January 30 - Stocks are mixed at mid-day on the back of mixed economic news and earnings results, with the Dow Jones slightly higher, the S&P 500 roughly unchanged, and the Nasdaq in the red at the time of writing. The VIX has cooled throughout the day, falling back near the 13.4 level. The dollar remains slightly weaker, hovering below 103.3 after pushing above 103.4 earlier in the session. Treasuries have firmed from their morning lows in the wake of a stronger than expected U.S. jobs market, with 10-year yields pushing near 4.08% and 2-year yields now in the green above 4.37%. Crude oil is holding onto morning gains thus far, with the nearby WTI contract hovering near $78/barrel at the time of writing. A surprising turnaround Tuesday is being seen in the grain markets, with the entire complex now in the green despite a lack of fresh positive fundamental news, following an ugly finish to last week and start to this week.

This morning's JOLTs report showed continued strength in the U.S. labor market, with December U.S. job openings rising to 9.026M, sharply above forecasts of 8.75M and above November's upwardly-revised 8.925M. After some signs of cooling this fall, December marks the highest job openings since September. The continued strength in the U.S. labor market has been a major driving force behind the inflationary pressures seen in the U.S. due in large part to wage inflation. Today's much stronger than expected job openings reading provides the hawks additional ammunition to point to as a sign of the need to hold rates higher for longer.

Conversely, U.S. job quits fell to their lowest since January 2021 at 3.392M, down from the 3.471M in November and below market expectations of a moderate decline to 3.45M. This helps the dove's case, with record quits in recent years largely driven by leaving current positions for higher paying jobs, adding to wage inflation. The quits rate is often viewed as a measure of confidence in the labor market, meaning the slowdown in employees voluntarily leaving jobs is a potential reflection of a changing perception of opportunities at the employee level. The mixed results of today's JOLTs report highlights the challenge in front of the Fed as they gather today. Some signs of weakness have emerged in certain sectors of the U.S. economy, but overall continued economic strength keeps fears of a resurgence of inflationary pressures present, forcing the Fed to walk a tight rope in the year ahead.

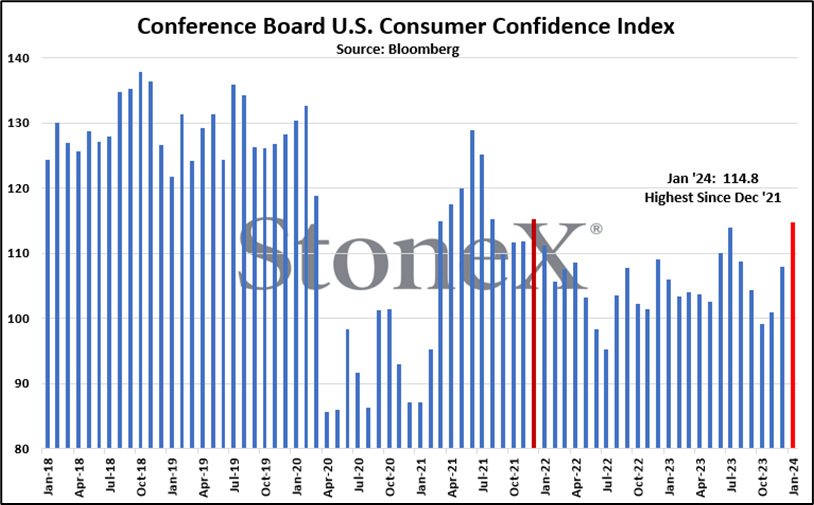

U.S. consumer confidence surged to start the new year, with this morning's Conference Board Consumer Confidence Index rising to 114.8 in January, well above December's 108 and marking the highest level seen since December 2021. This was the third consecutive monthly improvement in consumer confidence and coincides well with the firm consumer spending data seen to finish out 2023. Today's strength could be an indicator of some of that firmness continuing to start 2024. As with the above labor data, this is a bit of a double-edged sword for the Fed. The continued resilience of the U.S. economy is improving consumer confidence, but that could also lead to persistence in inflationary pressures if that leads to continued strength in spending. As the data continues to roll in, parsing through commentary from Fed members following this week's meeting gains more and more importance as the market attempts to gauge their reaction and project their course accordingly.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.