Polyethylene (PE)

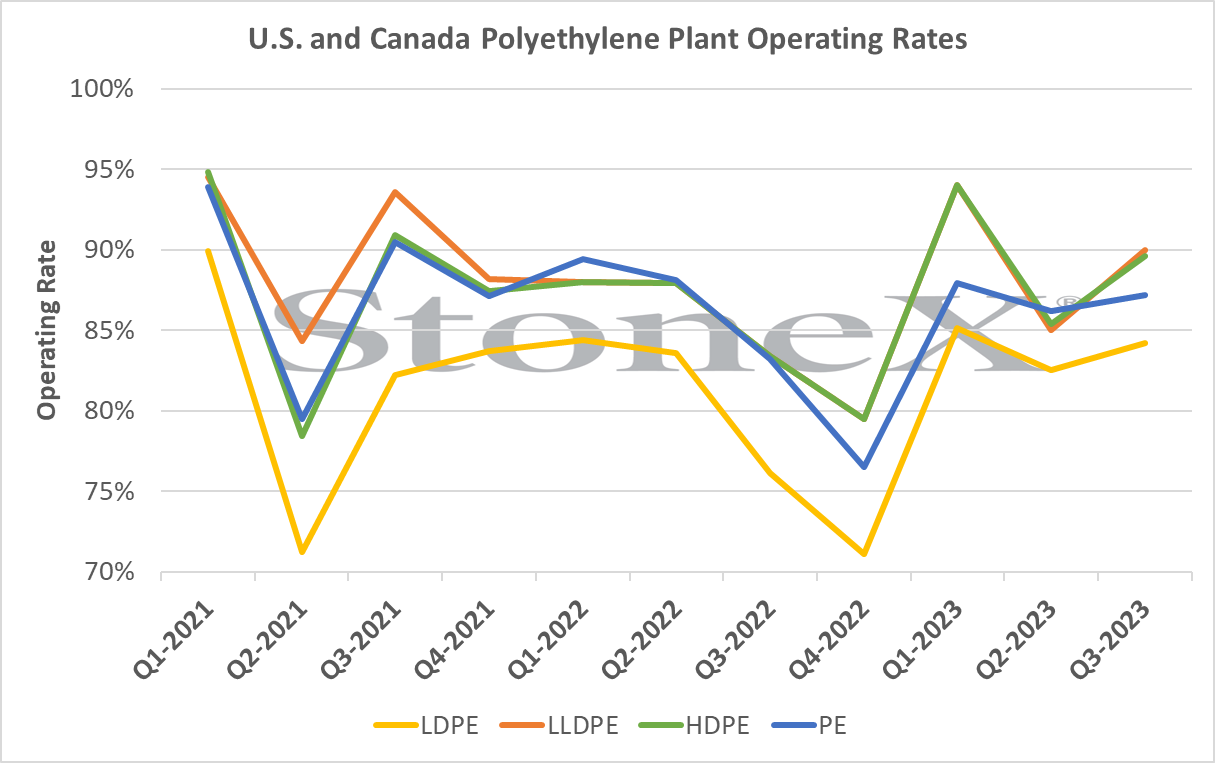

- PE prices held flat once again as supply conditions have improved and upward pressure on ethylene prices has subsided.

- Natural gas and crude oil prices have both remained under pressure throughout the month of November and December. Ethane prices are moving downward along with natural gas, due to warmer-than-expected weather and sufficient inventories.

