| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 5.33% | 5.31% | 4.63% | 4.23% | 4.25% | 4.25% | |

Powell keeps rates unchanged, holding at 23-year highs

- The FOMC voted unanimously to leave the Federal Funds target range unchanged today, at the current lower and upper bound of 5.25%-5.50%

- This keeps SOFR and the effective Federal Funds rate at ~5.30% and marks the 5th consecutive meeting of policy rates left on hold

- The closely watched Dot Plot saw the Fed’s forecast unchanged at 3 cuts this year but removed a cut in 2025 and another in 2026

- Reaccelerating inflation over the past few months was enough to shake up expectations, but the mix resulted in the same 3 cut median projection this year (9 of the 19 officials find themselves in this camp now)

- Notably, for the first time in recent memory, the Long-Term target rate moved higher (albeit just slightly from 2.5% to 2.6%) – indicating that their estimation of neutral policy rates has moved higher and that policy rates today could be at a less restrictive level than previously thought

- Yet, in the same breath the Fed now expects to see much higher growth and core inflation this year – a somewhat conflicting message to markets

- Just a few months back, resilient economic growth, sticky inflation, and strong employment was viewed as the reason to keep rates “higher for longer” – but today, faced with the same variables, Powell seems committed to only cutting rates going forward

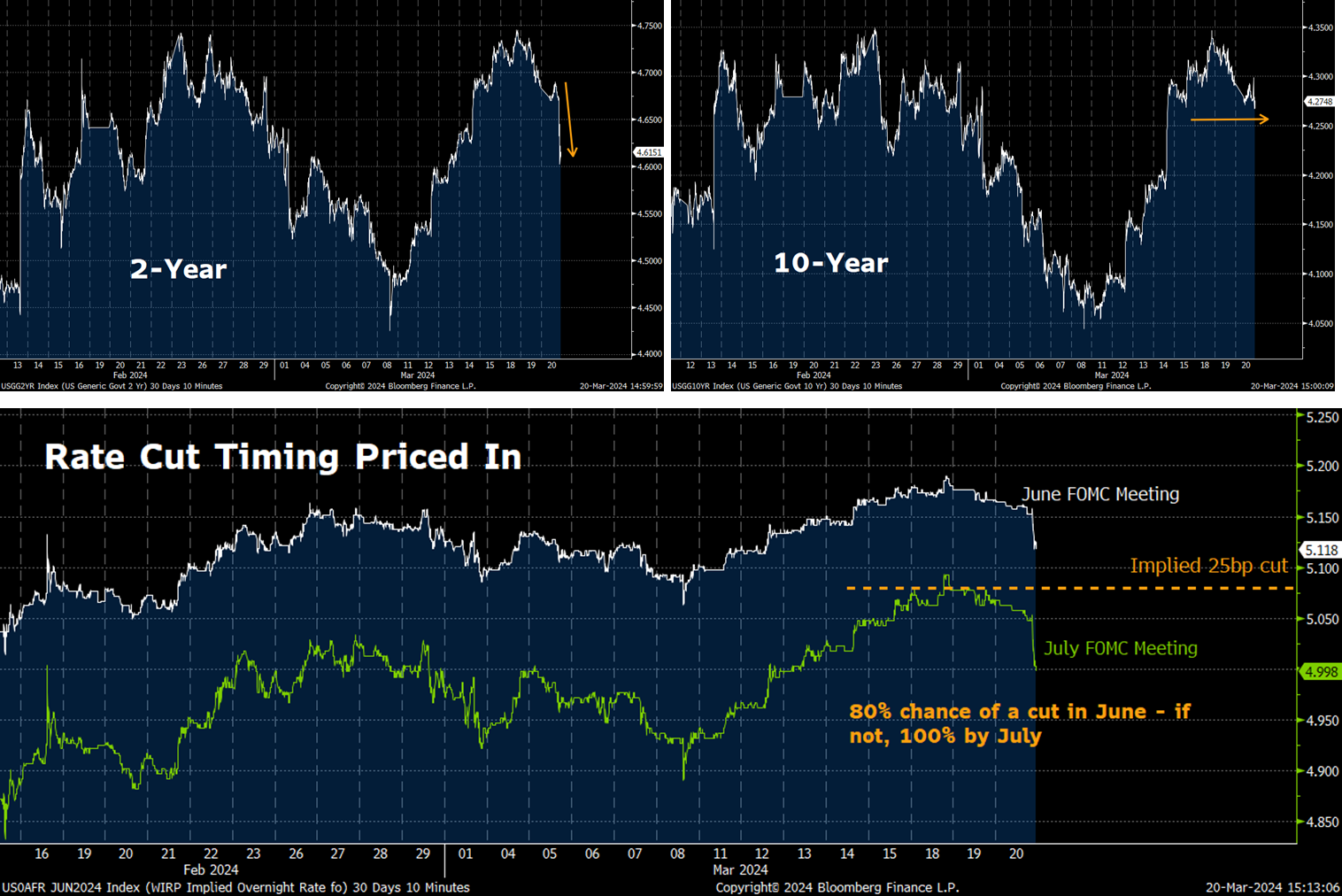

- Market’s felt positioned for a hawkish turn of events today, but instead got the same dovish leaning message from January. It was enough for risk-on sentiment to take hold: equities found new all-time highs, and yields across the curve bid lower with SOFR/Fed Fund futures keeping June/July in sight for the first cut

Source: Bloomberg

Powell in his own words:

- “January and February CPI was quite high, but not terribly high. The two of them together, did not change the story of a bumpy road to 2%”

- “If the Fed eases too much or too soon, we could see inflation come back. And if we ease too late, we could do unnecessary harm to employment”

- “We’re looking for data that confirms the kind of low readings that we had last year, and give us a higher degree of confidence that what we saw was really inflation moving sustainably down toward 2%”

The takeaway for the moment seems to be that the Fed’s reaction function is clearly asymmetrical skewed toward employment numbers going forward. If the higher-than-expected inflation numbers from January and February aren’t enough to move the needle on rate cut expectations, then inflation importance is moving to the background

