- Low international demand for American corn;

- Good expectations for Argentine production;

- Drop in wheat futures in Chicago;

- USDA figures above expectations for Brazilian production and global stocks.

- Despite posting a more favorable weather pattern, concern about crops in Brazil, especially the 2nd corn crop, persists;

- CONAB reduces the estimate for Brazil's corn crop.

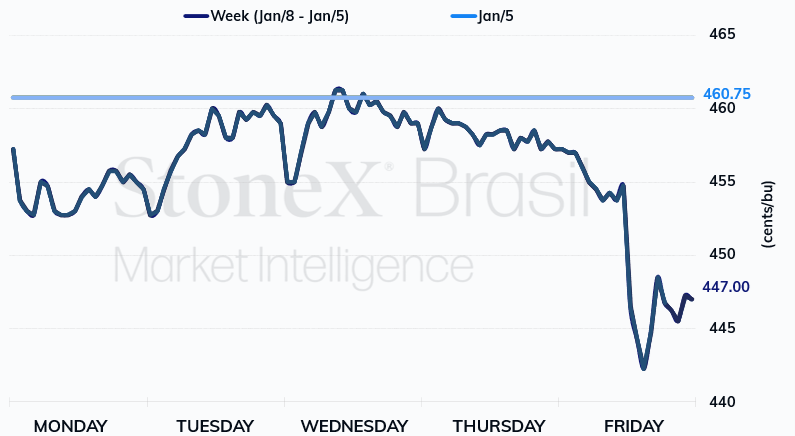

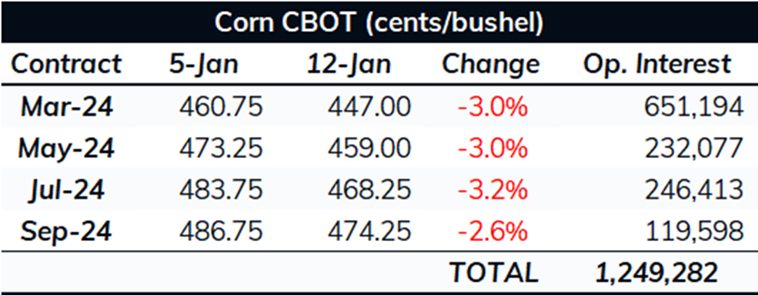

Corn futures ended another week with sharp drops in Chicago, which occurred mainly after the release of the USDA supply and demand report. Despite the Department bringing negative revisions to the Brazilian crop, as expected, the figure remained above market expectations. In addition, USDA brought higher-than-expected numbers for production from Argentina, the US, and global stocks. The March/24 corn closed last Friday, January 12, at 447 cents/bu, a depreciation of 3% compared to the previous week and the lowest closing recorded by the contract.

US export inspections: The US Export Inspections Report released last week indicated that the country exported 856.6 TMT of corn in the week ended January 4, up from the 569.9 TMT recorded in the previous week and the 402.1 TMT in the equivalent week of the previous crop season. Thus, total loadings in the 23/24 crop reached 12.8 million tonnes versus 10 million in the same period of the 22/23 cycle.

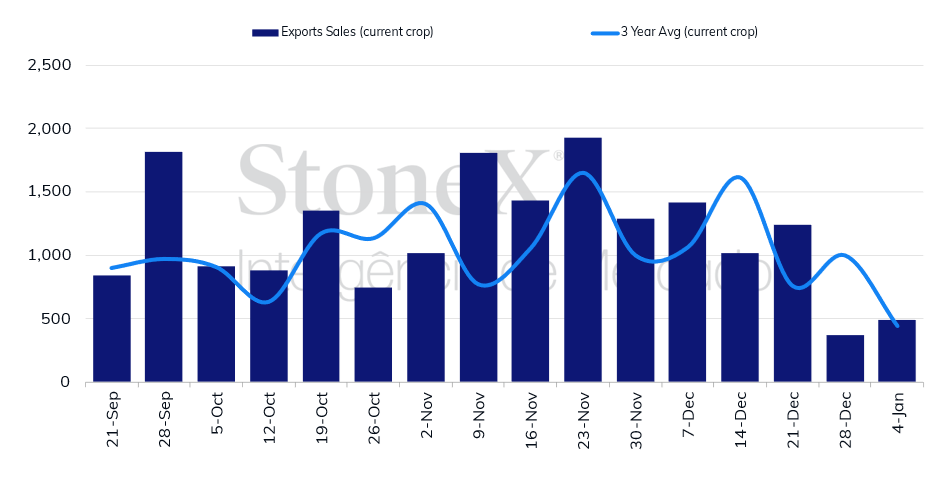

US export sales: The USDA export sales report showed a net sale of 487.6 TMT in the week ended on the last day 4, compared to 367.5 TMT in the previous week and also above the 255.7 tmt sold in the equivalent week of 2023. The volume stayed within the market's expectations range, from 400 thousand to 1 million tonnes. In the accumulated, the sales of the 23/24 crop totaled 30.3 million tonnes, against 22 million in the same period of 22/23.

Export sales per week - USA (tmt)

Ukrainian exports: Ukraine's success with its grain corridor boosted wheat futures. According to Ukraine's Deputy Prime Minister, Oleksandr Kubrakov, the country has moved 10 million tonnes of agricultural products (including grains) through its corridor since July, despite all the attacks carried out by Russia. The total of grain exports through all distribution channels since the beginning of the season was 19.4 million tonnes of grains. This figure is still 4 million lower than in the same period last year, but it is considered a success, given the conditions faced by the country.

