- The first-quarter growth in US GDP and the March reading of the PCE index are expected to reinforce the perception that inflation is becoming resilient and that the Federal Reserve will keep interest rates higher for longer, strengthening the USD.

- The processing of agendas with high fiscal costs in Congress is expected to keep perceptions of risks associated with Brazilian assets high, increasing investors' demand for risk premiums and weakening the BRL.

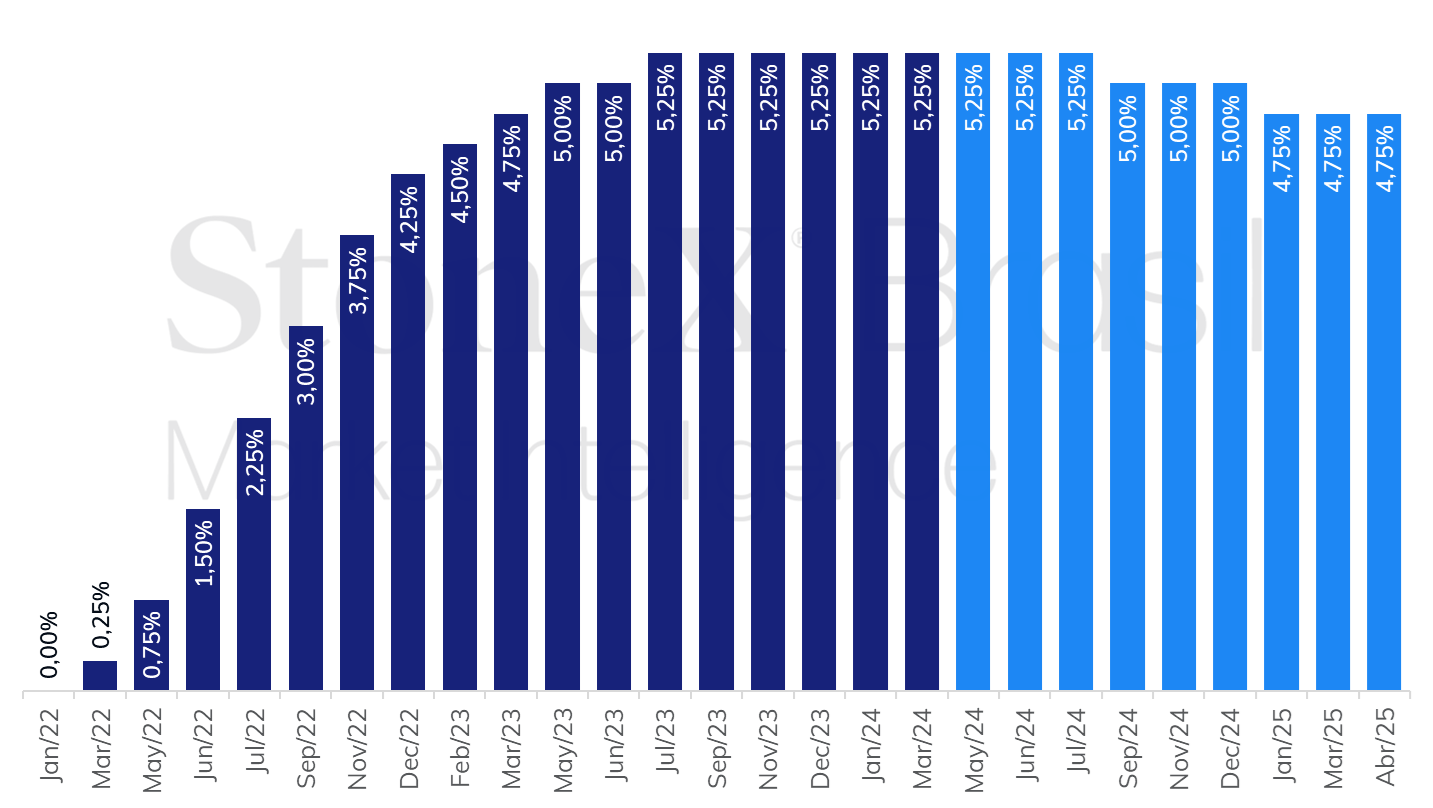

- A milder IPCA-15 in April is expected to reduce concerns about price moderation in Brazil and increase the possibility of Copom maintaining its pace of 0.50 p.p. interest rate cuts to Selic in May, which would harm the Brazilian interest rate differential and weaken the BRL.

