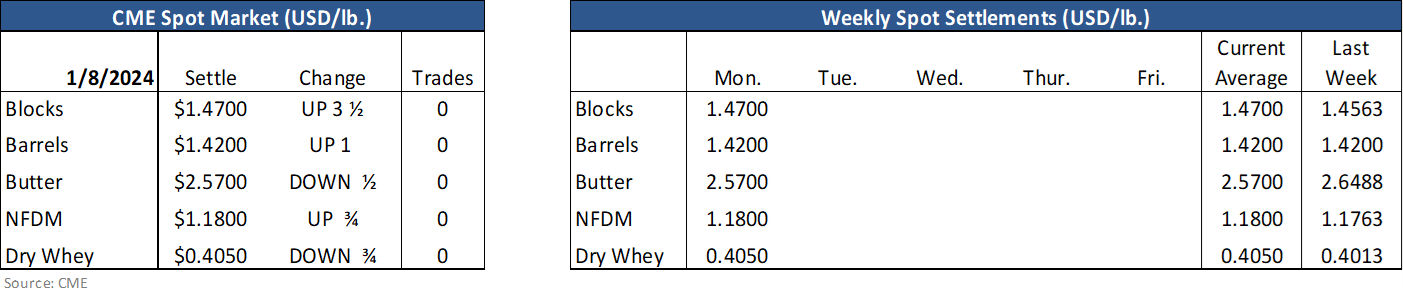

Class III and Cheese futures traded both sides of unchanged ultimately turning higher on good volume and rising open interest as spot cheese firmed Monday. Block cheese gained 2.25 cents on 6 trades while barrel cheese increased 4.50 cents on 4. The futures trade firmed despite the premium to spot already in place but the most interesting part of yesterday’s trade is that open interest increased. With over 1,800 Class III contracts trading and 517 Cheese futures changing hands, open interest increased by 383 Class III and 210 Cheese.

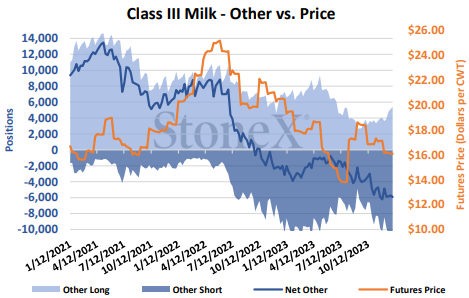

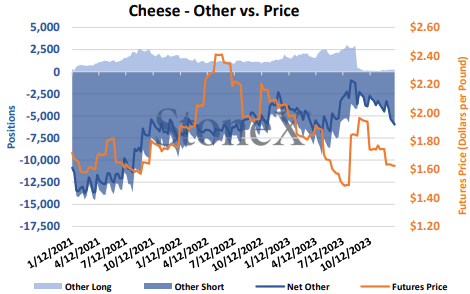

On more than one occasion and yesterday, we pointed out the massive Managed Money net short position in both Class III and Cheese. The “other” category – those who carry smaller positions either as hedges or speculatively – are also increasingly short these Class III and Cheese contracts. Despite yesterday’s bump to prices, the overarching trend for both markets is down and the people (Managed Money) who are in the market to make money are short and presumably still expecting weakness. The risk here is the same as it was a month ago: short-covering.

From a technical – or chart - perspective, nearby Class III and Cheese are expected to firm more now. But it may be orderly and slow. We’ll likely need to see something more bullish for the market to be gripped by buyer panic we haven’t seen in months. With the annual IDFA conference just two short weeks away, we wonder what the market moving news will be in the hallways of the JW Marriott in Scottsdale.

Butter futures continued to their multi-day slide after nearby contracts re-tested futures highs set back in September last week. Spot Butter fell 4.5 cents to $253.000 on 3 trades as the butter market is “appropriately priced” between $245.000 and $267.000 – it’s most recent 7-week trading range. At least that is an appropriate market clearing price looking backward. Futures weakness was relegated to the first half of 2024 contracts with 205 contracts changing hands and open interest up 102 contracts. End-user buy side interest remains alive and well and likely a few pennies below current at $245.000-$250.000 for the Jan or Feb to December timeframe.

Spot NFDM firmed slightly Monday but remains quite sideways. For the last 7-weeks, spot NFDM has sat between $1.1550 and $1.1900 as the market clears product in a very orderly fashion. Futures were mixed Monday but also directionally sideways. We hear comments from our colleague in Singapore that China continues to rely more heavily on their domestic supply of SMP. On the other hand, SGX WMP futures were strong today (along with some firming in EU SMP) as traders sift through the fallout a December 31 fire in a dairy raw materials storage unit in the Algerian municipality of Bourguiga. The warehouse contains approximately 10,000 – 12,000 tonnes of milk powder, according to several market sources. They wasted little time in what appeared to be an attempt to rebuild lost inventories as a new Onil tender occurred yesterday.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.