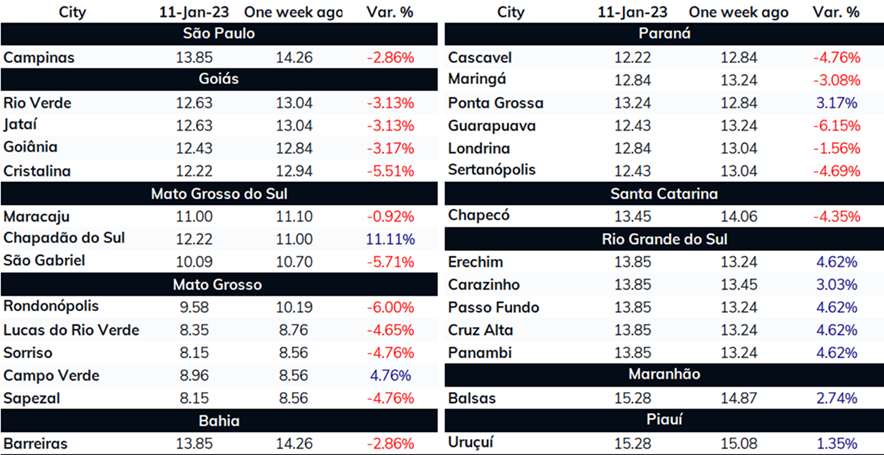

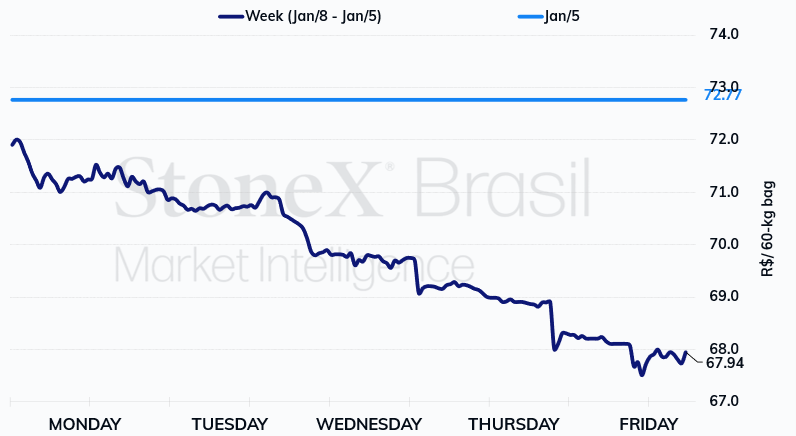

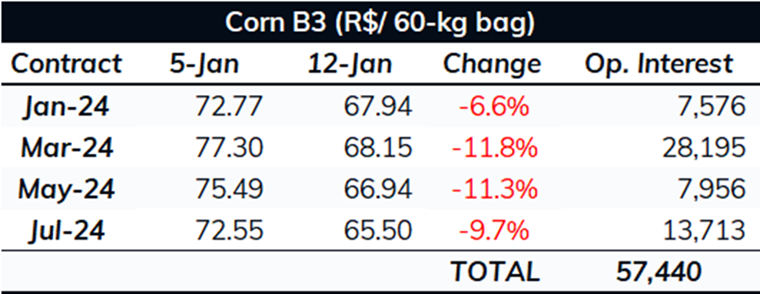

After following the opposite path of Chicago in recent weeks, corn futures in Brazil followed the same direction as international prices in the last week. January/24 ended last Friday at BRL 69.74/bag, a depreciation of 6.6% for the week. The sharp drop seen on the B3 was motivated by more favorable prospects for the cereal crop in Brazil. The weather pattern of the last few weeks brought a reprieve for the soybean crop and a more favorable outlook for the corn crop. In addition, the shortening of the soybean cycle observed in some regions can foster the planting window for safrinha in these locations.

Brazilian crop: The weather pattern in Brazil continued to be favorable for soybean and corn crops in the last week. In general, the country has recorded good volumes of rain over the past two weeks, which tends to support the conditions of the crops and, in some cases of areas where sowing occurred later, even further improvements. The rains in practically the entire soybean belt should be much less intense in the coming days, which should foster the harvest progress and provide a better planting window for safrinha corn in some regions. The rainfall is expected to return in the following week, bringing better moisture to the soil and benefiting the second crop of the cereal, especially the recently planted areas. On the other hand, these rains can also delay the harvest of some soybean areas and impact the sowing window of the winter crop. Furthermore, there have been reports of a shortened soybean cycle in some regions, which can foster the planting window for safrinha in these locations. Anyway, it will be essential to continue monitoring the progress and development of the crops to get a more concrete idea of the Brazilian crop volume.

CONAB Estimate: In the last week, CONAB reduced the total crop production for 2023/24 to 117.6 million tonnes, a result of a reduction of almost 1 million tonnes in the first crop, which, in turn, was also mainly motivated by adjustments in productivity.

USDA Estimates: The event that moved the market during the week most was the USDA's WASDE report. The Department, as expected, reduced its estimate for Brazil's 23/24 crop by 4 million tonnes to 127 million tonnes. Nonetheless, the figure exceeded the market's average expectations, at 125.3 million. Another factor that surprised the market was the increase in US production, from 387 to 389.7 tonnes, contributing to slightly larger stocks in the country. At a global level, carryout ramped up to 325 million tonnes, a volume more than 10 million above market expectations, significantly contributing to the price drop. Still, on the side of the stock, USDA also released its quarterly stocks position report, indicating the stocks of American grains on December 1st, 2023. The Department indicated a volume of 309.1 million tonnes, above the market's average expectations (306.1 million) and the one recorded on December 1, 2022 (274.9 million).

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.