| Interest Rate Market Snapshot | ||||||

| Federal Funds | SOFR | 2Y Treasury | 5Y Treasury | 7Y Treasury | 10Y Treasury | |

| 5.33% | 5.32% | 4.19% | 3.80% | 3.84% | 3.87% | |

Fed in a holding pattern

- The first Fed meeting of 2024 is a quiet one, with the Federal Funds target range remaining unchanged between 5.25%-5.50% (unanimous FOMC vote)

- No updated forecasts, but the official statement did however include this notable addition:

- “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward two percent.”

- With the hold penciled in as a given, and minimal statement changes, focus was squarely on the messaging Powell gave on rate cuts this year

Powell in his own words:

- “Inflation is still too high, ongoing progress in bringing it down is not assured”

- “We believe that our policy rate is likely at its peak for this tightening cycle and, if the economy evolves broadly as expected, that it will likely be appropriate to begin dialing back policy restraint at some point this year”

- “Reducing policy restraint too soon, or too much, could result in a reversal of the progress we’ve had on inflation and ultimately require even tighter policy to get inflation back to 2%”

- “We’re looking for a continuation of the good data we’ve been seeing”…”What we care about is the aggregate number, not so much the composition”

- “There was no proposal to cut rates…we’re not at a place of working out rate cut planning details”

- “We’re not declaring victory at this point”

- And the crescendo of it all: “I don’t think it’s likely that the committee will reach a level of confidence by the time of the March meeting, to identify that March is the time to do that (cut)”

