Weekly roundup for StoneX Bullion 25 March 2024

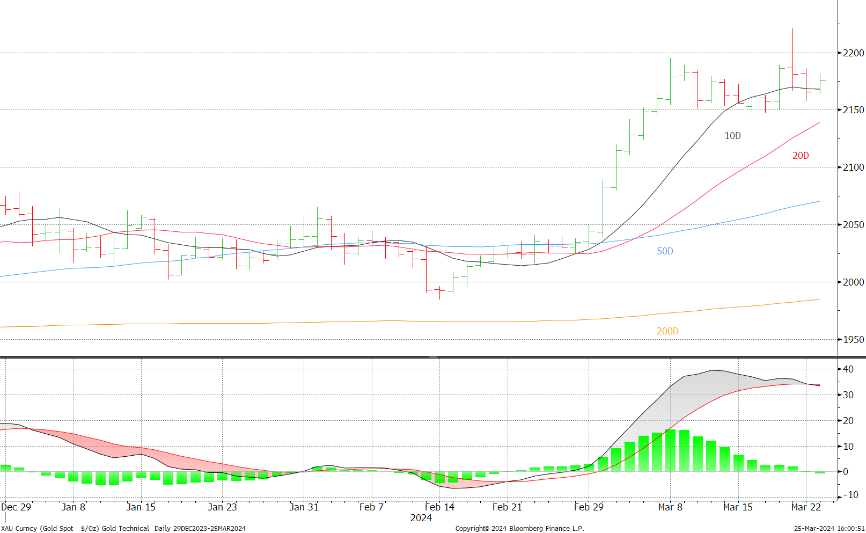

- Gold hit $2,220 on Wednesday last week as markets thought they read a softening in the Fed’s tone

- The price has retreated to the 10-day Moving average as FOMC members remain at odds

- Simple price action now shows no support until $2,080, but the 10D and 20D moving averages reach down only to $2,140

- Silver reached 10-month highs at $25.77 before staging its usual vicious reverse – under a massive spec overhang and mixed technical signals

- Outright long gold and silver positions have been posing large overhangs in the market – although silver’s was much bigger than the previous week while gold has moderated ever so slightly

- Medium-term geopolitics remain the strong tailwind and ETF activity may be signalling a positive shift

Outlook; time for fresh consolidation. Geopolitical risk and financial uncertainty support gold, while silver is way overbought in tonnage terms on COMEX. The shifts in ETP activity suggest that interest has been piqued. Overall the bull argument for gold is stronger than the bear.

The Fed was, as usual, the key focus last week and the markets thought they detected a slightly softer tone, but the details, especially coupled with Jay Powell’s Press Conference and the Q&A session, pointed in the opposite direction and this contributed to the correction in both gold and silver in the latter part of the week.

So as we write, gold peaked last Thursday 21st March, the day after the FOMC meeting’s conclusion with an intraday print of $2,221, way overbought (again) and has now shaken off some of the froth, retreating to support at the 10-day moving average at $2,168. So if we go back to 29th February, the start of the move into the new range, gold has gained a net 7.3%, while in terms of the correction, the recent retreat has posted an exact Fibonacci 23.8% reversal, which also gives it support at the present level of around $2,170.

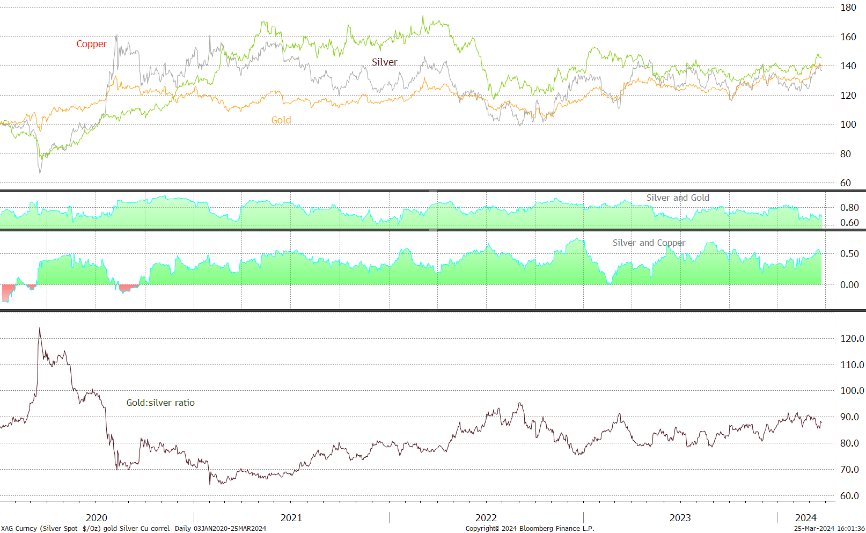

Silver also peaked, with gold, on 21st March with that ten-month high of $25.77 and the fall thereafter was a typical silver move, dropping by 4.9% in 25 hours. On a larger scale, as we write the move from 29th February to the prevailing level of $24.75 represents a gain of 11.2% so silver has outperformed gold after an initial reluctance; the correction to today’s level is slightly more than the 23.8% Fibonacci level, and actually came close to the next level down (38.2%). Over the course of last week in isolation, the gold:silver ratio changed only very little.

