- Low international demand for American corn;

- Good expectations for Argentine production;

- USDA figures above expectations for Brazilian production and global stocks.

- Despite registering a more favorable weather pattern, concerns about crops in Brazil, especially the 2nd corn crop, persist;

- CONAB reduces the estimate for Brazil's corn crop.

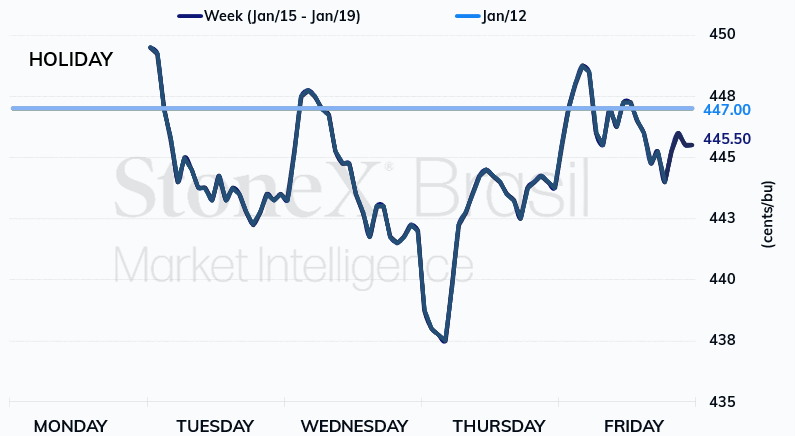

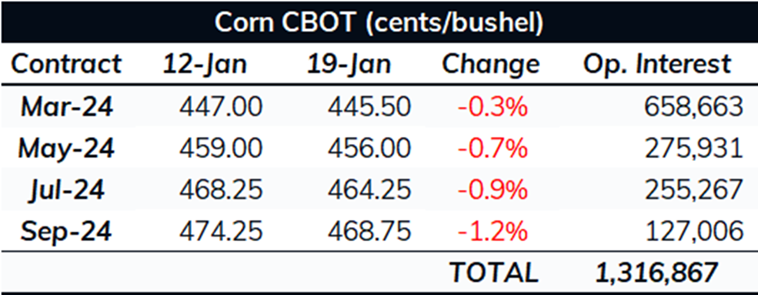

In the last week, which was shorter due to the Martin Luther King Jr. Day holiday, corn futures accumulated devaluations in Chicago. The March 24 closed Friday (19) at 445.5 cents/bu, a slight decrease of 0.3% for the week. Among the main drivers, we still have the development of the South American crop as the main point on the supply side and, on the consumption side, uncertainties about global demand for cereal. For the US, the feeling regarding the demand for American grain is that the demand for the ethanol and animal feed sectors is safer. Nonetheless, its destination for export is more uncertain. The low levels in the Panama Canal continue to hinder the arrival of American products in Asian markets and contribute to a pace of sales and exports of US corn below expectations. In addition, the high supply of wheat from the Black Sea has also affected the demand for corn.

Corn ethanol production in the US: According to data released by the Energy Information Administration (EIA), US ethanol production totaled 1,054 thousand barrels per day (tbpd) in the week ending Jan. 12, down eight tbpd from a week earlier and 24.4 tbpd below the 5-year average for the same period. The stocks increased by 1.32 million barrels to 25.7 million.

US export inspections: Despite bringing a better figure in the annual comparison and a sharp upward revision for the week of January 4, corn export inspections were insufficient to promote greater optimism among traders. According to USDA data, 875.6 TMT of corn were loaded in the week ended January 11, above the 779.8 TMT shipped in the same week last year. Still, below the 1.09 million tonnes recorded in the previous week - in the previous report, the Department had indicated that 856.6 tmt had been exported that week. This positions the accumulated shipments in the US 23/24 crop at 10.8 million tonnes, 1.2 million behind the registered in the same period of 22/23.

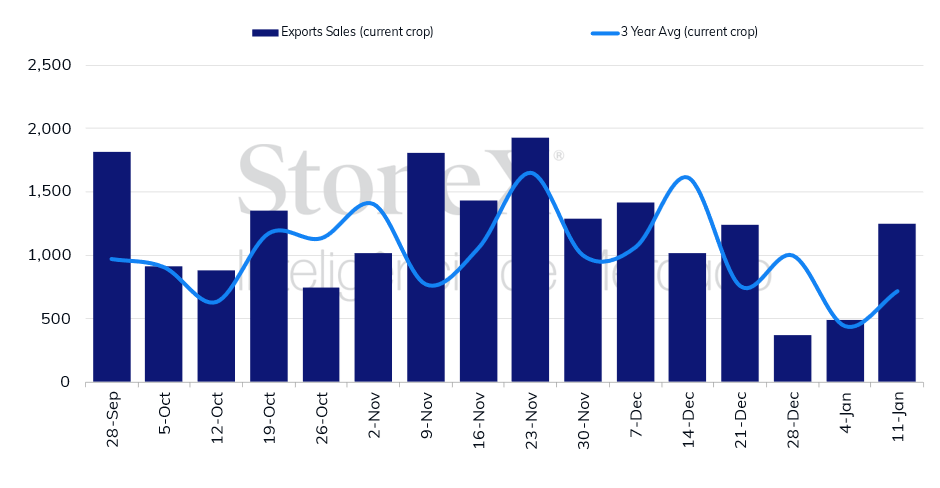

US export sales: Despite bringing good figures, the USDA export sales report did not have the strength to reverse the losses in the future. The Department reported that the US recorded 1.25 mmt of net sales in the week ended on the last day of the 11th, compared to 487.6 thousand in the previous week, a significant advance, and in sympathy with the 1.1 mmt sold in the equivalent week of 2023. The figure was slightly above the upper range of the market estimates, which ranged from 500 thousand to 1.2 million tonnes. In the accumulated, the 23/24 crop sales totaled 31.5 million tonnes, against 23.1 million in the same period of 22/23.

