Polyethylene (PE)

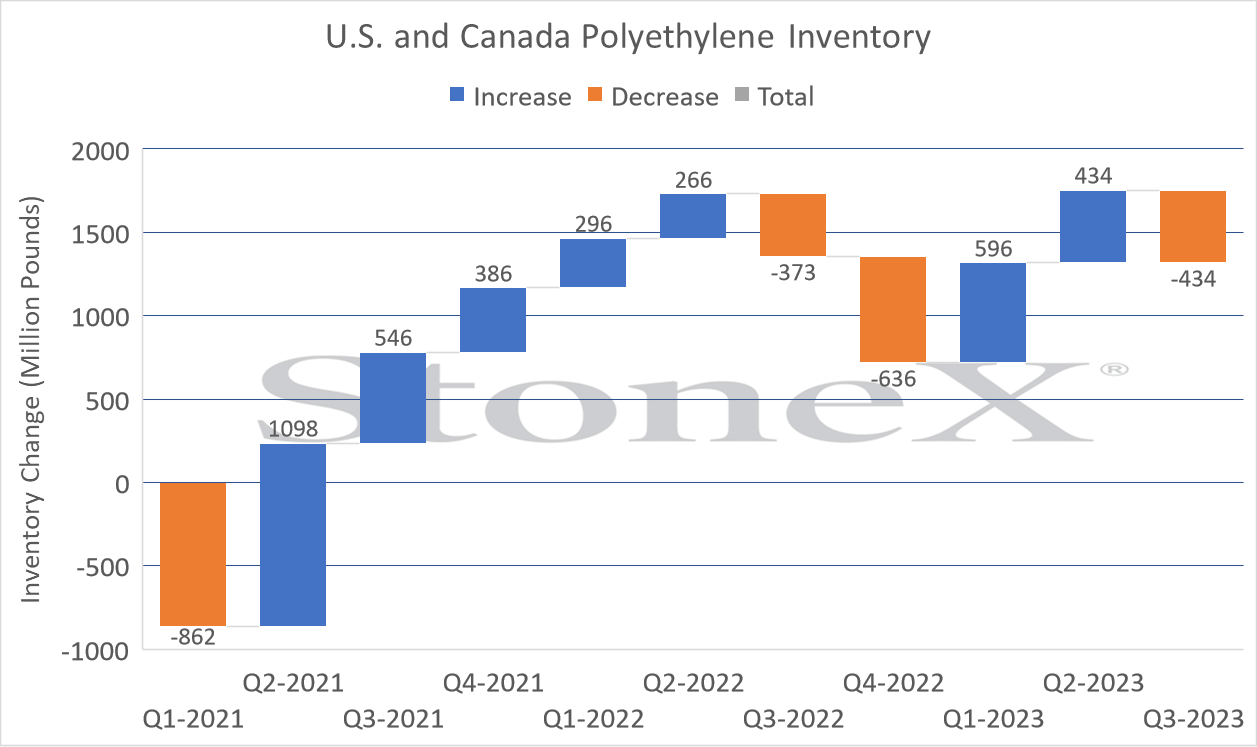

- PE prices held flat for the third consecutive month but buyers are expecting the bottom to have been reached. Prices are expected to begin moving up in January.

- Natural gas and crude oil prices continued to experience pressure in December even amidst supply concerns on shipping routes. However, cold weather in the U.S. has temporarily brought natural gas prices back above $3/MMBtu.

