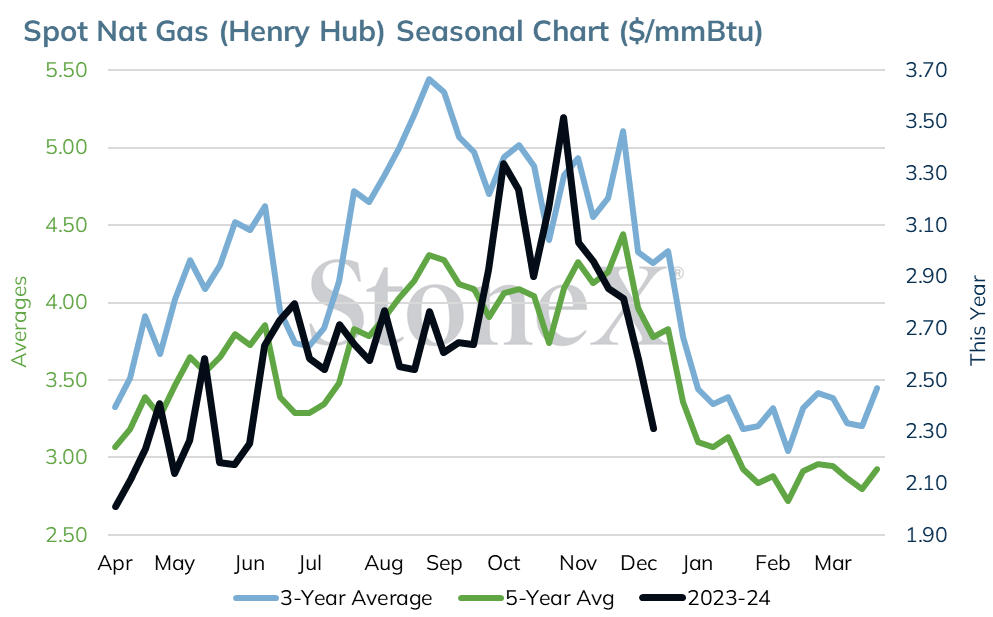

Both spot month and winter NG prices declined in yesterday’s trade on following through selling given the overall bearish sentiment across the energy complex. Jan futures sank about 5% to 6 month lows as weather forecasts continue to show well above normal temps for the next 2 weeks. Feb and Mar prices also continued to trade backwardated given the glut of supply. Jan NG settled 12 cents lower at $2.311.

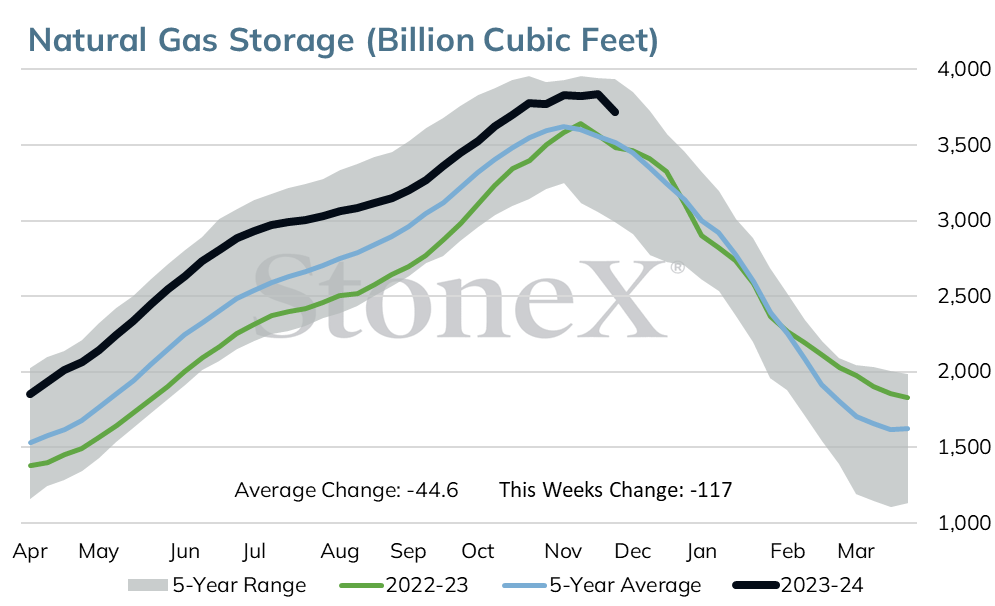

Platts is calling for a bearish storage withdrawal for the week ended Dec 8 of 55 BCF. This compares to the 5 yr avg pull of 81 BCF and last year’s pull of 46 BCF. If correct, the 5 yr avg surplus would expand to 260 BCF.

