- Federal Reserve authorities should continue to advocate a cautious stance while carrying out its interest rate cutting cycle, aiming to curb excessive investor optimism regarding the trajectory of interest rates this year.

- Talks between the Executive and the Legislative on the PM of payroll tax reinstatement seem to be heading towards a long-term solution, which would not contribute to increasing government revenues this year and would increase the perception of fiscal risks of Brazilian assets, weakening the BRL.

- Economic data for the United States may suggest that economic activity in the country is slowing down in the first quarter, increasing bets for interest rate cuts by the Fed and weakening the USD.

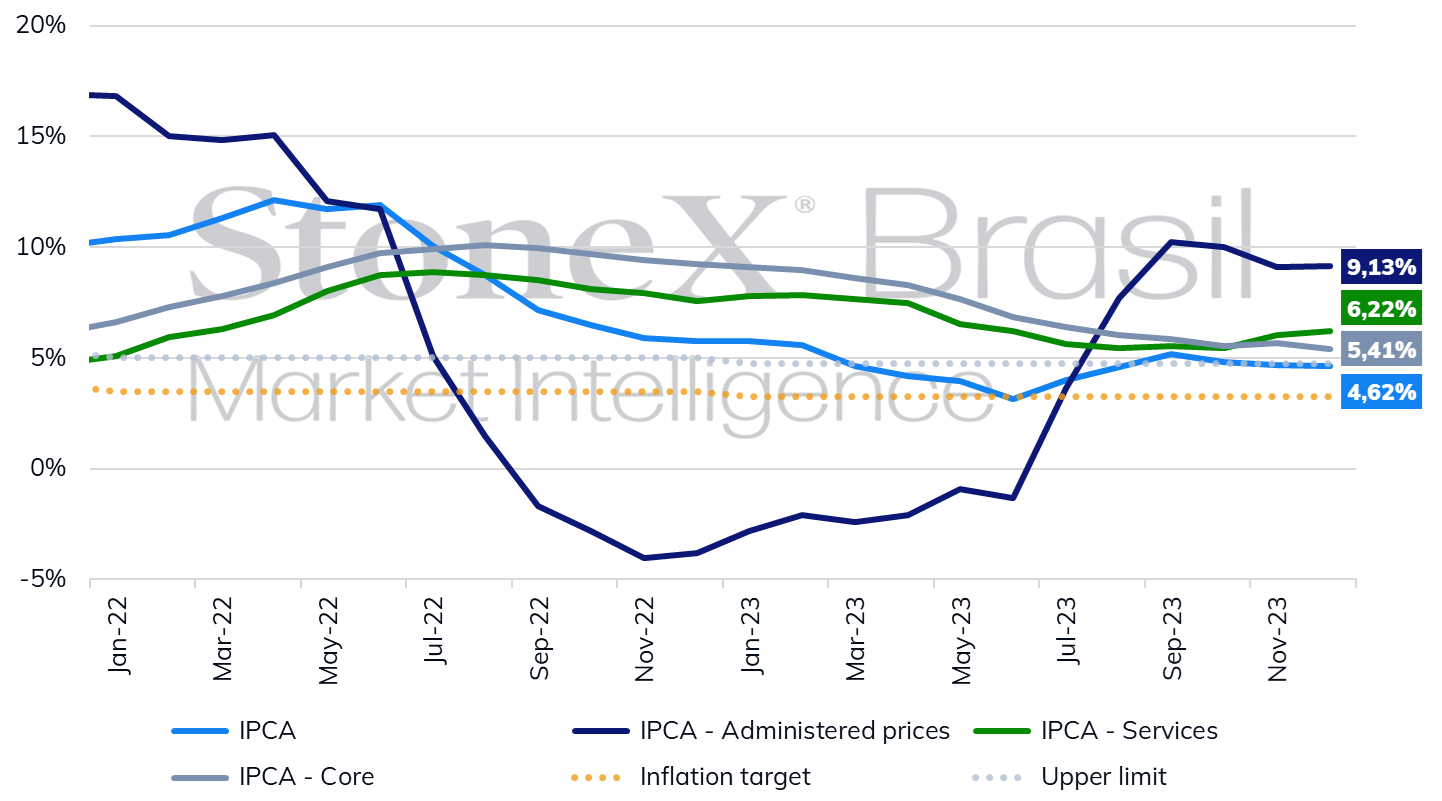

- IPCA-15 is expected to show a moderate increase in January. It may suggest the need for less intense cuts to the basic interest rate (SELIC) by the Central Bank, which would benefit the Brazilian interest rate differential and strengthen the BRL.