Market Reaction

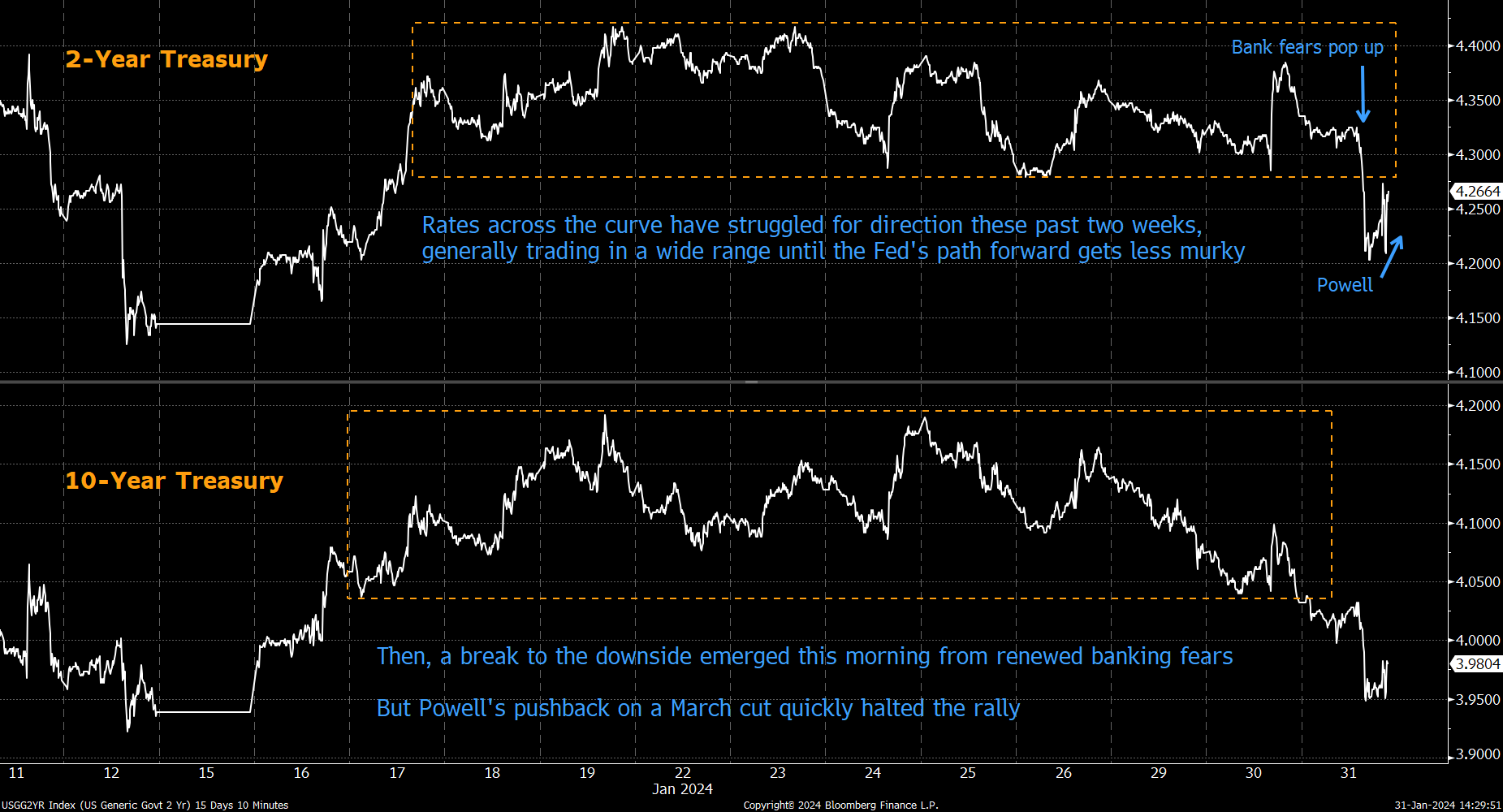

-

Huge intraday moves today

-

This morning, shares in New York Community Bancorp were halted due to a 40% drop at the open

-

The bank, after acquiring assets from Signature Bank last year, set aside $552 million for loan loss provisions and stiffer regulations due to its new size

-

While not looking systemic like last year, it didn’t smell good, and a flight to safety trade commenced – pushing rates lower and out of it’s the 2-3 week range

-

-

Then, Powell’s comments reverted the attention to the fundamentals again

-

Overall, 10-15 basis point rollercoaster today

-

2-Year: Hanging around 4.25% (~10 basis points lower)

-

10-Year: Hovering just under 4.00% (~10 basis points lower)

