TRADING DESK COMMENTARY – NOT A RESEARCH PRODUCT

Table of Contents

- Loans: Carestream Dental (CARDEN), Neovia (SPLLOG), Power Stop (POWSTO), Neovia (SPLLOG), RX Benefits (RXBENE), RV Trailer (RVRETL)

- Private Equity, Private Credit, and ReOrg: Serta (SERSIM), Mallinckrodt (MNK), Tailored Brands/Mens Warehouse (TLRD), Cirque Du Soleil (CIRQUE)

- Distressed: Endo (ENDP), Enviva (EVA), LEH ECAPS, Ligado (NEWLSQ), Mallinckrodt (MNK), NGL Energy (NGL), Office Property (OPI), Serta (SERSIM), Telesat (TELSAT)

- EU Trading Commentary

- Credit of Note: Endo International PLC (ENDP)

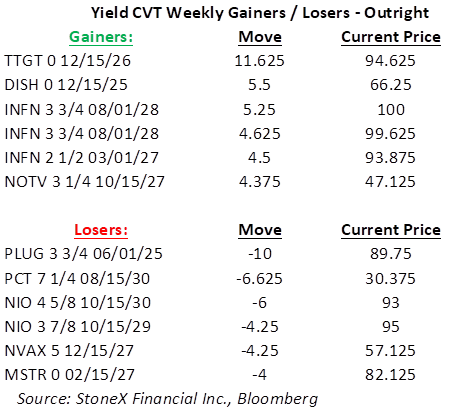

- Converts Commentary: EchoStar/Dish Network/DISH DBS (SATS)

- Asia Credit Commentary

- Commodities Commentary: IRON ORE, STEEL, TECK

Attachments

- Tearsheets:

- Azul SA (AZUBBZ) from strategist Brett Marfurt (212-692-5129- [email protected])

- EchoStar Corp/Dish Network (SATS) from strategist Rob Weaver (212-621-5189 – [email protected])

- Endo International PLC (ENDP) from strategist Ken Smalley CFA (212-485-3570 – [email protected])

- StoneX Rates Strategy: Fade the March Cut Probability from strategist Kathryn Rooney Vera (305-913-9112-[email protected])

- LOANS

Axed: Carestream Dental (CARDEN), Correct Care (CCSINT), CIBT Global (CIBHOL), Delivery Hero (DELHER), Elevate Textile (ITXN), First Brands (TCGIR), Loparex (LOPARX), Research Now (EREWDS), RV Trailer (RVRETL) and Sound Physicians (SOUINP)

US loan funds saw an inflow of $84mm vs. $64mm for the previous week. The primary market was active and next week looks no different with ten deals already on the docket to price. The desk picked up a few new names last week. We started with RV Trailer (RVRETL) and traded sociable size that left us a buyer of more. RX Benefits (RXBENE) and Power Stop (POWSTO) are two other new credits for us, and we ended the week in touch with supply. We also traded a block of Neovia (SPLLOG). Please call the desk for details. Lastly, Carestream Dental (CARDEN) remained a top name as we move towards the lender call next week; Ken Smalley covers the name if you want to compare notes.

- PRIVATE EQUITY, PRIVATE CREDIT, AND REORG

AXED: Full Beauty (FBB), Cirque Du Soleil (CIRQUE), J Crew/Chinos (JCG), Elevate Textile (ITXN), KORE Power (KORE), Lehman (LBHI), Men’s Warehouse (TLRD), and Serta Simmons (SERSIM)

Serta (SERSIM) equity was active and topical on the desk this week . We saw prices stabilize somewhat but continue to be in touch with decent supply after the first sizable trade in the single digits. Mallinckrodt (MNK) equity moved higher on light volume finishing the week up ½ a point with better buyers. Please reach out to strategist Ken Smalley to discuss. Tailored Brands (TLRD) was also a name for the desk with markets still in the 15 ½-17 ½ context; call desk for more detail. Cirque Du Soleil (CIRQUE) was active in the later part of the week – we closed in touch with both sides. American Tire (ATD) came up a few times, and we ended the week in touch with supply. Ben Briggs covers ATD if you want to compare notes.

