Base Metal Fundamental Trends Over the Next Three Months: Nickel

On 22nd March, we published an article (HERE) on our view for the macro-economic landscape and its impact on base metals over the next three months, delivering a bearish to neutral outlook. In the below commentaries, we will highlight the ongoing trends within the underlying fundamentals of the suite over the same period, which in our view, will separate out price performances in the months ahead.

Q2 Outlook: Most Bearish to Most Bullish Base Metals - Based on Underlying Fundamentals

Source: Bloomberg

Nickel LME 3M Price

Source: Bloomberg

Nickel: Expanding Capacity & Accelerated Mining Permits in Indonesia May Mean We Have Already Seen Peak Annual Nickel Prices

At present, nickel is the second best-performing base metal in 2024 (behind tin), with higher prices having arisen from increasing supply-side risks. Indeed, not only is Indonesia, the world’s largest refined nickel producer, facing delays in issuing nickel ore mining permits (RKABs*), but seasonal factors, with the second largest nickel ore producer the Philippines facing its rainy season, in addition to low nickel prices forcing at-risk nickel miners** to suspend operations or close altogether.

*Indonesia Delayed Permits: Following corruption allegations last year, Indonesia has altered the way in which it issues its mineral mining permits, centralising the process. As a result, smelters are facing delays in obtaining their production and sales quota (RKABs) and are being forced to halt operations until a permit is granted. SMM has reported that by 26th February 145M wmt of nickel ore for 2024 were approved, accounting for ~60% of demand.

**Volatile price swings in the nickel market over the last several years have made it challenging for nickel miners ex-Indonesia to remain profitable. As a result of falling prices over much of 2023, we have seen several miners close their operations in recent months, including two in Australia belonging to First Quantum and BHP removing ~2% of global nickel resource reserves from the current market.

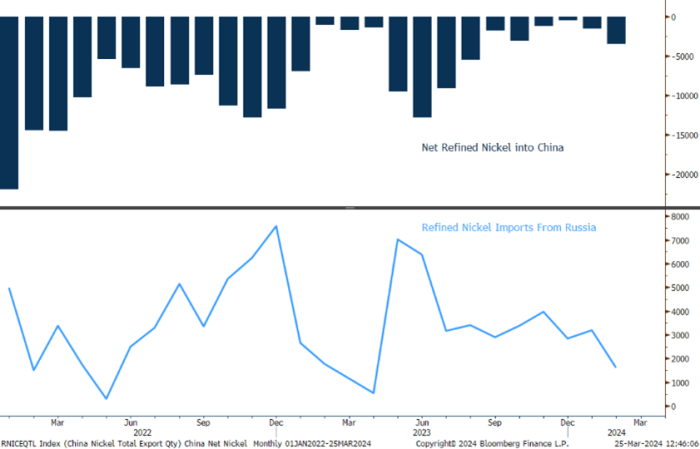

However, as we approach the end of March, we see supply-side disruptions starting to ease. Indeed, Indonesia has vowed to accelerate its pace of permit approvals with a target deadline the end of this month. Based on SSM data as of 22nd March, a total of 107 companies or 152.6Mt (~63%) of capacity had already received approvals. In addition to this, based on SMM data, Chinese production of refined nickel is forecast to rebound by 3% M/M in March, reversing losses over the previous month. Furthermore, China could increase its imports of Russian high-grade nickel (which have been in decline since June 2023). Having said this, we will be closely watching how nickel ore prices develop over the next few weeks, given that Indonesian smelters largely anticipated permit delays last year and moved to store up inventory (~3 weeks) for the start of this year. Meanwhile on the demand side, downstream industries are reportedly expressing pessimism about future demand, with SMM reporting a notable drop in orders Y/Y.

To read our previous nickel article with more details on the demand outlook, click HERE.

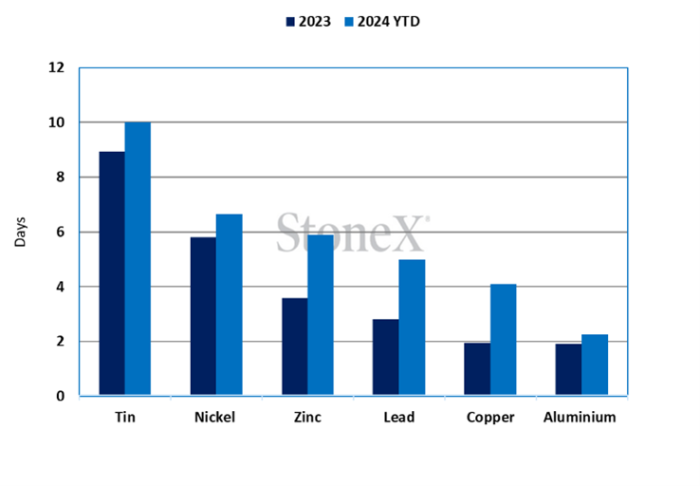

Consumption Ratio – Nickel Holds a Higher Ratio of Stocks:Demand in 2024 than 2023