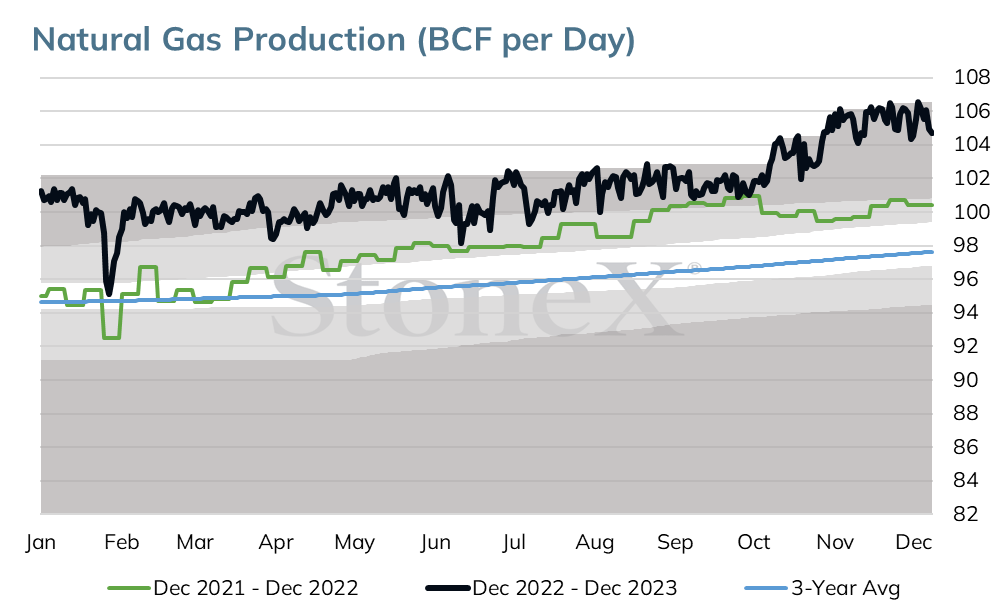

Gas demand last week fell about 9.6 BCF/day due mostly to lower res/comm sector usage as well as small declines in power and industrial usage. As for supply, output remained near 105 BCF. Overall, the supply/demand balance loosened by about 8.4 BCF/day. The latest EIA STEO forecasts stocks will end winter 22% above the 5 yr avg at more than 2 TCF.

Near record production levels have been a bearish driver for weeks. Output during November exceeded 105 BCF/day on 8 separate days, leaving the average for the month at 104.4 BCF/day. December output is averaging slightly lower, at 103.8 BCF/day. This still outpaces the annual 2023 average just short of 102 BCF/day.

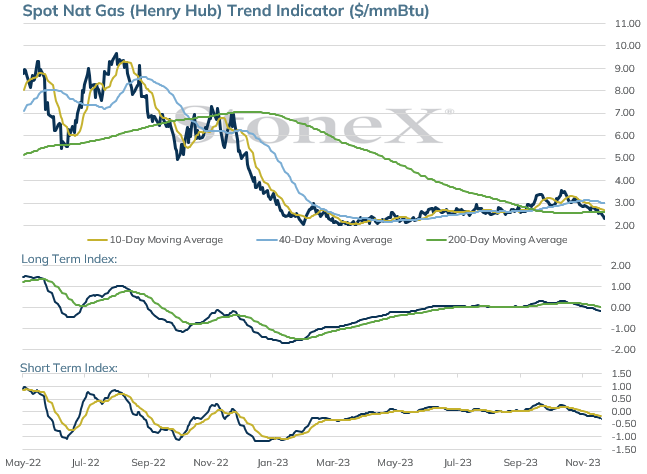

Late day selling on Tuesday dropped the January 24 natural gas contract under another retracement support level as it closed the session at 2.311, down .120 or 4.9%.

The support broken was the 78% retracement support of the April-October uptrend at 2.315 keeping the market in a bearish downtrend.

The 2.235 overnight low is near term support followed by 2.150 which is the final 88% retracement support.

If 2.150 support is reached and broken, the mid-April 1.944 low will become the next downside objective.

2.340-2.350 is near term resistance with longer term resistance at 2.580 (10 day moving average)-2.620 (200 day moving average) and 60 minute chart trend line resistance.

Daily RSI is now in the oversold area at 26.27 and could indicate an upside correction is coming.

Moving Average Alignment – Neutral-Bearish

Long Term Trend Following Index – Bearish

Short Term Trend Following Index – Bearish

Relative Strength Index – 25.35

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.