| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 5.33% | 5.32% | 4.36% | 4.04% | 4.09% | 4.13% | |

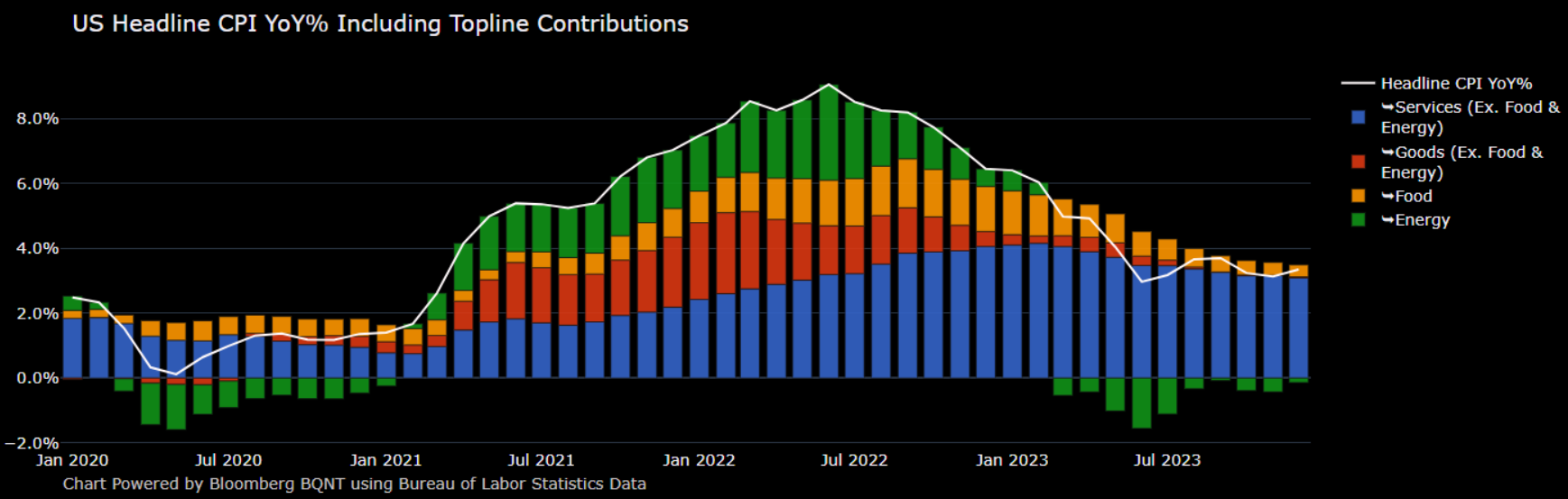

- The Consumer Price Index surprised to the upside this morning, reporting a 0.3% pace of inflation last month – well above the 0.1% November pace and the 0.2% consensus forecast

- The monthly increase takes the annual change of consumer prices from 3.1% to 3.4% - marking its 7th consecutive month of inflation stuck north of 3%

- Core CPI posted a similar 0.3% pace in December, taking its annual figure from 4.0% to 3.9%. Yet another, marginal inch lower

- The shelter index (again) contributed to over half of the monthly rise. And over the past 12 months, shelter alone has contributed to over two thirds of the total Core CPI increase

- The energy index rose 0.4% last month after its 2.3% decrease in November with gasoline prices no longer having a significant drag on the index and electricity prices rising 1.3%

- Consumer food prices have largely normalized at a 0.2% monthly pace, except for egg prices which rose 8.9% last month

- Lastly, goods prices were stagnant in the prior month – reversing a three-month deflationary trend. Yet the annual figure remains at an inconsequential 0.2% rate of change

