Global expertise and liquidity for the rates markets

Global interest rate products

The StoneX Rates team is composed of seasoned professionals averaging 15 years of industry experience per member. The desk’s approach combines fundamental thinking with tactical relative value, technical, and time-based analysis to deliver superior service and solutions tailored to each client’s unique situation over time. Product coverage persists around the clock with specialized trading teams operating in both New York and Singapore.

Our StoneX Government Bond Desk is a full-service dealer in all classes of US Treasury securities and a provider of best-in-class futures execution globally across developed bond markets. StoneX’s Rates business is a leading provider of market liquidity on a myriad of E-commerce platforms.

The US Rates team transacted more than $500B in US Treasury volume with nearly 500 counterparties in the first half of 2023.

- Treasury notes & bonds

- Treasury bills & floating rate notes

- Inflation-Protected Securities (TIPS)

- Zero-coupon bonds (STRIPS)

- CME – US Treasuries, Eurodollars

- CME – Fed Funds, SOFR

- ICE – Euribor, Gilt futures

- Eurex – Euro-Bund futures

- Dedicated sales coverage

- StoneX Direct on Bloomberg (FCSR)

- Bloomberg RFQ – FIT / ALLQ

- Futures & options execution – CME Direct & Trading Technologies

- US hours full access & overnight orders

- Benchmark duration, curve, and cash-futures basis

- Off-the-run duration & spread

- Futures calendar rolls

For the past decade, the success of our clients has been a key driver of growth and a constant benchmark for how we measure our own success. We maintain a commitment to providing clients with personalized service while offering the highest level of value within each market we trade.

Through sustained expansion of product offerings and consistent development of new, innovative solutions, we are focused on continuing to create durable and successful client partnerships.

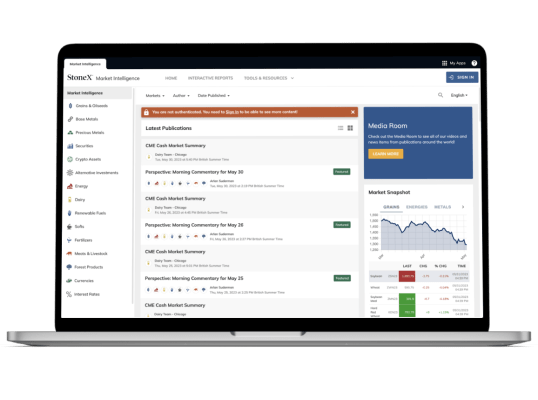

Market Intelligence and trading tools

- Highly tenured sales and trading team

- Thematic and tactical position recommendations

- Spline modeling with historicals

- Benchmark curve relative value models

- Daily technical analysis and flow reporting

- Event-driven systematic trading models

- Asset managers

- Pension funds

- Hedge funds

- Insurance companies

- Bank portfolios

- State/Municipalities

- Money market funds

Agency debentures

The StoneX Agency desk is a topflight collection of traders and sales executives bringing ideas and balance sheet to meet the unique needs of more than 500 institutional clients. Our agency traders have more than 50 years of combined experience in the rates markets, each with a niche focus in products and yield curve. Our knowledgeable salesforce takes a team approach in providing clients trade ideas and investment solutions to maximize their investing objectives.

In 2021, StoneX was the 11th largest underwriter of GSE Agency debt, and ranked #2 among all non-primary dealers. We provide consistent bid-side liquidity and maintain one of the largest Agency inventories on Wall Street.

Inventory

A full array of debentures from overnight discount notes to 30YR callables, marking one of the largest and broadest inventories in the Street. We tailor our underwriting to the needs of our individual customers across product type, structure and maturity. We bid the GSE auctions daily across all products and are also active in reverse inquiries. StoneX is a selling group member of FHLB, FFCB, Freddie Mac, Fannie Mae, and Farmer Mac. We make markets and offer liquidity across many ATSs and ECNs.

Municipal securities

StoneX’s Municipal Securities department specializes in delivering speed, accuracy and quality execution to our customers in a complex market. We offer a wide array of capital market solutions, including competitive underwriting, sales and trading.

Our seasoned desk of sales and traders monitor the primary market and actively participate in the secondary market trading municipal bonds issued in all 50 states. Our traders and senior underwriters maintain close relationships with numerous institutional buyers to create greater demand, lowering overall costs for our clients. We focus on building strong relationships with our clients, and currently support SMAs, mutual funds, insurance companies, and banks with superior service, daily liquidity and timely trade ideas.

