- Low international demand for American corn;

- Good expectations for Argentine production;

- USDA figures above expectations for Brazilian production and global stocks.

- Despite registering a more favorable weather pattern, concern about crops in Brazil, especially the 2nd corn crop, persists;

- CONAB reduces the estimate for Brazil's corn crop.

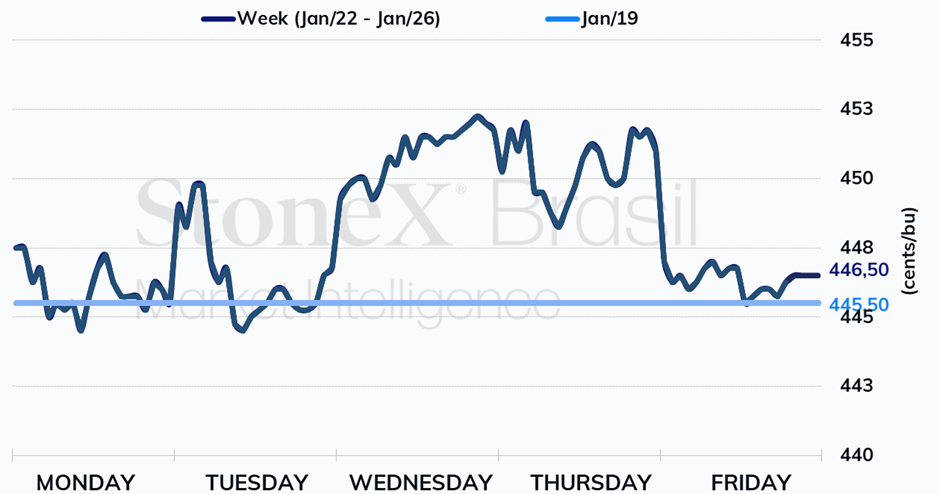

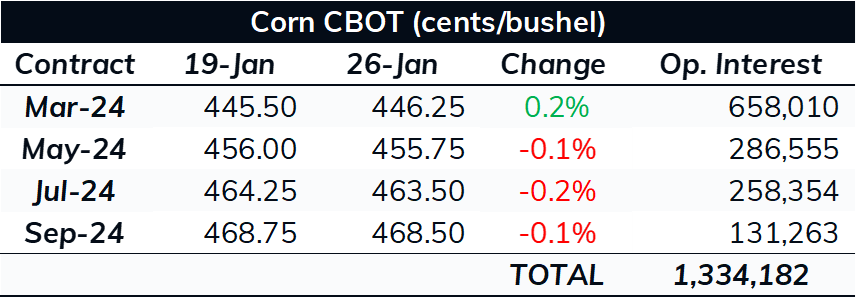

After six consecutive weeks with corn futures ending the period lower, the cereal ended last week near unchanged in Chicago. The March 2024 contract ended last Friday (26) quoted at 445.5 cents/bu, a 0.2% increase compared to the previous week.

Corn-based ethanol production in the US: According to data released by the Energy Information Administration (EIA), US ethanol production totaled 818 thousand barrels per day (tbpd) in the week ended Jan. 19, down 236 tbpd from a week earlier and 196.4 tbpd below the 5-year average for the same period. This significant drop is related to the extreme cold wave that hit the US and negatively impacted the ethanol plants in the country. The stocks ramped up by 120 thousand barrels to 25.8 million.

US export inspections: Corn export inspections did not bring any major surprises to the market at the beginning of last week. According to USDA data, 713.3 TMT of corn were loaded in the week ending January 18, in sympathy with the 728.84 TMT shipped in the same week last year, but below the 946.4 TMT recorded the week before. Thus, total loadings in the US 23/24 crop reached 14.7 million tonnes, 3.2 million behind the registered in the same period of 22/23.

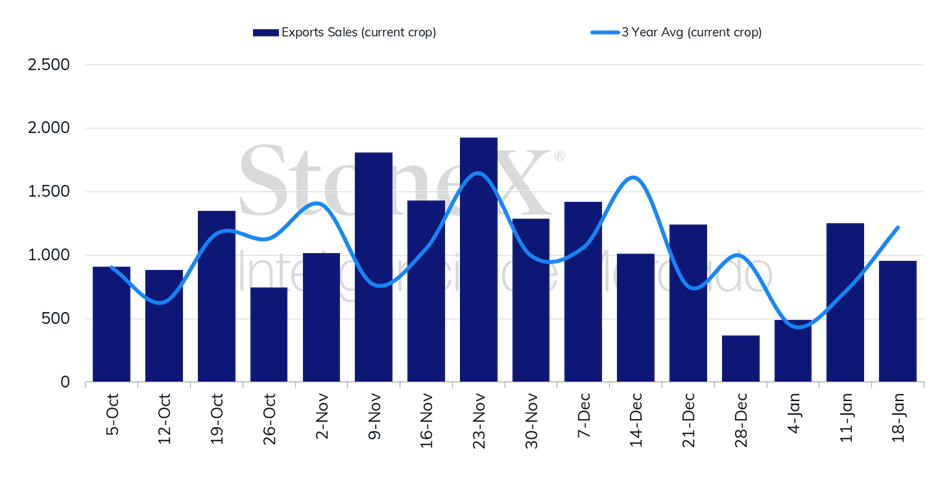

US export sales: The USDA export sales report also did not bring very surprising figures. The Department reported that the US recorded 954.8 TMT of net sales in the week ended on January 18, compared to 1.25 million in the previous week and in line with the 910.4 TMT sold in the equivalent week of 2023. The figure stayed within the market's estimated range of 725 thousand to 1.4 million tonnes. In the accumulated, the 23/24 crop sales totaled 32.8 million tonnes, against 24 million in the same period of 22/23.

