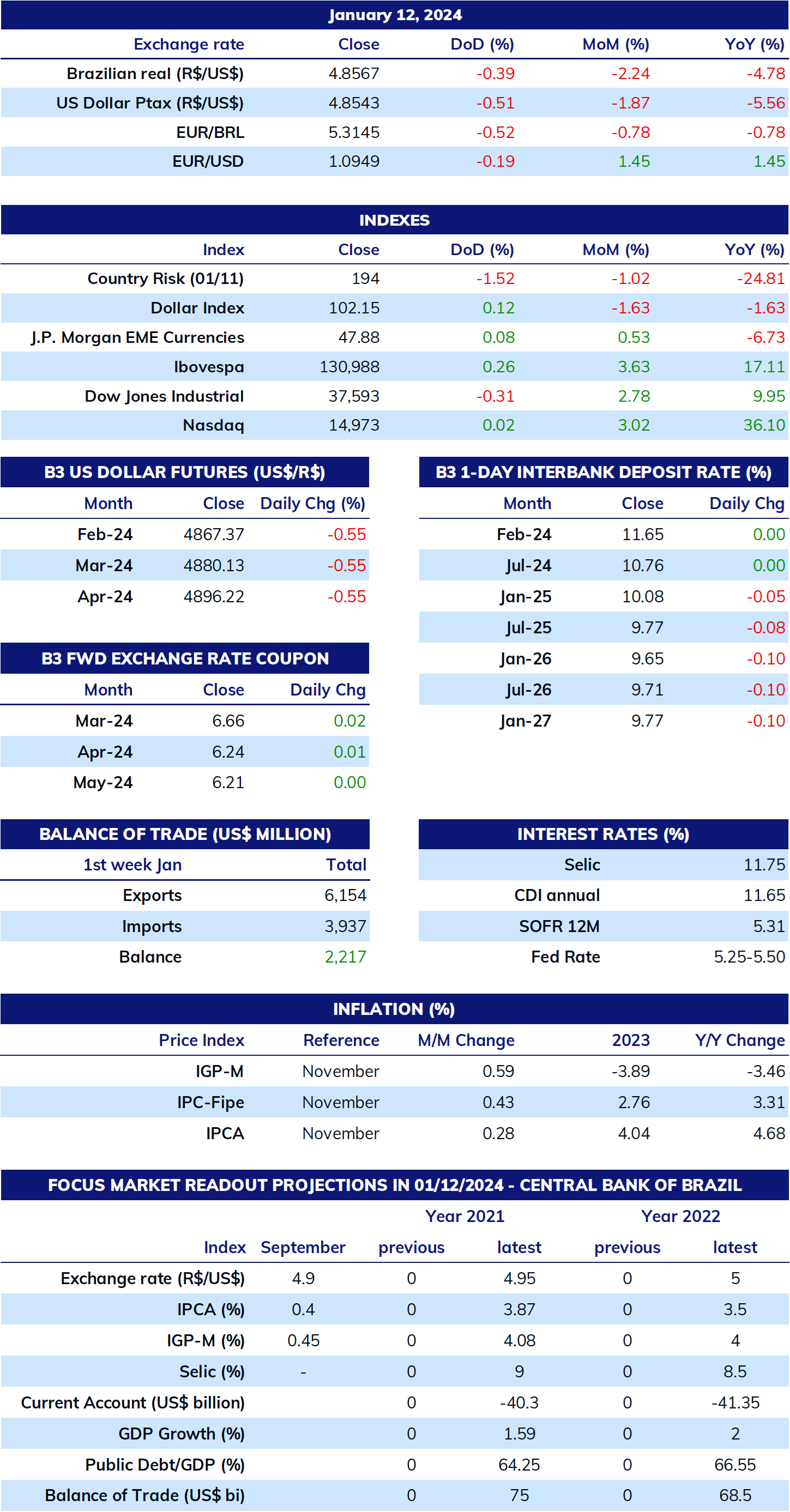

The USDBRL ended the week lower, closing Friday's session (12) at BRL 4.857, a variation of -0.3% for the week, +0.1% for the month, and +0.1% for the year. The dollar index closed Friday's session at 102.2 points, a weekly gain of 0.0%, a monthly gain of 1.1%, and an annual gain of 1.1%.