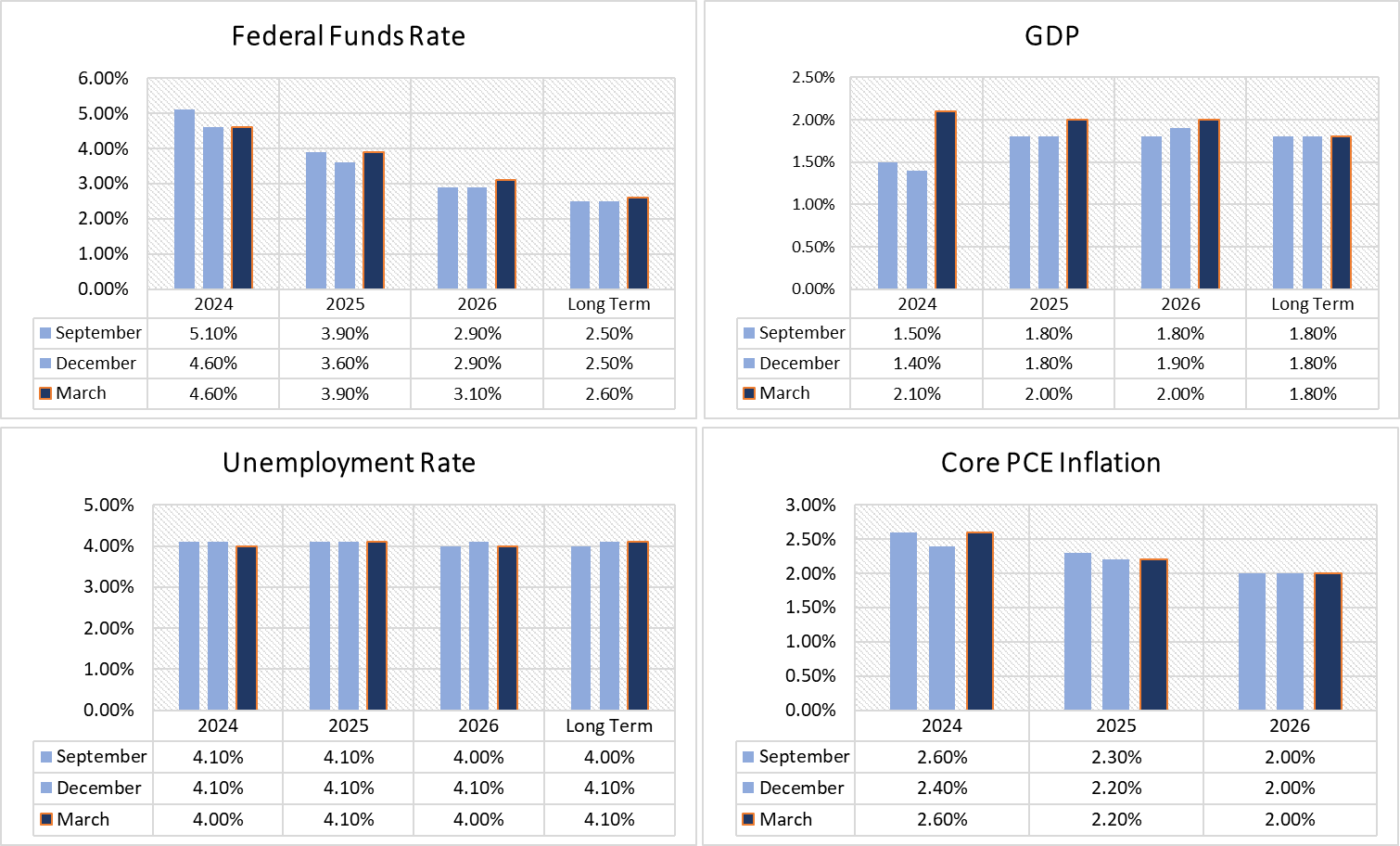

Summary of Economic Projections – updated

-

Fed Funds:

-

2024: 4.60% (unchanged from December)

-

2025: 3.90% (1 less cut than before)

-

2026: 3.10% (1 less cut than before)

-

LT: 2.60% (0.1% higher than before now that 3 officials feel neutral rates are closer to 3.0% than 2.50%)

-

-

GDP better than before – well north of recessionary levels

-

Unemployment better than before – soft landing/no landing positive

-

Core inflation higher than before

-

The Fed’s 2024 Core PCE outlook has remained unchanged for roughly 6 months now. Hard to reconcile the need to cut rates up to 3 times this year while inflation progress has stalled – but that’s the message they went with today

-

Market Reaction

-

Range bound trading and likely more of it to come

-

2Y: Lower to ~4.60% (stuck between 4.75% - 4.58%)

-

5Y: Lower ~4.25% (stuck between 4.36% - 4.23%)

-

10Y: Lower to ~4.30% (stuck between 4.35% - 4.20%)

-

Refreshing the 3-Year Costless SOFR Collar:

-

Long 4.75% Cap – below spot SOFR by 0.56% and pays the difference monthly. Continues to pay monthly until the Fed cuts 3 times (our view puts that sometime in 2025 – unchanged after today)

-

Short 3.85% Floor – Float down until SOFR reaches 3.85%, or the equivalent of the Fed cutting rates ~6 times

-

Option Premium due – none (dfmm 3.45%)

-