Export sales per week - US (tmt)

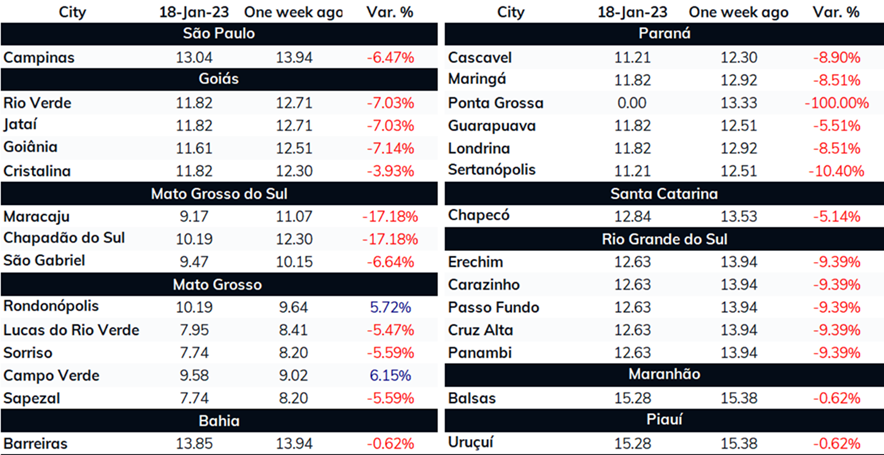

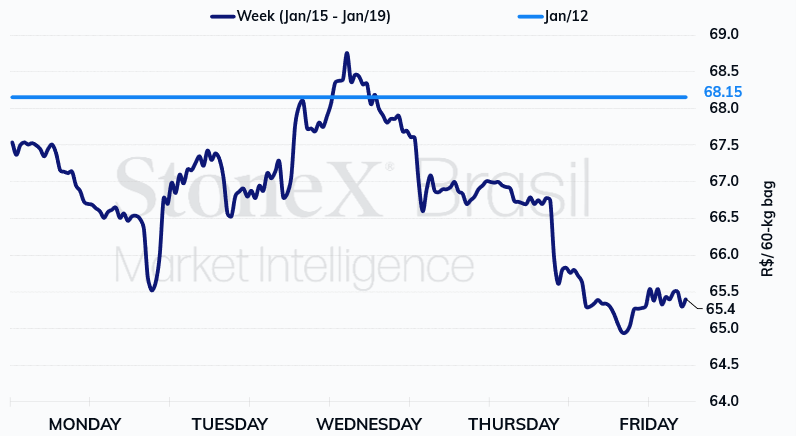

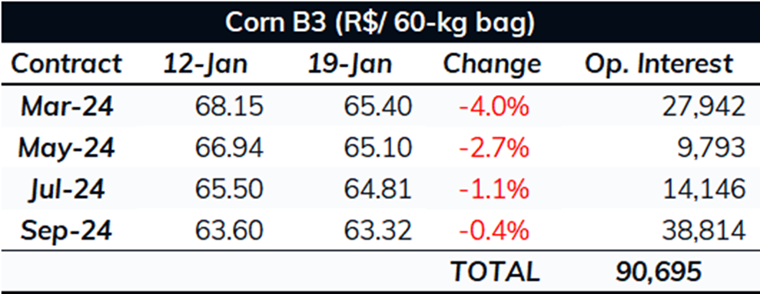

Like in Chicago, corn futures in Brazil also fell, but with much greater intensity. March/24 ended Friday's session at BRL 65.40/bag, a depreciation of 4.0% for the week. The sharp drop seen on the B3 was once again motivated by more favorable prospects for the cereal crop in Brazil.

Brazilian crop: One of the main focuses of the market today is production in South America, especially soybean production in Brazil, where the harvest is in progress. Nonetheless, agents are already speculating about the Brazilian safrinha corn production. Nonetheless, over the past few weeks, good volumes of rain have been recorded, and the outlook for the next two weeks is also for high precipitation, which can contribute to better water conditions for the 2nd crop, which is in its initial planting phase. According to StoneX's follow-up, the cereal harvest reached 4.1%, compared to 0.5% in the same period last year.

Crop in Argentina: Last week, the Buenos Aires Grain Exchange (BCBA) indicated a hike in crops classified as good/excellent condition, reaching 46%, ten p.p. higher than the previous week and 41 p.p. higher than the same period last year, boosting optimism regarding the supply in the country. The BCBA estimates the 23/24 corn crop at 55 million tonnes, 21 million more than last year.

Chinese demand: China has shown signs of lower grain demand, contributing to the pressure observed in the cereal market. The largest pig production companies in the Asian giant indicate that they are about to reduce the size of the herd in the coming months, which could pressure the country's demand for imported grains, including corn.

Chinese imports: China imported 5 million tonnes of corn in December, a hike of 37.9% versus November and nearly five times more than in December 2022. Thus, the country imported 27.1 million tonnes in 2023, 6.5 million more than in 2022. Of the total imported by the Asian giant in the last year, Brazil was responsible for 47.2% (12.8 million tonnes), China's main trading partner. The US ranked second, with a share of 26.3% (7.1 million tonnes), while Ukraine came in third, with 20.3% (5.5 million tonnes). The Chinese government has approved more varieties of corn and soybean for cultivation. Adopting genetically modified cereal may cause a major transformation in the market, turning the Asian giant from an importer into an exporter of the cereal. Indeed, this change is not imminent, and the country should go through a long process, but it is a discussion that is constantly raised.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.