February 1 - Stocks are attempting to gain back some of yesterday's losses, with the major indexes remaining in the green at mid-day, while the VIX cools back around 14 after its slight spike yesterday. With so much focus on the Fed, bad news is back to being good news, as today's worse than expected U.S. jobs data is helping provide a boost on hopes of a dovish pivot in the months ahead. The U.S. dollar is fading through the day, off its morning highs as it falls below the 103 level at the time of writing. Treasuries are considerably weaker on the day, with 10-year yields at month-plus low around 3.85% and 2-year yields at 3-week lows around 4.19%. Crude oil is in the green today with the weaker dollar and continuing OPEC+ production cuts providing support as the nearby WTI contract rises to trade near $77/barrel. The ags are largely mixed, with the soy complex leading the way downward, while the cattle complex is seeing considerable strength on the back of yesterday's bullish inventory report.

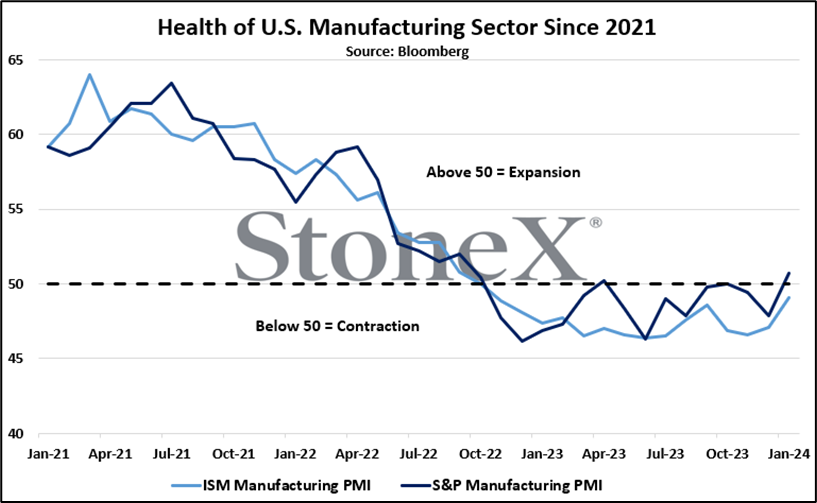

The U.S. manufacturing sector is showing signs of an attempted recovery from its persistent weakness, with today's January Manufacturing PMI reading from S&P hitting its highest level since September 2022 at 50.7, the first month of expansion seen since April. The ISM reading remained in contractionary territory at 49.1, but this was still a solid improvement from the 47.1 seen in the month prior and marked its highest reading since October 2022. Both indexes noted an improvement in new orders, a welcomed sign of improving demand, but also saw a noteworthy increase in price pressures, potentially a sign of stubborn inflation returning. The other noteworthy takeaway from today's data was a slowdown in the employment portion of the index, coinciding well with this morning's softer than expected jobs data. While this sounds negative on its surface, with the trade so closely focused on the Fed, any signs of weakness in the labor market will be looked at as further evidence of slowing wage inflation, providing ammunition to the doves for rate cuts in the months ahead.

Weakness in the manufacturing sector hasn't been limited to the U.S. either, as a multitude of countries continue to see contraction in their respective manufacturing sectors, according to data releases overnight and this morning. The struggling European manufacturing sector saw some silver linings like the U.S., continuing its recovery from lows hit last summer, though remaining well within contractionary territory, while neighboring Canada got opposite news as their Manufacturing PMI fell to 45.4, its lowest level since the pandemic-hit spring of 2020. China's Caixin Manufacturing PMI showed a surprisingly strong reading of 50.8 in January, matching the same level seen in December and remaining in expansionary territory for the third consecutive month. This is a bit contrary to China's official NBS Manufacturing PMI which came in at 49.2 the day prior, remaining in contraction for the fourth consecutive month as the larger, state-owned enterprises continue to struggle. Contrasting to weakness in China is the great strength seen in India's manufacturing sector, rising to its firmest pace of expansion since September and reflecting the current phenomenon of firms leaving China in favor of India and others due to the ongoing geopolitical tensions with the west. This serves as a highlight of another impact that geopolitics are having as the global economy evolves.

Mortgage rates in the U.S. cooled slightly this week according to Freddie Mac, with the average 30-year rate falling by 0.06% to 6.63% and the average 15-year rate falling by 0.02% to 5.94% after both saw upticks last week. This is a fair bit below their recent peaks this fall of roughly 8% and 7%, respectively, but still high enough to weigh on buyers. Sentiment has improved slightly in early 2024, however, with the housing market proving resilient, much like the broader U.S. economy. With housing costs accounting for such a large portion of the average American's budget, the health of the housing market does have implications for lingering inflationary pressures.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.