Elsewhere…June can’t come soon enough for Office Commercial Real Estate folks

-

Sebastian Junger’s The Perfect Storm is a great analogy for what the US office market is going through right now

-

US office properties – troubled with a fundamental shift in office demand post-COVID, falling cashflows, and lower assets values – are increasingly finding it difficult to refinance decades of cheap debt in this new rate environment

-

And this year – a ton of debt is coming due. Loans on office properties total about $920 billion as of October, according to Commercial Edge, with $150 billion maturing by the end of 2024 and $300 billion by 2026

- But given the shift in valuations, tightening lending standards, and higher interest rates - CBRE thinks US office landlords face a $73 billion refinancing shortfall between now and the end of 2025

-

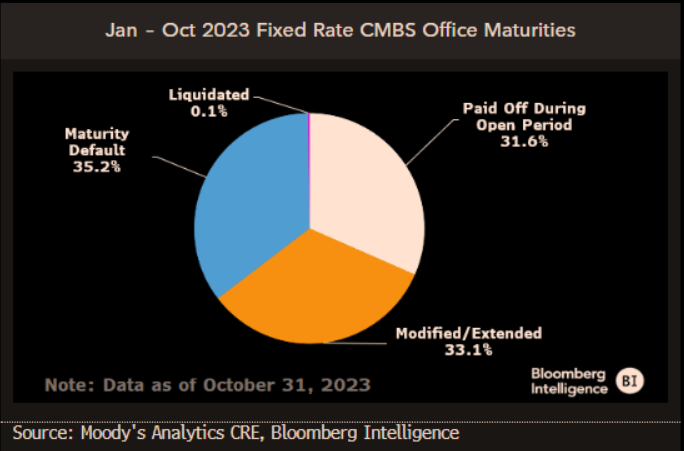

- Loans held in commercial mortgage-backed securities (CMBS) make up a small component of overall property debt but provide an indication of potential trouble brewing

- About $7.5 billion of fixed-rate office CMBS loans reached their maturity in the first 10 months of last year. And of that amount, 35% ended up in default

- Then, another third was extended as borrowers kick the can down the road and hold their breath for either lower rates and/or return-to-office trends to improve