-

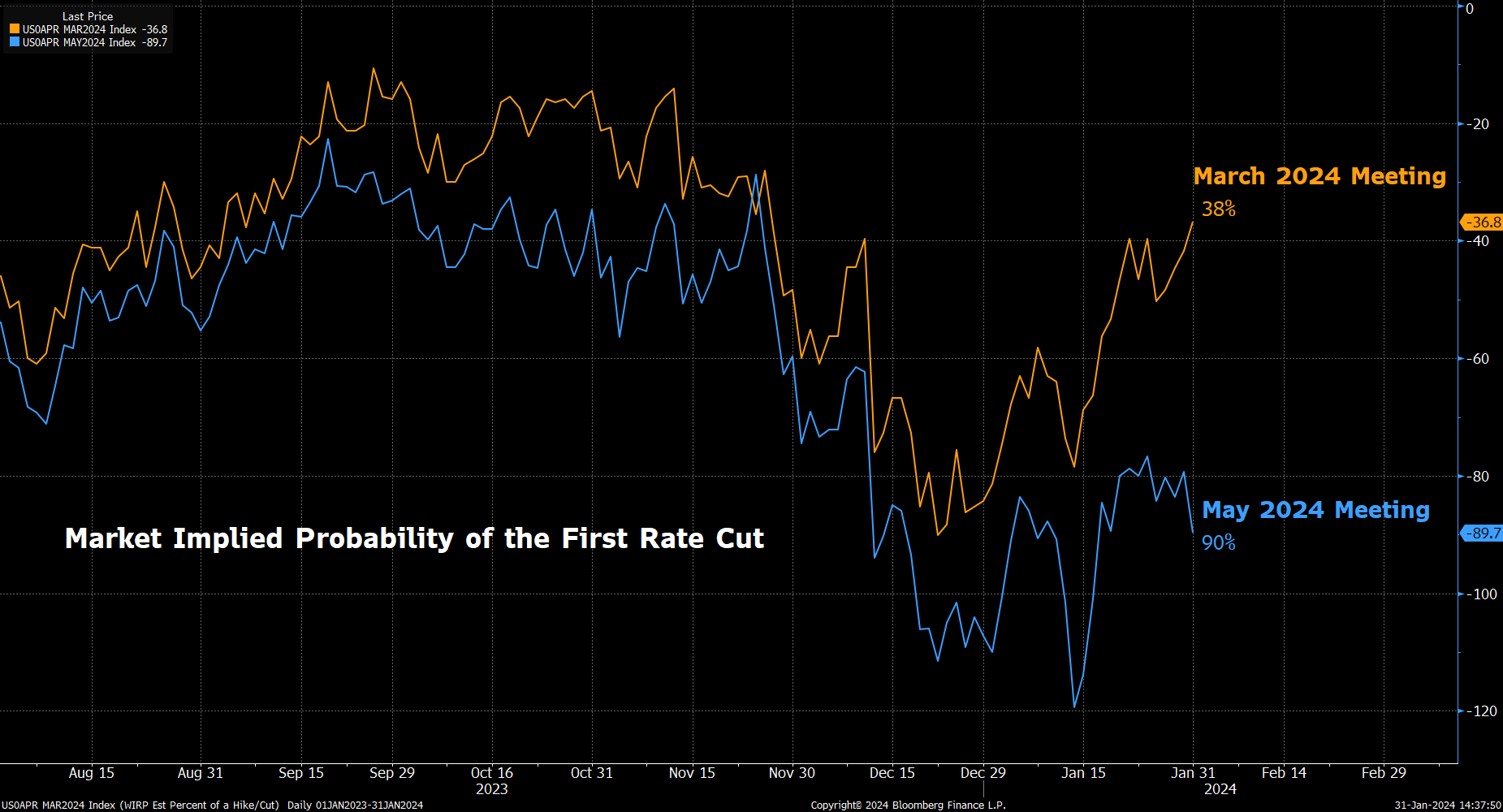

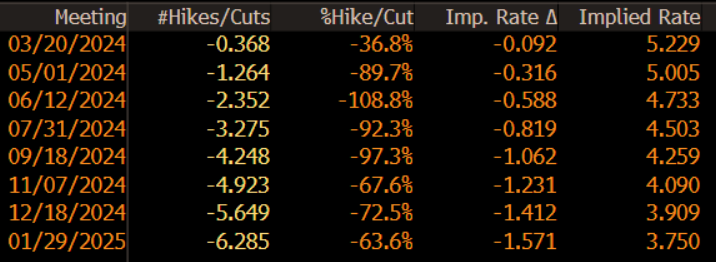

Consensus for the first cut: May

-

-

What looks good:

-

1-Year Swap for floating rate loans

-

0.50% of positive carry, good balance of risk/reward

-

-

2-Year No-Cost Collars for floating rate loans

-

Same 0.50% of positive carry, with the ability to float down to 3.00-3.25%, nothing out of pocket

-

-

3-10 Year Swap for fixed rate loans

-

Positioning for rates to fall later this year or next

-

-

-

Next up: The CPI revisions for 2023, released next week. Powell reiterated needing to have “confidence” about inflation several times today, so perhaps he knows something we don’t regarding this release

- Powell did a much better job communicating to the market today

- March rate cut expectations are now being dialed back and replaced with May

The Fed is just not in a hurry to cut rates

- What incentive do they have? Nothing is creating a sense of urgency to pivot

- In fact, the economy on its current trajectory, is a good problem for the Fed to have

- Fourth quarter GDP growth exceeded expectations at a 3.3% annualized rate, with personal consumption making up 1.9% of it

- The unemployment rate is at 3.7% (near 50-year lows) with payroll growth coming in at ~200k each month and unemployment claims generally unchanged for the past 2-years

- Wage growth is outpacing inflation, helping consumer sentiment and confidence rise to 2.5-year highs

- Services and manufacturing PMI figures are back into expansionary territory with both factory and durable goods orders rebounding

- While directionally, inflation continues improve (albeit at a snail’s pace)