Gold, silver and the ratio

Source: Bloomberg, StoneX

So silver, too, has danced a merry dance but the heat has now been taken out and we are again in need of a period of consolidation for both metals.

In the physical market everywhere is quiet in the gold market, with the exception of Turkey, which remains incredibly robust as locals continue to worry about inflation rates and the currency. Chinese buying has slowed as consumers worry over the impact of the problems with the property market and are not really prepared to commit “disposable” income for the time being; while the higher cost of capital and its impact on mortgage payments, which then reduces discretionary spending, are still having affecting spending in Europe and North America.

Which brings us to the FOMC meeting last week.

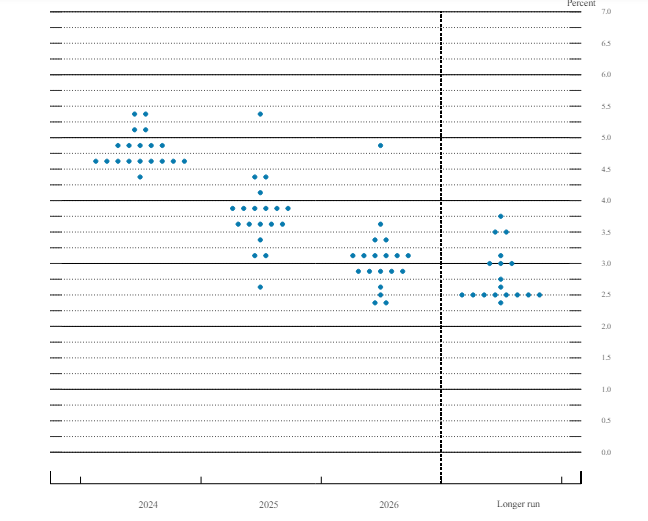

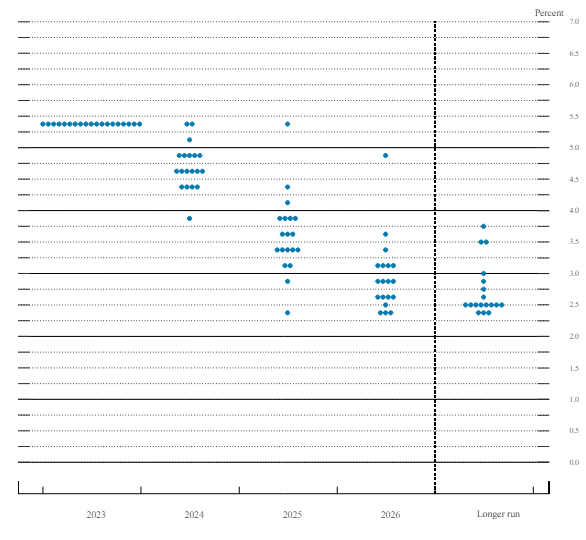

The Fed Dot PlotMarch dot plot; ’24 median 4.6%; ’25, 3.9%

December dot plot

Source: Federal Reserve Board

The only key change in the FOMC March Statement from that of January was that job gains, previously described as “have moderated since early last year but remain strong” to “job gains have remained strong”. The intention to garner more evidence and confidence that inflation is moving towards 2% is still there, as is the intention to continue to reduce Treasury Securities and mortgage-backed securities.

The Special Economic projections have included a sizeable upward revision to 2.1% for 2024 year-end GDP from 1.4% and the forecast for core PCE (Jay Powell's key indicator) has also been raised, to 2.6% from 2.4% and the unemployment forecast has been shaved marginally.

Meanwhile the dot plot (above) leaves the median fed funds forecast at 4.6% at end-2024, while the end-2025 target forecast is 3.9%, up from 3.6%. With fed funds target currently at 5.5%, this implies three rate cuts this year and three more in 2025. So the markets’ initial reaction made sense, but then needed to be tempered on the economic numbers and projections, especially when taken with the fact that in the Q&A Jay Powell kept on using “uncertainty” and he made no commitments.

The overriding statement that should capture attention is that “The policy rate is likely at its peak and if the economy evolves as projected it will likely be appropriate to begin dialling back “at some point” [he emphasised “some”] this year”.

Since then at the start of this week, FOMC member Raphael Bostic sees just one rate cut this year; member Lisa Cook (former Economics Professor) is urging caution and Austan Goolsbee, the Chicago Fed President, is expecting three cuts.

So “uncertainty” certainly does remain the watchword.

