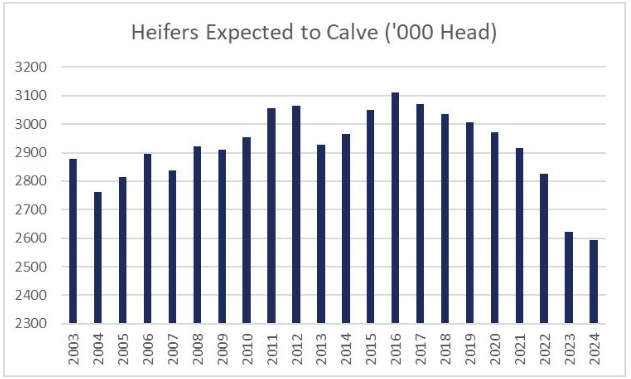

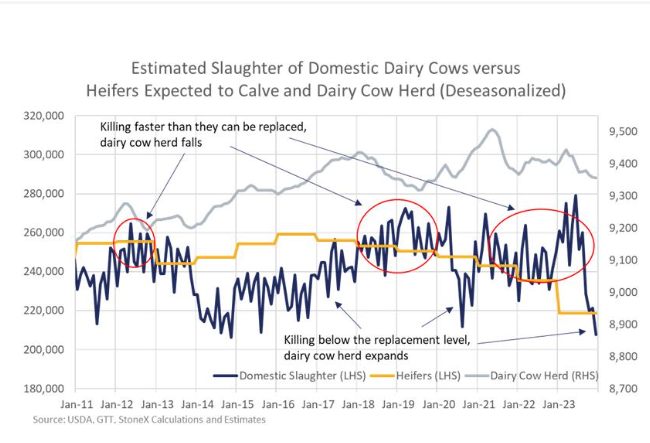

The much anticipated January Cattle Inventory report was released yesterday afternoon with a little something for everyone. Heifers expected to calve are only down 1.1% from last year, which was not a record decline despite a growing belief that a systemic heifer supply problem exists. HOWEVER, the USDA revised down last year's heifer supply from a 2% decline to a 7% decline, which goes a long way to explaining how the herd continued to drop in the second half of 2023 despite very strong slaughter. The drop in 2023 was a record large drop (although data only goes back to 2003). This report gives us a nice overview but will likely have little impact to dairy market trading as is perennially the case.

*On a side note, the 7% drop in 2023 looks a little suspicious and it is possible the USDA has changed methodology. We've reached out to get some clarity and make sure we are interpreting the data correctly but haven't heard back from the USDA yet

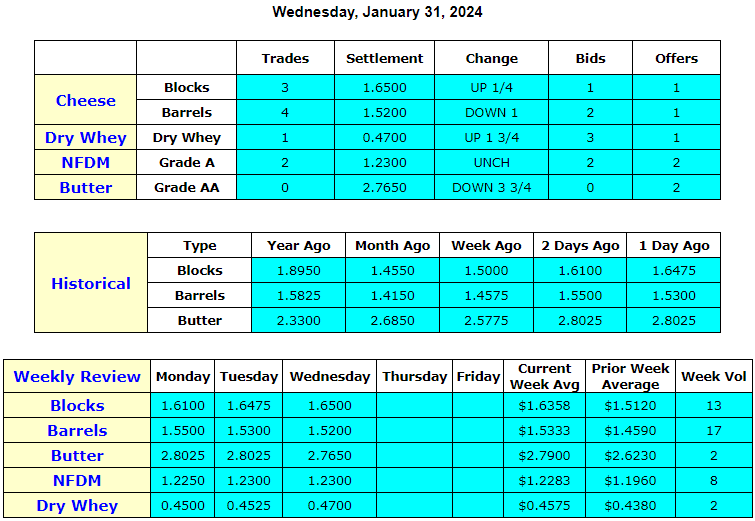

Class III and Cheese futures started mostly lower Wednesday initially on some follow-thru weakness from Tuesday’s weaker close. We continue to hear more mixed comments around cheese. There seems to be some bit of tightness in the country around the barrel market, but you wouldn’t know that by looking at spot. Sellers continue to be relatively aggressive – mainly for barrels (down a penny to $1.52 on 4 trades), which launched a wave of Class III/Cheese futures selling particularly in the nearby contracts. In fact, midday the nearby March contract gave up about 50% of the prior 4-day price gains. As we mentioned in our report yesterday, however, we think a solid ‘buy the dip’ sentiment exists in the derivative markets today and that at least played out to some degree yesterday. Futures prices recovered, well off their lows, but still closed modestly lower on the day.

While Cheese battles some headwinds this week, Class IV, Butter and NFDM futures all moved mostly higher to close out January. Spot butter actually fell yesterday – down 3.75 cents on 2 unfilled offers. No doubt the ‘buy the dip’ mentality is at least a marginal feature for the butter futures market lately, and nearby futures prices are still running a modest discount to spot, but it appears the spot market has adjusted “enough” for the time being. We may now find ourselves on a bid-finding mission, so there is potential for more spot weakness here in the short-term.

Spot NFDM opened and closed unchanged at $123.000 – the high end of a 4-month trading range. Futures were a little buoyant again yesterday as buy side order flow remained good mid-week. And volume remained robust yesterday. When the closing bell rang, 502 NFDM contracts changed hands and open interest rose by 331 (when you ignore the January OI increase). Similarly butter futures saw another day of strong trading volume with 449 contracts trading and OI up 186. Both contracts are, in our view, consolidating around current levels now and will likely need something more to continue higher. Butter specifically runs the risk of some downward stabs on futures prices short-term.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.