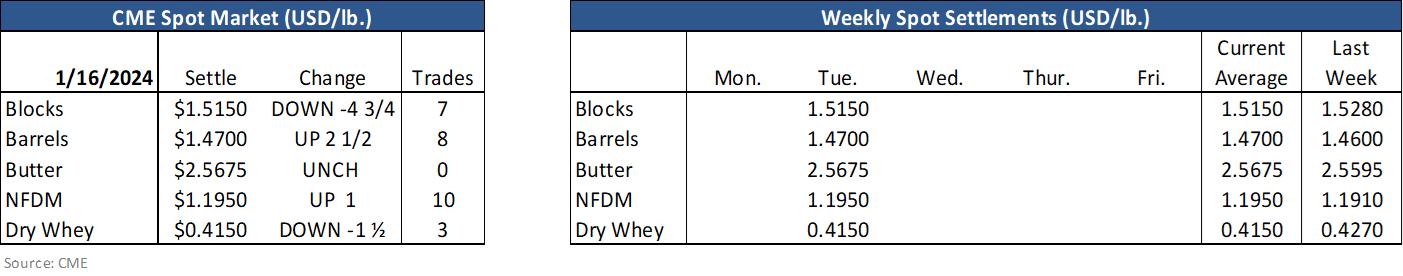

New Class III and Cheese futures selling resumed in earnest Tuesday with solid futures trade volumes and rising open interest. Spot block weakness (down 4.75 cents on 7 trades) was likely the driving force as US spot cheese market continues to deal with an steady stream of sell orders – despite firm global cheese prices - here in week 3 of the New Year. The price of barrel cheese actually increased closing 2.5 cents higher on 8 trades as anecdotal comments point to tighter supply of barrels particularly in the Midwest. The net result of the futures trade yesterday is a market caught in a sideways chop within a larger still-bearish market trend. That said, new contract lows for nearby futures have not been made and the back and forth activity could be evidence of the market trying to etch out a bottom. Too early to call that, but we expect more of the same sideways distribution on price today.

While Class III moved lower Tuesday, Class IV moved higher perhaps paying some attention to the firm GDT auction results. Trade volumes on butter and powder were lackluster both coming in under 100 contracts. Stable spot markets continue to stymy futures downside potential at the moment and while global price action isn’t magnificently bullish, the US trade is coming to terms with growing limited downside potential specifically on NFDM.

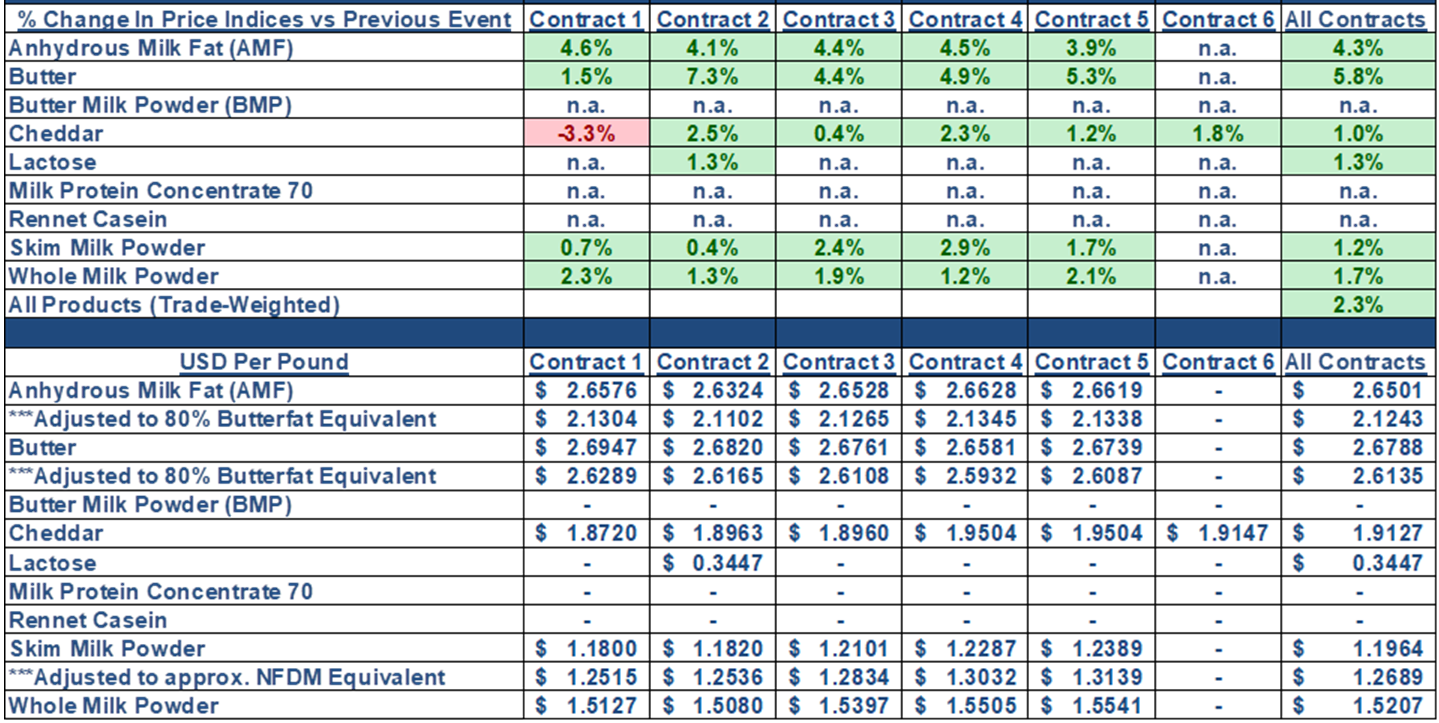

The GDT price index moved 2.3% higher yesterday, falling short of where futures pinned price expectations. Volume offered was down 19% and total volume purchased was down 22%, primarily from declining demand from Asia. All products moved higher in price except mozzarella, which saw a 3.3% decline. AMF was up significantly due to Chinese demand.

