The intention of the below graphs are not to use to say "my price should be X based on this graph". These prices are derived from an FOB price point average. The intent is to show major global price movement trends. Your values will likely have significant basis difference (similar to your local grain price being different than the traded market price).

This graph is labeled as MT in USD currency.

commentary

commentary

commentary

commentary

NOLA/New Orleans, Louisiana

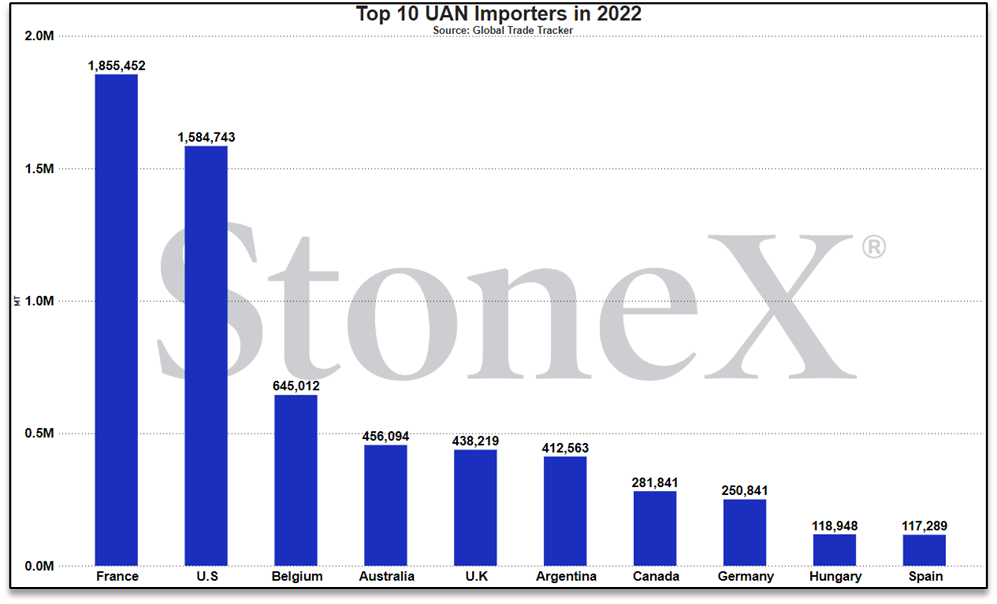

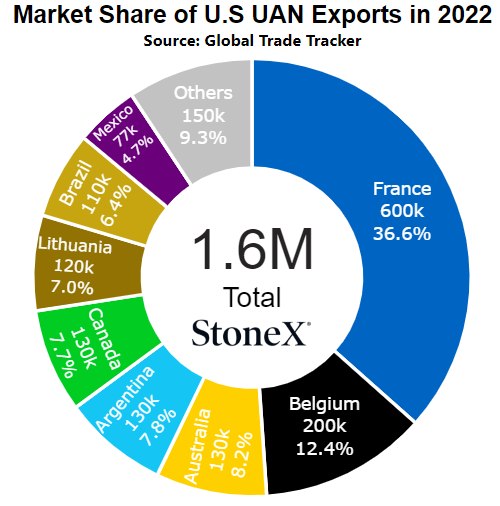

Number 2 global importer in 2022

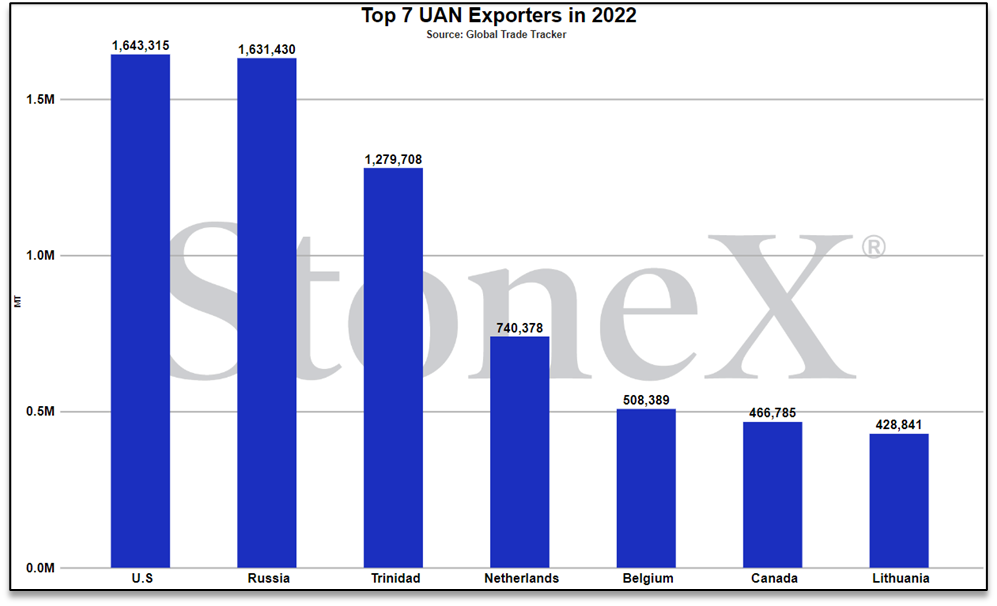

Number 1 global exporter in 2022

Price comparisons

Vs 30 days ago -

Vs 90 days ago -

Vs 6 months ago -

Vs 1 year ago -

Black Sea (Russia)

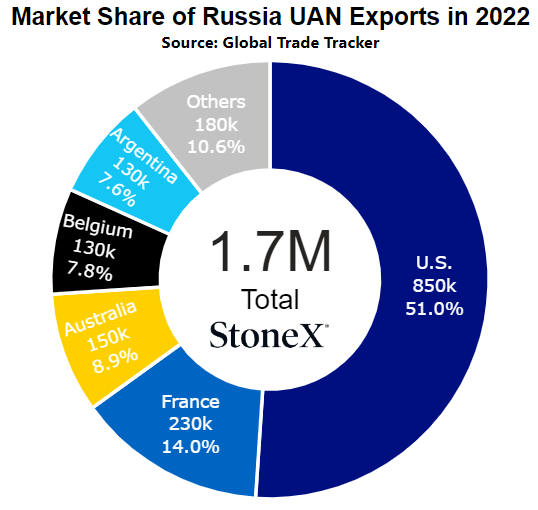

Number 2 global exporter in 2022

Price comparisons:

Vs 30 days ago -

Vs 90 days ago -

Vs 6 months ago -

Vs 1 year ago -

- commentary - commentary

- commentary - commentary

- commentary - commentary

- commentary - commentary

- commentary - commentary

- commentary - commentary

We believe that only looking at the flat price of either grains or fertilizer can be misleading:

-

Only selling grain can hurt you if fertilizer prices rise substantially

-

Only buying fertilizer can hurt you if grain prices fall

We look at the ratio "value" to get a better indication of where we are or how many bushels of X does it take to pay for 1 ton of fertilizer.

Would you rather:

-

Spend 100 bushels to pay for 1 ton of UAN

-

Spend 60 bushels to pay for 1 ton of UAN

When we compare the current ratio value against recent years, we start to see if we are high or low.