US export sales (tmt)

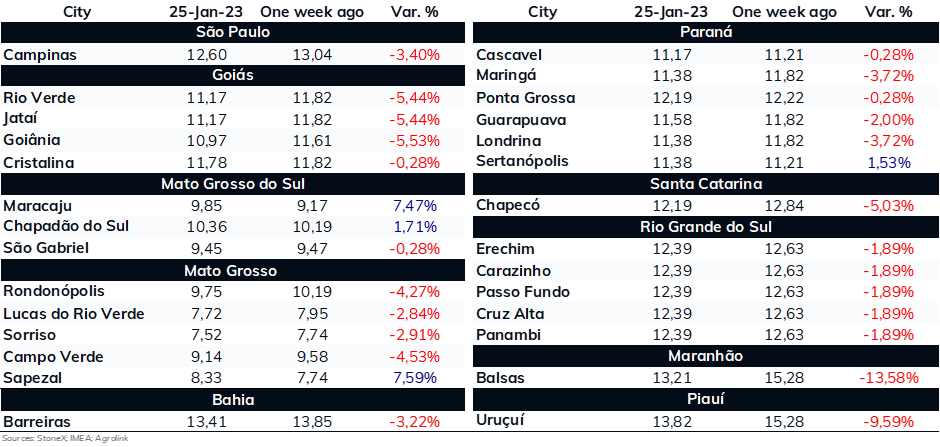

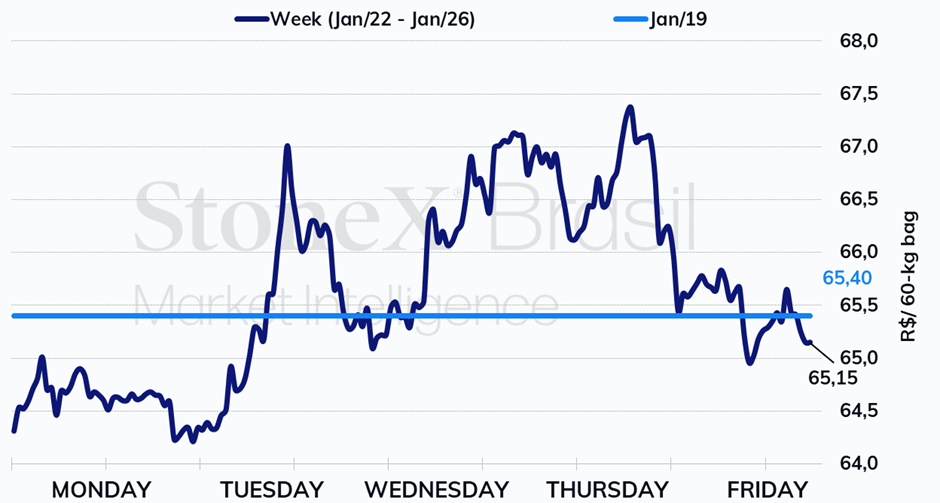

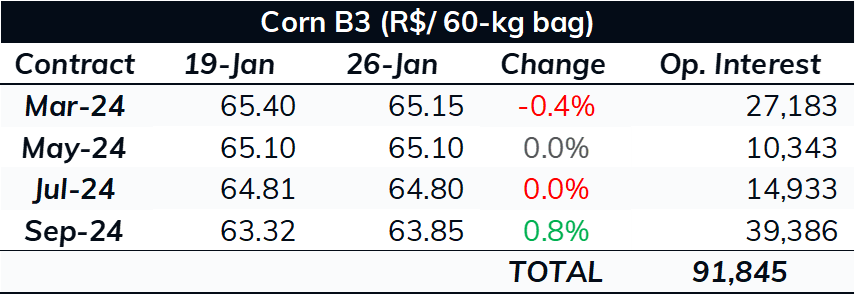

Similar to what was observed in Chicago, corn futures in Brazil also ended the last week nearly unchanged, a behavior that responded to technical factors after the sharp losses accumulated since the beginning of 2024. March 24 ended last Friday at BRL 65.15/bag, a slight decrease of BRL 65.40/bag for the week.

Crop in Argentina: Last week, the Buenos Aires Grain Exchange (BCBA) indicated a slight decrease in crops classified as good/excellent condition, reaching 41%, five p.p. lower than the previous week but 29 p.p. higher than the same period last year. Thus, optimism regarding the supply in the country remains quite high, so much so that the BCBA raised its estimate of the 23/24 corn crop production to 56.5 million tonnes, 1.5 million more than its previous figure and 22.5 million above last year's harvest.

Crop in Brazil: The weekly crop progress report by StoneX indicated that the summer corn harvest reached 11.7% of the total last Friday (26), while 10.8% of the safrinha has already been sown. The focus should now turn to the weather for the second corn crop fields, as the winter cycle is already riskier, as it develops before the dry season, starting in May, in much of Brazil. The forecasts for the next two weeks indicate rain in the entire producing region, emphasizing the second week of the period.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.