- The expectation of a 100% payout of Petrobras' extraordinary dividends may increase foreign investments in the company's stock and strengthen the BRL.

- Reducing fears of a direct conflict between Iran and Israel is expected to decrease global risk aversion and contribute to the rebound of risky assets, benefiting the Brazilian real.

The week in review

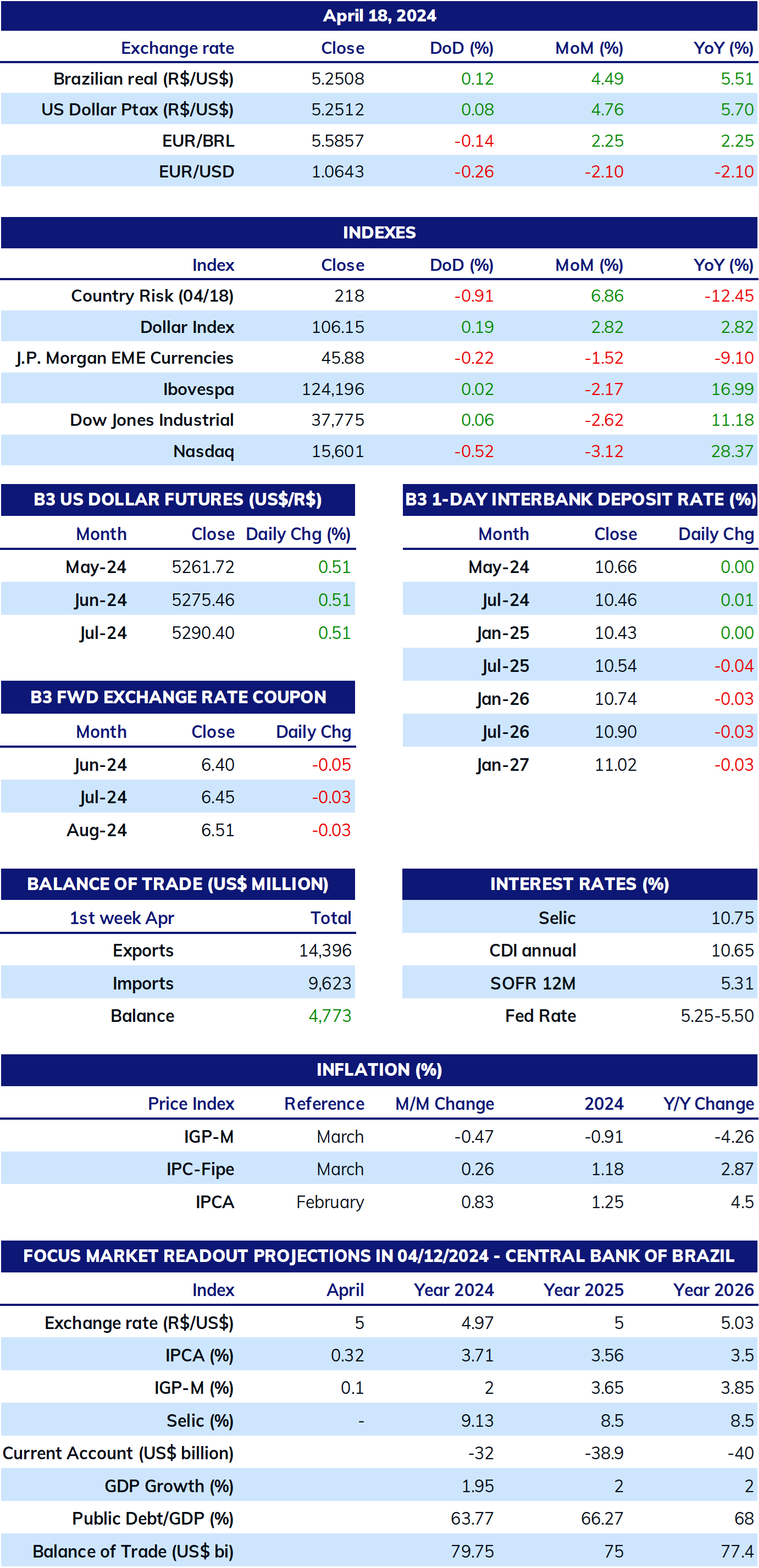

The week was marked by the sharp depreciation of the Brazilian real amid a global risk aversion due to inflationary fears in the US, concerns about a military conflict between Iran and Israel, and concerns about fiscal stability in Brazil after the federal government reduced its budget target between 2025 and 2027.