THE MOST IMPORTANT EVENT: Payroll tax reinstatement

Expected impact on USDBRL: bearish

Investors' attention this week should be on the talks between the Minister of Finance, Fernando Haddad, and the President of the Federal Senate, Senator Rodrigo Pacheco (PSD-MG), regarding the Provisional Measure (PM) that proposes revoking the payroll tax relief. After the National Congress dropped the veto of the Brazilian President and kept valid the extension of tax relief for 17 sectors of the economy until 2028, with an annual cost estimated by the Treasury at BRL 12 billion, the Executive published the Provisional Measure on December 29, amidst the parliamentary recess, establishing a phased re-taxation and maintaining the benefit partially only for some segments and in a restricted manner. Parliamentarians considered the measure an insult to the Legislative branch and advocated for its revocation or, at the very least, a relaxation of the proposal from the economic team. As an alternative for revenue recovery, some congressmen suggest taxing international remittances of up to USD 50, which is currently exempt. Anyway, the Treasury has already indicated that it prioritizes the search for revenue alternatives on the legislative agenda, trying to make the execution of the target of zero primary fiscal deficit possible this year - something that many consider unattainable without the joint execution of public spending cuts, which the Administration has not discussed.

Brazil economic data

Expected impact on USDBRL: bullish

The release of figures for the services sector in Brazil in November and the Central Bank Economic Activity Index (IBC-Br) for the same month should also be highlighted this week. The median estimate is that the services sector remained stable in the month and that the IBC-Br will increase by only 0.1%. After the Gross Domestic Product grew 0.1% in the third quarter, some analysts see the possibility of a negative result in the last period.

Logistics crisis in the Red Sea

Expected impact on USDBRL: bullish

The recent attacks by a coalition between the United States and England on Houthi military targets in Yemen have raised concerns about worsening bottlenecks in global logistics chains. Shortly after the start of the conflict between Israel and Hamas, Houthi rebels began attacking various vessels that they perceived to be connected to Israel in some way - from being from a friendly country to Israel to having Israel as a possible route. Missiles and drones targeted dozens of ships, while militants hijacked some. In a month, traffic in the region decreased by approximately 40%. In comparison, traffic on the longer and more expensive alternative route passing through the Cape of Good Hope increased by 60%, which could result in higher prices for industrial goods and commodities if the situation persists.

US economic data

Expected impact on USDBRL: bullish

After warmer data for the labor market and consumer inflation in the United States in December, American retail sales are also expected to repeat the good performance of November and increase by 0.4% in December due to holiday sales, resulting in an annual increase of 4.0%. This reading reinforces interpretations that price moderation in the US may experience some setbacks in the coming months, which may motivate the Federal Reserve to be more cautious and prudent in its interest rate cuts throughout 2024. On the other hand, manufacturing should remain stable in December, with the exhaustion of the statistical effect of the end of the strikes in the automotive industry observed in November.

China economic data

Expected impact on USDBRL: bullish

Since the end of the zero-tolerance measures against Covid-19 in China at the end of 2022, the performance of the Chinese economy has been one of the main drivers of global asset markets, particularly risky assets such as commodities and currencies of emerging countries. This week, the country's Gross Domestic Product is expected to continue to lose pace and ramp up only 1.0% in the fourth quarter, compared to 1.3% in the previous quarter. Although this reading should result in accumulated growth of 5.3% compared to the fourth quarter of 2022, it should be remembered that this period was particularly bad due to a heavy lockdown in Shanghai, which generated a momentary statistical effect that distorts the weakness of the country's situation.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.