The week in review

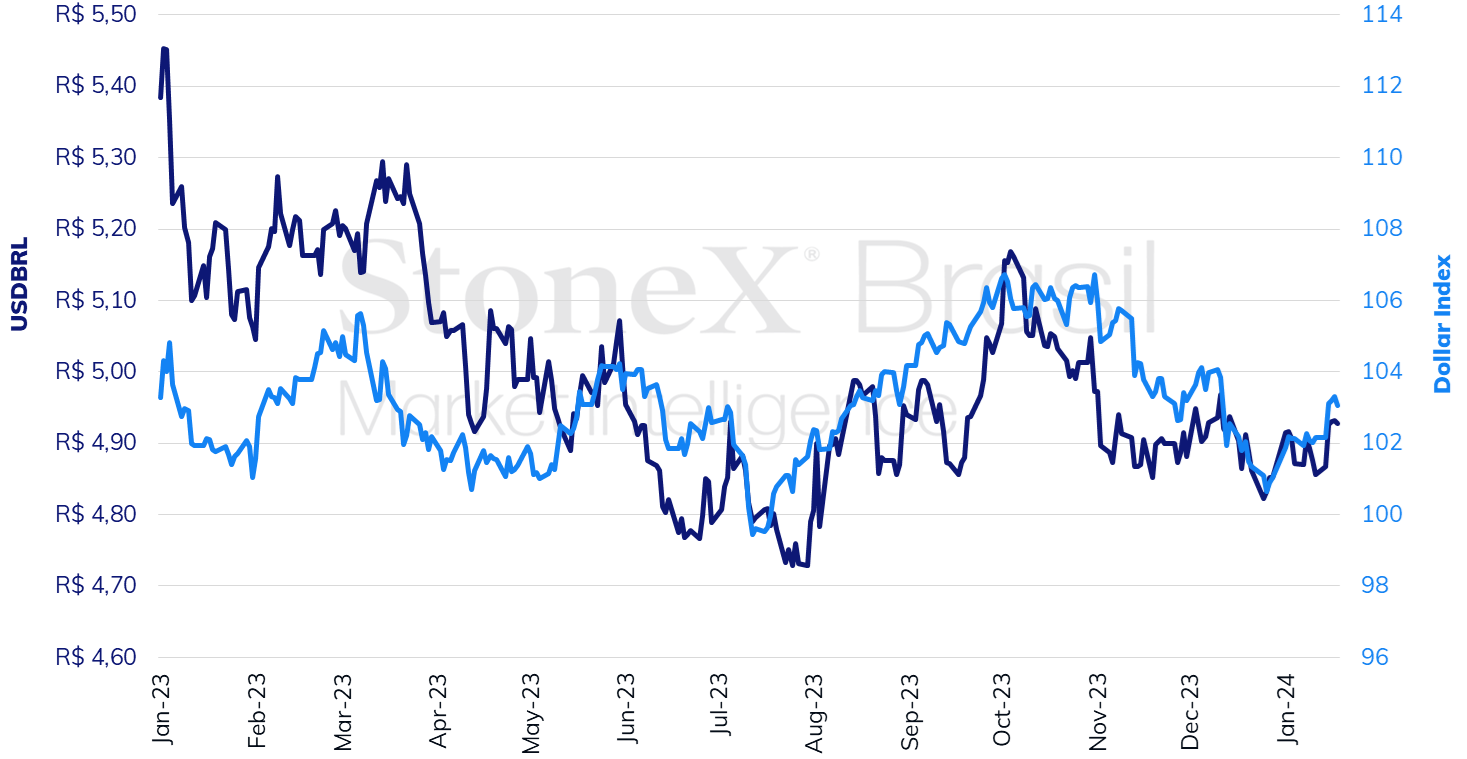

The week was marked by a systematic effort by the Federal Reserve and the European Central Bank to curb these institutions' excessively optimistic bets on interest rate cuts throughout 2024, promoting a moderate readjustment of positions among market agents and global strengthening of the American currency.

