Underlying Fundamentals Will Be the Area to Watch in H2 2024

Base metal price direction has been heavily dominated by macro-economic forces over the previous few years, including on a YTD basis; however, we forecast that underlying fundamentals will play a pivotal role in price performance in 2024, especially in second half of the year. Understanding these fundamentals, therefore, will be central in forecasting how individual metals within the suite will behave. In this article, we will discuss the current macro-outlook for Q2, how this will impact the base metal suite, in addition to building trends within the underlying fundamentals for each metal in subsequent reports.

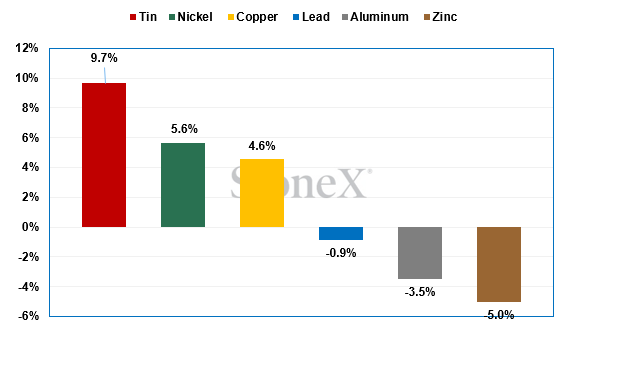

LME 3M Price Performance Across Base Metals YTD

Source: Bloomberg, StoneX

LME 3M Price Performance Across Base Metals YTD

Source: Bloomberg, StoneX

The Macro Situation – Bearish to Neutral in the Next Three Months

In our view, the two largest events of H1 2024 will arise from the health of the Chinese market (following the Two Sessions meeting held in March), in addition to the timing of the first U.S. interest rate cut. Once the markets have a stronger understanding of how these two events will impact base metals over 2024, we forecast that individual fundamentals will play a larger role in separating out price performance within the suite.

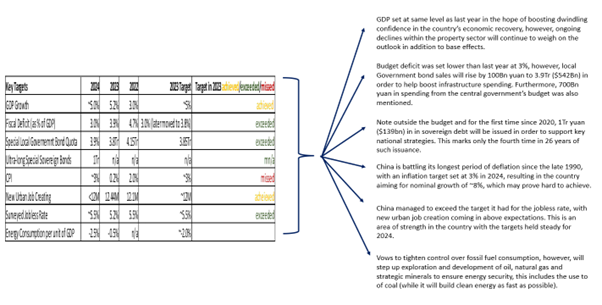

China – Set Growth Targets Will be Hard to Achieve Given Multiple Headwinds

The annual ‘Two Sessions’ meeting in China (held 4-14th March), refers to the National’s People Congress (NPC) and Chinese People’s Political Consultative Conference (CPPCC), in which targets both domestic and foreign are set for the year ahead.

What Were the Key Takeaways?

In our view, Premier Li Quang’s statement at the start the NPC meeting, in which he cited “Its not easy for us to realise these targets”, set the tone of the event, in which markets concluded that reaching moderate goals outlined, would be difficult this year.

Key Goals Set in the NPC Meeting

Source: Bloomberg, StoneX

Indeed, while the of a setting a 5% GDP growth rate and steady Y/Y target for inflation and job creation were likely chosen in order to encourage higher confidence in the country, not to mention an increase in broad-based fiscal spending Y/Y, missing information on how exactly these targets would be met (including the absence of a press conference from the Premier for the fist time three-decades), resulted in domestic equity markets declining in the days following. Given this, we saw the rare implementation of China’s ‘National Team’ (state-related bodies) utilised to prop up the equity market, reflecting the weak sentiment surrounding the event.

