Exclusive dairy market insights designed to help you make smarter business decisions

Commodity markets are naturally volatile, and the dairy industry is no exception where milk and dairy products are produced, traded and consumed on a massive global scale.

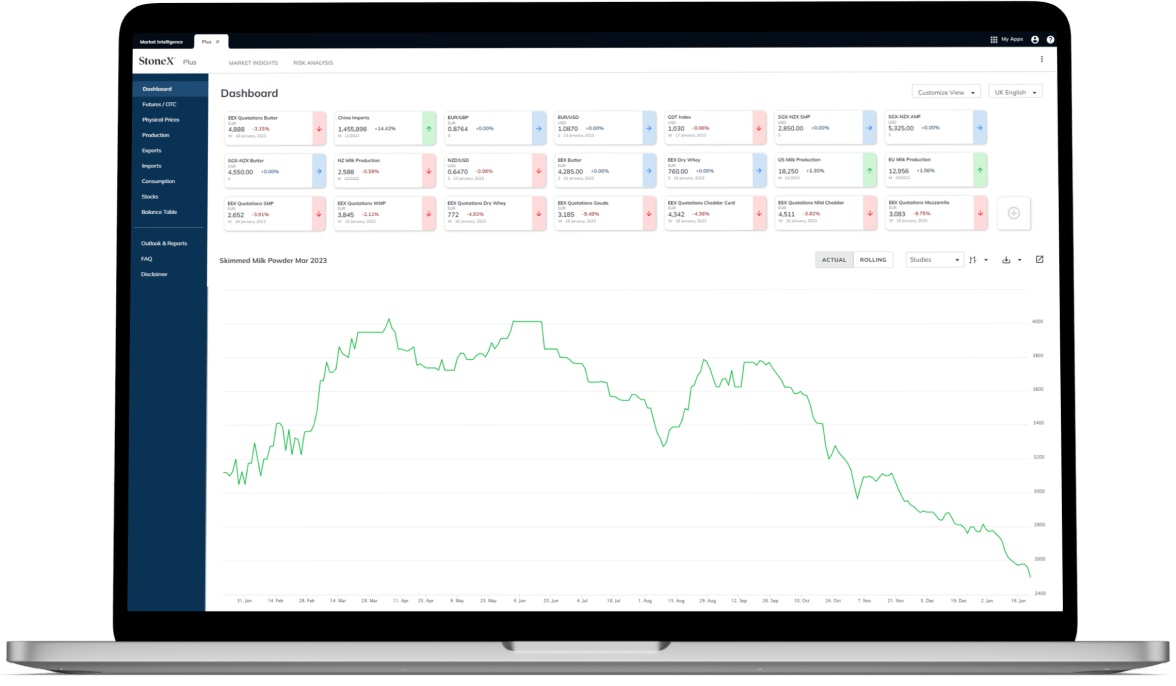

Be prepared for sudden price movements with StoneX Plus, our powerful analysis and risk management platform.

Why use StoneX Plus?

StoneX Plus gives you a hands-on understanding of the biggest market factors so you can anticipate price changes and stay one step ahead of the competition.

- Access leading market intelligence, insights, and proprietary forecasts supported by in-depth analysis by our team of experts

- Analyze all relevant data in one easy-to-use portal

- Customize the platform specifically to your needs with interactive charting and data displays

- Receive live and delayed futures market prices and proprietary OTC market updates

- Access trading account statements and analytics

What information does StoneX Plus provide?

Powerful tools

- Forward spread calculators

- Customized dashboard

- FMMO calculator

- Position analysis

Prices

- More than 100 regional prices for dairy commodities

- Futures prices for all the dairy exchanges

- CME

- EEX

- SGX-NZX

- Proprietary OTC quotes

- GDT prices

Production

- Milk and major dairy product production by country

- Monthly production forecasts

- Statistically consistent historical production data

- Fat and protein of the milk

Trade data

- Export data covering 85% of global trade

- More than 20 dairy products

- Forecasts for the top-5 global dairy exporters

- Imports data for the top-40 dairy importers

StoneX Plus data is sourced from our leading team of economists, analysts and brokers located throughout the US, Europe, and Asia. We’ve been helping businesses navigate volatile dairy markets for over 20 years.

Our dairy group works with all steps along the dairy supply chain from producers, traders, manufacturers, right through to retailers. We work closely with the vast majority of top global dairy companies.

How much does StoneX Plus cost?

We create bespoke, tailor-made packages that meet your business’s individual needs.

To request more information on StoneX Plus pricing, click the button below and a member of our team will be in touch shortly.

Why choose StoneX?

StoneX is an institutional-grade financial services network that connects world-leading companies, organizations, and investors to global markets with ease. Our commitment to investing in state-of-the-art digital platforms, end-to-end clearing and execution services, and top talent has been the cornerstone of our success.

Our diverse global workforce spans six continents in 80+ offices, providing a high-touch service to over 50,000 commercial and over 400,000 self-directed clients across more than 185 countries.

StoneX Group Inc. is also a Fortune 100 company (NASDAQ: SNEX) with a nearly 100-year track record.

