January 19 - Price is a function of supply and demand, but as modified by the flow of money. Managed money controlled by algorithms make up a large portion of today's commodity markets, from crude oil to live cattle. Some of that managed money is there because it sees an opportunity to make money being either long or short a commodity, or the commodity sector at large. Some of that money is present simply because it balances out overall portfolio objectives, while there are other motivations as well. The algorithm computers simply speed up the implementation of the fund objectives, often to a fraction of a second. Supply and demand remain vital components of determining a fair value for a particular commodity, but the market's perception of the overall economy shapes its objectives for involvement in the sector, and that also influences how the market manages supply and demand.

A simple regression study utilizes historical price versus stocks relationships to determine a fair value for a commodity. But my study of marketing year average cash prices for corn and soybeans found that average cash prices frequently came in well above, or well below the projected levels determined by those historical relationships. The primary factor that seemed to determine whether a particular year would end up with a higher or lower price than projected by the price regression study was the market's perception of whether we were in an inflationary period or a deflationary period. In other words, the market tended to manage the same supply and demand fundamentals at different price levels, all the way to the farm gate, depending on whether fund managers felt that we were moving into an inflationary period, or if we were moving into a potential recession and/or deflationary period.

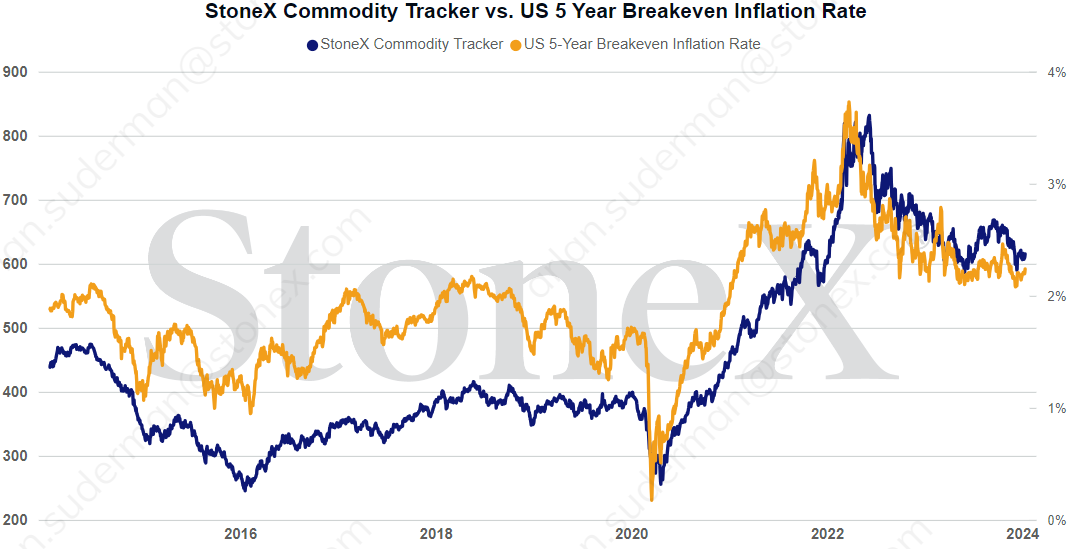

The five-Year Breakeven Inflation Rate reflects the market's perception of whether the average inflation rate will be rising in the years ahead or whether it will be in decline. The below graphic shows rising inflation expectations coming out of the pandemic in 2020, but declining expectations as the Fed began to ramp up interest rates in 2022. History shows that the value of a broad basket of commodities - our StoneX Commodity Tracker in this case - rises and falls with these expectations, with a 10-year correlation of a strong 0.87. Fund managers tend to build long positions of ownership to protect their portfolios in times of inflationary expectations, while shorting the commodities in times of expected declining inflation, which has been the case since roughly June 2022. Those inflation expectations are leveling off currently, with some talk that they may rebound later in 2024. The funds hold large short positions in most commodities today, so would that mean a reversal? That's a question likely to be answered in the second or third quarter of this year.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.