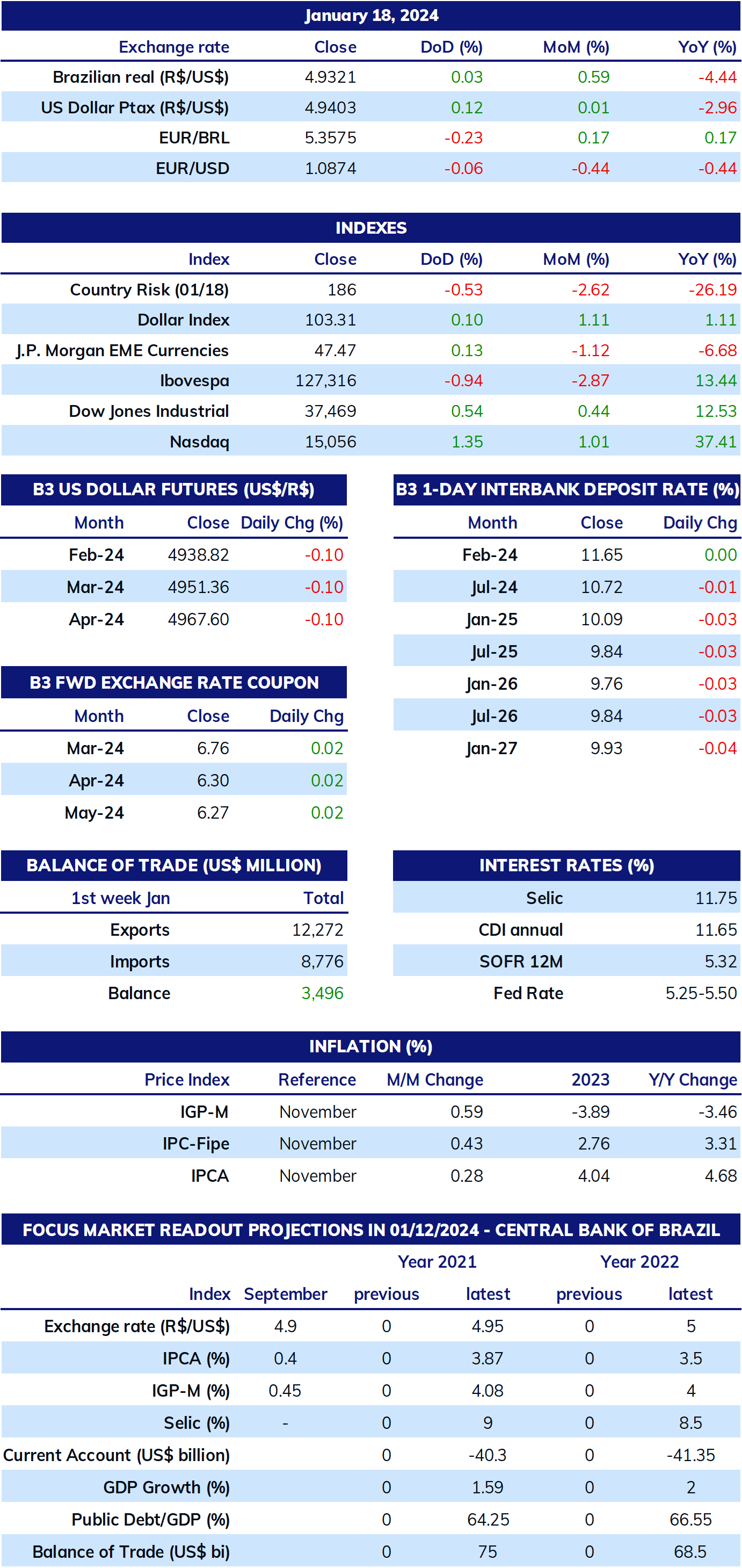

The USDBRL ended the week higher, closing Friday's session (19) at BRL 4.9273, a weekly increase of 1.5%, a monthly increase of 1.6%, and an annual increase of 1.6%. The dollar index closed Friday's session at 103.1 points, a change of +0.9% for the week, +2.0% for the month, and +2.0% for the year.