Demand

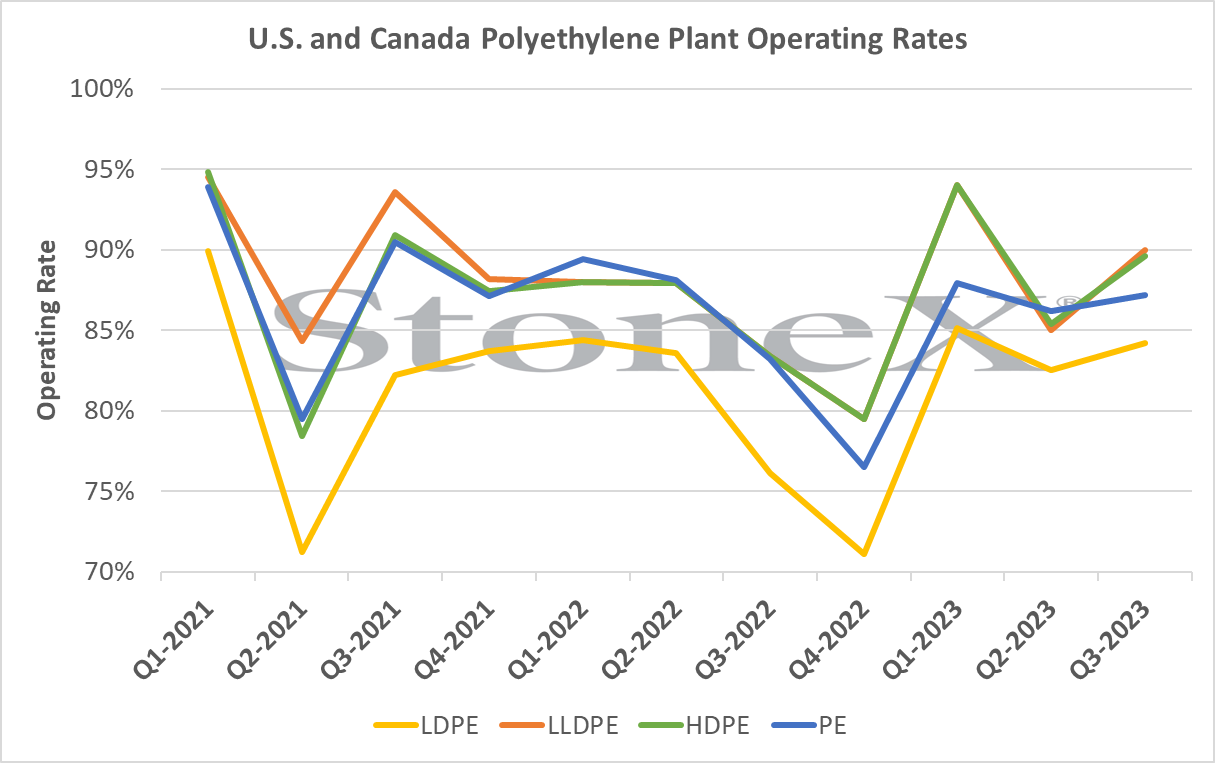

Domestic North American PE demand through November 2023 dropped 9.3% compared with the previous year. Some resin consumers reported double-digit declines in demand from their end-user customers last year. They blamed the demand decreases on initiatives to reduce single use plastics and the pursuit of sustainability and circularity strategies. Exports in 2023 were up over 25% versus the first ten months 2022. In addition, exports to Mexico were up 7.5%, while exports to the rest of the world were up almost 30% compared with 2022.

Feedstocks

- PP prices settle flat on the month after months of weak demand continue to increase inventories in the U.S. The market is well supplied and could experience price pressure unless feedstock strength spills over to PP.

- Propane prices are rallying from their most recent lows and are above 70 cpg for the first time since October. Cold weather and inventory adjustments by the EIA have put some strength back into propane prices which could spill over into PGP and PP.