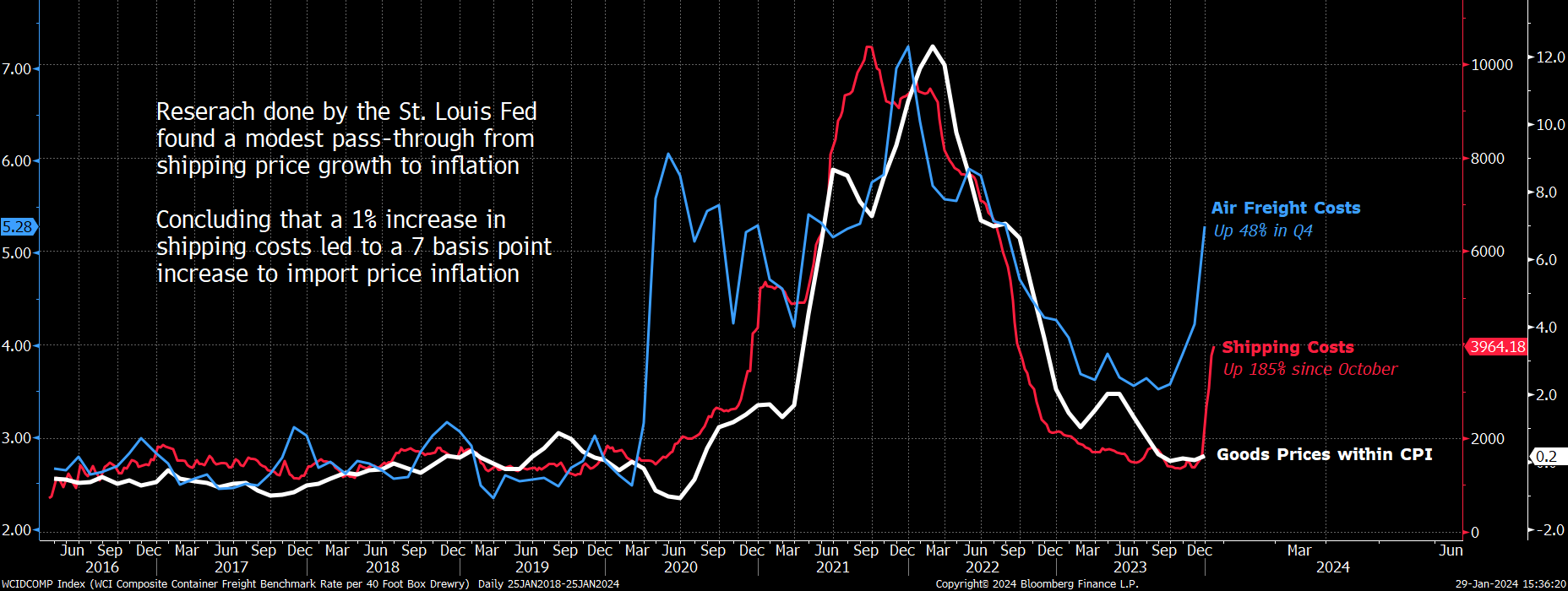

- But that is not to write-off the threat of it reaccelerating this year. Supply chain disruptions, once perceived as a tail-risk, are materializing in a real way again

- Conflicts in the Red Sea have already impacted shipping and air freight costs and risk reversing the disinflationary trend of Goods’ prices

- Despite the relatively small weight the Goods category has within inflation measurements like CPI, it may be enough to keep the Fed on their toes

- The Fed is simply no longer wrestling with the need for higher rates – rather, grabbling with the appropriate pace of when and how to being lowering them

- Timing is tricky for Powell – wait too long and risk the cuts being perceived as political in nature given the November elections looming, but cut too soon (or too much) and risk being labeled the reincarnation of Arthur Burns and spawning a second wave of inflation

- For now, the Fed can afford to be patient

Try not to use the market for a forecast

-

The market’s rate cut romantics remain intact

- Current pricing alludes to expectations of (at a minimum) a:

- May cut

- June cut

- July cut

- September cut

- November cut

- Current pricing alludes to expectations of (at a minimum) a:

