- Low international demand for American corn;

- Good expectations for Argentine production;

- Drop in wheat futures in Chicago.

- Despite posting a more favorable weather pattern, concern about the crop in Brazil, especially the 2nd corn crop, persists;

- StoneX reduces the estimate for the 2023/24 corn crop.

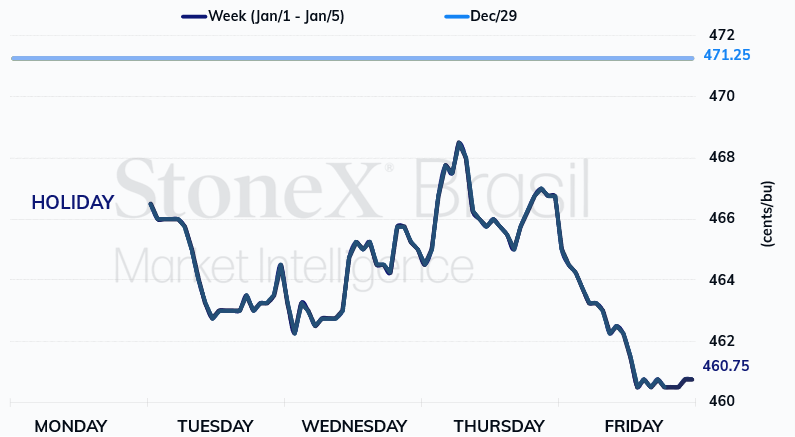

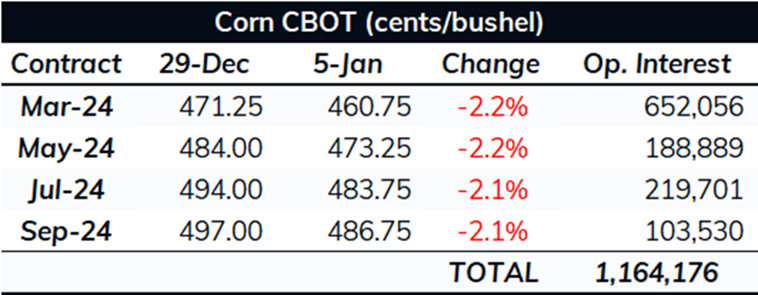

Corn futures ended the first week of 2024 lower in Chicago. Despite the concern about Brazil's winter crop 2023/24, the weak volumes of export sales and shipments from the US weighed more on the market. The bearish pressure was supported by the good prospects for the corn crop in Argentina and the devaluation observed in international wheat prices. March 24 corn closed last Friday, January 5, at 460.75 cents/bu, the lowest closing recorded by the contract since it started trading.

US export inspections: The US Export Inspections report released last week indicated a low interest in American corn. This issue contributed to the observed decline in corn prices pressured in Chicago. The USDA reported that the US shipped 570 TMT in the week ended December 28, compared to 1.23 MMT the previous week and 683 TMT in the same week of 2022. Amidst a lower volume of exports compared to the previous year, the surplus to the 2022/23 crop fell to 2.35 million tonnes. By the end of December, shipments for the 2023/24 season from the US had reached 11.95 million tonnes, compared to 9.6 million tonnes in the same period of 2022/23.

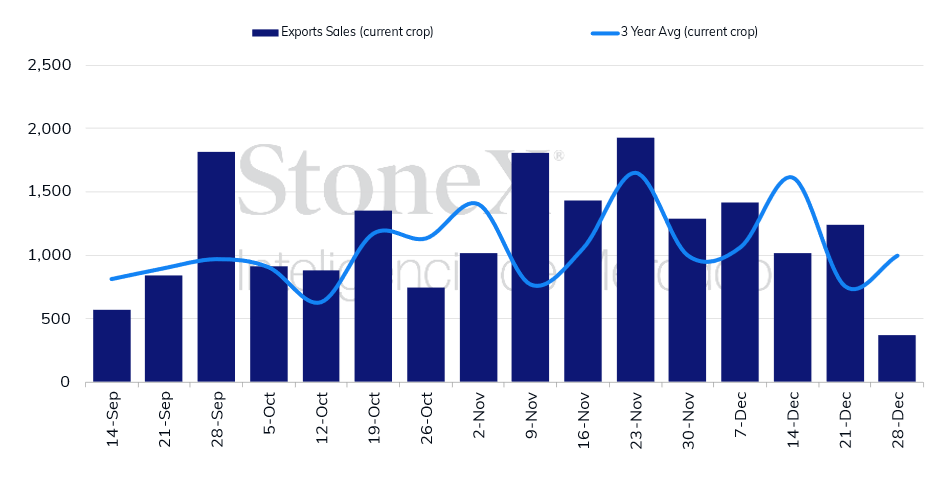

US export sales: The USDA's weekly export sales report also gave reasons for weakening the quotes in Chicago. According to the Department, the US recorded 367.5 TMT of net sales in the week of December 28, 48 TMT above the previous year's figure but below the lower end of market expectations, ranging from 500,000 to 1.2 MMT. In the weekly comparison, the volume recorded in the last week of December decreased to 875 TMT. The accumulated sales totaled 29.8 million tonnes, 8.05 million more than in the 2022/23 season.

