We continue to field questions on speeds within higher coupons. Base case, we think the model is likely to slow on these higher coupons and likely undershoots historicals, especially considering the changes to the conforming loan limits in pools.

General Thesis:

- Speeds into -50 to -125bps scenarios are likely too slow on models.

- The negative convexity of current coupon Cheapest to Deliver (CTD) is likely worse than most think.

- TBAs should lose duration into a rally faster then they have in the past.

- Carve outs of ANY call protected story should shift up from a pay-up perspective for this foreseeable future... Bullish for quality Specs

We did this fast and this requires far more analysis but the quick thought is:

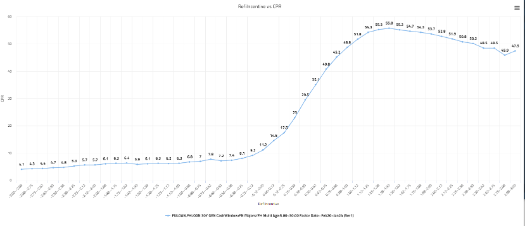

Start by taking the S-curves on the majors (shown below from RiskSpan)

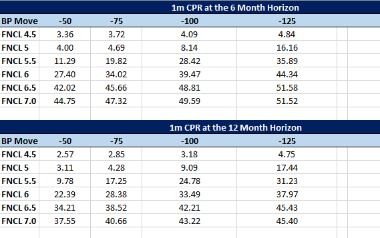

Run YB Scenario Analysis for Current coupons:

** -50 to -125bps parallel shift scenarios

** Running a 6 month gradual shift and a 12 month gradual shift

Examine the projected speeds at the horizon

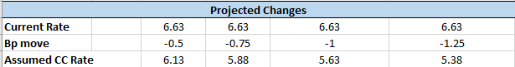

Take current mortgage Rate 6.63% (YB mtge rate), Subtract 50, 75, 100, 125 bps to find new mortgage rate

** this is assuming primary secondary spreads stay the same, can be noise here given rates may not move 1:1 with the curve

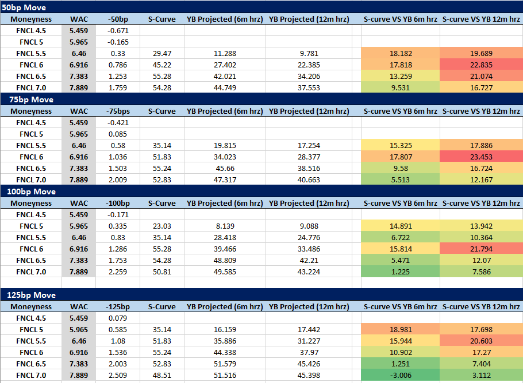

Compare the Historical Major S-curves to what YB projects in these scenarios

Example: 30yr 6s with the WAC at 6.916 on the cohort, a -75bp parallel shift means these bonds should be 103bps in the money.... (6.916 WAC vs 5.88 Assumed NEW CC Rate)

At the 6 month horizon speeds are projected to be 34.023 CPR. S-curves says speeds will be 51.83cpr, meaning large difference between YB projected speeds and historicals.

Conclusion:

The difference between historicals and YB projected speeds is large. YB may be too slow, or historicals may be too fast.

Historicals were from an environment where:

- Housing prices were moving up 20% per year

- We had a Bull market in risk assets the economy was flying

- Housing affordability was near the highs

- Inflation was high

Current environment we have:

- less housing supply

- slowing inflation

- tightest affordability market in history (upgrade housing trade may be harder)

This means speeds likely fall somewhere in between. There is a dynamic now with the float having a ton more negative convexity in it which would support speeds to be on the higher end of the range given the Refi incentive is likely a TON higher now on these current coupon cohorts.

We think this is positive for specs in a big way, The OAS between the TBA and spec pools is likely to tight... the TBA needs to have a higher option cost applied to it vs what is being applied to call protected spec pools.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and is registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser.

This commentary is not research or a recommendation and does not take into account whether any product or transaction is suitable for any particular client. SFI does not produce debt research and therefore this communication is not subject to all of the independence and disclosure standards and other requirements applicable to research reports under FINRA’s research rules. This document is only intended for institutional investors, as defined by FINRA Rule 4512(c), and is not subject to all of the independence and disclosure standards applicable to research reports prepared for retail investors. Clients should assume that this document is not independent of SFI’s proprietary interests. SFI trades, and will continue to trade, the securities covered in this document for its own account and on a discretionary basis on behalf of certain clients. Such trading interests may be contrary to or entered into in advance of this document.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views. This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.