- DISTRESSED BONDS

Axed: CEC Entertainment (CEC), Cooper Standard (CPS), Emergent BioSolutions (EBS), Endo (ENDP), Enviva (EVA), Finance of America (FIAMER), Franchise Group (FRG), Guitar Center (GTRC), Jo-Ann Stores (JOAN), LEH ECAPS, Ligado (NEWLSQ), Mallinckrodt (MNK), McDermott (MDR), Michaels (MIK), NGL Energy (NGL), Office Property (OPI), Serta (SERSIM), Telesat (TELSAT), Tenneco (TEN), United Site Services (UNSTSV)

Activity picked up the second week of the new year in distressed across a number of credits the desk is involved in. Office Properties Income Trust (OPI) was very topical after management announced they are slashing the dividend, which in turn sent the equity down 35%. Bonds remain steady, and the desk is axed across the capital structure. Please contact Ben Briggs for more information. Enviva (EVA) was once again one of the big movers in the market after weeks of little activity. The EVA 6.5% bonds traded down 8 points as investors searched for liquidity. The company has an interest payment on this issue due this weekend. We remain axed and active in the ENDO capital structure both secured and unsecured. Please see Ken Smalley’s comments on most recent developments including his take on the potential proceeds unsecured and second lien lenders will receive from the to be formed Litigation Trust. Serta (SERSIM) Exit TL continues to drift lower with the desk in touch with supply in mid 90s, a yield of just over 14%. Also axed in SERSIM equity. Contact Ben Briggs for more information.

- EU CREDIT

Tickers active / traded: ADJGR, AMSSW, ALTICE, ARYNSW, ASSDLN, ATALIA, BMELN, BNTLR, CGGFP, CMPSTB, COFP, DAVLLO, END, ENQLN, FLOAT, FOURSN, GRFSM, HRGNO, HTHROW, INTERM, KCADEU, KPERST, LECTA, LNZING, MAHLGR, MANTEN, MARGRO, MAXDIY, MERLLN, MPWLN, MRLBID, MRWLN, NEPSJ, NOHOLB, ODLNO, ORPFP, PHMGRP, PGSNO, PSFE, PUBLN, PURGYM, RLTECH, SDSELE, SIGHCO, SFRFP, SPPEUS, TALKLN, TENN, THAMES, TLWLN, VKFP, VOYCAR, WESODA.

It was a week for consolidation and stability after the volatility we witnessed in the first trading sessions of the year. On the week, the iTraxx Xover index was 18bps tighter and is currently trading at +320. On the year, however, we are still 10 bps wider. The cash bond market remains firm in most cases as the dearth of issuance, particularly in the HY market, has created a supportive technical. We do however continue to see dispersion. The big mover and active name on the week was Grifols (GRFSM) where a short selling report drew attention to accounting practices at the Spanish blood plasma company. The subordinated 3.875 bonds maturing in 2028 are down 8 points on the week, closing the week on the lows at 83.5. Friday also saw weakness, and activity, across the ATOS (ATOFP) bond complex in sympathy with the equity, with paper lower by 3-4pts.

- CREDIT OF NOTE

Endo International PLC (ENDP): Specialty Pharmaceuticals company with a focus on aesthetics, sterile injectables, and generics

3/14/24: Confirmation Hearing scheduled

11/20/23: Endo lenders announced proposal (eventually adopted) to satisfy DOJ Tax Claims

8/16/22: Filed Chapter 11, SDNY Case #22-22549 (JLG)

Considerations:

- Valuation: First Lien Notes trading at <6.0x 2024 Adjusted EBITDA (expected trough)

- Opioid & Tax claimants have reached a favorable settlement

- Portfolio: believe projected growth (Disclosure Statement) is achievable

Concerns

- Generics: Varenicline (Chantix generic) facing multiple new competitors

We remain constructive on ENDO notes and loans (secured and unsecured).

Please see attached tear sheet and reach out to strategist Ken Smalley for our waterfall, valuation, and to discuss the to be formed Litigation Trust (212-485-3570 – [email protected])

- CONVERTS COMMENTARY

Please see our attached note on the EchoStar / Dish Network / DISH DBS transactions announced Wednesday

- EMERGING MARKETS COMMENTARY

Asia IG (Billy Kewley/ Khai Wen Lim)

Despite ongoing macro uncertainty with CPI ticking up slightly this week at 3.4% vs a lower consensus, the prevailing trend in Asia credit remains spread compression as we close WTD -3/8bps. This puts IG at -50bps from November 23 with technical factors on the supply side continuing to prevail. WTD we saw $5.2BN in Asia-ex issuance which although represents marginal improvement WOW still lags behind broader DM & EM; as such any spread compression in secondary is generally perceived as an entry point. Flows this week have revolved around new issues. For the desk the focus was the SK Hynix (HYUELE) multi 3/5Y. Desk’s view was FPG looked rich; however, a robust US book and sustained AI optimism contributed to a strong secondary performance. WTD we close -12bps with 3Y outperforming as global RM/AM looked to top up. Elsewhere with curves steepening so far this year, duration was well supported. RM looked to add in HQ names with BABA/TENCNT 30Y & EIBKOR 33 closing the week firmer. High beta was more balanced at current valuations prompting some profit taking from AMs, desk saw good 2 way flows in DAESEC, DFHOLD, BNKEA & FWDGHD.