Gold; year to date; MACD indicator is turning negative

Source: Bloomberg, StoneX

Gold (inverted) and the two-year and ten-year yields, January 2023 to date

Source: Bloomberg, StoneX

Gold, silver, copper and silver’s correlation with each

Source: Bloomberg, StoneX

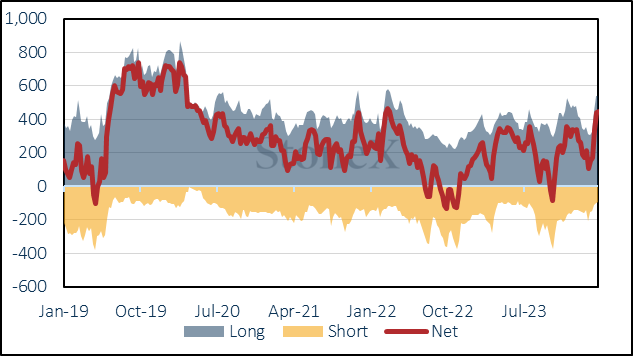

In the background the Commitments of Traders for the week to 19th March saw a change in sentiment in gold, although the change was very small week-on-week, with only four tonnes coming off the outright longs (541t down to 537t, or just 0.8%), along with a ten-tonne or 10% contraction in the short side from 10t to 92t. This takes the net position up marginally, from 439t to 444t.

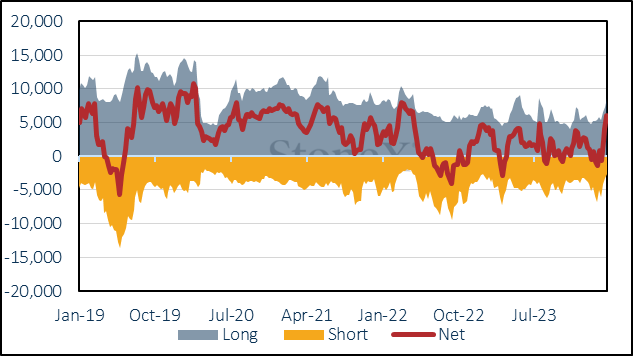

Silver was much more aggressive, with longs careering yet higher, adding 1,280t or 18% from 7,318t to 8,598t; shorts contracted by 2,630t or 17% to 2,630t, taking the net long from 4,146t to 5,967t. To put this into context, the outright long was last Tuesday at its highest since mid-July 2023 and a massive 43% higher than the twelve-month average.

Amongst the Exchange Traded Products, the latest figures from the World Gold Council (to 15th March) showed a drop of 127t year-to-date to 3,118t. The largest drop, in both tonnage and percentage terms, is of 65.0t or 4.0%, in North America; European Products shed 3.3% or 46.1t. Asia has posted small gains of 3.4% or 4.5t. Subsequent figures from Bloomberg, which are not as comprehensive as those from the Council, nonetheless identify trends, suggest that from 18th to 22nd March the gold ETPs had something of a turnaround, with a chunky 12.4t injection on the 18th and a further strong day on 20th point to gains of 15t over the period, takngi the total to 3,134t, which would be a net drop of 95t.

Whether this heralds a turning of the tide remains to be seen, but there is little doubt that the sound and fury surrounding the FOMC’s likely course of action is raising interest in alternative investments.

Silver ETPs have also had something of a change of heart. Three days of notable increases from the 15th onwards and a month-to-date increase of 681t (or 3.2%) give a year-to-date gain of 420t after months on the back foot. World mine production is approximately 26,500t.

Silver technical; 10-day moving average now offering resistance at $24.9, while the 50D is looking to cross the 200D to the upside so the picture is mixed

Source: Bloomberg, StoneX

Gold COMEX positioning, Money Managers (t)

Source: CFTC, StoneX

COMEX Managed Money Silver Positioning (t)

Source: CFTC, StoneX

|

|

26 March 2024 |

Previous week |

% change |

Year-to-date |

Range Jan 2022 onwards |

Range as % |

|

|

|

|

|

|

|

Min |

Max |

|

|

Gold (pm LBMA price) |

2,171.60 |

2,163.45 |

0.38% |

5.03% |

1,628.75 |

2,180.45 |

33.87% |

|

Silver (LBMA price) |

24.59 |

25.22 |

-2.50% |

2.69% |

21.06 |

25.84 |

22.73% |

|

Platinum (pm LBMA price) |

903.00 |

945.00 |

-4.44% |

-8.60% |

850.00 |

1,128.00 |

32.71% |

|

Palladium (pm LBMA price) |

1,007.00 |

1,078.00 |

-6.59% |

-8.54% |

875.00 |

1,628.00 |

86.06% |

|

S&P 500 |

5,234.18 |

5,117.09 |

2.29% |

9.74% |

4,055.99 |

5,241.53 |

29.23% |

|

$:€ |

1.0808 |

1.0889 |

-0.74% |

-2.15% |

1.0467 |

1.1236 |

7.35% |

Source: Bloomberg, StoneX

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.