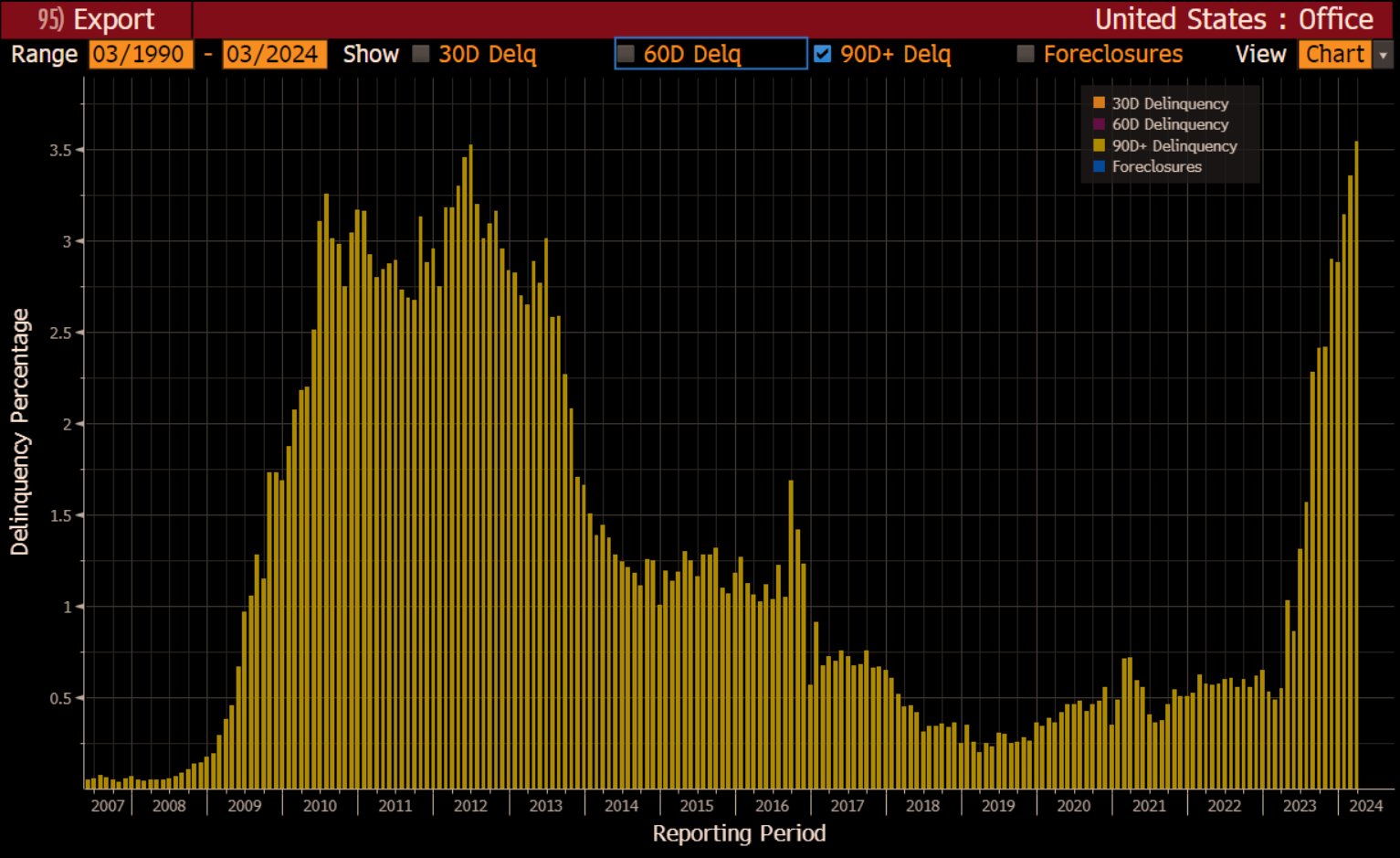

- With deals no longer penciling out – defaults are on the rise. Especially in the floating rate CLO market (the first cousin of the financial crisis’ CDO market)

- Mark Neely of GenTrust eloquently described it in this manner: “The CRE CLO market is the first shoe to drop in terms of defaults in the CRE debt markets. The loans inside CRE CLOs tend to be for transitional properties, so the borrowers are counting on reselling them before the loan matures. But today many borrowers can’t sell properties for anywhere near where they bought them.”

- And, CRED IQ recently reported that the amount of CLOs under distress ballooned from $1.3 billion in February 2023 to over $6.8 billion in January 2024 – a 440% increase over the past 12 months

- And outright delinquency rates tell much of the same story, with 90+ day delinquencies for US offices now higher today than they were after the 2008 Financial Crisis

- With property prices in free fall, occupancy rates stuck at 50% of pre-COVID levels, and interest rates at multidecade highs - no matter how you look at the US office market, it’s hard to see how it shakes out without defaults accelerating or the Fed cutting rates to save the day – but even that may not be enough

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.