Demand

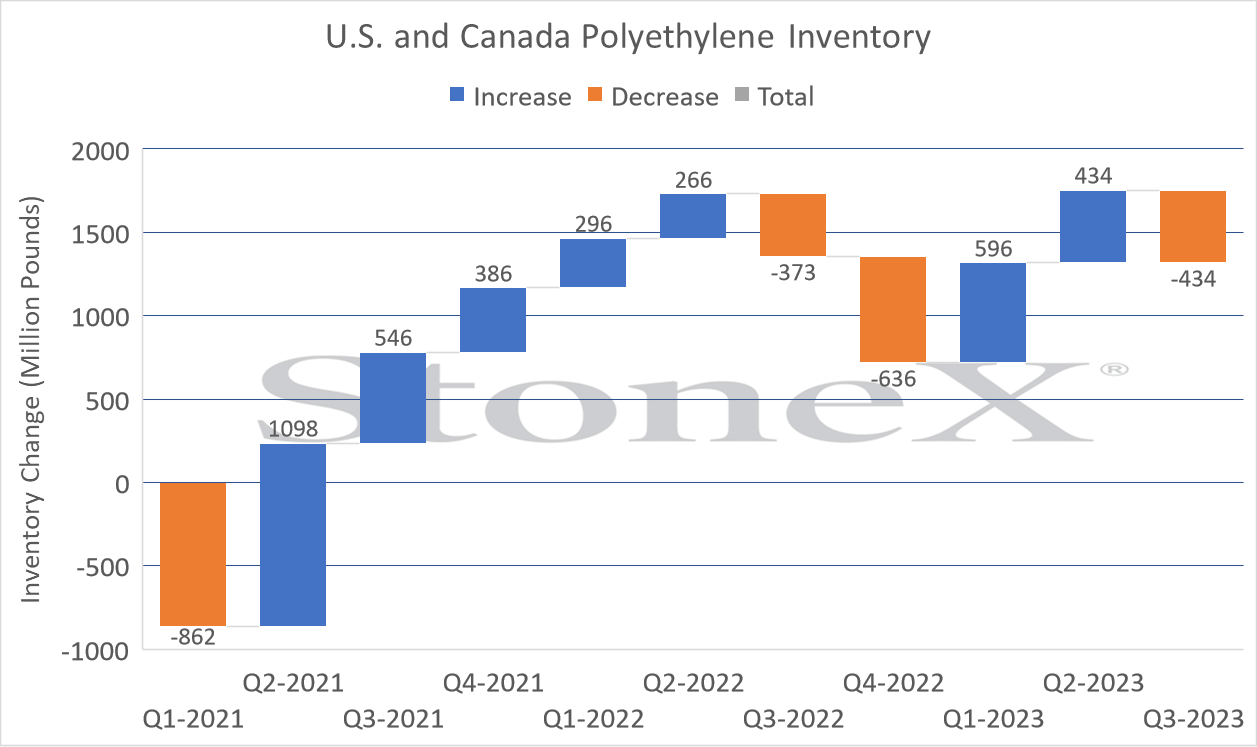

Domestic demand plus imports increased by almost 9.0% from September to October. US exports have slowed down a bit, however YTD totals are reflecting 26% growth when compared to the previous year. Demand for HDPE blow-molding applications (the largest HDPE end-use market) increased over 9.0% in October but is actually down by 8.2% YTD versus 2022. Regionally, North America experienced an increase in imports from South America, rising by a substantial 38.0%. YTD through October, PE demand has dropped by 8.9% when compared to last year.

