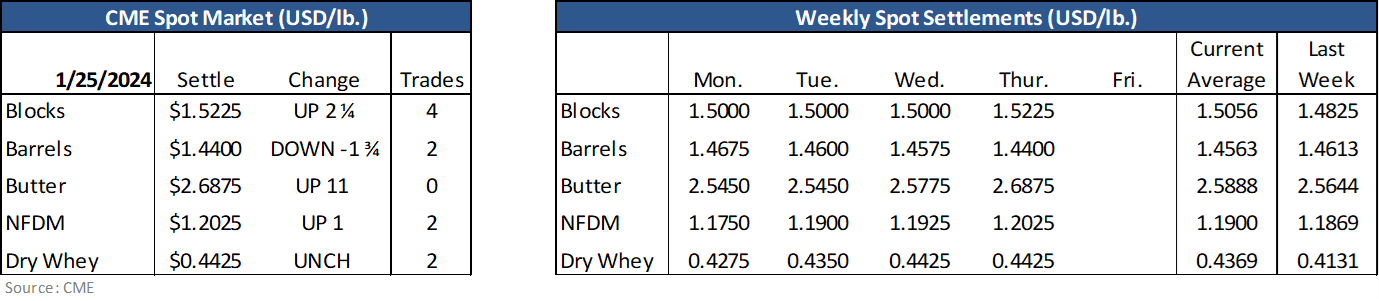

Class IV, Butter, and NFDM will have expanded limits today.

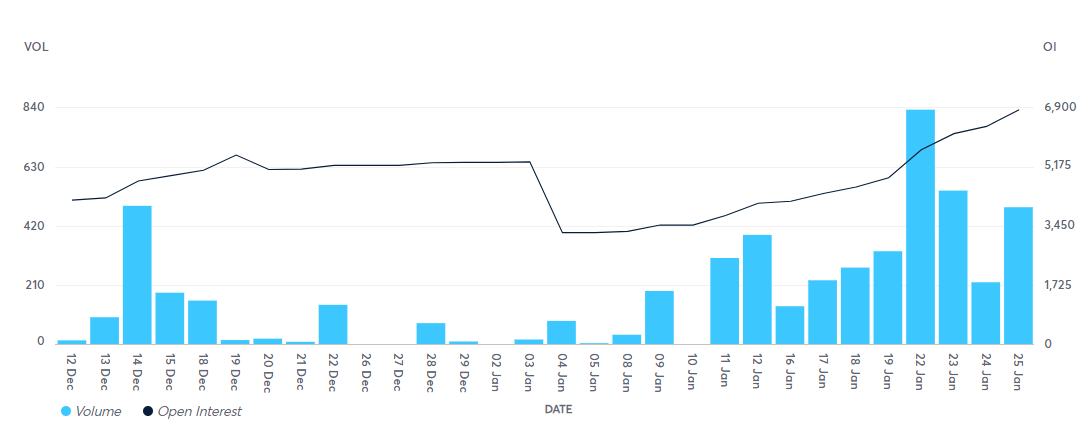

The headline yesterday was the butter market as buyers sent futures limit up (+7.5 cents) between February and July after the bullish Cold Storage report. Sentiment has shifted quickly in this butter market and this risk of $3.00 butter this year is back once again. Futures volume fell to just 193 contracts as sellers back off for the most part. Interestingly enough, options trading has been lively this monthly with open interest rising aggressively. The stronger butter market supported stronger Class IV prices and volume with over 300 contracts trading with nearly all of it being new open interest as it increased by 241 contracts.

Although spot cheese prices were mixed, Class III decided to push higher in sympathy. Block prices were up 2.25 cents on 4 trades while barrels were down 1.75 cents with 2 trades. Futures volume fell from the 3,300 trading day on Wednesday with volume posting 2,500 contracts with most of that seen in Feb and Mar contracts as we continue to see participants roll positions. Cheese futures trading was actually stronger with over 1,100 contracts trading. Futures prices may shrug this off if spot prices remain steady short term. As we mentioned yesterday, component production remains stronger and has been enough to meet current demand but a long term view could shift that perspective.

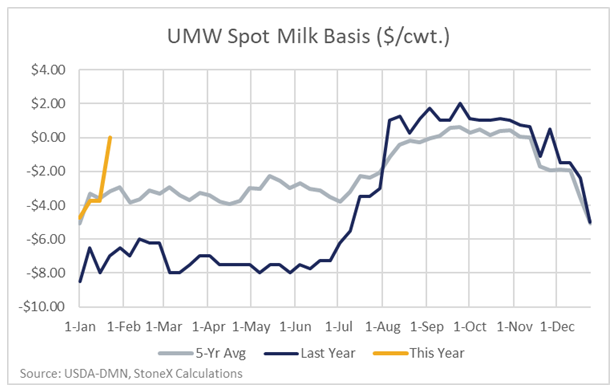

Spot milk basis in the Upper-Midwest leapt higher this week to an average price of even with Class III. Class I demand has re-entered the market as schools are back from the holiday season which is putting some upward pressure on spot milk prices. Cheese processing returned to a bit more consistent schedule this last week. Milk and cream availability have diverged according to the USDA with there being ample cream supply but a tightening milk supply. The USDA is now bringing up the question of milk availability in the second half of 2024 given the processing needs. The last time we experienced a non-negative average spot load price in the 4th week of the year was back in 2019 (+0.25 over Class III).

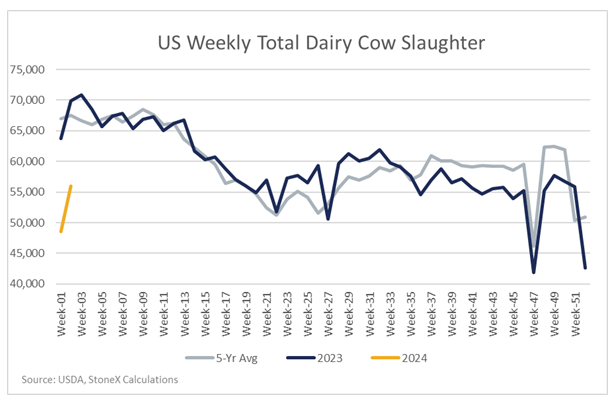

Dairy cows slaughtered in the U.S. increased from the first week of the year as processing plants were running a full week. Total volume being harvested are still much lower than they were last year though, down 19.95% YoY. Given that heifer prices are in the mid $2,000 range depending on location, there just don’t seem to be cows for farmers to cull if they want to have a dairy running in a year or two. Reports from farmers is they know replacements will be an issue given the amount of culling and beef-cross breeding that was done and they are now working on correcting the situation, which takes time.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.