-

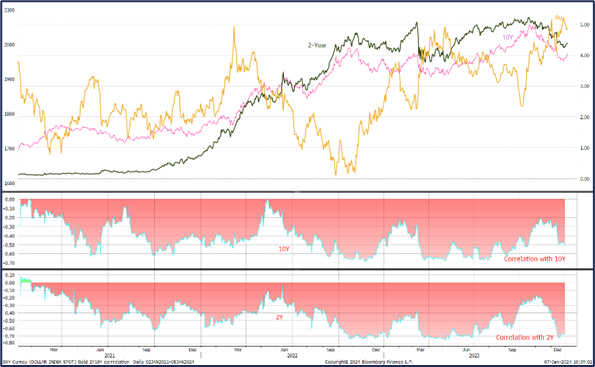

Gold outlook positive for this year, due to a range of uncertainties. Trading at $2,045 as we write

-

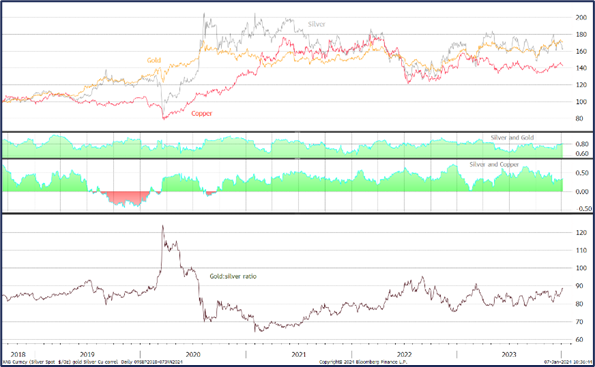

Silver is less constructive because of the same economic uncertainties – which is historically unusual; trading at $23.16 as we write

-

In the short term gold continues to respond to yields, as the bellwether for financial expectations

-

Silver’s ETPs lost the equivalent of three weeks’ global mine production last year

-

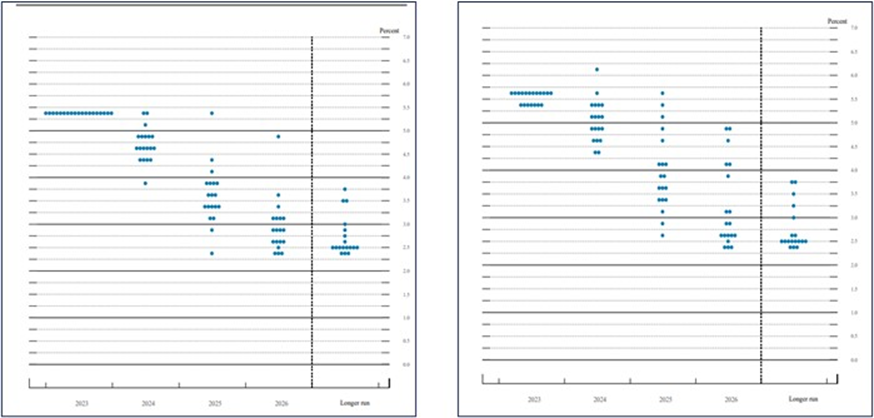

We are expecting Fed rate cuts to start in the second half of this year. Core PCE is encouraging, but there is more to do

Gold technical, six months view; spot below the 10D MA, above the longer-term averages. MACD (a key short-term indicator) marginally negative

Source: Bloomberg, StoneX

FOMC fed funds rate projections

December ` September

Source: The Federal Reserve

When we last wrote, the FOMC had completed its December meeting and as we noted at the time “the markets took the outcome of the Federal Open Market Committee’s final meeting of 2023 as (again) postulating an easier rate prognosis than is likely to be the case. Once the Statement came out and Chair Powell’s Press Conference got underway yields dropped sharply and gold ran up from $1,982 to close the session in the United States at $2,025 then tested $2,050 the following day for a 3.4% gain”

Now we have had the Minutes of that meeting and as usual the devil is in the detail.

On the positive side for gold, the Minutes said that “slowing growth of labour income and increased use of credit may contribute to softer consumer spending. Delinquency rates are rising for many types of consumer loans…. And in addition, some small businesses are already seeing tighter credit conditions and increasing delinquencies”.

This talks to the argument about banking risk, which has been a persistent cause of concern for this writer, at least, and continues to be a potential support for gold – think back to how gold came to life in March-May last year when we had banking “crises”, even though the Fed and the Swiss National Bank were fleet of foot in addressing the problems.

What is particularly interesting is that some participants are of the view that improved supply stemming from better supply chains and labour supply is largely complete; this implies that further progress in reducing inflation may “come mainly from further softening in product and labor demand, with restrictive monetary policy continuing to play a central role”. While participants judged that the “policy rate as likely at or near its peak for this tightening cycle”, they did note that the actual policy path will depend on how the economy evolves. Also that the outlooks are associated with an “unusually elevated degree of uncertainty”. Several noted that “circumstances might warrant keeping the target range at its current value for longer than they currently anticipated”.