Export sales per week - USA (tmt)

Depreciation of wheat in Chicago also weighs on corn futures: Amidst the lack of major news related to the Russo-Ukrainian war, the low demand for American wheat, and the high availability of Russian grain, wheat prices fell on the CBOT, a movement that influenced corn quotes. March 24 wheat finished the last week quoted at 616 cents/bu, a drop of 12 cents/bu, or 1.9%, compared to the previous week.

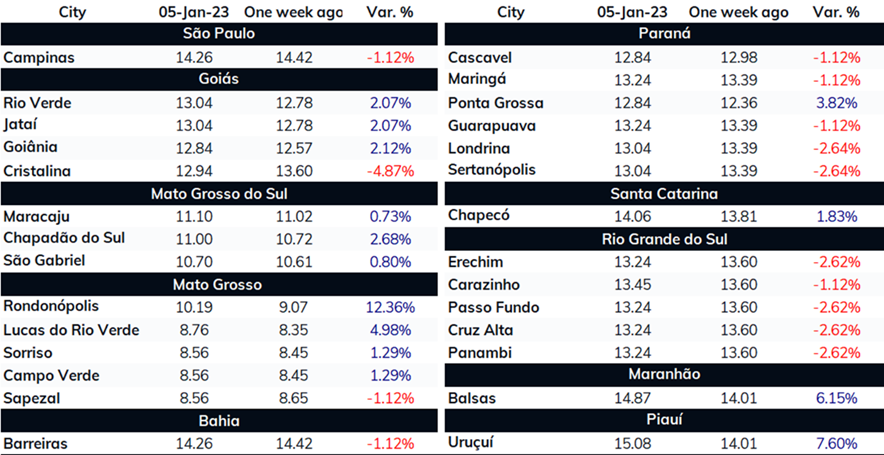

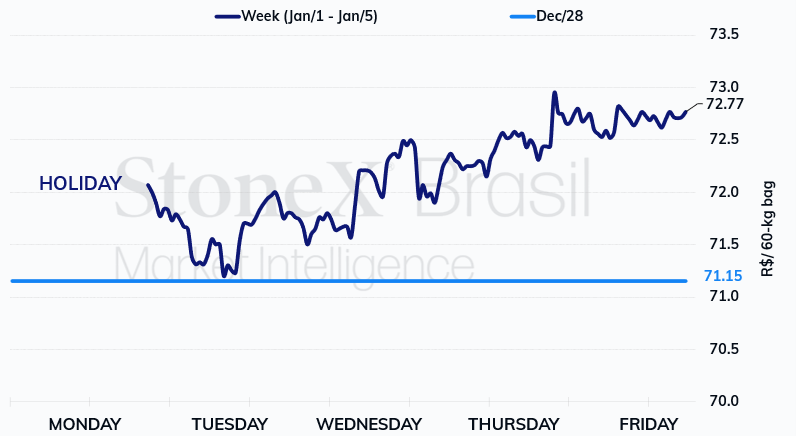

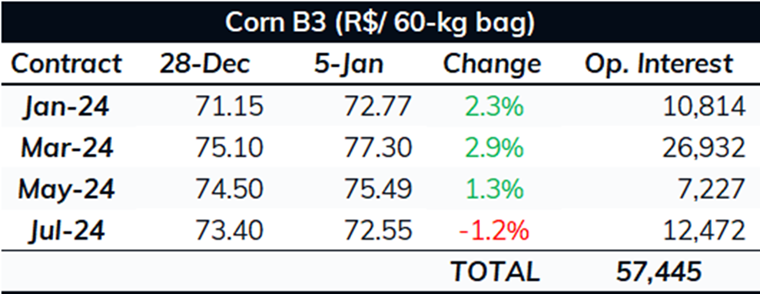

Unlike in Chicago, the first week of the year was marked by increased corn futures on the B3. If the concern about the safrinha 2023/24 did not have enough strength to boost quotes on the CBOT, the same cannot be said for the Brazilian exchange. January 24 ended last Friday at BRL 72.77/bag, an appreciation of 2.3% for the week.

StoneX crop estimate: On January 2, StoneX released its monthly Crop Estimate Report. In this latest report, StoneX has once again reduced its estimate for the 2023/24 first crop to 25.81 million tonnes, a decrease of 2.4% compared to the figure released in December 2023. The main reason for the cut was the downward revision in productivity estimates in the North/Northeast. A large part of the region experienced very irregular rainfall, and although some regions have improved conditions, a significant portion of the crops faced unfavorable weather conditions.

The estimate for the winter crop production in 2023/24 has been reduced to 96.56 million tonnes, a 0.8% fall compared to the previous month. Like the 1st crop, this decline is due to less favorable prospects for production in the North/Northeast region. Due to the significant delay observed in the planting of the soybean crop, there is a greater chance that a larger portion of the winter crop will be planted outside the ideal window, which resulted in a fall in planting intention.

Thus, the total Brazilian production for 2023/24 was reduced to 124.56 million tonnes, a volume approximately 1.5 million less than that reported in December.

Argentinian crop: If concern over the Brazilian crop has increased, the opposite has been observed in Argentina. According to data from the Buenos Aires Grain Exchange (BCBA), 97% of the country's corn crop is in normal or good/excellent conditions, compared to 68% a year ago and an average of 83%. The BCBA estimates Argentine production at 55 million tonnes, 21 million more than recorded in 2022/23.

This week, the monthly reports from CONAB (Jan 10) and USDA (Jan 12), always highly anticipated by traders, will be released.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.