The StoneX municipal securities desks are adding a $150mm Algo trading engine in Q4 of 2023.

Repo & collateral financing

The StoneX Matched Book Repo desk provides clients with access to our financing platform offering leverage against their securities positions and an alternative source of funding liquidity. The StoneX platform can both execute creative trade ideas that we generate for our clients and finance those positions following settlement.

We are active across the full spectrum of products from Treasuries/Agy MBS/Agy Debt to IG/HY Corporates and Emerging Market Sovereigns. We equally provide liquidity for counterparties seeking short covering across those products.

StoneX is active in TriParty Repo in the cash market and works closely with our cash-lending clients to build a collateral schedule that fits their requirements.

Active in:

- Agency MBS

- Treasuries

- Corporates

- Emerging Markets Sovereigns

- Triparty Repo

- Short Covering

Upcoming events

StoneX: We open markets

Our market expertise, advanced platforms, global reach, culture of full transparency and commitment to our clients’ success all set us apart in the financial marketplace.

-

Globality

With access to 36+ derivatives exchanges, 180+ foreign exchange markets, nearly every global securities marketplace and numerous bi-lateral liquidity venues, StoneX’s digital network and deep relationships can take clients anywhere they want to go.

-

Expertise

From our proprietary Market Intelligence platform, to “boots on the ground” expertise from award-winning traders and professionals, we connect our clients directly to actionable insights they can use to make more informed decisions and achieve their goals in the global markets.

-

Transparency

As a publicly traded company meeting the highest standards of regulatory compliance in the markets we serve; our financials and record of accomplishment are matters of public record. StoneX’s commitment to “doing the right thing over the easy thing” sets us apart in the industry and helps us build respect, client trust and new partnerships.

If you're an existing customer, please direct any inquiries to your StoneX sales team.

StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Advisor. References to securities trading and prime services are made on behalf of the BD Division of SFI. References to exchange-traded futures and options are made on behalf of the FCM Division of SFI. You can learn more about the background of StoneX Financial Inc. on BrokerCheck.

StoneX Outsourced Services LLC provides Outsourced Trading Services. The company is a member of FINRA/SIPC and NFA , and registered with the SEC as a Broker Dealer and CFTC. You can learn more about the background of StoneX Outsourced Services LLC on BrokerCheck.

Wealth management services are offered through StoneX Wealth Management, a trade name used by StoneX Securities Inc., member FINRA/SIPC and StoneX Advisors Inc. StoneX Securities Inc. and StoneX Advisors Inc. are wholly owned subsidiaries of StoneX Group Inc. You can learn more about the background of StoneX Securities Inc. on BrokerCheck.

StoneX One is a proprietary online trading platform through which investors and traders can open securities and/or futures accounts. Accounts opened through StoneX One are currently available to U.S. persons only. Not all products are available. StoneX One accounts opened through StoneX Securities Inc. are introduced to and custodied at StoneX Financial Inc. (SFI), and all customer orders will be transmitted to SFI for execution, clearance and settlement.

Securities products offered by StoneX Financial Inc. (“SFI”) & StoneX Outsourced Services LLC are intended only for an audience of institutional clients only. Securities products offered by StoneX Securities Inc. and investment advisory services offered by StoneX Advisors Inc. are intended for an audience of retail clients only.

This information is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX Group Inc. of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you.

Additional disclosures can be found on https://stonex.com/compliance-library/

StoneX Financial Pte. Ltd. ("SFP") (Co. Reg. No 201130598R) is regulated by Monetary Authority of Singapore and holds a Capital Markets Services Licence (CMS100476) for Dealing in Securities, Collective Investment Schemes, Exchange-Traded Derivatives Contracts, Over-the-Counter Derivatives Contracts, and Spot Foreign Exchange Contracts for the Purposes of Leveraged Foreign Exchange Trading, is an Exempt Financial Advisor under the Financial Advisors Act 2001, and is a Major Payments Institution (PS20200625) under the Payment Services Act 2019 for Cross Border Money Transfers.

StoneX Financial (HK) Limited ("SHK") (CE No.: BCQ152) is regulated by the Hong Kong Securities and Futures Commission for Dealing in Securities and Dealing in Futures Contracts.

SFP acts as an appointed agent for SFL's payment services business.