Source: Bloomberg

Key Nickel Charts to Watch in the Months Ahead

Refined Nickel Net Imports into China - Starting to Improve

Source: Bloomberg

Global Exchange Nickel Stocks - Continue to Build

Source: Bloomberg

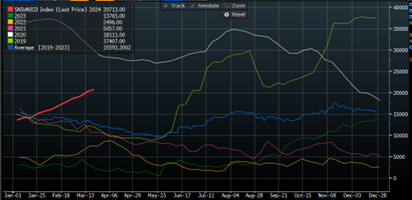

SHFE Deliverable Nickel Stocks Seasonality Chart – Nickel Inventories Chart Their Own Historical Course Higher

Source: Bloomberg

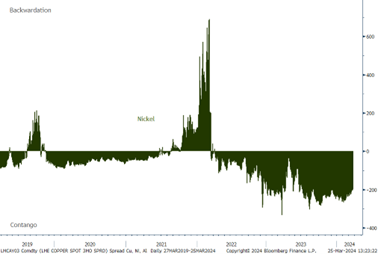

LME Cash-3M Spread Nickel – Highlights Deep Contango Market

Source: Bloomberg

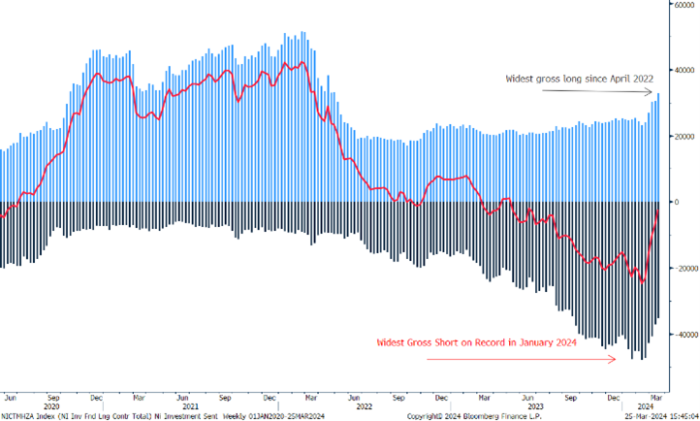

What do Investors Think?

Combined Net Investor Speculative Positions Across LME, COMEX and SHFE for Base Metals - Nickel Still Remains the Least Favoured Base Metal of the Suite by Investors

Source: Bloomberg

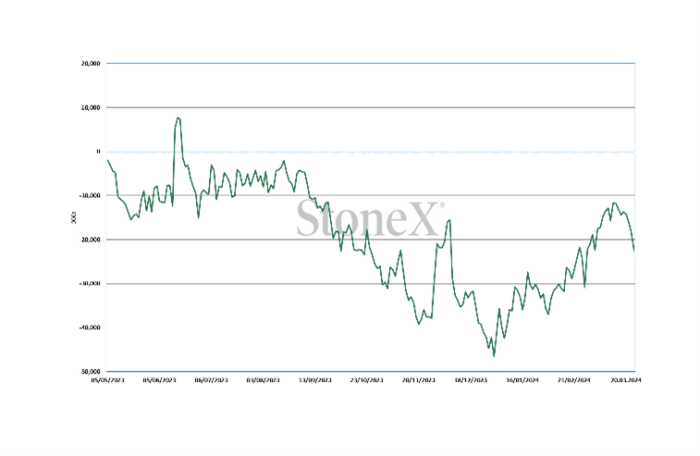

Despite nickel being the least favoured metal of the suite by investors, largely driven by memories of the LME short squeeze in March 2022 limiting confidence and participation in the benchmark, not to mention nickel struggling with holding the least favourable fundamental of the group in 2023 (marking a second year of expanding surpluses). The recent supply-side disruption stories altered sentiment towards nickel at the start of the year, although the combined (LME & SHFE) net position never quite reached a net long. However, looking at the most recent daily numbers from SHFE, it does appear as though sentiment towards nickel is returning to a more bearish stance, with the net short position widening once gain since mid-March.

LME Net Speculative Investor Positions Weekly – Short Covering Rally Removes Extreme Gross Short Positions Out

Source: Bloomberg

Daily Investor Speculative Positions on SHFE - Nickel Net Short Position Deepens

Source: Bloomberg

Our Outlook for Nickel Prices Over the Next Three Months

As it appears as though the benefit of supply-side risks is evaporating from the nickel market, we expect that bearish sentiment will continue to build over the next several months, with demand expectations from China and the western world modest at best. Meanwhile, we take into consideration the comments from Indonesia’s deputy at the Coordinating Ministry for Maritime Affairs and Investment, in which he stated that the country would aim to hold nickel prices between two key levels, $18,000/t at the high-end and $15,000/t at the low-end (to read more on this please click this link HERE). Therefore, we suspect that nickel will likely be held between $18,000-$16,000/t in Q2, with mounting pressure to the downside on expanding overcapacity within Indonesia.

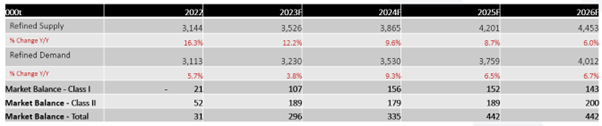

Annual Market Balance: Nickel on Track to Post Record Surplus in 2024

Source: SMM; Bloomberg, StoneX

To see our latest nickel outlook presentation, click the link HERE.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.