January 9 - Stocks are mixed at midday, with traders eyeing a big Treasury auction later this week. The VIX slipped below 13 again, while the dollar index firmed to trade near 102.5.Yields on 10-year Treasuries are trading near 4.01%, while yields on 2-year Treasuries are trading near 4.36%. The broader commodity complex found support today, with crude oil prices trading 2% higher on a renewed focus on Middle East risks, while the grain and oilseed sector is mostly higher as well. Gains are a bit larger for wheat, which saw big losses on Monday, while more modest for corn and soybeans. The protein sector is again trading weather premium, with a series of winter storms expected to challenge animal performance and packer operating schedules in the Plains and Midwest, with heavy snow and bitter cold temperatures spreading across the region in the days ahead.

The commodity sector started 2024 with the same bearish sentiment that clouded its outlook for much of 2023. In fact, we've been in commodity deflation mode since mid-June of 2022 as managed money fretted about the anticipated recession that was going to reduce demand for commodities. And we've seen that decline in demand for commodities, and we've seen a surplus of supplies relative to that demand. Throughout the past year and a half, we've seen managed money build short (sold) positions across the majority of commodities based on that expectation of soft demand as inflation pulled back amid recession expectations. Individual commodities would periodically rally when a bullish headline emerged, but that usually was due to speculative short-covering, with managed money quickly rebuilding short positions again once the headline died.

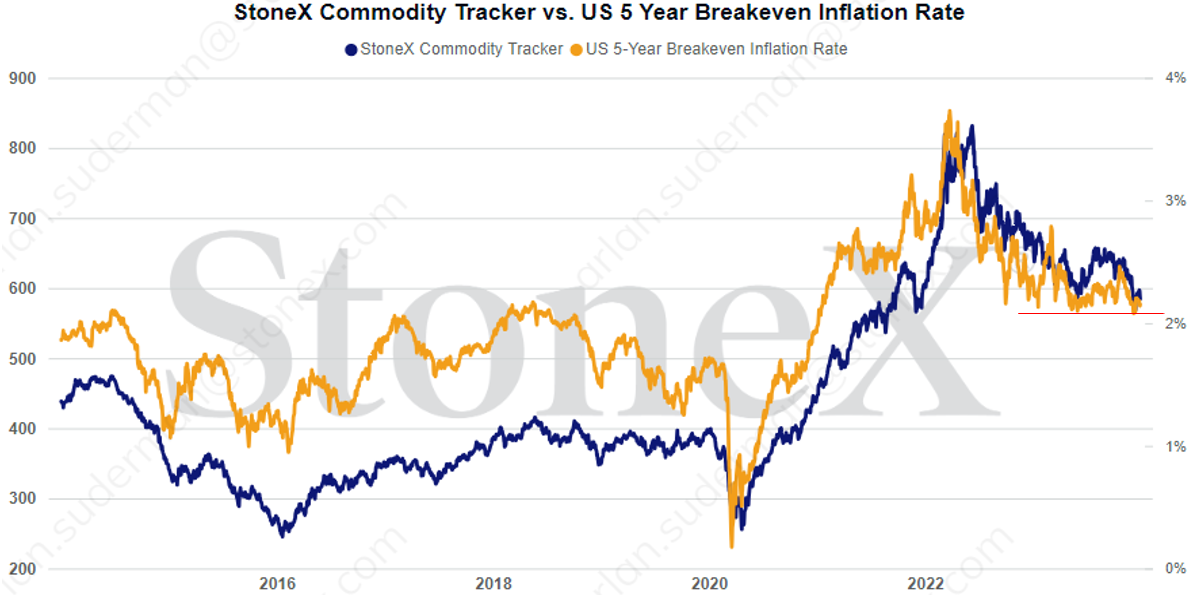

That's in sharp contrast to the period emerging from the initial Covid pandemic dip in the second quarter of 2020. The primary theme then was rising inflation expectations as the domestic and global economy opened up. An expansive economy means increased demand for raw commodities, while managed money also wanted to own commodities in their portfolios to hedge their inflation risks. The graphic below shows the correlation between our StoneX Commodity Tracker and the Five-Year Breakeven Inflation Rate - what the markets believe will be the average inflation rate over the coming five years. Those expectations are currently starting to level out. A correlation above 0.70 is considered to be statistically strong. The 10-year correlation shown below is a solid 0.87. The question before us then is, where do we go from here? Zero interest rates, and extremely low inflation rates, appear to be a thing of our past, and I agree with that. Rather, my bias is that we see a bounce in inflation expectations as we go deeper into 2024. That doesn't mean that I'm bullish commodities, but it does suggest that such a shift could result in managed money reducing or eliminating much of their short positions in the sector, and possibly build some ownership, making it easier for rallies to run when/if a story unfolds.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.