INDON/PHILIP outperformed on the week reversing last week's trend on the back of rates rallying - belly/duration up +1.5/2pts, tightening -5 bps/-8 bps on the week. Continued seeing better buying across INDON/PHILIP throughout the week.

For the most part in Asia primary, new issues this week px-ed little to no NIC and traded -1/-4 bps tighter since issued. Outperformers included the new HYUELE trading -11/-14 bps richer since pricing. Elsewhere, worth noting that the new 3Y CICCHK px-ed 10 bps rich vs the CICCHK 5.442 26s - continued see it tighten further -3 bps since RO on the back of onshore demand. With rates rallying, we saw some AM sellers looking to take profit in the new issues notably in the new SBIIN, SUMILF Perp and CICCHK.

Likes : BNKEA PERP/ FWDGHD 33/ KHFC 33 / HYUNHI 27

Asia HY (Frank Ip)

Asia HY saw sluggish movement in the beginning of the week, a continuation from the prior Friday, resulting in wider bid offer and subdued volumes. However, a positive shift on Wednesday, driven by expectation of potential RRR cut in China. Notable names like DALWAN, FUTLAN/FTLNHD, GLPCHI, and YLLGSP saw decent buying interest, leading things 1-2 points higher. ROADKG also made a positive turn, as the company announced partial redemption for the 24s and both 25s; closing up 2-3 point for the week, excluding both FFL perps. The Asia gaming sector saw a moderate uptick throughout the week, closing unchanged to 0.5 points higher. Active in WYNMAC and SANLTD, primarily driven by real money clients. Indonesian high-yield bonds remained resilient amid a rotation out the credit spectrum and an extension in tenor. However, overall flows remained subdued.

Active tickers : CHINSC | CSCHCN | DALWAN | FLTNHD | FUTLAN | GLPCHI | INDYIJ | RDHGCL | ROADKG | SANLTD | WYNMAC | YLLGSP

- COMODITIES COMMENTARY

-IRON ORE: Down -$4.55 to $131.20 (Platts). Down -$12.75 from Jan 3rd. Remain in the camp we eventually get to the ~$120 level. (I sent a more detailed email on Wednesday if you didn’t get a chance to take a look).

-STEEL: US HRC futures finally gaining some footing….but the damage has been done. Platts and CRU still around the $1,100 level….while Feb futures are trading at $960 and March at $890. Platts at $1,100 is really due to no spot activity to move the assessment. Scrap prices now not looking down as much vs previous chatter of down -$50….which is helping. 4Q earnings more or less known…so will come down to 1Q outlook (which could easily disappoint from my seat). Still think a majority of the steel equities look vulnerable here.

-TECK: Why is TECK down -9% YTD with met-coal +4.5% and Copper only down -2% YTD? Closed at $38.60, and I think holds the 50-day of $38.32. I think there is a trade here.

-ECO DATA: PPI numbers bringing the USD lower…which is helping metals (gold especially) and broad equity mkt.

Please reach out to Michael Lovecchio (347-268-1509 – [email protected]) or Michael Cuoco (980-867-9011 - [email protected])

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments, and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI.

The author(s) responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is intended for institutional investors only and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

This commentary is intended for Institutional and Investment Professional Use Only and may not be distributed to the investing public. The views expressed are those of the author and are current only through the date stated. These views are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. These views may not be relied upon as investment advice and should be construed as market commentary, merely observing economic, political and/or market conditions, and not intended to refer to any particular trading strategy, promotional element or quality of service provided by StoneX Group Inc. or its affiliates. There is no guarantee as to its accuracy or completeness. Past performance is no guarantee of future results StoneX Financial Inc. a registered broker dealer, member FINRA, SIPC, MSRB, is a wholly owned subsidiary of StoneX Group Inc.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. It is not guaranteed as to accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Past performance does not guarantee future results.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.