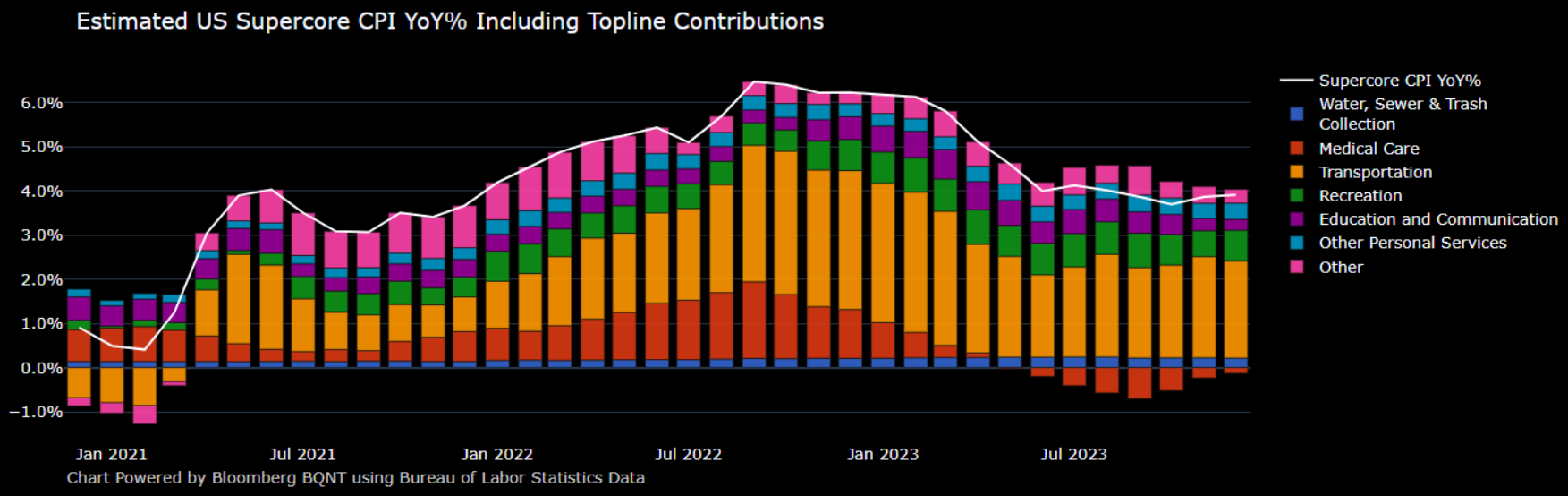

- Stripping out the weight of shelter doesn’t necessarily show an improving outlook either, as the Fed’s “supercore” inflation index has been generally unchanged since June 2023 (4.0% in June to 3.91% today)

- There, the inflation pressures are broad with transportation leading the way largely thanks to car insurance consistently repricing higher each month (another +1.5% last month and +20.3% over the past 12 months)

- Then on the fringes, other categories that saw higher prices in December: recreation, new and used vehicles, education, hospital and physician services, and airline fares

- Overall, not a great report to suggest an easy path to the infamous 2% inflation target. If inflation were a weight loss journey, the first 10 pounds were easy but the last 10 are proving frustrating to achieve. Yet the muted reaction from the market this morning suggests that with two more months of economic reports to come before the March meeting, today’s had little influence in backing out those rate cut expectations. In conjunction with a labor market that isn’t requiring a sense of urgency at the FOMC, holding rates into Q3 this year looks to be the base case for now

- Despite today’s inflation reading not supporting the notion of early and often rate cuts from the Fed, the market just doesn’t care

- Fed fund/SOFR forwards still allude to ~6 rate cuts this year

- ~70% chance it begins in March, followed by the expectation of a rate cut every 6 weeks through November

- Too much and too soon if you ask me, with the 1-2 year part of the curve looking opportunistically cheap this morning

- 1Y SOFR swaps and/or 2Y SOFR collars continue to be the hedge of choice for many commercial borrowers

- Specifically targeting those apparent mispriced future Fed decisions baked in

- Collecting ~50 basis points of positive cashflows each month

- And a conservative and short-lived hedge that can be easily reworked should the next chapter of Fed policy turn on a dime

- Treasury yields and swap rates are marginally lower this morning: 2-3 basis points on the frontend, 1-2 in the belly of the curve, and unchanged thereafter

- 2-year rates spiked higher on the inflation headlines, but have since moderated and returned to its sideways trading pattern that we’ve seen since the start of the new year

