January 22 - Wall Street euphoria pushed the S&P 500 stock index to a fresh record high this morning boosted by mega cap and chip stocks, while the commodity sector also boasted a positive bias on the screen as well. The VIX continues to trade just above 13 at midday, while the dollar index is trading quietly near 103.2. Yields on 10-year Treasuries are trading near 4.10%, while yields on 2-year Treasuries are trading near 4.38%. Crude oil prices rose by more than 2%, testing areas of overhead chart resistance, as Middle East geopolitical risks escalated. Grain and oilseed prices also moved into positive territory during the morning, although the rallies there continue to be met by willing sellers. Strength in the crude oil market gave a boost to soyoil prices, which then added support for soybeans. Even so, the grain and oilseed sector remains well supplied, with producers on both sides of the equator currently undersold and looking for rallies to sell. The protein complex spent the bulk of the morning in the red, led by the feeder cattle complex as the activity picks up in the auction barns after adverse weather kept it quiet there in recent weeks.

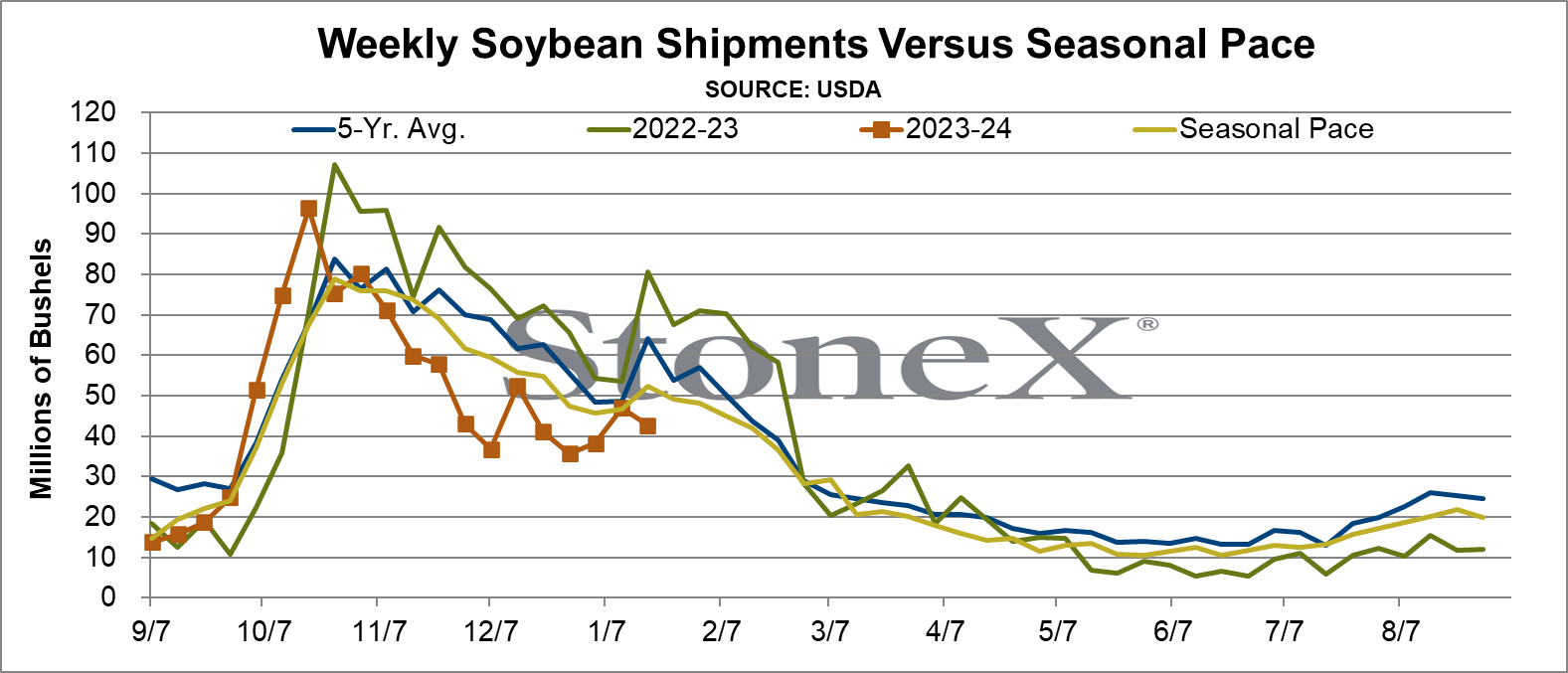

USDA inspected 42.7 million bushels of soybeans for export in the week ending January 18, as shown below, along with 28.1 million bushels of corn, 11.6 million bushels of wheat and 3.1 million bushels of grain sorghum. The portion of the above that was inspected for shipment to China included 29.4 million bushels of soybeans, 0.07 million bushels of corn, 3.3 million bushels of wheat, and 3.1 million bushels of grain sorghum. Marketing year to date wheat export inspections fall short of the seasonal pace needed to hit USDA's target for the year ending May 31 by 52 million bushels, where the deficit has largely been holding for a while now as China has been slow to take shipment of its large purchases this winter. On the other hand, marketing year to date grain sorghum export inspections exceed the seasonal pace needed to hit USDA's target by 36 million bushels, because China has largely been taking shipment of its purchases of the feed grain.

