Kathryn Rooney Vera Chief Market Strategist [email protected] +1 305.913.9112

Rhona O’Connell Head of Market Analysis - EMEA & Asia [email protected]

Nick Reece, CFA Senior Investment Strategist [email protected]

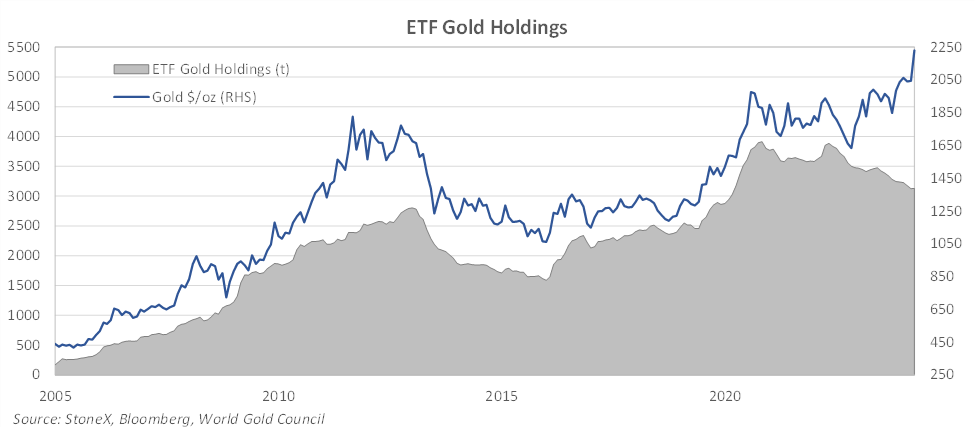

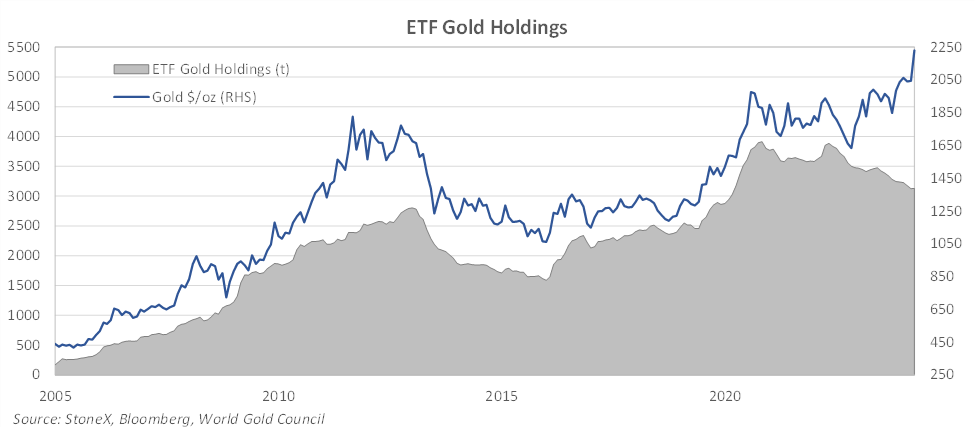

In the past couple of years, higher interest rates have generally dampened private sector institutional investor appetite for gold, evidenced by declining ETF gold holdings. In our analysis, the recent rise in the gold price has been largely driven by increasingly important geopolitical factors. Geopolitics, including efforts to diversify FX reserves away from the dollar, have informed official sector (central banks, sovereign wealth funds, etc.) attitudes towards gold.

Strong official sector net purchases, while providing vital physical demand in the market, also send an important psychological message to other market participants—the desire to hedge risk. For context, in 2010, net official flows were $2.8 billion, and in 2023, they were $64.5 billion—a CAGR of 27%. The oficial sector, which had for many years been a net seller of gold, turned net purchaser in 2009 in the wake of the Global Financial Crisis and has been a net buyer ever since.

