January 10 - Stocks traded modestly higher midday as traders anticipate key inflation data over the next two days. The VIX is trading below 13 again, while the dollar index is trading near 102.4. Yields on 10-year Treasuries are trading near 4.03%, while yields on 2-year Treasuries are trading near 4.37%. The broader commodity sector is mixed, with crude oil prices near unchanged at midday, while grain and oilseed prices consolidate ahead of Friday's big set of USDA crop reports. The agency will be releasing the results of its winter wheat seedings survey, quarterly grain stocks survey, final 2023 U.S. production estimates, while also revising its domestic and global balance sheets. It's the largest data dump of the year, opening the door for a higher risk of surprises in either direction. Meanwhile, the protein sector continues to deal with weather disruptions. Lean hog futures are consolidating from recent strong gains, but both the cattle and hog complex continue to be impacted by the current weather pattern. Feed yards in the western feedlot region are finally getting back into all areas to feed cattle, while a packing plant in Dodge City is still shut down. Performance of both cattle and hogs are being negatively impacted by the snow and the cold.

China reviewed its grain reserve acquisitions over the past year in a national work conference on Monday and Tuesday. It purchased more than 400 million metric tons of grain in 2023 for the reserve, which is 57.5% of the country’s total output for the year of 695 million tons. China utilized strategic measures to ensure national food security through policy-based purchases and/or sales to help stabilize domestic prices against the impact of fluctuating international grain prices. Policy-based transactions dominate China’s corn, wheat, and rice. Authorities set price floors for wheat and rice in major producing provinces to protect farmers' interests. China has built a storage capacity of standard warehouses for grains to contain as much as 700 million tons in its reserves, which exceeds its annual production. It believes that this lays a solid foundation for China to maintain abundant grain inventories, with the stock-to-use ratio above the international grain security threshold of 17-18%. China believes this keeps prices stable for its producers, but as we learned in the 1980s, it also disincentivizes production. That's one of the reasons why its trend corn yield is still just above 100 bushels per acre. However, it also means that China believes that is less vulnerable to famine that could cause its citizens to stage a revolt against the government.

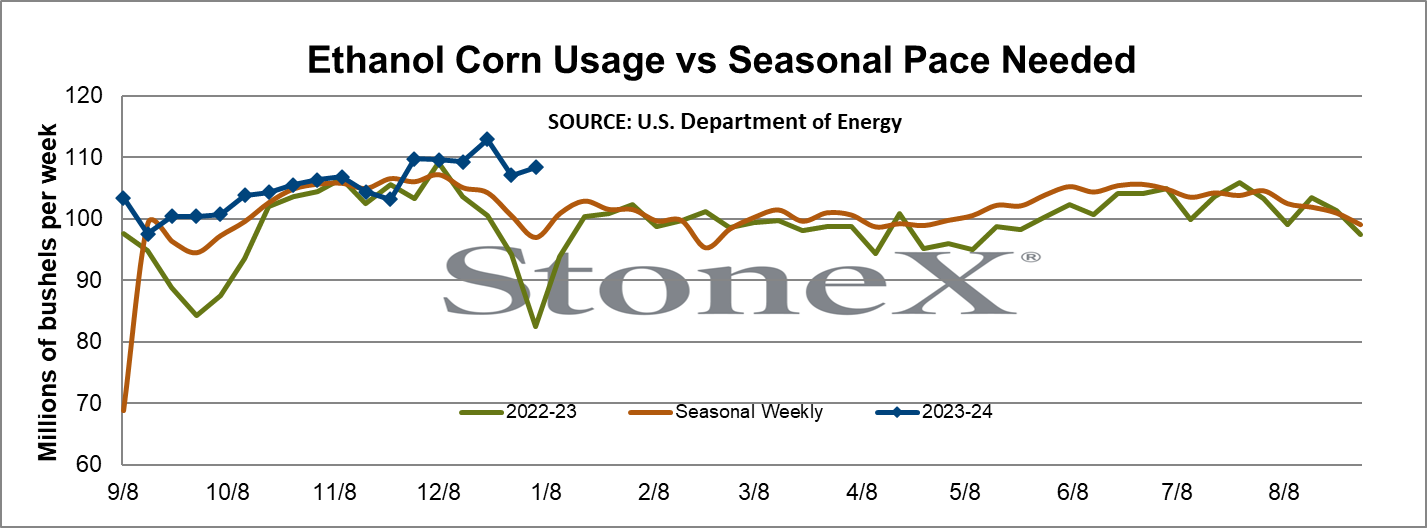

U.S. commercial crude oil stocks (excluding the Strategic Petroleum Reserve) rose 1.3 million to 432.4 million barrels in the week ending January 5, leaving it still about 2% below levels typically seen in early January. Gasoline stocks increased by 8.0 million barrels, putting them 1% above seasonal levels. Distillate stocks jumped 6.5 million barrels, putting them still roughly 4% below the five-year average for this week of the year. Ethanol stocks rose to an eight-month high 24.4 million barrels in the week ending January 5, up from 23.6 million the previous week, and up from 23.8 million barrels in the same week last year. Ethanol production rose to 1,062K barrels per day on favorable grind margins during the week, up from 1,049K bpd the previous week, and up from 943K bpd in the same week last year. The production of ethanol utilized an estimated 108.4 million bushels of corn in the week ending January 5, as shown below, up from 107.0 million the previous week, and up from 93.9 million bushels the previous year. Estimated year to date corn use for ethanol totals 1.908 billion bushels, up 119 million or 6.7% from the previous year's pace, arguing for USDA to bump its corn use for ethanol target by another 30 - 50 million bushels on Friday.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.