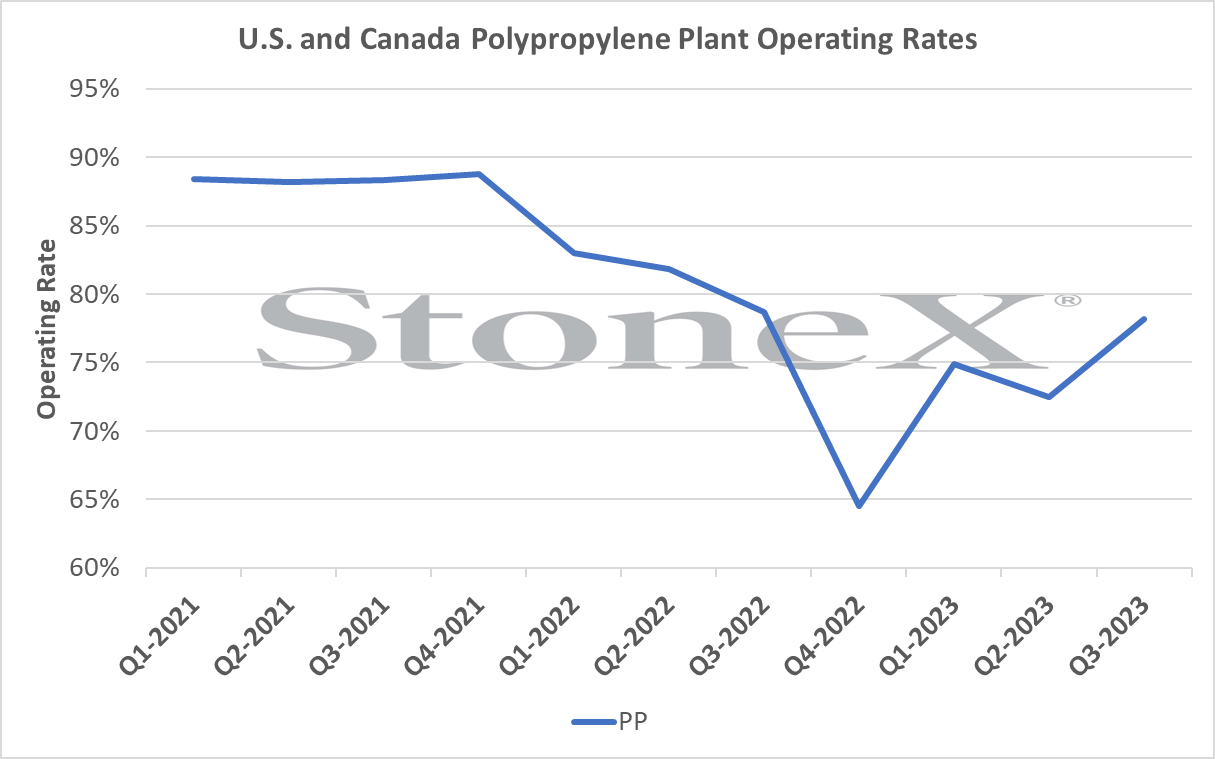

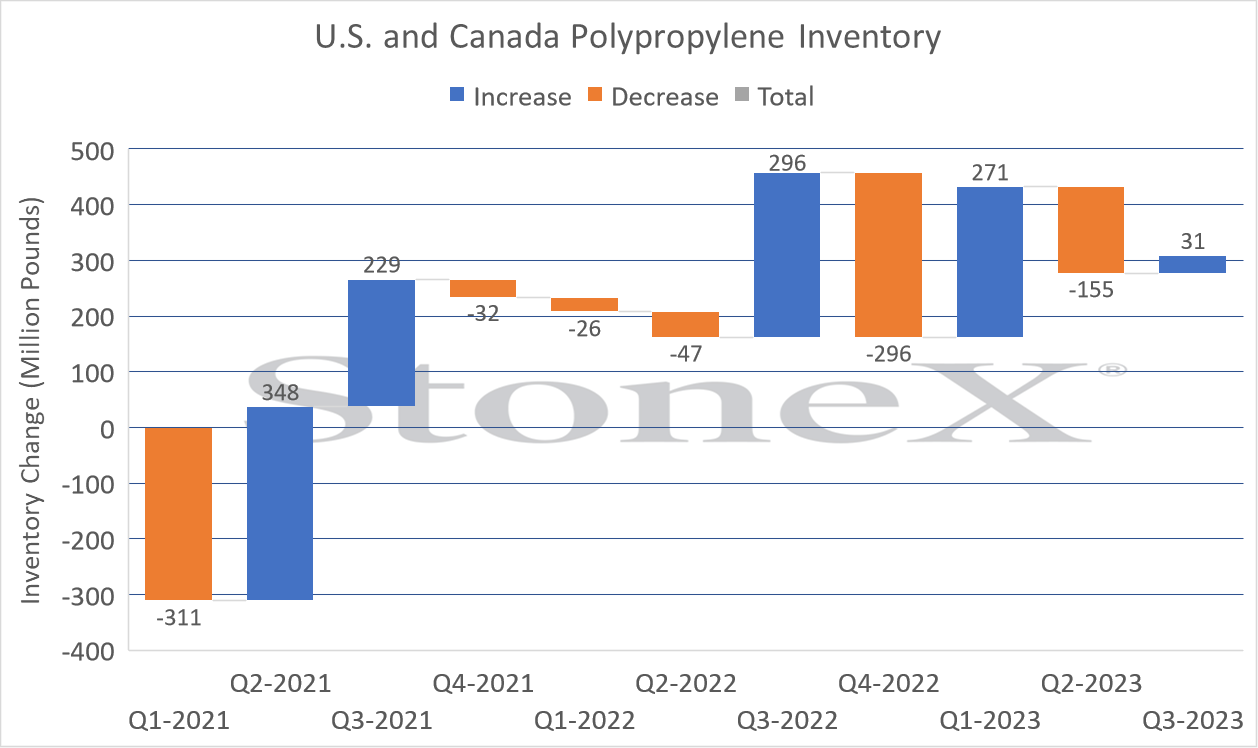

North American PP inventory days surpassed 40 by year-end and operating rates remain low, therefore supply is expected to meet demand adequately, barring unforeseen weather events. There has been an upward trend in plant operating rates, which actually reached 80% in November for the first time since the summer of 2022. There is an expectation of lower plant production rates in December and January in an effort to reverse the inventory build trend.

Demand

PP total sales for November were a weak 1.4 billion pounds, the worst-performing month since April’s 1.4 billion pounds. Resellers continued the trend of more competition by third parties as producers look to them to sell excess product in the market. It is anticipated that 2023 will be a year of declining PP growth for North America and that the full year will reflect a decline of nearly 4% for domestic demand with imports. Cups & Containers trails the prior year by 22% and Housewares, Oriented Film, and Caps & Closures segments are also down.

US polymer-grade propylene (PGP) supply is expected to improve in January compared to the previous months. Costs are expected to decrease slightly this month with a decline in propylene contract prices before moving up in February, ahead of several planned outages at on purpose propylene production units. Domestic demand for propylene derivatives remains bearish into the new year. Polypropylene (PP) producers are seeing reduced demand due to squeezed margins. Export margins are forecast to drop as propylene prices are likely to move up as supply is expected to be less abundant later in Q1.

Price Outlook

North American polypropylene prices settled “flat” for the month of December. Higher arbitrage levels with Asia continue to be an area of concern, inviting more imports of resins and finished goods into North America at the expense of local production. It appears to be a buyers’ market and going into contract season buyers are perceived to have leverage. PP margins are under extreme pressure and the range of contract discounts appears quite wide, with smaller buyers at much higher prices relative to very large buyers.

This material should be construed as the solicitation of an account, order, and/or services provided by StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the individual authors or presenters. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results. All references to and discussion of OTC products or swaps are made solely on behalf of SXM. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. SXM is not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SXM for specific trading advice to meet your trading preferences.

Howard Rappaport is an independent consultant to the Swap Dealer, StoneX Markets LLC (“SXM”) focusing on plastics market commentary. He does not have a personal futures trading account. All forecasting statements made within this material represent the opinions of the author unless otherwise noted.

Reproduction or use in any format without authorization is forbidden.

© 2024 StoneX Group Inc. All Rights Reserved.