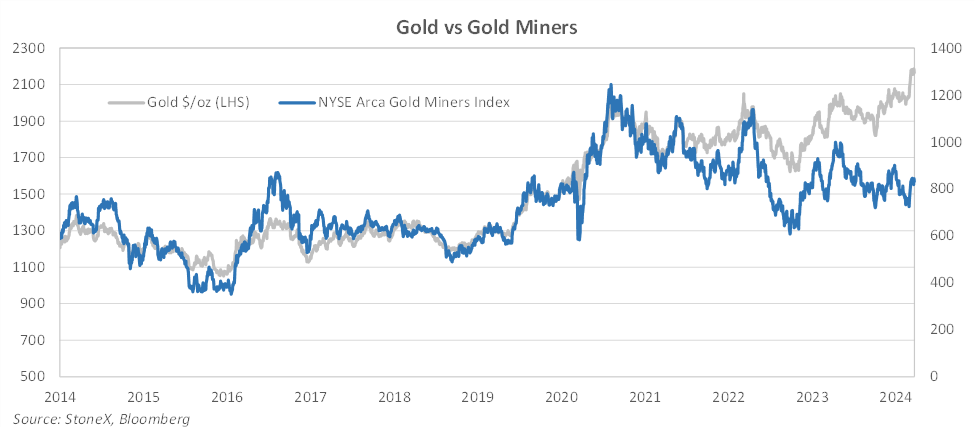

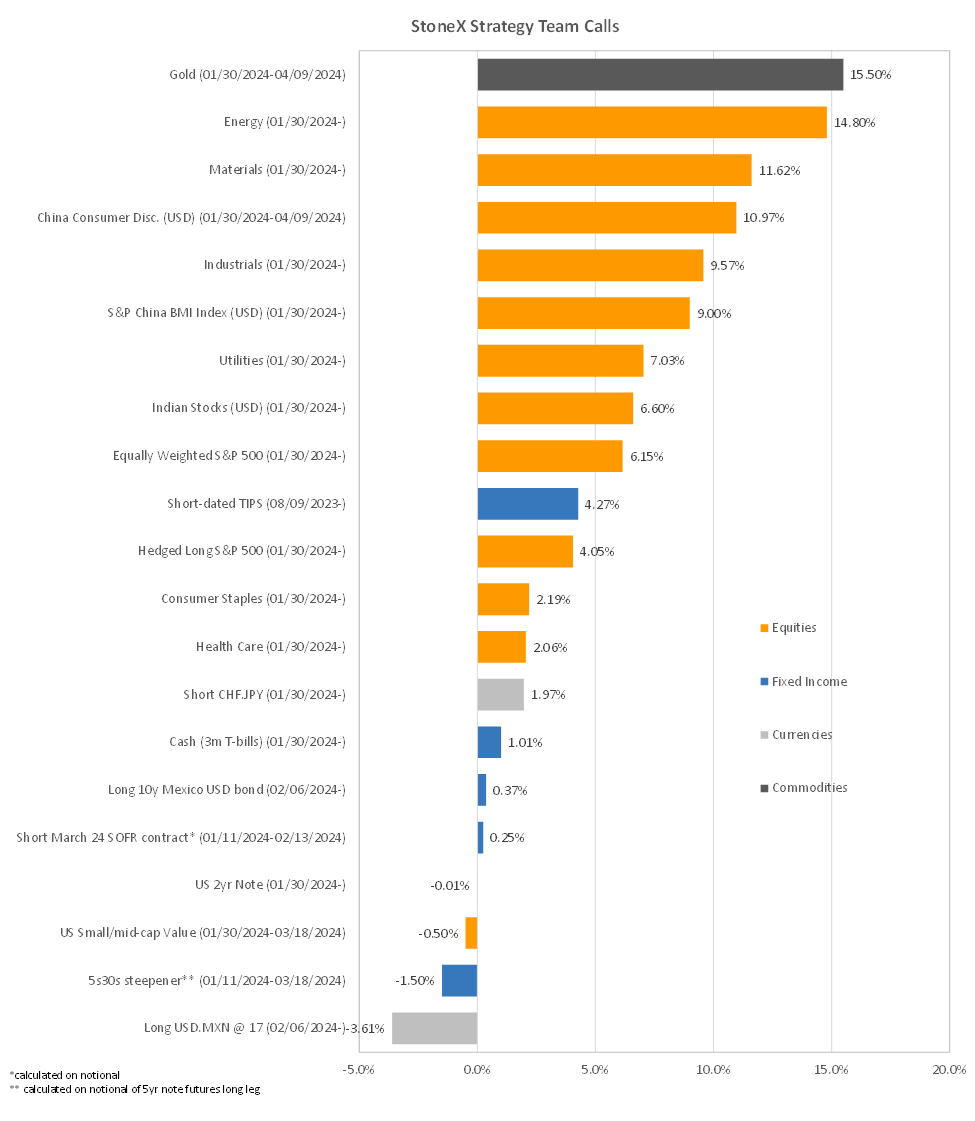

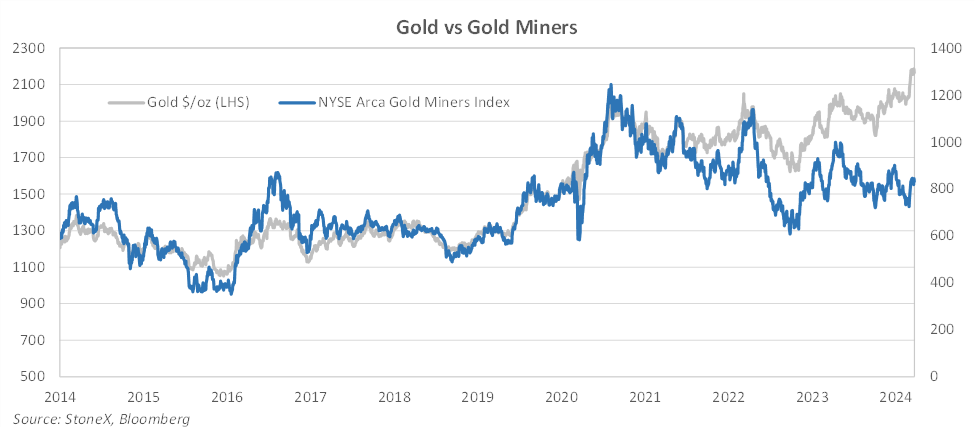

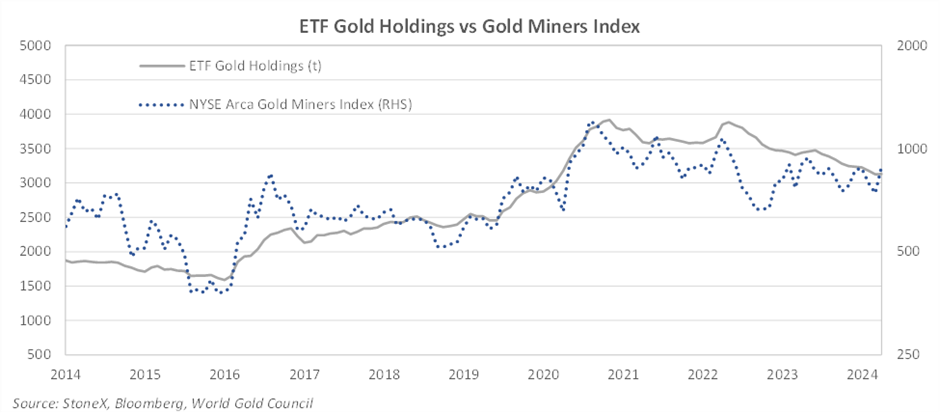

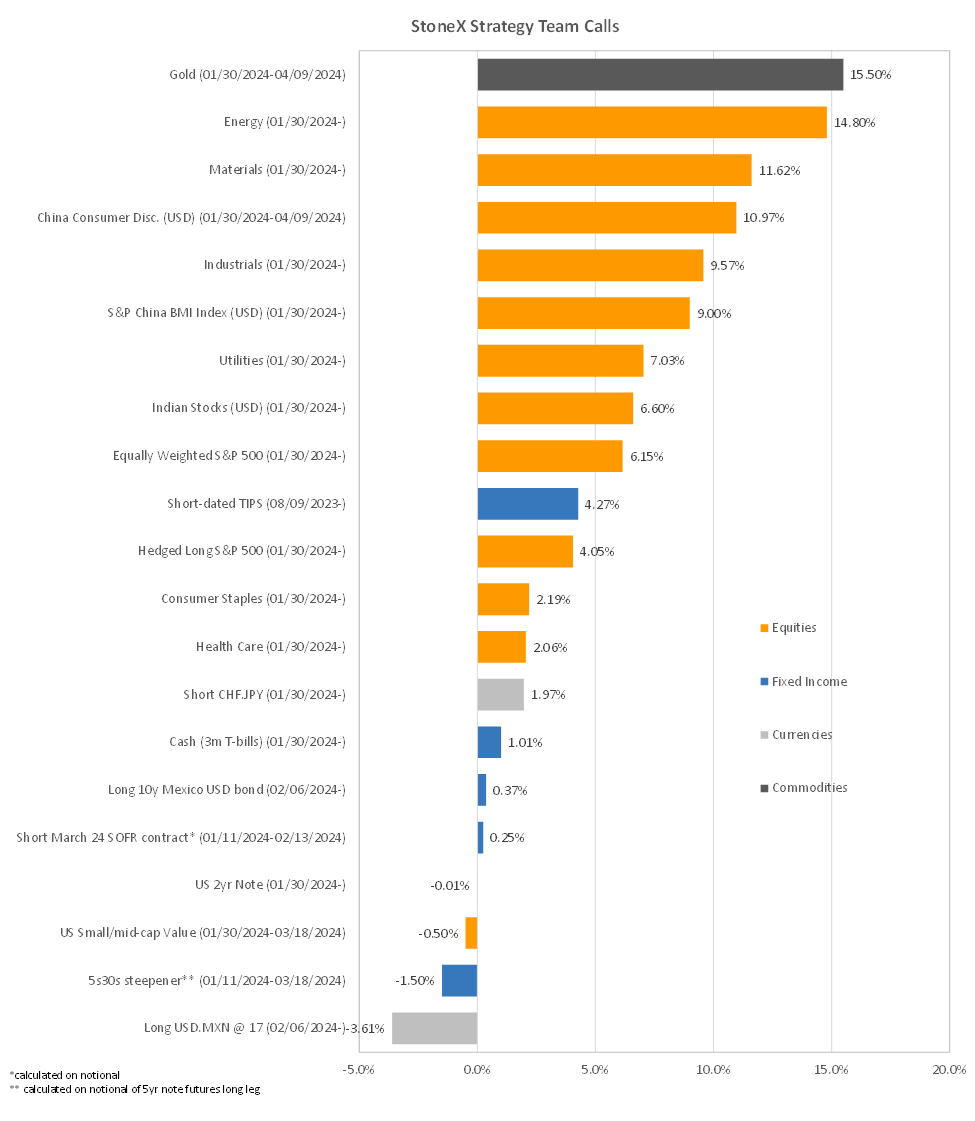

Official sector demand has helped drive gold prices to new all-time highs. Meanwhile, the gold miners index remains well below all-time highs, primarily due to profit margin pressures and lack of investor interest in the asset class. The recent move in gold and gold miners looks near term extended as of April 9th. We are tactically closing our gold long from Jan 30th after a +15% move that has exceeded our year end price target. Given the potential trend exhaustion, we would recommend taking profits on gold and gold miners at current levels and waiting for a more attractive entry point.

Official demand for gold increased dramatically following the 2022 imposition of international sanctions on Russia, specifically the SWIFT ban and asset freeze (note that many major gold purchasers recently have been in Asia and Eastern Europe). Also, in a break with their tradition of neutrality, even Switzerland participated in the Western sanctions on Russia, making the Swiss franc less of a safe haven. Increasingly, many central banks are diversifying away from sovereign currencies into gold.