China's National Team Step in Prop Up Domestic Equity Market

Source: Bloomberg, StoneX

The Latest Release of Macro Economic Data Has Not Helped Matters

With the exception of industrial profits, China has released all hard data points for the months of January and February and despite the markets positively absorbing the figures for Fixed Asset Investment (FAI) and industrial production (which outpaced growth at end-2023 levels), in our view, there remains significant headwinds for a rapid recovery. Indeed, key areas of concern arise from property investment remaining deep in the red, property sales accelerating declines since end-2023, an uptick in the jobless rate, weaker than expected growth in retail sales and falling values of traded products. Furthermore, we forecast that the uptick in CPI into growth over the same period will be short-lived given the removal of holiday-related demand and adverse weather conditions, with factory-gate prices (PPI) a more accurate gauge of inflation, recording a 17th month in deflation. Meanwhile, the prospect for higher stimulus releases is being offset by weak demand for loans, both household and in the business space, despite the surprise move in February by the PBoC to lower the 5-year Loan Prime Rate (LPR), in addition to the reduction in the Reserve Requirement Ratio.

January & February Key Economic Readings Versus End-2023

Source: Bloomberg, StoneX

Please note, we view the property sector as the key headwind to China’s recovery in 2024, with the sector contributing to ~25% of China’s GDP

Despite Government efforts to stimulate the property market in the form of reducing down payments for first-time buyers, loosening home-purchase restrictions, in addition to the latest move to cut the five-year LPR, which is a proxy for mortgages, weak confidence in the sector remains with further declines ahead possible. Please note, based on BBG calculations, with 2021 the peak period of construction, a 30% drop in supply would be required to push the market into balance. Given current demand levels, this would result in a further ~10% decline in the sector ahead. In addition to this, it is worth noting in this sector:

• Interest Rate Cuts Don’t Equal Immediate Reduction in Payments

A further thought to point out, is that many mortgage contracts are only adjusted once a year on a ‘re-pricing day’, which means that current rate cuts may not be felt until next year or years ahead.

• It’s Not Just Low Confidence But Structural Change Impacting the Sector

It isn’t just weak confidence that is hurting the property sector, but a structural change in housing demand. Please note, with shrinking birth rates and indeed record-low levels of marriage in the country, the requirement for first time homes (and or upgrades) is weakening.

• It’s the Private Sector Developers that are the Worst Hit

Based on BBG data, sales in January for private developers fell 45% Y/Y, versus a 28% drop for state-owned developers. Given the recent Hong Kong liquidation order on Evergrande Group (the world’s largest indebted property-developer) on 29th January, in addition to the Fitch downgrade of China’s Vanke Company to junk territory om n22nd March, the situation is only likely to get worse, with demand for presold projects unfavourable.

The U.S. Federal Reserve Stick to Three Interest Rate Cuts This Year

Turning to the U.S., the outcome of the March FOMC meeting and comments from Chairman Jerome Powell have been the focus point of the last week, with the forecast direction of the U.S. dollar of particular importance to the base metal suite. Please note, the base metal suite holds a robust negative correlation to the U.S. dollar.

Correlation of U.S. Dollar Versus LME 3M Copper Price

Source: Bloomberg, StoneX

What Were the Key Takeaways?

The Special Economic Projections

In 2024

• Upward revision end-year GDP to 2.1% from 1.4%

• Upward revision to end-year core PCE to 2.6% from 2.4%

• Modest downward revision to unemployment rate to 4.0 from 4.1%

In 2025

• Upward revision end-year GDP to 2.0% from 1.8%

• Upward revision to end-year core PCE to 2.2% from 2.1%

In 2026

• Upward revision end-year GDP to 2.0% from 1.9%

• Modest downward revision to unemployment rate to 4.0 from 4.1%

The Dot Plot

The median fed funds forecast was left unchanged at 4.6% at end-2024, while the end-2025 target is forecast at 3.9%, up from 3.6 in the December meeting.

With the fed funds target current at 5.5%, this implies:

- Three rate cuts in 2024

- Three rate cuts in 2025

Special Economic Projections

Source: Federalreserve.gov

Impact on the Base Metal Market?

With no alternation to the outlook on the numbers of rate cuts this year from the December meeting, the U.S. dollar has strengthened over the days since the meeting, which in turn has placed negative pressure on the base metal suite. However, with the bond market now pricing in a 65.5% chance of a rate cut in June, prospects for a weaker U.S. dollar in the second half of the year are increasing and should alleviate price caps placed on the suite over the previous two years.

Over the next week, we will release (in subsequent days) our outlook for each individual base metal.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.