While the rate is seen as at or near its peak the Committee is not ruling out any further firming if warranted by “the totality of incoming data the evolving outlook, and the balance of risks”.

So, adding all this to the latest economic numbers (notably the nonfarm payroll figures at the end of last week), employment continues to increase in the manufacturing sector and economic growth is still expanding, albeit at a slower rate than previously.

So on that basis there is a considerable degree of uncertainty swirling through the outlook for the US economy and that too is extended into Europe while the Chinese economy is still not out of the woods.

Gold tends to thrive on uncertainty (and of course we must not forget geopolitics, which are currently supportive and on a humanitarian basis we must hope that that goes into reverse), and this implies that the outlook for gold prices remains positive.

For silver, in principle a bullish gold outlook should theoretically imply an ever more bullish silver prognosis, but at present the economic uncertainties are keeping silver comparatively subdued and the ratio between the two may be more likely to expand in the next few months than to contract.

Gold silver and the ratio; silver’s correlation with gold and with copper

Source: Bloomberg, StoneX

Gold and the two-year and ten-year yields, January 2021 to date

Source: Bloomberg, StoneX

Exchange Traded Products

In the ETP sector, the latest numbers from the World Gold Council (the most reliable source) showed a fall of 239t in 2023 as far as 15th December (funds exodus of $14.0Bn); subsequent figures from Bloomberg, which doesn’t cover quite as many funds as the WGC, suggest a further drop in the final fortnight of 12t, leaving an estimated drop for the year of 251t to 3,213t. World mine production is roughly 3,650t. The last week of the year was one of redemptions.

Silver ETPs remained mixed during December and have started 2024 in negative vein. For the year as a whole the silver ETPs dropped from 23,296t to 21,770t (world mine production is approximately 26,500t). This was therefore a fall of 1,526t, equivalent to three weeks’ global mine production.

Gold spot price vs ETF holdings

Source: Bloomberg, StoneX

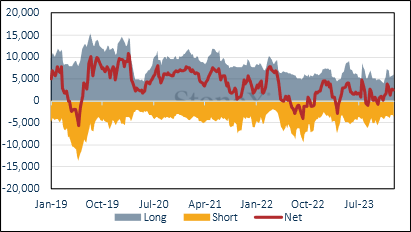

Futures positioning;

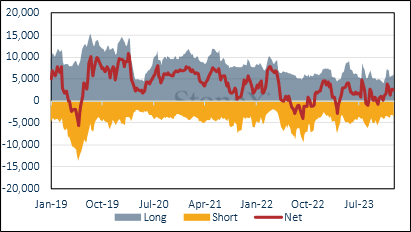

In the week to 2nd January the managed money positions in gold saw a very small increase in longs and reduction in shorts, leaving the net position at a long of 339t, against a twelve-month average of 221t; silver saw increases on both sides; 5% or 302t in ln longs and a 13% or 421t increase in shorts, reducing the net long from 2.700t to 2,581t – although this is still a lot higher than the twelve-month average of 1,686t.

At end-2022 gold was showing a net long of 158t and at end 2023 that position was a net long of 218t; the silver net long had been 4,632t and by end-year was down to 2,700t, demonstrating silver’s lack of attraction last year compared to gold. For the time being silver is still under something of a cloud. The outright short on COMEX does point to the scope for a short-covering rally and the longer-term demand fundamentals are strong, but it is more than likely that silver will struggle in the immediate term.

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

| 7 January 2024 | Previous week | % change | Year-to-date | Range Jan 2022 onwards | Range as % | ||

| Min | Max | ||||||

| Gold (pm LBMA price) | 2,056.35 | 2,069.40 | -0.63% | -0.54% | 1,628.75 | 2,078.40 | 27.61% |

| Silver (LBMA price) | 22.98 | 24.26 | -5.26% | -4.03% | 20.09 | 26.03 | 29.54% |

| Platinum (pm LBMA price) | 956.00 | 976.00 | -2.05% | -3.24% | 850.00 | 1,128.00 | 32.71% |

| Palladium (pm LBMA price) | 1,040.00 | 1,174.00 | -11.41% | -5.54% | 957.00 | 1,732.00 | 80.98% |

| S&P 500 | 4,688.68 | 4,781.58 | -1.94% | -1.70% | 3,855.76 | 4,783.35 | 24.06% |

| $:€ | 1.0945 | 1.1061 | -1.05% | -0.91% | 1.0467 | 1.1236 | 7.35% |

Source: Bloomberg, StoneX

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.