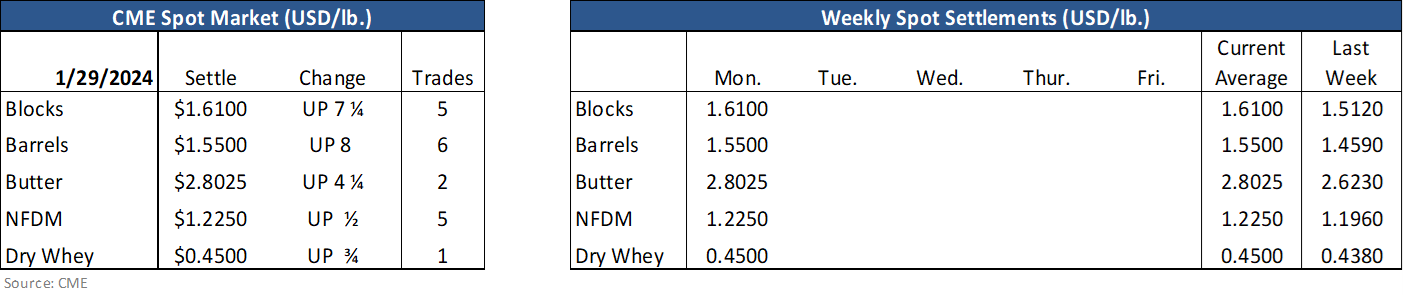

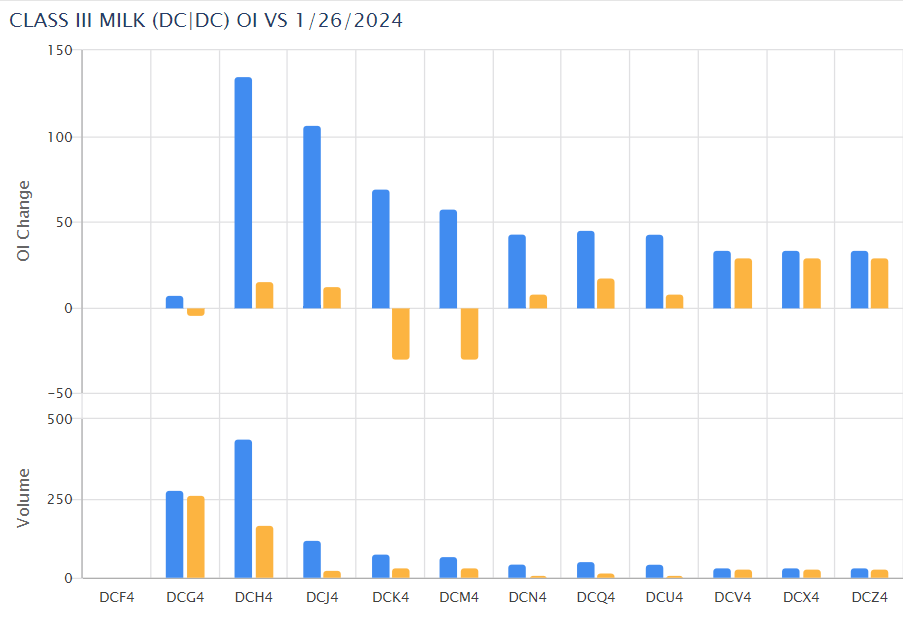

Nearby Class III and Cheese continued its ascent Monday with buyers becoming more aggressive as the speculative “shorts” in the market unwind some positions. Class III open interest fell 54 contracts overall yesterday driven by the February contract, which saw open interest decline by 199 contracts on 1,199 trades. You read that right. Of the 2,829 Class III contracts that traded yesterday, 42% traded in February alone. Cheese futures were also active with 699 contracts changing hands and open interest up by 40 contracts. But narrowing in the view, open interest declined in Jan-April contracts.

The butter market – prompted by the bullish Cold Storage report released last Wednesday - seems to have stirred dairy overall during the past few trading sessions. Sometimes markets don’t need a clear path – just enough of a news print to make people worry. Between the red hot butter rally seen late last week and anecdotal comments about lackluster milk production and better US cheese exports over the past month or so, Class III and Cheese futures traders have taken a shoot-first, ask-question-later approach so far this week. While there may be more upside for both Class III and Cheese – especially given the more aggressive spot market bidding trying to keep pace with futures – we won’t be surprised to trade both sides of unchanged today as air pockets exist after swift moves.

Interestingly, it was butter futures that traded mixed Monday despite continued gains in spot. Spot butter closed over $2.80 ($2.8025) for the first time in three months. Futures consolidated recent gains yesterday. The wave of buying last week (a) doesn’t continue indefinitely and (b) was met on Friday with excellent broad-based selling in the mid to high $2.70s. The butter futures market may resigned itself to more of this choppy trading that developed yesterday as it builds stamina to make another move. Within that view, however, moderate downdrafts on futures prices are possible especially if spot selling interest picks up north of $2.80.

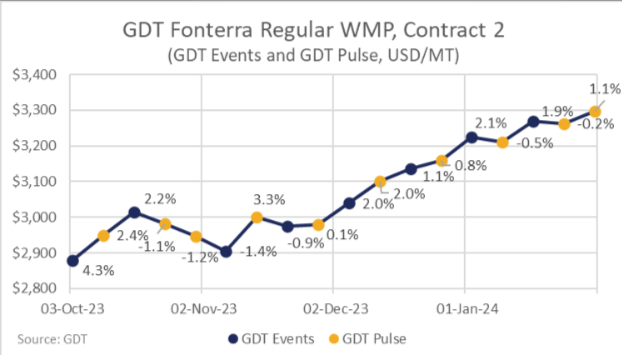

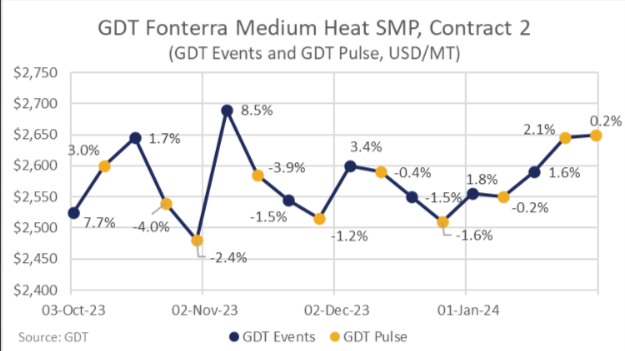

Spot nonfat pushed higher for the 5th consecutive session as it has likely gotten some support from the strong rally in butter. Nonetheless, spot nonfat is approaching the highs seen in October at $1.24/lb. Fundamentally, as we mentioned, comments of lackluster milk production and a need for milk for the additional cheese capacity, could leave nonfat underpinned as we also aren’t in a heavy stock environment. Globally, powder prices continue to hold up on GDT. After mixed results last week, both WMP and SMP were up at the GDT Pulse auction today. WMP was up 1.1% to $3,298 while SMP was up 0.2% to $2,650. NZ WMP has been the cheapest source of dairy solids for more than 2 years which was a drag on the entire dairy complex. The fact that GDT WMP has generally been trending higher for 3 months is supportive for dairy prices in general. However, all indications are that Chinese import demand is still weak and the higher WMP price could dent demand in the rest of the world.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.