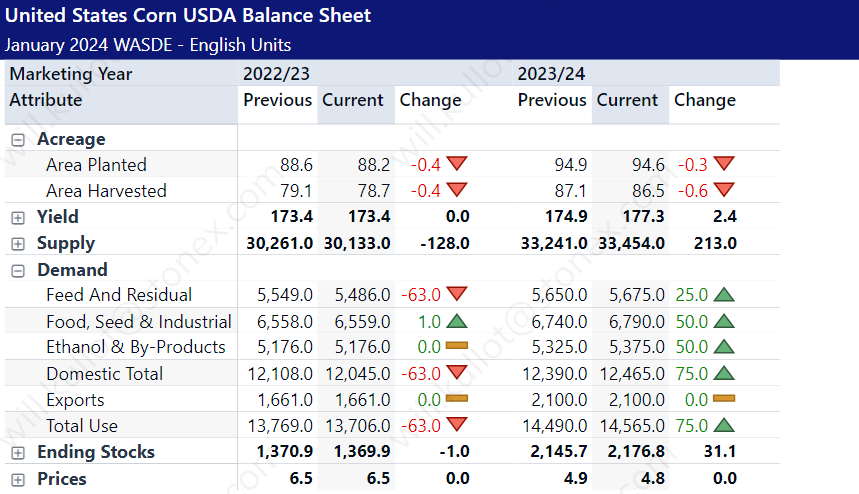

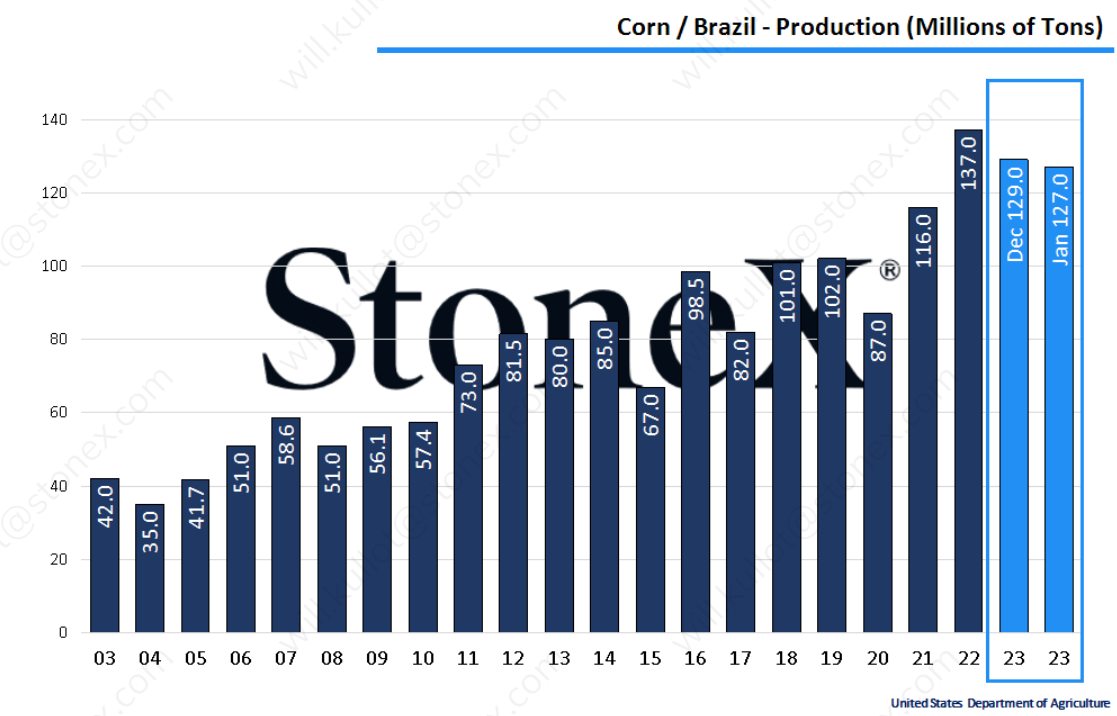

The WASDE report from last Friday was slightly bearish, mostly on domestic fundamentals. Corn yield was a record 177.3 bu/acre, with many states revised higher including Nebraska, Iowa, and Illinois. To eat at that yield, planted and harvested acres were revised down, along with increased estimates for feed, food, and ethanol demand. Soybeans had a similar story with yield estimates up .7 bu/acre to 50.6. Brazil production was revised down but not as much as expected. Ukraine has been able to export commodities at rates seen before the war with Russia started, and with Argentina harvest starting in March/April, Brazil’s production will need to come significantly lower for US to participate in the export market.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.