- $4.4 trillion in combined volume traded

- 161 million derivatives contracts traded

- StoneX Market Intelligence reports were viewed more than 1.6 million times in 2022

CME Cash Market Summary

Wednesday 4:51 PM

CME Cash Market Summary

Wednesday 4:51 PM

CME Cash Market Summary

Monday 4:48 PM

CME Cash Market Summary

Monday 4:48 PM

CME Cash Market Summary

Fri, Dec 6, 2024 at 05:14 PM UTC

CME Cash Market Summary

Fri, Dec 6, 2024 at 05:14 PM UTC

Upcoming events

FAQ

How are the StoneX forecasts determined?

All forecasting is a mix of art and science. We try to exhaust the science before we resort to the art, but both are necessary. Prices are forecasted with an iterative process that finds the milk price level that balances supply and demand globally at an annual level.

We believe the world market is where the last marginal buyer and last marginal seller find each other. Any country with extra product usually tries to export it, and any country with a deficit looks to import. It is the relative supply of exportable supply and the demand for that product that sets dairy prices.

Milk production is forecast for each of the major dairy exporters based on lagged milk prices, feed costs, weather, seasonality, trends, government policy and other country-specific variables. We then forecast domestic demand to determine how much surplus will be available to export.

On the demand side, we build individual demand models for the 27 largest importers and group the remainder of the countries together and develop a demand model for them as well. The demand models are driven by milk price, income, population, foreign exchange and other country-specific variables.

Since milk prices affect both supply and demand models, the two supply and demand models can be linked and the milk price is adjusted until the quantity exported equals the quantity imported to find the market-clearing price for milk. Individual dairy product prices are forecast based on the market-clearing milk price assuming that the relative returns from producing different dairy products equalize over time.

Can I use StoneX Plus to trade futures or OTC?

Is the futures information live or delayed?

How are the OTC prices determined?

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 40+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

-

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

© 2024 StoneX Group Inc. all rights reserved.

The subsidiaries of StoneX Group Inc. provide financial products and services, including, but not limited to, physical commodities, securities, clearing, global payments, risk management, asset management, foreign exchange, and exchange-traded and over-the-counter derivatives. These financial products and services are offered in accordance with the applicable laws in the jurisdictions in which they are provided and are subject to specific terms, conditions, and restrictions contained in the terms of business applicable to each such offering. Not all products and services are available in all countries. The products and services offered by the StoneX Group of companies involve risk of loss and may not be suitable for all investors. Full Disclaimer.

This website is not intended for residents of any particular country, and the information herein is not advice nor a recommendation to trade nor does it constitute an offer or solicitation to buy or sell any financial product or service, by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Please refer to the Regulatory Disclosure section for entity-specific disclosures.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The information herein is provided for informational purposes only. This information is provided on an ‘as-is’ basis and may contain statements and opinions of the StoneX Group of companies as well as excerpts and/or information from public sources and third parties and no warranty, whether express or implied, is given as to its completeness or accuracy. Each company within the StoneX Group of companies (on its own behalf and on behalf of its directors, employees and agents) disclaims any and all liability as well as any third-party claim that may arise from the accuracy and/or completeness of the information detailed herein, as well as the use of or reliance on this information by the recipient, any member of its group or any third party.

This communication is issued in the European Economic Area by StoneX Financial Europe S.A.

STONEX is the trade name used by STONEX GROUP INC. and all its associated entities and subsidiaries. StoneX Group Inc. companies provide financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to certain over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets, LLC (“SXM”), a member of the National Futures Association (NFA) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. Wealth Management is offered through StoneX Securities Inc., member FINRA/SIPC, and StoneX Advisors Inc., an SEC-registered investment advisor, both wholly owned subsidiaries of StoneX Group Inc. StoneX Financial Ltd (“SFL”) is registered in England and Wales, company no. 5616586. SFL is authorised and regulated by the Financial Conduct Authority (registration number FRN:446717) to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Financial Europe S.A. (“SFE”) is a securities trading firm registered in the Grand Duchy of Luxembourg under Company No. RC Lux B 10821. SFE is authorised by the Luxembourg Ministry of Finance and regulated by the Commission de Surveillance du Secteur Financier (registration no. P00000012) to carry out, inter alia, the activities of investment adviser, portfolio manager, professional acting on own account, broker in financial instruments, and commission agent. StoneX Financial Pte. Ltd. (Co. Reg. No. 201130598R) (“SFP”) holds a Capital Markets Services Licence and is regulated by Monetary Authority of Singapore (“MAS”) for dealing in Exchange-Traded Derivatives Contracts, OTC Derivatives Contracts and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading. StoneX Financial (HK) Limited (CE No.: BCQ152) (“SHK”) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Futures Contracts. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX Financial Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors.

The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX Group Inc. of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you.

The information herein is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. © 2023 StoneX Group Inc. All Rights Reserved.

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

StoneX APAC Pte. Ltd. (“SAP”) (Co. Reg. No 200616676W) is regulated as a Dealer (PS20190001002) under the Precious Stones and Precious Metals (Prevention of Money Laundering and Terrorism Financing) Act 2019 for purposes of anti-money laundering and countering the financing of terrorism. SAP is an “Approved International Trading Company” authorized to act as a “Spot Commodity Broker” under the Commodity Trading Act.

SFP acts as an appointed agent for SFL's payment services business.