- 10-year rates continue to trade on either side of 4% until a meaningful catalyst dictates a direction

- As we know, one of the main hurdles for inflation to durably fall below the 2% target is the slow pace of disinflation in services – and already, some services related businesses have more price hikes planned this year

- Including the largest insurer in California, which is set to raise premiums for both housing and car insurance by 20% and 25% respectively this year

- Moreover, more than half of US states are set to hike the minimum wage, with Florida increasing it by as much as 18% this year and California raising fast-food workers’ minimum wages by 30%

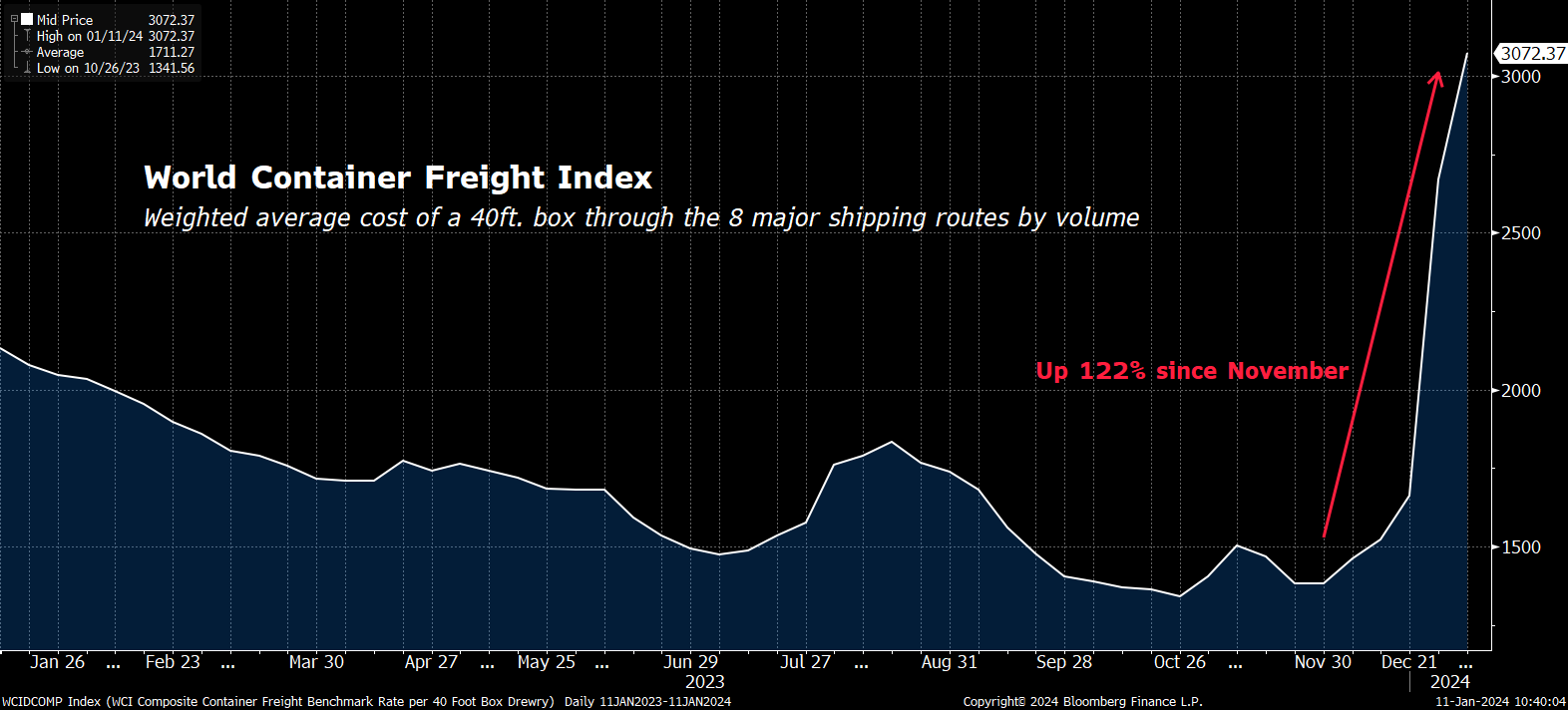

- Then, sprinkle in the resurgence of supply chain bottlenecks from the conflicts in the Middle East, a persistent increase in shipping costs could drive goods prices up again

