- The Federal Reserve's monetary policy decision is expected to reinforce the institution's cautious stance as it carries out its interest rate-cutting cycle this year, which may foster the American interest rate differential and strengthen the USD.

- The Bank of Japan may increase its basic interest rate for the first time in over eight years, contributing to the search for safety assets and harm currencies of emerging countries, such as the BRL.

- Changes in the Copom statement could lead to an expectation of a slower pace of cuts to the basic interest rate (SELIC), which would be beneficial for the Brazilian interest rate differential and contribute to a strengthening of the BRL.

The week in review

The week was marked by the release of ambiguous data for the American economy, with an increase in the Consumer Price Index (CPI) and Producer Price Index (PPI) above expectations and slower growth in retail sales. The data must reinforce the Federal Reserve's cautious stance in conducting monetary policy this year.

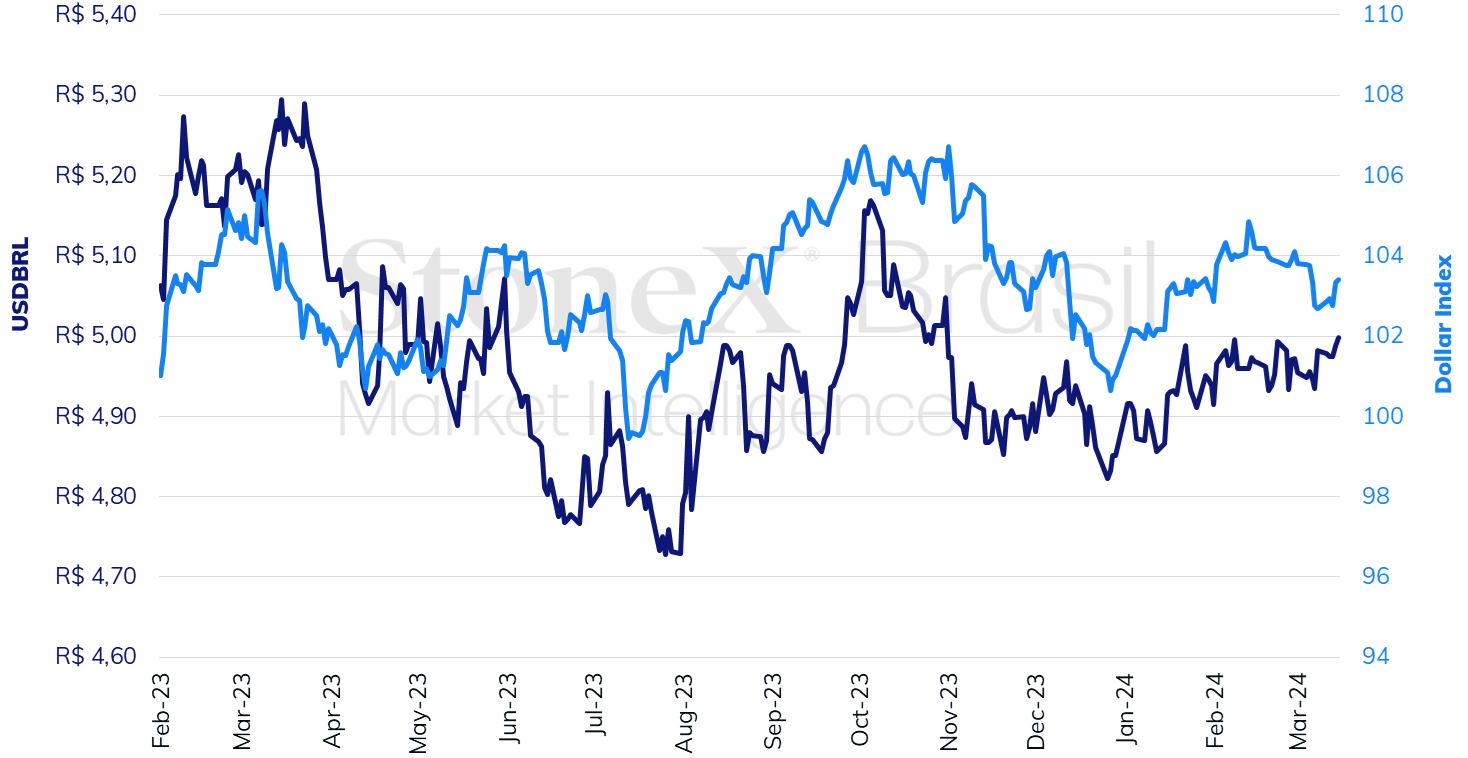

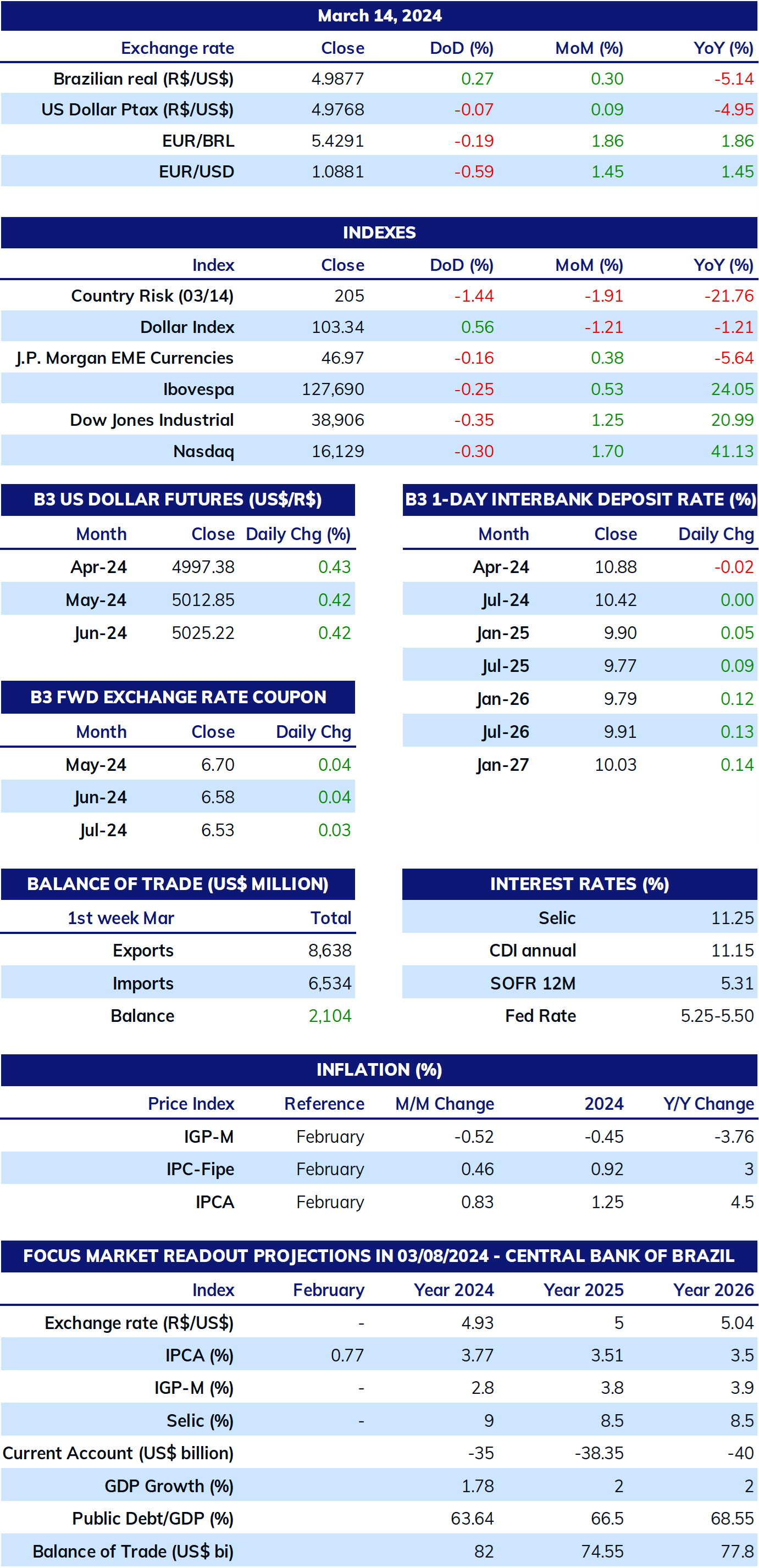

The USDBRL ended the week higher, closing Friday's session (15) at BRL 4.999, a weekly gain of 0.3%, a monthly gain of 0.5%, and an annual gain of 3.0%. The dollar index closed Friday's session at 103.4 points, a change of +0.7% for the week, -0.7% for the month, and +2.4% for the year.

THE MOST IMPORTANT EVENT: Federal Reserve monetary policy decision

Expected impact on USDBRL: bullish