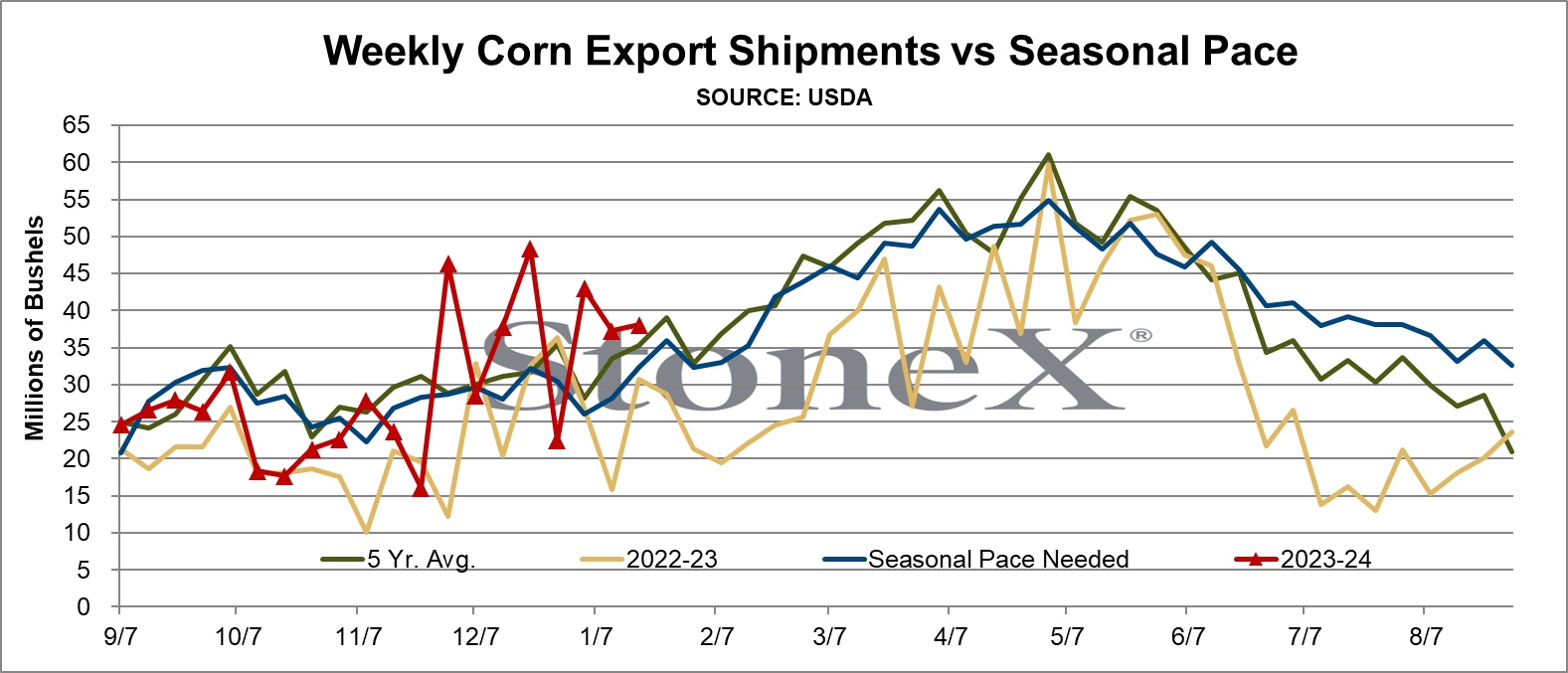

USDA has inspected 983 million bushels of soybeans for the marketing year to date, down from 1.192 billion bushels at this point last year. As such, this year's total falls short of the seasonal pace needed to hit USDA's target by 53 million bushels, and the deficit is 10 million bushels wider this week than it was last week. We're basically where we were a few weeks ago, when I stated that we could see USDA cut its soybean export target in the January 12 WASDE report. It did not do so. So, now we'll watch to see if it does so in the February report. Soybean bulls have been holding out hope that Brazil's crop will be so short - due to hot dry conditions in Center-West Brazil - that it necessitates an increase in U.S. exports. Thus far we see no evidence of that in Brazil's cash market, with soybeans booked for shipping in February, March, and April running roughly $2 per bushel cheaper than U.S. Gulf soybeans shipped into China, after freight, currency, and import taxes are considered. Brazilian basis has fallen sharply as harvest has begun, reflecting little worry about the crop size. Meanwhile, marketing year to date corn export inspections total 579 million bushels, up from 453 million the previous year, and 17 million bushels above the seasonal pace needed to hit USDA's target for the year. The next several months are seasonally our strongest corn shipping period of the year ahead of Argentina's crop harvest.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.