- Freight costs are up over 122% in the past 6 weeks…

- Add in the heavy weight of shelter, where Case-Shiller metrics are showing strength again, and the threat of inflation coming back should not be dismissed

Meanwhile, Fed Presidents continue to shout into the wind

- Fed Governor, Michelle Bowman: “Should inflation continue to fall closer to our 2% goal over time, it will eventually become appropriate to begin the process of lowering our policy rate to prevent policy from becoming overly restrictive. In my view, we are not yet at that point (to start talking about rate cuts). And important upside inflation risks remain”

- Dallas Fed President, Lorie Logan: “If we don’t maintain sufficiently tight financial conditions, there is a risk that inflation will pick back up and reverse the progress we’ve made. In light of the easing in financial conditions in recent months, we shouldn’t take the possibility of another rate increase off the table”

- Atlanta Fed President, Raphael Bostic: “We are in a restrictive stance and I’m comfortable with that, and I just want to see the economy continue to evolve with us in that stance and hopefully see inflation continue to get to out 2% level.” Adding later, that he expects two rate cuts this year, beginning in Q3

- New York Fed President, John Williams: “My base case is that the current restrictive stance of monetary policy will continue to restore balance and bring inflation back to our 2% longer-run goal. I expect that we will need to maintain a restrictive stance of policy for some time to fully achieve our goals, and it will only be appropriate to dial back the degree of policy restraint when we are confident that inflation is moving toward 2% on a sustained basis”