There is virtually consensus that the Federal Open Market Committee (FOMC) of the Federal Reserve (Fed) will keep the interest rate unchanged in the range between 5.25% to 5.50% p.a. this Wednesday (20). Nonetheless, investors will closely monitor the release of the Summary of Economic Projections and the tone adopted in the Committee's statement and its president's press conference, Jerome Powell. After two more heated inflation readings than anticipated (January and February) and ambiguous readings for employment and activity indicators in the country, most analysts expect the Projections to show a higher inflation expectation in 2024 and a lower number of anticipated interest rate cuts by Committee members. Powell must reinforce that it is necessary to achieve higher confidence in price stabilization to start a cycle of interest rate cuts. This should stall slightly longer due to the recent, more heated data. If these expectations are confirmed, investors' risk appetite will likely decrease, and the US currency will strengthen against other currencies.

Copom's monetary policy decision

Expected impact on USDBRL: bearish

Just like the Federal Reserve decision, there is almost a consensus that the Monetary Policy Committee (COPOM) of the Central Bank of Brazil will reduce the basic interest rate (SELIC) by 0.50 p.p. this Wednesday (20), from 11.25% p.a. to 10.75% p.a. Nonetheless, some analysts argue that the space for the Central Bank to cut interest rates is shrinking amid the persistence of service inflation in Brazil and the prospects of American interest rates being maintained for longer. Therefore, there are doubts whether the Committee's statement will change its rating on inflation risks in Brazil or the international economic situation. In addition, several members of Copom commented in the previous weeks that the Committee is studying the best timing and the appropriate way to change its forward guidance, removing