- But history says these expectations are almost very right

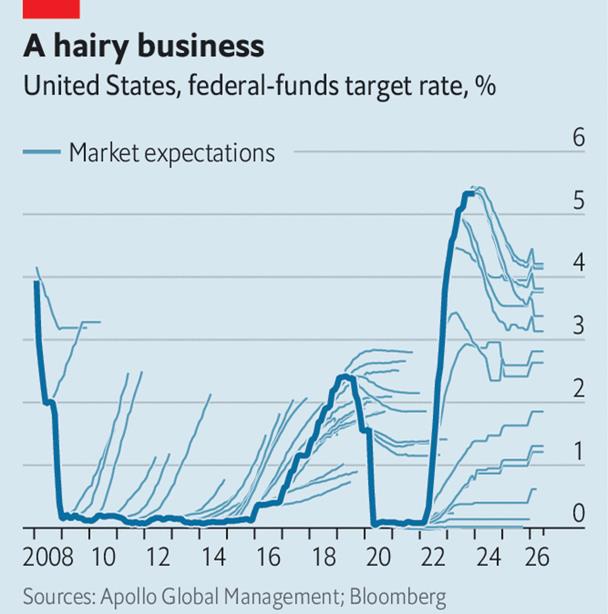

- The infamous Hairy Chart is makings its rounds in the rates world again

- That is, actual Fed Funds (in dark blue below), overlaid with forward curve pricing at various points in time (light blue)

- Coined the Hairy Chart because market expectations almost always misprice future rates and gives the appearance of Fed Funds having hair coming from it

- Could this time be different? Of course, forecasting the future is an educated guessing exercise

- But…the market is pricing in future rates in a way that is more indicative of a recession (the Fed cutting rates at almost every single meeting this year) – yet we have no signs of a recession to justify it

The StoneX Group Inc. group of companies provides financial services worldwide through its subsidiaries, including physical commodities, securities, exchange-traded and over-the-counter derivatives, risk management, global payments and foreign exchange products in accordance with applicable law in the jurisdictions where services are provided. References to over-the-counter (“OTC”) products or swaps are made on behalf of StoneX Markets LLC (“SXM”), a member of the National Futures Association (“NFA”) and provisionally registered with the U.S. Commodity Futures Trading Commission (“CFTC”) as a swap dealer. SXM’s products are designed only for individuals or firms who qualify under CFTC rules as an ‘Eligible Contract Participant’ (“ECP”) and who have been accepted as customers of SXM. StoneX Financial Inc. (“SFI”) is a member of FINRA/NFA/SIPC and registered with the MSRB. SFI is registered with the U.S. Securities and Exchange Commission (“SEC”) as a Broker-Dealer and with the CFTC as a Futures Commission Merchant and Commodity Trading Adviser. References to securities trading are made on behalf of the BD Division of SFI and are intended only for an audience of institutional clients as defined by FINRA Rule 4512(c). References to exchange-traded futures and options are made on behalf of the FCM Division of SFI . StoneX is a trading name of StoneX Financial Ltd (“SFL”). SFL is registered in England and Wales, Company No. 5616586. SFL is authorized and regulated by the Financial Conduct Authority [FRN 446717] to provide to professional and eligible customers including: arrangement, execution and, where required, clearing derivative transactions in exchange traded futures and options. SFL is also authorised to engage in the arrangement and execution of transactions in certain OTC products, certain securities trading, precious metals trading and payment services to eligible customers. SFL is authorised & regulated by the Financial Conduct Authority under the Payment Services Regulations 2017 for the provision of payment services. SFL is a category 1 ring-dealing member of the London Metal Exchange. In addition SFL also engages in other physically delivered commodities business and other general business activities which are unregulated and not required to be authorised by the Financial Conduct Authority. StoneX Group Inc. acts as agent for SFL in New York with respect to its payments services business. StoneX APAC Pte. Ltd. acts as agent for SFL in Singapore with respect to its payments services business. ‘StoneX’ is the trade name used by StoneX Group Inc. and all its associated entities and subsidiaries.

Trading swaps and over-the-counter derivatives, exchange-traded derivatives and options and securities involves substantial risk and is not suitable for all investors. Past performance of any futures or option is not indicative of future success. Indicators are not a trading system and are not published as a specific trade recommendation. The information herein is not a recommendation to trade nor investment research or an offer to buy or sell any derivative or security. It does not take into account your particular investment objectives, financial situation or needs and does not create a binding obligation on any of the StoneX group of companies to enter into any transaction with you. You are advised to perform an independent investigation of any transaction to determine whether any transaction is suitable for you. No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior written consent of StoneX Group Inc.

© 2024 StoneX Group Inc. All Rights Reserved.