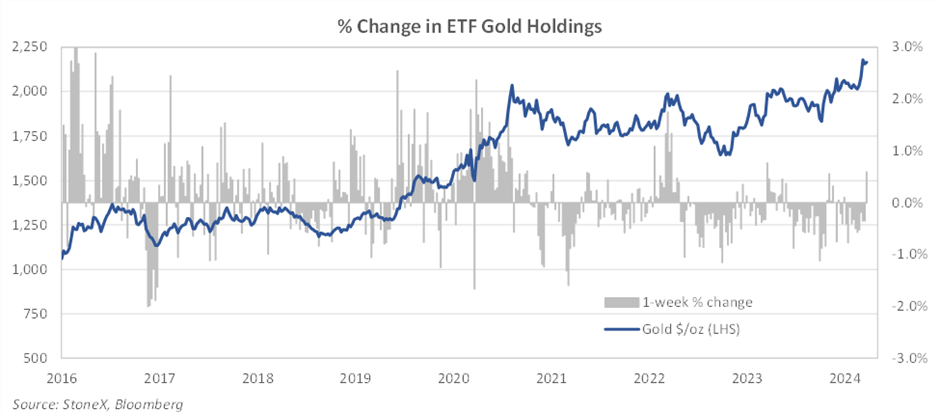

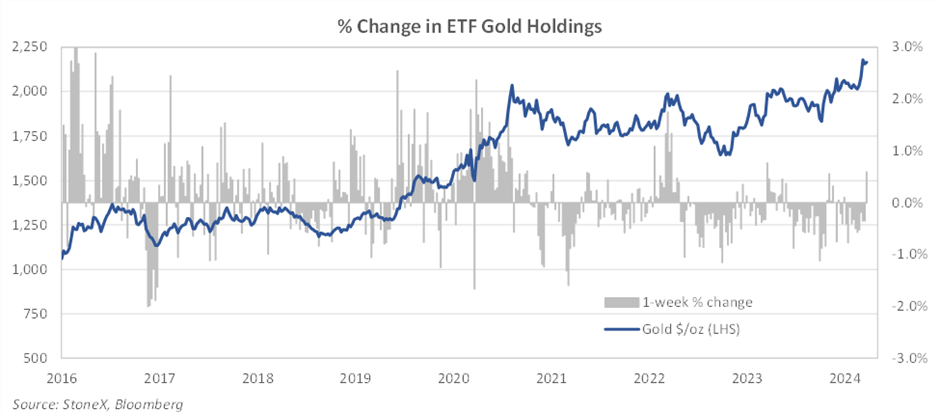

In contrast, ETF investors have reduced gold allocations. Rising interest rates have induced yield chasing and increased the cost of carry for physical investment, overpowering the risk mitigation allure of gold for some investors. Total ETF gold holdings (measured in metric tonnes) have declined by 20% since the peak level in late 2020. Currently, total ETF gold holdings stand at 3,130t, equivalent to ten months of global mine production, and just 10% above the late 2012 holdings level.

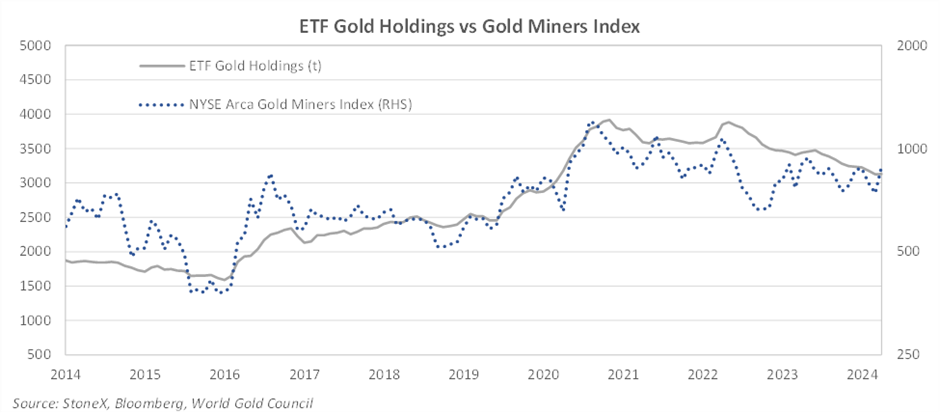

Low investor allocations leave plenty of room for re-accumulation of gold positions over the medium-term, which is bullish from a contrarian perspective. Indeed, we are already starting to see some ETF buying. In the near term, renewed investor demand would be a catalyst for the miners. As the chart below illustrates, the gold miners index tends to follow the level of ETF gold holdings (a proxy for investor interest in the asset class). Without investor demand, it is hard for the miners to participate in the gold bull market; not only for price-related reasons but because of the necessary contagion of bullish sentiment. Central banks buy gold not for profit motive but for FX reserve diversification and risk management. Moreover, they buy gold, not gold mining stocks. As such, the bid for gold has not translated into a bid for the equities.