Feedstocks

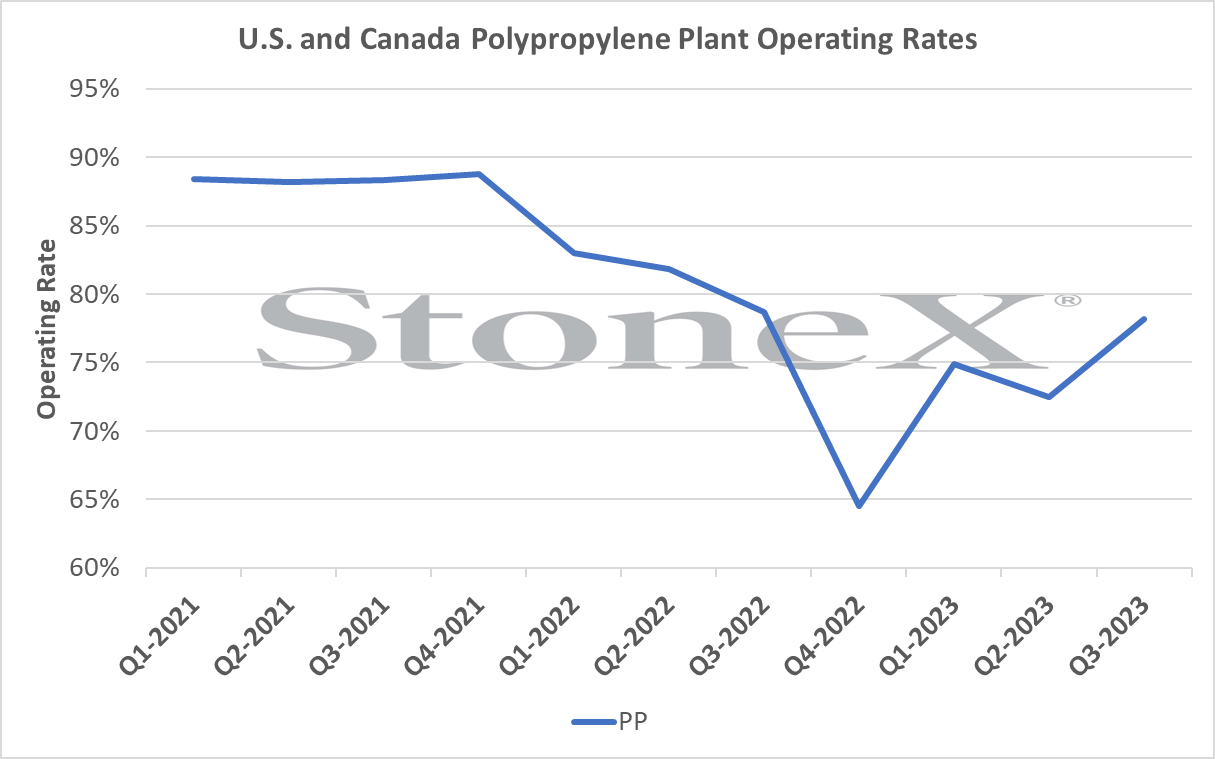

- PP prices were up 5 cpp on the month as PGP prices have remained supported. Producers have kept the brakes on many plants, maintaining lower-than-average operating rates.

- Propane prices have recovered from their lows in the middle of November, but fundamentals remain far from bullish. PGP strength has been likely due to unplanned PDH outages which have kept propylene inventories tight.