the plural from the phrase that "foresees a reduction of the same magnitude in the next meetings" without this being mistakenly interpreted as an indication that the pace of interest rate cuts will change. Indeed, it is quite likely that any of these changes will lead to a more conservative interpretation of the institution's next steps, potentially strengthening the BRL.

Bank of Japan's monetary policy decision

Expected impact on USDBRL: bullish

The Bank of Japan's (BoJ) monetary policy decision this Tuesday (19) may have a greater influence than usual and should be closely monitored in asset markets. Japan's last interest rate change was in February 2016, when it reduced its basic interest rate from 0.0% to -0.1% p.a., maintaining an ultra-flexible stance to encourage growth and combat the country's chronic deflation. The BoJ also maintained indirect control over the interest rates negotiated in the country's debt securities, with different tolerance margins. This week, a series of reports from specialized media claimed that the Central Bank could finally raise interest rates and abandon this yield curve control policy after being more satisfied with the growth of inflation (currently at 2.1% compared to last year) and wages in Japan. Most analysts believe that the institution will raise its interest rates at some point this year; however, it is still uncertain whether this will happen in this week's decision. As the yen is considered a safe haven in international finance, along with the dollar, the euro, and the Swiss franc, a BoJ policy change should strengthen the yen and lessen investors' appetite for risky assets, weakening the Brazilian real.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.