Fundamental reasons also underlie recent underperformance. Historically, mining companies have offered leverage to the gold price such that when gold rises by x percent, the profit margin rises by a multiple of x. However, the past few years have been different. Many mining companies have allowed costs to rise along with the gold price, attributable potentially to complacent management. However, in some cases it is deliberate as certain miners have flexibility to move to lower grade ore areas in order to conserve mine life.

Higher gold prices have not necessarily translated into improved margins. Work by consultants “Metals Focus”, shows that since the end of 2020, the ratio of gold mining majors' EBITDA to the gold price has been falling, which to some extent reflects reduced production. Capital expenditure has been under pressure, and in some cases has not been enough to maintain production at current levels.

In addition, mining companies have faced profit margin pressure from labor shortages and input cost inflation. Input costs have risen faster than the gold price in the past few years, hurting the bottom line. If the recent breakout in the gold price continues and higher price levels persist, mining margins should improve.

An increase in investor demand for gold would theoretically bode well for the gold mining stocks. Constructively, the week ending 22nd March saw the biggest inflow to gold ETFs in more than a year. Gold ETF inflows would likely imply a growing belief among investors that higher gold prices are sustainable, which would in turn help support estimates of fair value for mining businesses. Specifically, a higher assumed long-term gold price should improve projections of profitability for mining companies.