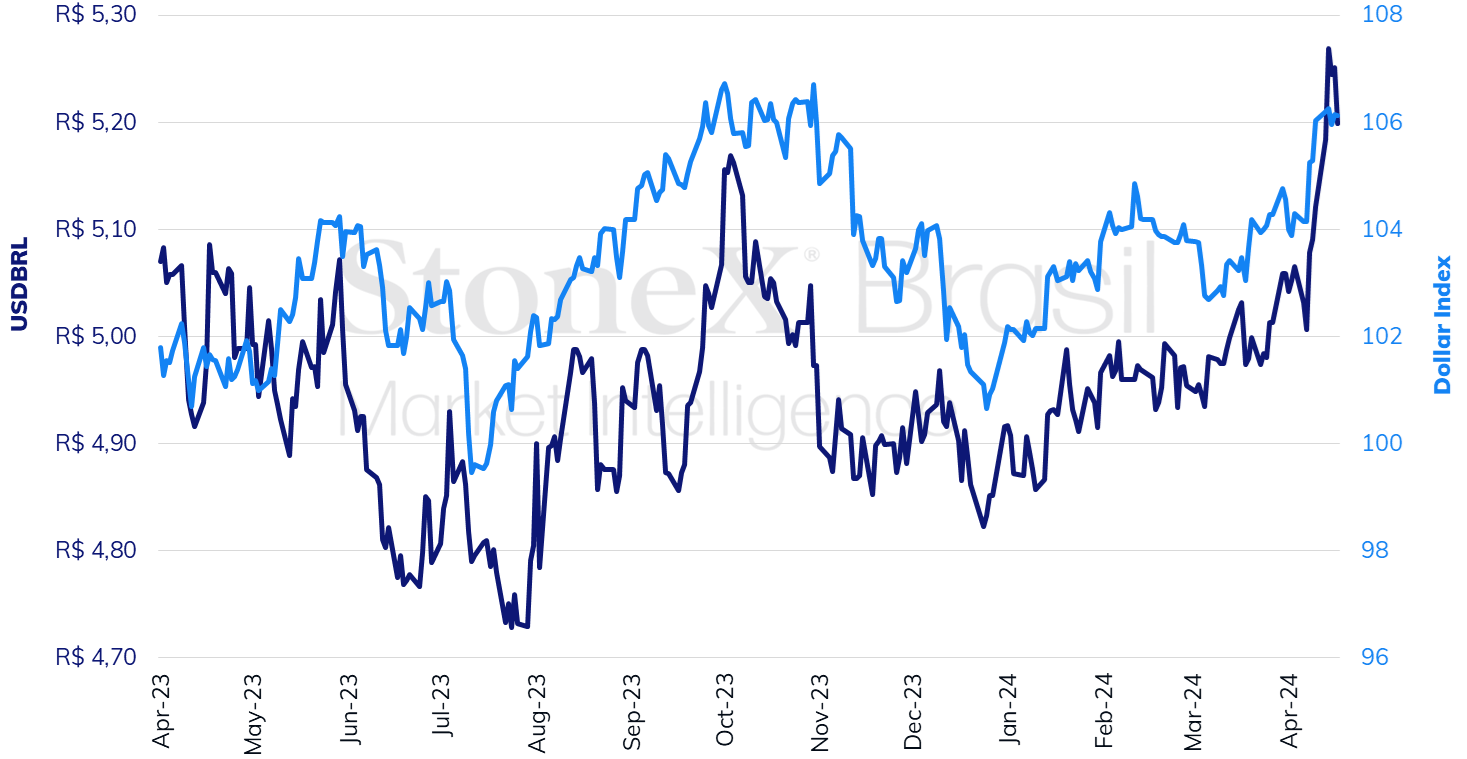

The USDBRL ended the week higher, closing Friday's session (19) at BRL 5.199, a weekly gain of 1.5%, a monthly gain of 4.6%, and an annual gain of 7.2%. The dollar index closed Friday's session at 106.1 points, a change of +0.1% for the week, +2.0% for the month, and +5.1% for the year.

