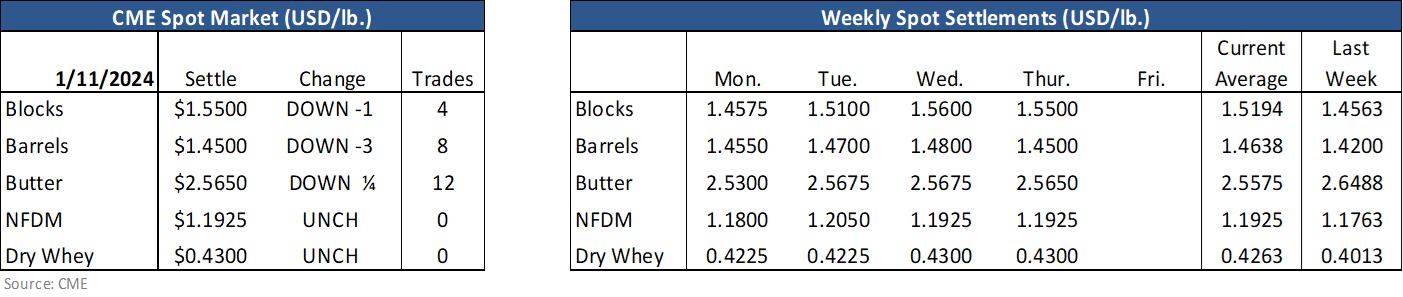

The demand for milk on National Milk Day did not draw down enough supply to keep the spot market climbing. The strength we’ve seen this week in Class III, cheese, and butter has been erased on a negative day in the spot market. Barrels fell the hardest, down 3 cents to $1.4500 and blocks were down 1 cent to $1.5600. Sellers took advantage of the two days on higher prices to start the week as Class III futures volume rose above 2200 contracts while open interest rose by 445 contracts. This is the first 2000+ volume day this year. Cheese volume nearly double with 1,190 contracts trading while open interest rose by 462 contracts.

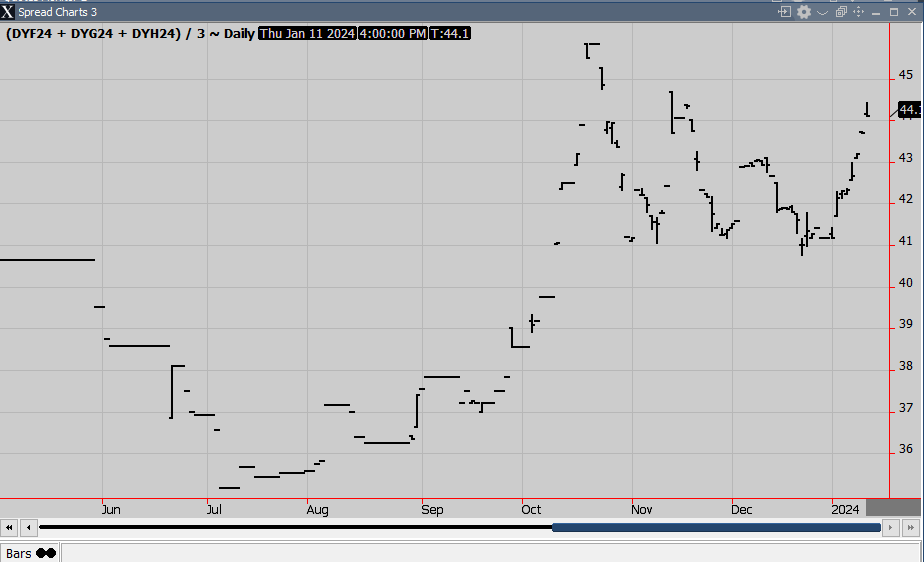

Spot whey, on the other hand, was unchanged but is higher on the week. Whey futures climbed above levels we haven’t seen for over two months before spot opened. After the lack of movement, it fell back down, leaving the nearby up at $44.5000. Nonetheless, futures are looking to test contracts highs after finding support in late December. Market participants continue to bring strong higher protein demand while Chinese demand for whey/carbohydrates wanes due to a falling hog herd.

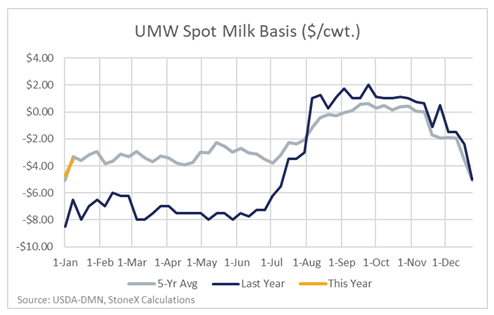

As we head into mid-January, spot milk basis has moved higher and is staying right in line with the 5 year average. The average spot load was sold at $3.75 under Class III prices, a nearly $3 increase from the average load sold in the second week of 2023. Weather went from very mild in the region recently to very extreme this week. Reports are that spot loads are available as some plants are going through scheduled downtime. Butter makers in the area are reportedly turning away cream offers as they are pushing capacity.

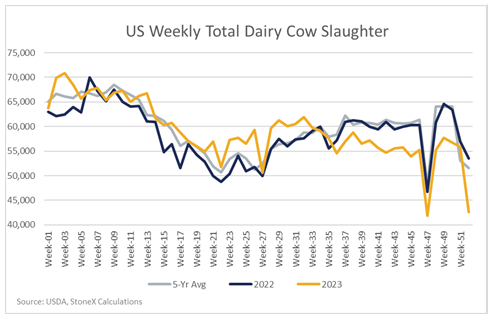

Dairy cows slaughtered in the U.S. during the final week of 2023 were much lower than in the year prior (-20.27% YoY). This being the final week of the year was expected to be low due to the holiday, but this was the lowest harvest volume of dairy cows since 2014. This was also the lowest market share held by dairy cows since Thanksgiving of 2022 when dairy cows accounted for 7.9% of total beef production that week. Total cattle slaughter was also down considerably but was still higher than during Christmas week of 2021.

Spot butter fell just a quarter cent yesterday which was enough to bring sell side liquidity as futures volume more than double with 204 contracts trading as prices were mostly lower. For now, in Q1, $2.60 has shown strong resistance. Nonfat markets didn’t seem bulled up from the ONIL tender news released yesterday. Futures prices were down more than a cent for most contracts through the end of the year as futures volume rose with 277 contracts trading. Overnight, SGX SMP and WMP futures did see some support but was marginal as traders likely wait for GDT on Tuesday.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.