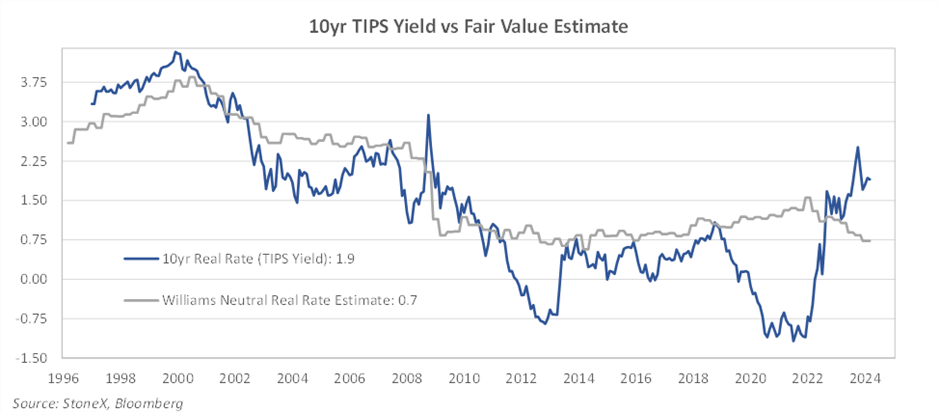

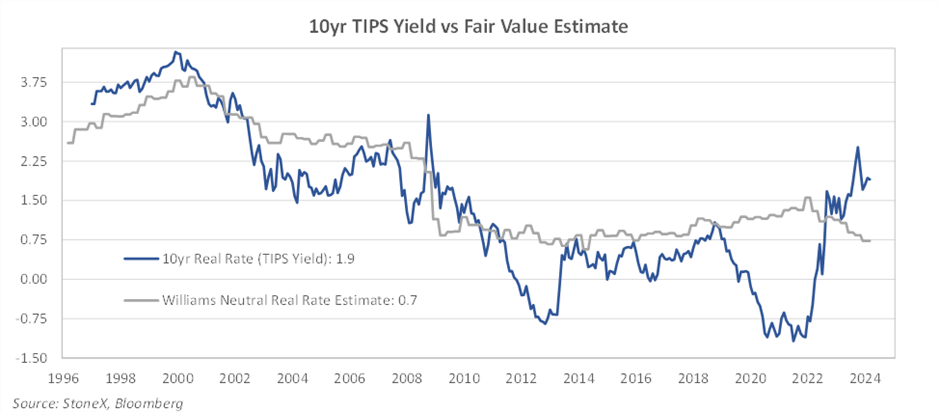

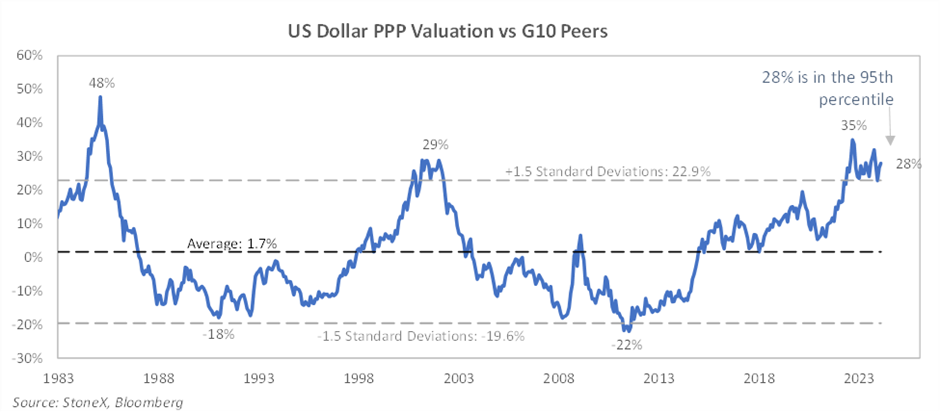

Gold tends to follow the inverse of US real rates and the US dollar (all else equal). Our analysis suggests that both should be declining over the medium-term. 10yr real rates are above estimates of fair value and the US dollar is significantly overvalued from a purchasing power parity (PPP) perspective. According to the model developed by John Williams (NY Fed President), the neutral real rate is more than 100bps below the current 10yr TIPS yield. The bottom line is that real rates have room to fall, which would likely provide a tailwind to gold.

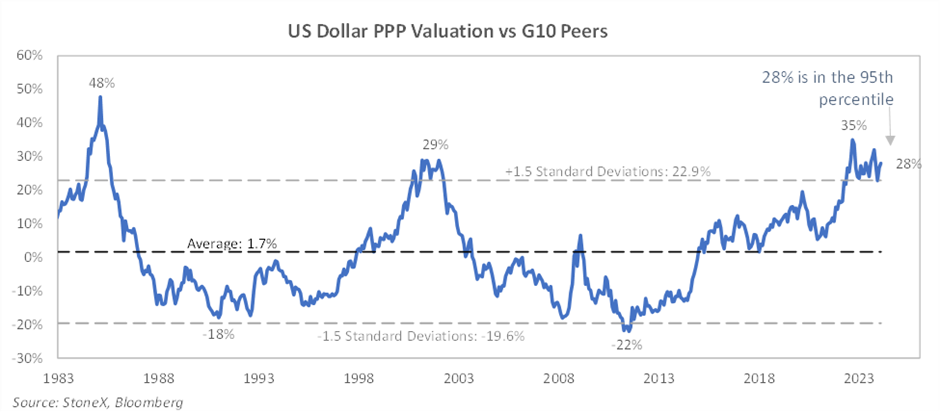

On the US dollar, our analysis suggests that the dollar entered a secular bear market in late 2022. With a relative PPP overvaluation of 28% versus G10 peers, the dollar is likely to continue to decline in the decade ahead, further providing a tailwind to gold prices.

Medium to longer term, we remain structurally positive on gold and gold miners but are looking for a tactical pullback in the near term and a more attractive re-entry point. We are taking profits on our long call gold from Jan 30th and also taking profits on our China equity longs from the same report.

Disclaimer

The authors responsible for the preparation of this commentary hereby certify that all the views expressed herein accurately reflect their personal views only. The author also certifies that no part of their compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

This commentary is intended for Institutional and Investment Professional Use Only and may not be distributed to the investing public. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc. The views are current only through the date stated and are subject to change at any time based upon market or other conditions, and StoneX Group Inc. disclaims any responsibility to update such views.

This material represents an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources. Past performance does not guarantee future results.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided.

Indices are unmanaged and investors cannot invest directly in an index. Unless otherwise noted, performance of indices do not account for any fees, commissions or other expenses that would be incurred. Returns do not include reinvested dividends.

The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is a market value weighted index with each stock's weight in the index proportionate to its market value.

|