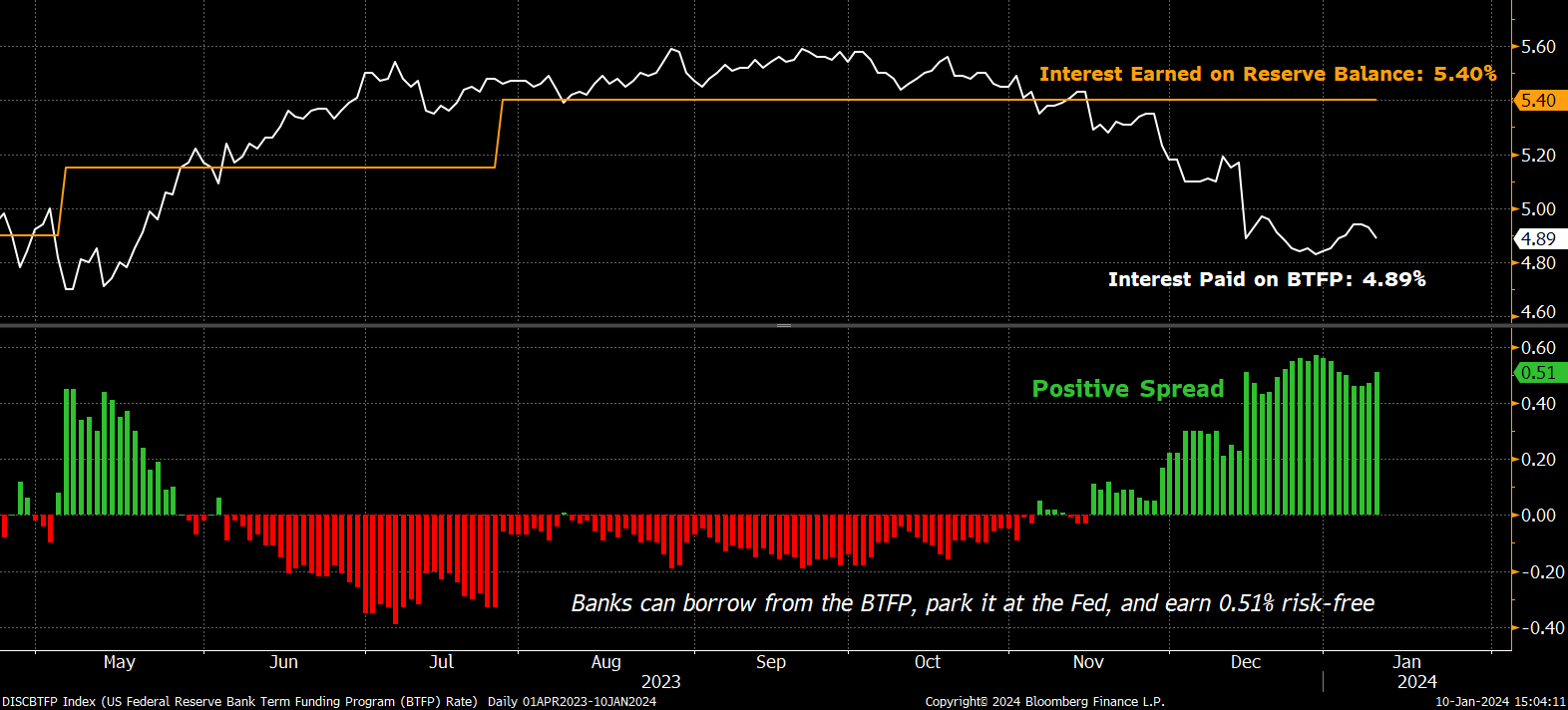

Banks are loving this pullback in 1-year swap rates - using it now to game the BTFP

- Following 3 of the 4 largest bank failures in US history last year, the Fed created a new lending facility unique to the situation - known as the Bank Term Funding Program (or BTFP)

- That new lending facility, similar the traditional discount window, allows banks to take loans from the Fed for up to a year to cover deposit withdrawals without forced selling of their underwater bond holdings. A solid Band-Aid on the bank run contagion that was taking hold with the collapse of SVB, Signature Bank and First Republic

- Is the weeks and months that followed its creation, demand for it flooded in and the total amount borrowed quickly ballooned north of $100 billion and eventually stalled out at ~$109 billion

- And since November, that demand has reemerged

- The total amount borrowed from the BTFP is now well over $140 Billion (a $32 billion increase or +30% in the past 2 months)

- However, the increase may not be a sign of bank stress as it used to be – but rather a reflection of a unique interest rate arbitrage that has appeared

- The interest rate charged for the BTFP is based on 1Y swap rates plus 10 basis points, and the rally that started in November pushed that borrowing cost below the return reserves earn at the Fed

- Banks can effectively borrow from the Fed at ~4.90%, leave it at the Fed to earn 5.40%, and collect an easy 0.50% spread

- But the free lunch won’t last forever. The renewal date for the facility is coming up on March 11th, and the Fed’s Vice Chair for Supervision (Michael Barr) has alluded to it coming to a close. Repeatedly commenting that the program “really was established as an emergency program” versus a permanent fixture in the banking industry

- Why does this matter? The probability of the safety net for banks is going away is very high, especially with it being used outside the scope of its original purpose. Should interest rates remain at current levels and maintain pressure on return chasing deposits, a reemergence of bank stress lurks just below the surface this year

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

This material should be construed as the solicitation of an account, order, and/or services provided by the FCM Division of StoneX Financial Inc. (“SFI”) (NFA ID: 0476094) or StoneX Markets LLC (“SXM”) (NFA ID: 0449652) and represents the opinions and viewpoints of the author. It does not constitute an individualized recommendation or take into account the particular trading objectives, financial situations, or needs of individual customers. Additionally, this material should not be construed as research material. The trading of derivatives such as futures, options, and over-the-counter (OTC) products or “swaps” may not be suitable for all investors. Derivatives trading involves substantial risk of loss, and you should fully understand the risks prior to trading. Past results are not necessarily indicative of future results.

All references to and discussion of OTC products or swaps are made solely on behalf of SXM. All references to futures and options on futures trading are made solely on behalf of SFI. SXM products are intended to be traded only by individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM.

SFI and SXM are not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Contact designated personnel from SFI or SXM for specific trading advice to meet your trading preferences.

Reproduction or use in any format without authorization is forbidden.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.