THE MOST IMPORTANT EVENT: US GDP and CPI

Expected impact on USDBRL: bullish

Global investors are becoming increasingly pessimistic about the possibility of the Federal Reserve (Fed) cutting interest rates this year. This week, the above-expected growth in US retail sales in March and more cautious statements from Fed members, including its president and vice president, Jerome Powell and Phillip Jefferson, respectively, regarding the need for patience before easing monetary policy, led investors to price in only a 0.25 percentage point interest rate cut in 2024, at the September decision. The contrast with the "exuberant optimism" at the beginning of the year is remarkable when the majority bets in the future interest rate market indicated seven cuts (-1.75 p.p.). As a result, the dollar index, which weighs the value of the American currency against six major currencies, reached its highest value since the end of October.

Next week, the Personal Consumption Expenditures (PCE) Price Index for March is expected to repeat its significant increase from February of 0.3% in both the full index and the core of the indicator, which excludes the volatile components of food and energy. Although the reading should be lower than that of the Consumer Price Index (CPI), which rose 0.4% at its core in March, the data is not expected to change the impression that the American economy is more heated and that consumer prices are persistent, maintaining expectations that US interest rates will remain at higher levels for longer, contributing to keeping the USD strong internationally. Likewise, the first estimate for the first quarter's US Gross Domestic Product (GDP) should show another healthy period of growth, marking the country's seventh consecutive quarter of expansion. The growth should be around 2.1% annually, driven by the sharp performance of American personal consumption.

US: History and expectation for the interest rate - April 19, 2024

Source: CME FedWatch Tool. Design: StoneX. Refers to the bet with the highest probability in the future interest rate market on the indicated date.

Fiscal fears in Brazil

Expected impact on USDBRL: bullish

Concerns about the Brazilian fiscal policy led to the intense weakening of the real last week, which reached over BRL 5.28 per USD, the highest value since March 2023. This week, concerns about the health of public accounts are expected to remain high amid the processing of agendas with high fiscal costs in the Legislature. On the last Wednesday, the Committee on Constitution, Justice, and Citizenship (CCJ) of the Federal Senate approved the Proposed Constitutional Amendment of the quinquennium (PEC 10/2023), which creates a monthly compensatory remuneration for public officials in legal careers based on their length of service and is not counted towards the maximum constitutional limit that each server can receive. Now, the proposal moves on to the Senate and House floor. The government's economic team estimates that the impact of this measure is BRL 42 billion per year. Furthermore, the Emergency Program for the Resumption of the Events Sector (PERSE), the exemption from payroll taxes for sectors of the economy, and the exemption for municipalities are still being processed in parliament, which could result in an additional BRL 38 billion in expenses in 2024. The perception of higher fiscal risks and the unfavorable external environment led investors to price in slower interest rate cuts to the basic interest rate (SELIC) of 0.25 p.p. starting from the May decision.

Brazilian April IPCA-15

Expected impact on USDBRL: bullish

The release of the National Consumer Price Index 15 (IPCA-15) for April on Friday (26) is expected to continue the benign trend seen in the March reading of the indicator, when there was an increase of less than 0.1% in both the core indicator and service prices. Amid bets of a slowdown in the pace of cuts to the Selic rate, the data, if confirmed, should alleviate concerns about the pace of price moderation in Brazil and give the Monetary Policy Committee greater leeway to maintain a 0.5 p.p. reduction in the May decision. This, in turn, would maintain the projections of a worsening Brazilian interest rate differential, which may result in lower foreign financial investment inflows and weaken the real.

Extraordinary dividends from Petrobras

Expected impact on USDBRL: bearish

The Petrobras shareholders' general meeting deliberates on the payment of extra dividends from the company on Thursday (25), when, according to a report from the newspaper O Globo, the full payout amount is expected to be approved. The news increased the company's stock value, which may be reflected in the entry of external investments in Bovespa during the week.

Reprieve in geopolitical tensions

Expected impact on USDBRL: bearish

Finally, it is worth mentioning that Israel's timid response to the Iranian retaliation on April 14 reduced fears of a direct military conflict between the two nations and should alleviate concerns about the global geopolitical scenario. This would contribute to a lower risk aversion and benefit the performance of risky assets, such as stocks, commodities, and currencies of emerging countries, like the BRL.

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.