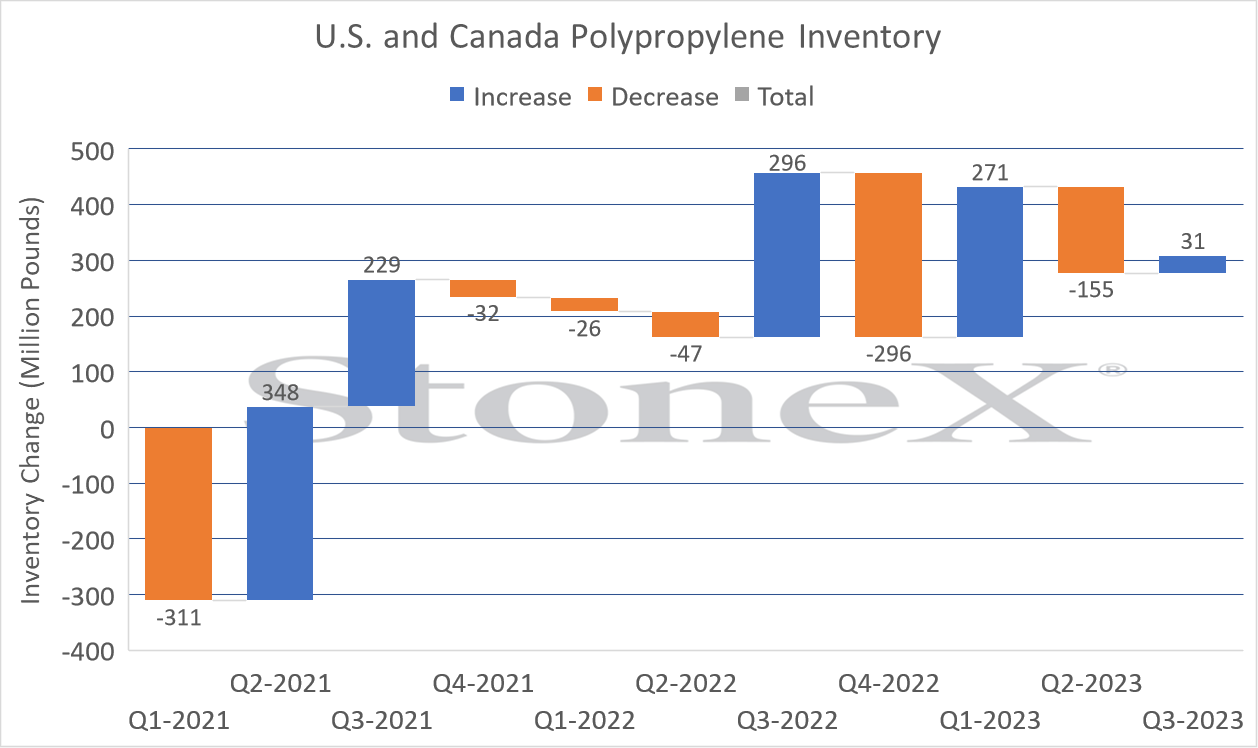

North American PP October operating rates were just over 76% (making October the fifteenth consecutive month under 80%). Days of inventory in October were 38 days, up from the prior month’s 35.8 days. Year to date through October, North American production is ahead of the same period last year. There are no planned outages in the coming months, and this could contribute to more spot availability in the market during Q1 2024. Producers are actively managing their inventory levels by operating at low production rates to help keep margins from declining further.

Demand

PP demand is facing some headwinds for growth this year as demand trails last year’s total January–September 2022 by 6.0%. The re-seller segment is the highest-performing segment, showing growth of over 11.0% YTD September. This continues the trend of more competition by third party seller as producers look to them to sell excess product into the market. Nonwovens and packaging sheet are likely to end the year with positive growth, but the rest of the segments are likely to end the year in negative territory.

US polymer-grade propylene (PGP) prices saw an additional 5 cent per pound surge in November. The rise in propylene prices is impacting demand negatively and putting pressure on margins going into 2024. On-purpose propylene supply in North America was tight in November as an unplanned outage continued at Enterprise PDH-2, which had been down since October due to operational issues. Producer margins are expected to decrease with relatively flat cash costs as PP is expected move lower, in line with the propylene movement.

Price Outlook

North American polypropylene contract prices increased 5 cents per pound in November and are expected to continue to move in line with PGP monomer movement through year end. The 5 cent increase in November comes on the heels of a 4 cent increase in October, and now totals 13.5 cents of increases over the past 90 days. This is putting tremendous pressure on North American PP competitiveness in the global marketplace. PP continues to be at the mercy of feedstock pricing, which has been the case for most of 2023. PP prices are being driven by the direction of propylene monomer.

Howard Rappaport is an independent consultant to the FCM Division of StoneX Financial Inc. (“SFI”) focusing on plastics market commentary. He does not have a personal futures trading account. All forecasting statements made within this material represent the opinions of the author unless otherwise noted.

The trading of derivatives such as futures, options, and swaps may not be suitable for all investors. Derivative trading involves substantial risk of loss, and you should fully understand those risks prior to trading. Past financial results are not necessarily indicative of future performance. All references to futures and options trading are made solely on behalf of SFI unless otherwise noted.

This material should be construed as market commentary, merely observing economic, political, and/or market conditions. It is not intended to refer to any particular trading strategy, promotional element or quality of service provided by StoneX Financial Inc.

SFI and its affiliates not responsible for any redistribution of this material by third parties, or any trading decisions taken by persons not intended to view this material. Information contained herein was obtained from sources believed to be reliable, but it is not guaranteed as to its accuracy.

Factual information believed to reliable was used to formulate these statements of opinion; and SFI cannot guarantee the accuracy and completeness of the information being relied upon. These opinions are that of the author and do not necessarily reflect the viewpoints and trading strategies employed by SFI or its affiliates. All forecasts of market conditions are inherently subjective and speculative, and actual results and subsequent forecasts may vary significantly from these forecasts. No assurance or guarantee is made that these forecasts will be achieved.

Reproduction or use in any format without authorization is forbidden. All rights reserved.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.