THE MOST IMPORTANT EVENT: US economic data

Expected impact on USDBRL: bearish

The first preview of the US GDP is expected to show a reduced pace of growth, going from 4.9% in the third quarter to 2.0% in the fourth quarter. The main reason for the fall is a cyclical decrease in stocks, but domestic demand, particularly personal consumption expenditures, is expected to remain strong during this period. Although the American economic performance surprised in 2023, the most recent high-frequency data seems to indicate that this movement will be smoothing in 2024; that is, growth will remain positive but at lower rates. The higher interest rates and more unfavorable credit conditions, sooner or later, reduce the country's expansion potential. The Personal Consumption Expenditures (PCE) Price Index is expected to have a smaller increase between November and December than the Consumer Price Index (CPI) due to the methodology used in its calculation. An increase of 0.2% is expected for both the overall indicator and its core, which excludes volatile components of food and energy, which should lead the 12-month accumulated index to 2.6% for the overall value and 3.0% for its core.

Effort to recalibrate expectations for the Fed's interest rates

Expected impact on USDBRL: bullish

The moderation of consumer inflation should result in a cycle of interest rate cuts by the Federal Reserve (Fed). Still, the optimism generated by the agency's last monetary policy decision on December 13 would hardly be observed. On January 12, the bets on interest rate cuts in the March 20 decision totaled 81%, according to the CME FedWatch tool, and reductions of 0.25 p.p. were expected in the six subsequent meetings, which would bring the US basic interest rates to a level between 3.50% and 3.75% p.a. by the end of 2024. In the summarized economic forecasts for December, the median of Fed officials anticipated only three rate cuts throughout the year, and no official believed to end the year at the level expected by investors.

Even after data that was on the rise compared to expectations for employment, inflation, retail sales, and manufacturing, and after the coordinated effort of Fed members to calibrate traders' expectations, more than 50% of bets are still for a rate cut in the March decision, while the final expected rate for 2024 has only risen to the range between 3.75% and 4.00% p.a. Thus, something will necessarily happen, either the Fed will change its stance and become more aggressive in its cuts or, more likely, investors' expectations will be frustrated, and an adjustment of these bets to a slower and more cautious trajectory will occur later on.

IPCA-15 in Brazil

Expected impact on USDBRL: bearish

The release of the National Broad Consumer Price Index 15 (IPCA-15) on Friday (26) will be the last inflation reading before the next Monetary Policy Committee (COPOM) decision on Wednesday, January 31. The median of the estimates shows an increase of 0.50%. Although inflation has been tempering in recent months and ended 2023 within the target tolerance range established by the National Monetary Council (CMN), it experienced a hike last month - IPCA increased by 0.56% in December, compared to 0.28% in November, while the core, which excludes volatile components of food and energy, rose from 0.30% to 0.50% in the same period. However, the inflation of service items decreased from 0.70% in November to 0.60% in December. Still, it remains more heated and may represent a challenge for the price stabilization sought by the Central Bank.

Payroll tax reinstatement

Expected impact on USDBRL: bullish

The week of negotiations between the Minister of Finance, Fernando Haddad, and the Presidents of the Chamber of Deputies, Arthur Lira (PP-AL), and the Federal Senate, Rodrigo Pacheco (PSD-MG), regarding the Provisional Measure (PM) proposing the payroll tax reinstatement was marked by few public statements by the authorities and indications that there are still significant divergences between the position of the Executive and that of the Legislature. On Friday afternoon (19), Pacheco told journalists that the federal government had committed to revoke the PM and edit it to end this topic. Haddad stated that the Treasury would insist on reinstating the payroll tax for the 17 labor-intensive sectors and avoided commenting on the Senate President's statement. Journalists will address the topic next Monday (22) when the Minister of Finance will participate in an interview program.

The edit of the Provisional Measure on December 29, amidst the parliamentary recess, caused great discomfort among the congress members, who had already overturned the president's veto and kept the extension of tax relief for 17 sectors of the economy valid until 2028, with an annual cost estimated by the Treasury at BRL 12 billion. Parliamentarians considered the measure an insult to the Legislative branch and advocated for its revocation or, at the very least, a relaxation of the proposal from the economic team. On the other hand, the economic team has mentioned the possibility of gradually reducing the tax relief as an alternative to the impasse.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.