YOUR VALUES MAY LOOK DIFFERENT

This graph looks at the NOLA UAN price vs the flat grain price. There are no logistics on either product. Your location will look different due to fertilizer logistical costs, grain basis, etc.

- commentary - commentary

- commentary - commentary

- commentary - commentary

StoneX Ratio Calculation

The ratio calculation is derived from Bloomberg historical grains values as well as fertilizer values from StoneX, NPKFAS, and Argus.

The calculation is simply dividing the fertilizer price by each grain price.

All data was sourced from StoneX unless otherwise noted.

This material should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by the FCM Division of StoneX Financial Inc. (“SFI”), StoneX Financial (Canada) Inc. (“SFFC”) or StoneX Markets LLC (“SXM”). SFI, SFFC and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI, SFFC or SXM for specific trading advice to meet your trading preferences. These materials represent the opinions and viewpoints of the author, and do not necessarily reflect the viewpoints and trading strategies employed by SFI, SFFC or SXM. The FCM Division of StoneX Financial Inc., a subsidiary of StoneX Group Inc., is a member of the National Futures Association (“NFA”) and registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a futures commission merchant and commodity trading advisor. StoneX Financial (Canada) Inc. is currently registered as a Futures Commission Merchant or equivalent in all provinces of Canada and is a member of the Investment Industry Regulatory Organization of Canada.

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

© Copyright 2024. All rights reserved.